EURGBP - BullishI’m flowing with price as it continues higher, reading behavior and tracking its footsteps. As price approaches higher highs, we’re seeing higher lows form, signaling a structure shift within the broader HTF bullish framework.

Momentum remains aligned with trend, so for now I’m simply waiting and tracking delivery.

Patience is key. Tracking is the edge.

Multiple Time Frame Analysis

CADJPY - BullishPrice is currently in a calm speculation zone as I observe the tape. We’re operating within a strong accumulation demand area, and from here I’m simply tracking price behavior and its footprints.

If price chooses to move forward, I’ll continue to monitor how it delivers. Until then, nothing is forced.

Patience is key. Tracking is the edge. Let’s go.

MGC Daily Analysis & Replay - Monday January 12 2026 part 1Day: 2-1-2 / +$123

(all 1 MGC trades)

--------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

HAL Short setup.

Spotted a high-probability short setup on Hindustan Aeronautics Ltd based on multi-timeframe confluence:

- 🔴 Supply Zone aligned with Daily EMA 50 and Weekly EMA 50 – strong resistance cluster.

- 🔄 Entry on retracement into the zone, post breakdown of prior pivot low.

- 🟠 Stop Loss placed at 15% DATR above the zone for volatility buffer.

- 🎯 Target set at 1:3 RR, respecting structure and momentum.

- 📉 EMA 21 < EMA 50 confirms short bias

The zone is placed with high probability.

The trade is valid till the time price retraces to to level and moves down.

The trade remains invalid if price moves down first to form lower high and lower low and then retraces back in sessions to come.

GBPJPY - BullishPrice will do what it wants — I don’t control it, I track it. That’s the edge. As long as structure remains intact, I flow with price behavior.

Current momentum is aggressive, but the blue order block below represents a stronger accumulation area if price seeks deeper liquidity to fuel continuation. For now, I’m observing how price reacts around the current IDM and engineered liquidity. If we hold, that gives information. If we dip, that also gives information.

Nothing forced. Just tracking.

Patience is key. Tracking is the edge.

MGC Daily Analysis & Replay - Monday January 12 2026 part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

AUDJPY - BullishPrice has delivered a clean distribution back into accumulation. This is where tracking becomes the edge — once you understand where price is operating, reading behavior becomes second nature.

If a full midterm liquidity sweep occurs within accumulation, I’ll then look for a structure shift during the corrective phase to align with the next delivery. Until that condition is met, it’s strictly observation and tracking.

Nothing rushed.

Patience is key. Tracking is the edge. Let’s go.

USDJPY - BullishPrice is aggressively expanding out of the prior distribution phase, clearing fast hands along the way. Internal liquidity, IDM, and external liquidity have been systematically taken, signaling strong intent and alignment with the higher-timeframe draw.

This expansion appears to be fueled by liquidity clearance, with price pressing toward the higher-timeframe liquidity pool. Once price fully mitigates the HTF point of interest within the accumulation territory, I’ll shift focus to how we correct and re-deliver from that area.

Until then, I’m simply tracking behavior and allowing price to complete its delivery.

Nothing forced.

Patience is key. Tracking is the edge. Let’s go.

GBPUSD - BullishAs price continues to press toward mid-term and higher-timeframe highs, I’m simply observing how momentum is being delivered into those objectives. As long as bullish structure and displacement remain intact, the draw on liquidity is still higher.

If price pauses or looks for a breather, I’d expect any pullback to be corrective in nature — potentially distributing back into prior accumulation zones rather than signaling a full shift in bias. Until price shows otherwise, the expectation remains continuation.

My focus is on how price reacts once it mitigates key areas of interest. From there, I’ll look for confirmation to participate in alignment with the higher-timeframe direction, targeting the highs as the primary objective.

Nothing forced, nothing rushed.

Patience is key. Tracking is the edge.

BTC: There is an H1 pattern, but daily volume is against buyingHi traders and investors!

The seller defended the weekly level at 90,128. We can see three buyer candle wicks there that failed to break and hold above this level. After that, yesterday a seller candle formed on the daily timeframe with solid volume. More details are covered in the previous review.

On the hourly timeframe, a false breakout pattern of the lower boundary of the range has formed. However, considering long positions here is extremely risky.

The reason is that the daily seller candle formed on increased volume, with the main volume accumulated in the upper part of the candle. Buying against such a signal carries a high level of risk.

Given the overall context, the priority scenario is to look for short setups, targeting the daily seller target at 83,822.

This analysis is based on the Initiative Analysis (IA) method.

MNQ Daily Analysis & Replay - Friday July 11 2025 part 2week of hell. today, 1-2 / -$75

made $63 this week with a million BE trades

---------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Friday July 11 2025 part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

DXY: the seller remains in controlHi traders and investors!

The U.S. Dollar Index has reached the seller’s weekly and daily targets — 97.048 and 96.767, respectively. At this stage, a period of consolidation and possibly a local bounce is likely.

However, in the medium term, the initiative remains with the seller.

More details can be found in my long-term analysis.

Profitable trades!

This analysis is based on the Initiative Analysis (IA) method.

MNQ Daily Analysis & Replay - Thursday July 10 2025 part 2Fugliest week of them all. 1-0-2 / +$84

-----------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Thursday July 10 2025 part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

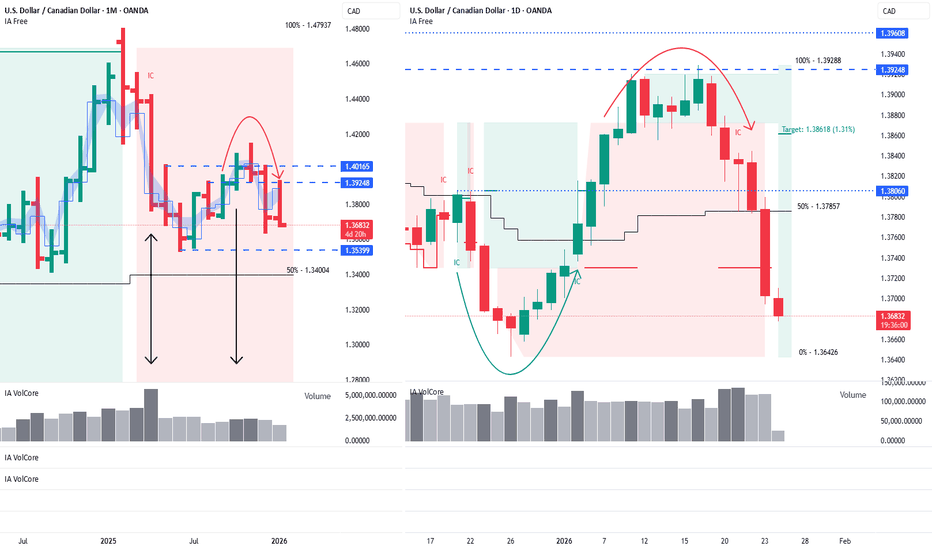

USDCAD: Seller reaction from the first resistance zoneA seller reaction followed from the first resistance zone at 1.39248–1.39608 (the previous review).

On January 20, the seller pushed the price back into the daily sideways range and reached the first target within the range at 1.373.

The next target is the lower boundary of the range at 1.36426.

Profitable trades!

This analysis is based on the Initiative Analysis (IA) method.

MNQ Daily Analysis & Replay - Wednesday July 9 2025PA week from hell. 0-0-1 / $0

---------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Tuesday July 8 20255.5 day weekend now. 1-0-2 / +$54

-----------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Monday July 7 2025 part 2Market makers took a 4.5 day holiday weekend. 1-1 / +$4

-------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Monday July 7 2025 part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.