MNQ Daily Analysis & Replay - Friday October 17 2025 - part 2As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

Multiple Time Frame Analysis

MNQ Daily Analysis & Replay - Friday October 17 2025 - part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Thursday October 16 2025 - part 2clean day: 2-1 (almost 4-1) / +$358

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

Xauusd bullish after consolidationOn daily time frame as we can see we are clearly on a bullish momentum an consolidating

Between resistance level 4620 and support 4580

On 4hour time frame consolidation breaks to the downside and aggressive backing up leaving a rejection wick and sweeping all liquidities below,

Confirmation 1H we will wait for more on confirmation that price will go up.

Change in state of delivery / forming new bullish FVG to support our analysis

Selling Nas100Nasdaq100

Daily time frame we are on a bullish momentum but as you can see price action still respected the daily bearish imbalance or a resistance 25800.

-create a new high sweeping liquidity but did no displacement of a body candle. We can see also the aggressive bearish candle stick creating a brand new lower low and a market structure shift.

4H S got a rejection and still respected the 25800 level of resistance and form a lower high

1H we have a slow bullish movement showing a retracement and again creating an aggressive candle stick.

Confirmation LIQUIDTY SWEEP

BREAK OF STRUCTURE

Change in state of delivery

And an imbalance

If price respected the bearish FVG price will move up

#XAUUSD Market Structure Outlook (H2)Gold has completed a clear liquidity sweep below the prior range and delivered a strong reaction from the Fair Value Gap (FVG), confirming active buyer presence.

The impulsive move following the sweep resulted in a Break of Structure (BOS), shifting the bias firmly bullish. Price is now trading within a consolidation range near recent highs, suggesting accumulation before the next expansion.

Key Observations:

• Liquidity swept → clean reaction from FVG

• Bullish BOS confirms trend continuation

• Consolidation at premium highs indicates strength, not weakness

Bullish Scenario:

As long as price holds above the FVG zone, continuation toward higher highs remains the higher-probability outcome.

Bearish Risk:

A sustained breakdown below the FVG would expose the lower order block as the next draw on liquidity.

Bias remains bullish while structure holds.

Patience over prediction.

— Eagle Pips Pro

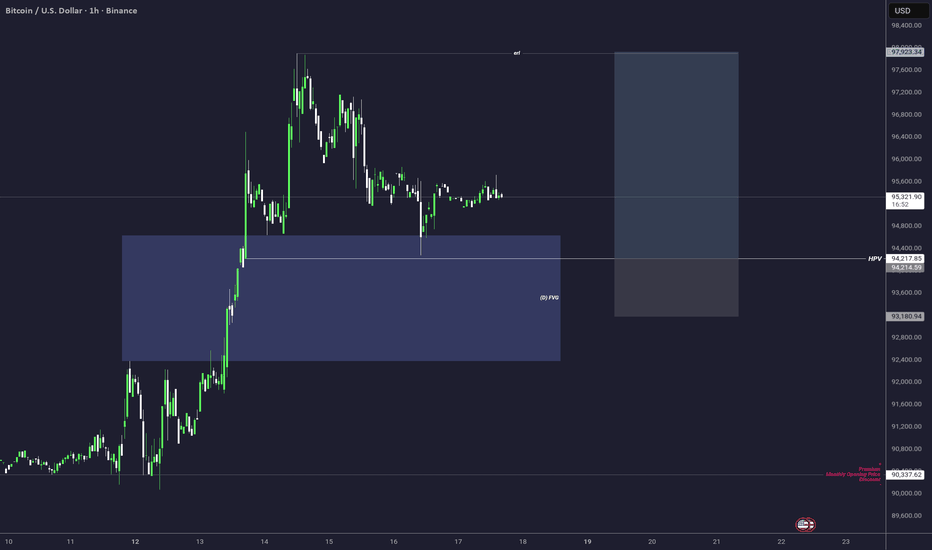

BTCUSD H1 – Price Action OutlookBTC has delivered a clean liquidity sweep into the H1 demand zone, followed by a strong bullish reaction, confirming buyer interest at discounted prices.

Market Structure & Key Observations

• Prior BOS to the upside established bullish intent.

• Recent pullback mitigated liquidity below the range lows.

• Demand zone respected, producing an impulsive bounce.

• Price is now consolidating, indicating potential accumulation.

Key Levels to Watch

• Demand Support: 94,200 – 94,500

• Immediate Resistance: 95,800 – 96,200 (Bearish FVG)

• Major Resistance: 97,500 – 98,000 (H1 Bearish Order Block)

Scenarios

• Bullish Continuation:

As long as price holds above the demand zone, expect a push toward the bearish FVG, with continuation potential into the H1 bearish order block.

• Bearish Risk:

Failure to hold demand opens the door for deeper downside toward the lower H1 order block.

Bias

• Short-term bullish while above demand

• Caution near premium zones due to overhead supply

MNQ Daily Analysis & Replay - Thursday October 16 2025 - part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Wednesday October 15 2025 - part 2Clean moving day: 3-0-3 / +$415

--------------------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Wednesday October 15 2025 - part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

How to Sit through Drawdown on GBPUSD (Part 2)Most traders don’t fail because they lack strategy.

They fail because they never slow down long enough to master one market.

In this video, I’m starting the only series I’m running in 2026: Mastering GBPUSD.

This is not about indicators or hype. It’s about rebuilding consistency by focusing on one pair, learning its rhythm, managing drawdown, and developing the discipline most traders avoid.

We cover

• Why mastering GBPUSD starts with a decision, not a strategy

• How to build trust in a market before increasing position size

• How to sit through normal drawdown without sabotaging your plan

• Practical ways to observe price, mark levels, and reduce overtrading

• Why alerts and walking away matter more than staring at charts

If you’ve traded before, had success, lost momentum, and you’re looking to get back into rhythm, this video is for you.

This series is about focus, patience, and self-mastery through one market.

Watch. Apply. Repeat.

Comment “GBPUSD only” if you’re committing to this journey, and subscribe so you don’t miss the next deep dive in the series.

MNQ Daily Analysis & Replay - Tuesday October 14 2025 - part 2Missed some opportunities and wasnt seeing this clearly today.

Still 3-1 / +$289

----------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Tuesday November 4 2025 - part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Wednesday November 5 2025no volume day, but slow trend: 1-1 / +$216

----------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

BTCUSDT M30 FVG Hold and Short-Term Bullish Reaction Setup📝 Description

BINANCE:BTCUSDT is trading above a key H1 FVG after a sharp sell-side sweep, showing stabilization and early signs of short-term accumulation. The recent pullback appears corrective rather than impulsive, with price holding above local demand.

________________________________________

📈 Signal / Analysis

Primary Bias: Bullish while price holds above the M30 / H1 FVG base

Preferred Setup:

• Entry: 95,215

• Stop Loss: Below 94,970

• TP1: 95,600

• TP2: 95,980

• TP3: 96,410 (H1 FVG / higher liquidity)

________________________________________

🎯 ICT & SMC Notes

• Sell-side liquidity has been swept before stabilization

• Price reacting from H1 FVG support

• Current structure suggests a relief bounce within range conditions

________________________________________

🧩 Summary

As long as CRYPTOCAP:BTC holds above the H1 FVG and recent sell-side low, a short-term bullish continuation toward higher liquidity pools remains the preferred scenario.

________________________________________

🌍 Fundamental Notes / Sentiment

Market sentiment remains neutral-to-constructive, with no immediate macro pressure forcing risk-off behavior, allowing technical support reactions to play out.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

MNQ Daily Analysis & Replay - Friday January 16 2026 - part 2Boring no volume and volatility day: 1-0 / +$190

----------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Friday January 16 2026 - part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Thursday January 15 2026 - part 2Fought through an ugly day: 3-2 / +$370

------------------

As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.

MNQ Daily Analysis & Replay - Thursday January 15 2026 - part 1As a learning, beginner day trader I go through the market replay predefining what I am looking for to enter a trade and walk through my thoughts as I experience the market action bar by bar throughout the entire day to see how I handle various events and assess my execution.

This is for me and others to learn if you desire.