USD/CAD | Bullish Continuation SetupBias: Bullish

HTF Overview (4H):

Price remains bullish on the higher timeframe, showing strong momentum and clear volume support. Buyers are controlling the structure, keeping the 4H trend intact.

MTF Overview (30M):

Mid-term setup shows inducement and sell-side liquidity being cleared. Price fell into the mid-term order block, confirming accumulation zones. Structure has been refined, mapping liquidity and identifying the areas where price is likely to react.

LTF Confirmation (5M):

Lower timeframe CHoCH occurred — break of lower highs confirming mid-term area control. Next, minor sell-side liquidity will be swept and nearest 5M order blocks mitigated to provide clean entry for continuation.

Execution Plan:

Stops placed below 5M structure. Targets: 5M highs → 30M highs → 4H highs depending on momentum and market delivery. If price fails the near order block, we’ll replot PD grid on higher timeframe to find the next valid entry zone before executing.

Trade Management:

Partial exit at first 5M high, second scale at 30M high. Trail stops below last 5M structural low. Full swing considered if momentum persists toward 4H highs.

Mindset Note:

Patience over speed — wait for structure to confirm. Losses are part of the process; smart money shows the path, we follow with discipline.

Progress Hook:

Each setup reinforces mapping and patience — tracking HTF → MTF → LTF ensures higher-probability trades and precision execution.

Tags:

#SMC #SmartMoneyConcepts #Liquidity #Inducement #OrderBlock #USDCAD #Forex #InducementKing

Multiple Time Frame Analysis

AUD/USD| Bullish Continuation SetupBias: Bullish

HTF Overview (4H):

Price remains bullish on the higher timeframe, respecting the overarching structure. Momentum is aligned with smart money intent, and buyers are maintaining control within the 4H range.

MTF Overview (30M):

On the mid-term chart, inducement play has been executed, with sell-side liquidity cleared. Price initially fell into lighter orange order blocks, then swept deeper into the darker discounted level, where it respected the zone. This indicates potential for continuation of bullish activity.

LTF Confirmation (5M):

Lower timeframe break of structure occurred, taking out prior minor lower highs. Price interacted with minor sell-side liquidity and tested recent order blocks, confirming interest. Entry executed once lower timeframe confirmation aligned with the deeper PD zone.

Execution Plan:

Stops below the minor 5M structure. Targets: 5M highs → 30M highs → aligning with 4H highs, depending on market delivery and momentum. Entry only taken once structure confirms and price shows follow-through.

Trade Management:

Partial exit at first 5M high, second scale at 30M high. Trail stops below last 5M structural low. If momentum persists, hold for potential 4H swing continuation. Reassess if price hits stop-loss and plot PD grid for next valid entry.

Mindset Note:

Accept losses gracefully — structure guides the plan. Smart money dictates direction; patience ensures precision.

Progress Hook:

Each mitigation and sweep reinforces discipline — staying calm under pressure allows me to spot higher-probability setups.

Tags:

#SMC #SmartMoneyConcepts #Liquidity #Inducement #OrderBlock #AUDUSD #Forex #InducementKing

USD/JPY| Bullish Continuation SetupBias: Bullish

HTF Overview (4H):

Strong bullish momentum is climbing steadily, leaving clear volume and momentum signals at the upside. Price currently sits at highs, showing sustained buyer control and high timeframe bullish intent.

MTF Overview (30M):

We’ve mapped and refined structure, identifying inducement and waiting for sell-side liquidity to be taken. Price is expected to drop into the 30M order block below (orange zone) before presenting a proper setup. Smart money activity is guiding this movement — patience is key.

LTF Confirmation (5M):

Waiting for a lower timeframe CHoCH to form: break of lower highs followed by micro-high creation. This will allow a clean entry off the fresh OB and capture the inducement sweep.

Execution Plan:

Stops placed below the 5M structure. Targets scaled from 5M highs → 30M highs → 4H highs, depending on momentum and market delivery. Entry executed only once lower timeframe structure confirms.

Trade Management:

Partial exit at 5M high, second scale at 30M high, trail stop below last 5M low. Full swing extension considered if momentum sustains toward 4H highs.

Mindset Note:

Patience before execution — smart money sets the stage, I follow only when structure confirms.

Progress Hook:

Mapping HTF to LTF with patience ensures precision entries — each setup reinforces disciplined observation.

Tags:

#SMC #SmartMoneyConcepts #Liquidity #Inducement #OrderBlock #USDJPY #Forex #InducementKing

GBP/USD| Bullish Continuation SetupBias: Bullish

4H Overview (Higher Timeframe):

Structure has broken significant highs, showing clear bullish intent. After taking out inducement and sweeping sell-side liquidity, price fell into our 4H order block and reacted strongly — printing a clean bullish wick and confirming high timeframe interest.

30M (Mid-Term Context):

Price has efficiently cleared sell-side liquidity and tapped into the refined mid-term zone. We’ve seen a healthy drop into the orange zone, which aligns with our discounted range. From here, I’m watching for price to hold this territory and present a lower timeframe break of structure — ideally a 5M LH break and pullback to confirm the bullish continuation leg toward higher targets.

Execution Plan (5M Entry Framework):

Stops remain below structure. I’ll be looking to execute once a valid 5M CHoCH + pullback forms within this zone, targeting 5M, 30M, and 4H highs depending on delivery and momentum. If price re-enters the zone once the market opens, I’ll be closely monitoring for that shift confirmation.

Mindset Note:

Patience pays — we let smart money reveal its hand before reacting. The setup is already built; we just wait for structure and timing to align.

EUR/USD- Bullish- Maintaining 4H Control🧩 Pair & Bias

EUR/USD – Bullish

Momentum continues to favor buyers as price remains within a strong 4H bullish range.

⸻

⏳ HTF Overview (4H Context)

Higher timeframe structure maintains strong upside momentum showing clear bullish intent for the week.

Price continues to respect the existing 4H range, holding the same structural formation that’s guided price since previous sessions.

Smart money still appears active within the bullish leg — control remains with buyers.

⸻

🧠 Mid-Term (30M Perspective / Inducement Play)

30-minute structure shows sell-side liquidity being taken.

The weak inducement pulled price into a cluster of mid-term OBs below, all of which have been mitigated.

From there, price shifted upward, breaking major LTF lower highs and revealing fresh bullish interest.

Last week’s early long entries were closed during minor retracements; current focus is waiting for new accumulation and confirmation inside this same 4H territory.

⸻

🎯 LTF Execution (5M Details)

• Looking for price to create a new 5M order block within current pullback structure.

• Will re-enter once that fresh 5M OB forms and confirms via CHoCH.

• Stops: always below the most recent 5M structural low.

• Targets: 5M highs → 30M highs → potential 4H continuation if momentum and volume sustain.

⸻

💰 Trade Management

Will allow price to develop naturally. Execution only after confirmation.

Holding time depends on momentum + volume readings and overall delivery behavior.

⸻

💭 Mindset Note

“Patience defines precision. Smart money already knows its path — my job is to wait for the new CHoCH to confirm I’m aligned with it.”

⸻

📈 Progress Hook

“Starting the week refining my 4H-30M-5M mapping and trusting the process. Letting structure, not emotion, guide execution.”

⸻

🔖 Tags

#SmartMoneyConcepts #SMC #InducementKing #MarketStructure #OrderBlocks #LiquiditySweep #Forex #PriceAction #EURUSD

EURUSD Weekly Forecast

My outlook for next week is still bearish, until we hit the area that started the whole upward move.

October ended with a swing high forming and a bearish candle close, which means we might see a fourth continuation candle.

Since the weekly candle broke through the EQL, we're probably going to get a pullback to the bearish 4-hour FVG early next week, then the drop should continue toward the EQL.

The main thing that could slow this down is a big bearish daily FVG; that will be some strong resistance. We really need to watch the price action there.

Tron/TRX on the Verge of a DropThe first expected level is the blue one, where breaking it makes the orange zones and the green trend line important, with a higher likelihood of reaction on the trend line. During the reaction for an upward move, if it hits the purple zone and lacks the strength to break it, there's a chance of continued decline. And when the price crosses the yellow zone, it signals that the uptrend is beginning. BINANCE:TRXUSDT

You Don’t Need a New Strategy—You Need a System (Here’s Proof)This week’s trade recap isn’t just about the winning setup — it’s about understanding why it worked and what that means for your long-term edge as a trader.

Most traders spend years chasing “the perfect strategy,” but strategy alone is just the product. Think of trading like business — McDonald’s and Burger King both sell burgers, but only one built a system that scales, duplicates, and dominates globally. The same applies to trading: your real edge isn’t the setup, it’s the structure behind it — your discipline, consistency, and process.

In this video, we break down:

The winning trade of the week and how the setup developed

Why edges are built through process, not predictions

How business thinking creates stronger traders

The mindset shift from “what to trade” to “how to operate”

Whether you’re trading forex, indices, or crypto, this session will help you think beyond entries and exits — and start building a business-level edge that lasts.

Tags: trading edge, trading psychology, weekly trade recap, trading mindset, how to build consistency in trading, forex strategy, trader discipline, trading process, profitable trading habits, business mindset for traders

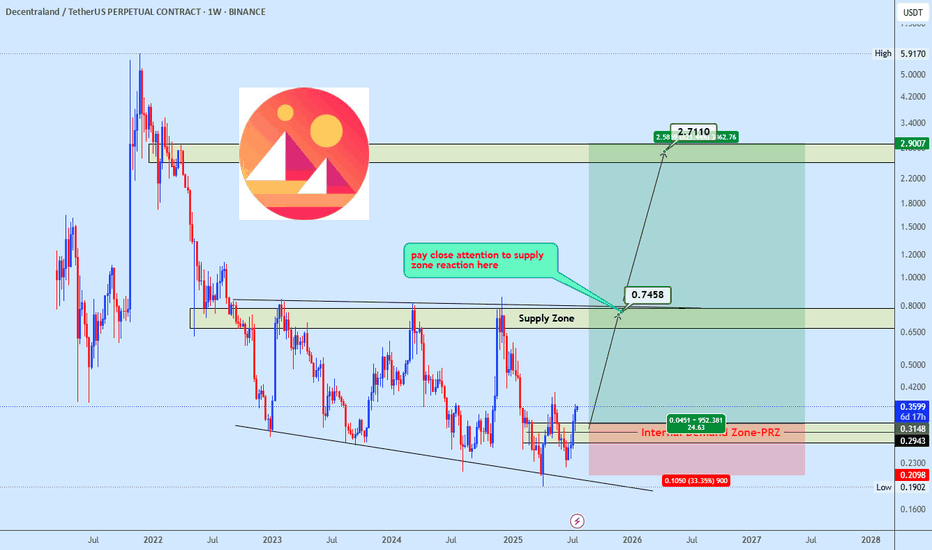

Manausdt buy opportunityMANAUSDT is gaining strength with price rebounding toward the bottom trendline and pushing upward. Momentum favors a continued rise toward the $0.65–$0.80 supply zone, a key level that previously triggered strong sell-offs. A successful breakout above this zone could unlock significant bullish momentum, with eyes set on the $2.70 region as the final setup target. Let price action lead, this could unfold swiftly.

Wave 3 Loading? FLOKI Prepares for Potential Upside ContinuationFLOKIUSDT is trading within an ascending channel, recently rejecting from the upper boundary near $0.00034416. Price has since entered a prolonged consolidation phase, forming a descending broadening wedge.

The current focus remains on the $0.00020188 region; a breakout from this level would validate a potential wave 3 extension. Overall structure still targets a revisit to the channel’s upper boundary, supported by the recent bounce from the lower channel trendline.

Key levels and targets are illustrated on the chart.

Ripple on the Verge of a Heavy DropGiven the breakdown of the trend line (green line), the formation of a supply zone (orange zone), and the price pulling back to the supply zone with a reaction at the supply level, our first support area is the blue line zones. This is because, after breaking the trend line, the price tends to oscillate between the trend line and the next level. If the price breaks below the blue level, it will reach the marked areas, indicating that Ripple could potentially drop to around 1.16. BINANCE:XRPUSDT

Short trade

📘 Trade Journal Entry

Pair: ETHBTC

Direction: Sell-Side Trade

Date: Thu 30 Oct 25

Time: 12:00 pm

Session: NY Session PM

Timeframe: 1 Hour

🔹 Trade Details

Metric Value

Entry 0.03498

Profit Level (TP) 0.031992 (+ 8.75 %)

Stop Level (SL) 0.03523 (– 0.71 %)

Risk–Reward (RR) 12.24 R

🔸 Technical Context

Wyckoff Structure:

ETHBTC remains in Phase E, completing distribution and entering the markdown sequence.

The pair broke consolidation support following repeated up-thrusts (UTAD) at premium pricing.

Market Structure Shift:

CHOCH confirmed bearish control after rejection from resistance (0.0359–0.0362).

BOS validated breakdown continuation toward the 4 hr FVG (0.0337 – 0.0333).

Phase E now marked by consistent lower highs and liquidity draws below structural lows.

Liquidity Targets / Zones:

Primary Target: 0.0319 (4 hr FVG + order block confluence).

Extended Objective: 0.0300 — deep demand and liquidity resting zone.

Resistance Zone: 0.0359 – 0.0362 (previous supply area).

Volume Profile:

Increasing sell-side volume through breakdown candle; institutional participation confirmed by accelerated momentum at liquidity breach.

🔹 Narrative & Bias

Following weeks of compressed distribution, ETHBTC finally confirmed bearish continuation through Phase E progression. The setup aligns with BTC dominance re-expansion and risk rotation away from ETH as capital flows toward Bitcoin safe-haven liquidity.

Sentiment Context:

Macro: Altcoin weakness amid USD resilience and broader market risk aversion.

On-Chain: ETH exchange inflows rising → evidence of distribution.

Technical: Repeated failures to reclaim resistance zone confirmed bearish supply control.

Projection:

Price expected to extend toward 0.0320 and potentially 0.0300 as the final liquidity objectives beneath September lows are met. Any re-accumulation likely to form only after a full mitigation of the FVG zone (0.0331 – 0.0319).

Long trade

📘 Trade Journal Entry

Pair / Symbol: ZS (Zscaler Inc)

Direction: Buy-Side Trade

Date: Tue 7 Oct 25

Time: 7:45 am

Session: LND Session AM

Timeframe: 1-Day

Metric Value

Entry 291.56

Profit Level (TP) 375.42 (+28.79 %)

Stop Level (SL) 286.09 (–1.85 %)

Risk–Reward (RR) 15.54 R

🔸 Technical Context

Structure:

Higher-timeframe break of structure (BOS) through prior swing-high resistance. Price respected the 0.5–0.618 retracement zone (Fib support) and reclaimed previous supply now turned demand.

Fibonacci Confluence:

Targets extend to 1.618–2.618 expansion levels (355 → 410 → 486 zones), aligning with historical resistance clusters.

Momentum Indicators:

Volume expansion and EMA slope confirm renewed institutional demand post-pullback.

Macro Trend:

Sustained up-channel from 2023 lows; structure suggests continuation into Q4 2025 with rotation toward previous all-time-high (486).

🔹 Narrative & Bias

Zscaler remains a leader in cloud-security and zero-trust network access.

The breakout follows a series of higher-lows within a well-defined accumulation base.

Institutional flows appear to be returning to cybersecurity and AI-linked SaaS stocks ahead of U.S. earnings season.

Fundamental Backdrop:

Expansion of AI-driven MDR and SOC solutions increasing client retention.

Sector rotation favouring defensive tech during market uncertainty.

Projection:

Expect price continuation toward the 1.618 Fib extension (≈ 355–376) initially, followed by potential mid-term target ≈ 410–486 should bullish sentiment persist into late Q4 2025.

META — Possible Macro Peak, Bearish Year AheadMeta may have completed its long-term C wave after reaching new all-time highs at the top of the macro channel.

The structure now shows emerging bearish sequences on lower timeframes , hinting that the next yearly cycle could be corrective or bearish rather than impulsive.

While the theoretical WCL sits far below (around 350–400), such a deep retracement would imply a 50% drop — an extreme but technical possibility.

A more realistic path could be a 20–30% macro correction as the market digests Meta’s extended rally and rebalances valuation.

Key Points:

Macro C wave completed at the upper channel boundary.

Lower timeframe sequences turning bearish.

WCL remains the ultimate downside target, though not the base case.

Expect a potentially bearish or corrective year ahead for Meta, within the long-term bullish structure.

Invalidation:

If price reclaims the 780–800 zone and breaks above the red B high, bearish structure fails.

Long trade 📘 Trade Journal Entry

Symbol: AAPL (Apple Inc.)

Direction: Buy-Side Trade

Date: Fri 10 Oct 25

Time: 11:00 am

Session: LND to NY Session AM

Timeframe: 1 Hour

🔹 Trade Details

Metric Value

Entry 248.43

Profit Level (TP) 278.00 (+11.88%)

Stop Level (SL) 243.56 (–1.98%)

Risk–Reward (RR) 6.0 R

🔸 Technical Context

Structure:

Price broke out from an extended accumulation zone with confirmation from a BOS (Break of Structure) and Demand Zone Retest on the 15-minute and 1-hour timeframes.

The move aligns with a strong fair value gap fill and retest of the order block around 244–245, which acted as a springboard for the next impulsive leg.

Fibonacci Expansion:

1.618 projection → 261.30 (short-term target)

2.618 projection → 267.60 (intermediate)

3.618 projection → 274.00 (high-probability swing)

4.236 projection → 277.92 (extended TP)

Volume Confirmation:

Volume spikes visible at the breakout candle reinforce institutional participation, marking a clear transition from consolidation to markup phase.

🔹 Narrative & Bias

Apple continues to exhibit buyside momentum after consolidating above the September accumulation range. The breaker block re-entry at 245 aligned with fib 0.618 retracement and strong volume demand, confirming bullish continuation.

Current structure mirrors prior accumulation-distribution cycles seen before major upside runs.

Macro Context:

Tech sector rotation in line with AI & earnings optimism.

Broader equity market stability encouraging risk-on positioning in mega-cap tech names.

Projection:

Price expected to extend toward 267–278 levels before the next major consolidation phase, with potential for partial take-profits near the 1.618 extension.