Bitcoin to crash 70% in 2026 to $35k? - January 2026This chart is so simple it should be illegal. Influencers push out super-cycle nonsense while the chart screams the most obvious return of gravity.

Two oscillators at the bottom of the above 1 month chart:

RSI

RSI closes below 54 on the monthly (red circles). If the month of January closes as is below 54, then the next 700 days will be a grand nothing burger. 2 years of zip. Look left, this time is not different. Influencers will still publish daily videos “Black rock is buying”.

Stochastic RSI

Here we see momentum crossing down 20 (Green circles) for the first time since January 2021. Each and every event throughout Bitcoin’s history saw 70% corrections at a minimum, 90% corrections at the maximum. A 70% correction could be conservative, with a forecast to $37k and 90% as low as $12k.

Is this time different?

No. Come on, seriously? How for gone are you?

Will I short?

No. I never short any market, there’s never any need to do that. Only long what is oversold and beaten down. And right now it’s Christmas come early as 99% of the market chase shinny objects. Me? I'm chasing 0.01% that's about to explode on ideas already published and yet so few have commented on.

Ww

==========================================

Disclaimer

Right. Listen up, you desperate, hopeful goblins. Before you read this and immediately sell your kids’ shoes to bet on a Bitcoin crash because some bloke on the internet drew some red circles… a word.

This isn’t financial advice. It’s not even good advice. It’s a chart with some lines and circles I made while avoiding proper work. Treat it with the same respect you’d give a horoscope written by a drunk pigeon.

I am a moron. Seriously, I tried to short Gold at $2k, din't you read the comments? I’m a stranger with a drawing tool. My greatest financial achievement this year was finding a 10 cent coin in the laundromat. Do not model your life on my squiggles. You wouldn’t let me perform surgery on you with a spoon, so don’t let me perform surgery on your portfolio with a stochastic RSI.

I Won’t Short It. I said I won’t short. Know why? Because I’m a coward. Or wise. It’s the same thing. So if it moons and you shorted because of me, you’re not only poorer, you’re also braver than I am. And bravery in finance is just a pretty word for “stupidity.”

In summary: This is for entertainment. If you lose all your money, you can’t have my 20 cents.

Oscillators

OG Fan Token OG to print 200% upside more to resistanceOn the above 8 day chart price action has corrected 90% since October on this football token.

Resistance is around 200% above current price action with RSI at ridiculously oversold levels for this timeframe. There's many more technical reasons for being bullish, but time is limited for usual waffle.

Is it possible price action falls further? Sure.

Is it probable? No.

Start scaling out after $8 or wait for a probability condition to print.

Ww

==============================================

Disclaimer

This idea is for educational and informational purposes only. It is not financial advice. Cryptocurrency trading carries significant risk of loss and is not suitable for all investors. Always conduct your own research (DYOR) and consider consulting a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results.

Bitcoin Structure Update (Daily)Bitcoin remains in a bearish structural regime on the daily timeframe.

Price continues to trade below the 200 EMA, with the 10, 20, and 50 EMAs all positioned beneath it. Shorter-term EMAs (10 & 20) maintain downward curvature, indicating that downside pressure remains unresolved and trend structure has not yet repaired.

Momentum & Participation

RSI: Downside pressure remains elevated, but momentum is beginning to decelerate following the most recent daily close. RSI is still deeply stretched and remains below key recovery thresholds, signaling early stabilization rather than confirmation.

Rate of Change (ROC): The pace of the decline is slowing, suggesting downside momentum is no longer accelerating. However, ROC remains negative, indicating that pressure has eased but has not yet transitioned into a positive regime.

Summary

Structure remains bearish. Momentum is showing early signs of deceleration, but no confirmed reversal or structural reclaim is present at this time. This remains a structural assessment of current conditions, not a prediction.

DF (Canada) - Slow And Steady Wins The Race?Given all the crazy volatility across metals, stocks, and crypto at the moment, I thought Id have a look for those quieter slow and steady stocks / etfs that are just ticking away and staying out of the drama.

Dividend 15 Split Corp II has quietly put together a very strong run, gaining over 54% in the last year. While the big tech names usually grab the headlines, this Canadian split share corporation has been trending steadily higher in a clear channel. It essentially acts as a leveraged bet on reliable dividend payers, and right now, in the current market, that momentum is hard to ignore.

Fundamentally, this strength is being driven by the performance of its underlying portfolio, which consists of 15 high-quality Canadian blue chips like banks, utilities, and telcos. As interest rate pressure eases, money has been rotating back into these yield-heavy sectors. Because of the split share structure, the Class A shares (DF) amplify the gains of those underlying stocks, which explains the aggressive move up compared to the broader Canadian TSX. The recent pause in price action looks like a healthy breather rather than a reversal.

Technically, the chart is well-behaved. The price has been respecting a rising channel for months, making higher highs and higher lows. The recent pullback successfully tested support near the moving average (the red line), and buyers stepped back in. The RSI is sitting at a comfortable 63, meaning there is still room to run before it gets technically overbought. It might be a little more expensive than it could be, but depends how long you want to hold it.

Might be worth a watch if you like yield with a side of momentum. ..................................................

PLEASE NOTE: Nothing I post is trading advice. All investing involves risk, and past performance doesn’t predict future results. Trends can and do end. For 2026 , my goal is to try and post one new asset each day. Something outside the usual gold, silver, BTC, or big tech names. I like to find stocks worldwide showing steady trends with some good gains, a recent pullback, and signs of renewed strength. I don’t necessarily hold positions in these. They are simply companies I find interesting at the time of posting. I’ll often revisit them within a week to see how they went and share any updates. If you enjoy these posts, please BOOST and FOLLOW ME to discover more under-the-radar stocks and businesses from around the world. ..................................................

RSI Continuation Analysis in Bull and Bear Market Regimes (BTC) This study set out to answer two practical questions about how Bitcoin behaves after extreme RSI readings, depending on whether the broader market is trending upward or downward:

1. In bear markets, does an RSI reading below 30 typically lead to continued price weakness?

2. In bull markets, does an RSI reading above 70 typically lead to continued price strength?

To investigate this, daily Bitcoin price data was examined over a multi‑year period, and each day was categorized by both its market regime and its RSI condition. Forward returns were then measured to determine whether prices tended to continue in the same direction after these extreme momentum signals.

1. Data and Time Period

The analysis used daily Bitcoin‑USD closing prices covering:

September 17, 2014 through February 6, 2026

This provided a long, diverse dataset containing multiple bull markets, bear markets, and transitional periods.

2. Indicator Construction

Two key pieces of information were calculated for every trading day:

Relative Strength Index (RSI‑14)

A momentum indicator ranging from 0 to 100.

• RSI < 30 is traditionally labeled “oversold.”

• RSI > 70 is traditionally labeled “overbought.”

200‑Day Moving Average (MA200)

Used to determine whether the broader market trend was upward or downward.

The slope of the MA200 over a 20‑day window was used to confirm whether the long‑term trend was rising or falling.

3. Market Classification

Each day in the dataset was assigned to one of two regimes:

Bull Regime

• Price above the 200‑day moving average

• MA200 trending upward

• Conditions sustained for several consecutive days to avoid noise

Bear Regime

• Price below the 200‑day moving average

• MA200 trending downward

• Conditions also required to persist for multiple days

This ensured that each day was placed into a stable, meaningful trend environment rather than reacting to short‑term fluctuations

4. Forward Return Measurement

For every day in the dataset, the 5‑day forward return was calculated.

This measures how much price changed over the next five trading days, expressed as a percentage.

This allowed the study to answer:

“After an extreme RSI reading, what typically happens next?”

5. Grouping by RSI Thresholds and Regime

Each day was placed into one of four groups:

• Bear regime + RSI < 30

• Bear regime + RSI > 70

• Bull regime + RSI < 30

• Bull regime + RSI > 70

For each group, the following were computed:

• Mean 5‑day forward return

• Hit rate (percentage of days with positive forward returns)

• Sample size (N)

These statistics were then compared to understand how RSI behaves differently depending on the market environment.

6. Results

BEAR MARKETS

RSI < 30: MEAN 5 DAY RETURN WAS -0.706%, HIT RATE WAS 57.86%, N = 140

RSI > 70: MEAN 5 DAY RETURN WAS +1.519%, HIT RATE WAS 57.92%, N = 183

BULL MARKETS

RSI < 30: MEAN 5 DAY RETURN WAS +1.968%, HIT RATE WAS 61.80%, N = 233

RSI > 70: MEAN 5 DAY RETURN WAS +3.278%, HIT RATE WAS 63.44%, N = 640

A second summary using median-based measures produced similar directional conclusions:

In BEAR MARKETS, RSI < 30 showed slightly negative continuation on average

In BULL MARKETS, RSI > 70 showed strong positive continuation

7. Interpretation in Plain Language

The findings show that RSI behaves very differently depending on the broader trend.

In bear markets, an RSI reading below 30 does not signal a reliable rebound; instead, prices tend to continue drifting lower over the next several days. In bull markets, an RSI reading above 70 does not signal an imminent reversal; rather, prices tend to continue rising, showing that strong momentum often persists. In short, “oversold” does not reliably help you buy dips in downtrends, and “overbought” does not reliably warn of reversals in uptrends, momentum tends to continue, not reverse.

Global X Lithium & Battery Tech ETF - Support & resistanceOn the above 2-week chart of the Global X Lithium & Battery Tech ETF price action has corrected 60%. A number of reasons now exist to be long.

1) Support and resistance. In 2011 and 2017 price action found strong resistance exactly at $40 before breaking out in 2020 for a massive 140% gain. Price action has now returned to $40.

2) RSI resistance breakout.

3) Seller capitulation. Regardless of market seller capitulation into past resistance is a wonderful thing. Always a gift horse, lets not start counting teeth.

It is possible price action corrects further? Sure.

Is it probable? No.

Ww

Type: Trade, not investment.

Risk: <=6%

Timeframe for long: This month

Return: 40%

ARMN (USA) - Gold Star Gold MinerAris Mining Corporation has been an absolute rocket ship over the last year, putting in a gain of over 430% . Based primarily in Colombia, Aris is a gold producer with high-grade underground operations. When you see a miner outperform the spot price of gold by this margin, it usually means they aren't just riding the commodity wave, but they are actively executing on production growth and expansion.

Fundamentally, the story here is about scaling up. They have been successfully expanding their Segovia operations and are pushing forward with major developments at Marmato. The stock has seen a sharp pullback recently caused by te overall market dropping as well as standard profit-taking after a parabolic run. There has been some chatter about rising costs (AISC) as they spend money to expand, which often gives traders an excuse to lock in gains. However, with gold prices remaining robust and their production numbers climbing, the core thesis for holding this miner remains intact.

Technically, the pullback has been orderly. As you can see on the chart, the price dropped right into the 20-day SMA area (the green line) and stayed above the 50. This is often where aggressive trend followers step back in. The RSI has reset from overbought levels down to a much more manageable 57, clearing out some of the gold hype without breaking the uptrend. The MACD histogram shows the selling momentum is already fading, suggesting the consolidation might be nearing its end.

Might be worth a watch.

..................................................

PLEASE NOTE: Nothing I post is trading advice. All investing involves risk, and past performance doesn’t predict future results. Trends can and do end. For 2026 , my goal is to try and post one new asset each day. Something outside the usual gold, silver, BTC, or big tech names. I like to find stocks worldwide showing steady trends with some good gains, a recent pullback, and signs of renewed strength. I don’t necessarily hold positions in these. They are simply companies I find interesting at the time of posting. I’ll often revisit them within a week to see how they went and share any updates. If you enjoy these posts, please BOOST and FOLLOW ME to discover more under-the-radar stocks and businesses from around the world. ..................................................

AMD | Oversold Into Range SupportAMD sold off hard despite a top-and-bottom-line beat, as the market focused on the quality of AI upside and how quickly that turns into earnings. In this tape, expectations matter more than the headline beat.

Technical Lens: Price is drifting back towards the lower bound of the sideways consolidation (~195–200 area on this view). RSI is oversold (~29), which often makes this zone a decision point rather than a straight-line move.

Catalysts: The next re-pricing catalyst is evidence that data-centre AI GPU revenue is scaling cleanly (less one-off driven) and that margins/operating leverage improve as volumes rise. Any clear proof of larger deployments or platform wins can push forward EPS estimates higher and re-open the re-rate conversation.

Takeaway: AMD is pressing into range support with oversold momentum — the next few sessions should reveal whether this is a stabilisation zone or a range breakdown attempt.

Bitcoin: Ugly but OversoldTrading through the lower Bollinger band with RSI (14) and MACD sitting at extreme levels, conditions are in place to spark some form of bounce or squeeze in BTC/USD, potentially putting upside levels in play.

$66,000 acted as both support and resistance for periods in late 2024, making it the first reference point on the topside. A sustained move above this level would allow for longs to be set with a tight stop beneath for protection, targeting a retest of the former support zone between $73,500 and $75,000.

Alternatively, if the price can’t break above $66,000, it would open the door for shorts with a tight stop above for protection, targeting $60,000 where the price bounced earlier in the session. If that level were to break, $52,650 and $49,575 come into focus, coinciding with lows set in 2024.

The message from RSI (14) and MACD remains entirely bearish, favouring selling into strength rather than setting counter-trend longs. That said, be selective on the short side given oversold conditions, paying close attention to price action around the levels outlined above.

Good luck!

DS

Breakdown risk buildingAustralian ASX 200 SPI futures are testing the key 200DMA after breaking out of the ascending channel they had been trading within since late November. With momentum beginning to swing to the downside, traders should be alert to the risk of a more prolonged unwind ahead. Price action into the close may prove instructive in gauging where near-term directional risks lie.

Should we see a close beneath the 200DMA, shorts could be established with a stop above either the moving average itself or former channel support, depending on the risk-reward profile you’re seeking from the trade. The 8652 level acted as both support and resistance around the turn of the year, putting it firmly on the radar as an initial hurdle for shorts. If price cannot break that level, it may be prudent to nix the trade. More appealing downside targets sit at the December 18 low of 8525, or 8400, where price bounced strongly in 2025.

Alternatively, if price were to recover and close back above channel support, the setup could be flipped. Longs could be established above the level with a stop beneath for protection, targeting a retest of 8925, where price struggled to break several weeks ago.

RSI (14) continues to set lower highs and lower lows and now sits beneath the neutral 50 level, indicating downside pressure is beginning to build. MACD has also crossed below the signal line from above and is trending lower, though it remains in positive territory. It’s not a definitive message from the oscillators by any means, but at the very least it suggests directional risks may be in the early stages of swinging lower.

Good luck!

DS

Why I Think GBPJPY Might Continue Selling...Technical Analysis Hey Rich Friends,

Happy first day of December! I wanted to share my analysis of GBPJPY. I haven't made any moves yet but I will be looking at it for a sell. This is only my technical analysis so I encourage you to check the news and cross-reference the indicators on your own chart. Here is what I am looking at:

- Price has crossed and closed below the previous level of support at 205.730 on H4. This is a bearish confirmation for me.

- The selling momentum has picked up over the last couple of hours

- The stochastic is below 20 on H4. This is a bearish confirmation for me.

Additional information:

- I will be setting sell stops and TPs at previous lows. A will choose a previous high as my SL.

- It's consolidating a little bit right now, but I have more sell confirmations.

Good luck if you decide to take this trade or trade this week.

Peace and Profits,

Cha

FLOKI Potential Correction Soon ! RSI at 99If you haven't read my article about meme coins:

Then the heightened RSI level of 99 for FLOKI signals a potential correction on the horizon.

Such an extremely high RSI often indicates overbought conditions, suggesting that the asset may be due for a pullback.

The price target, as per the Fibonacci retracement tool, is: $0.00000697

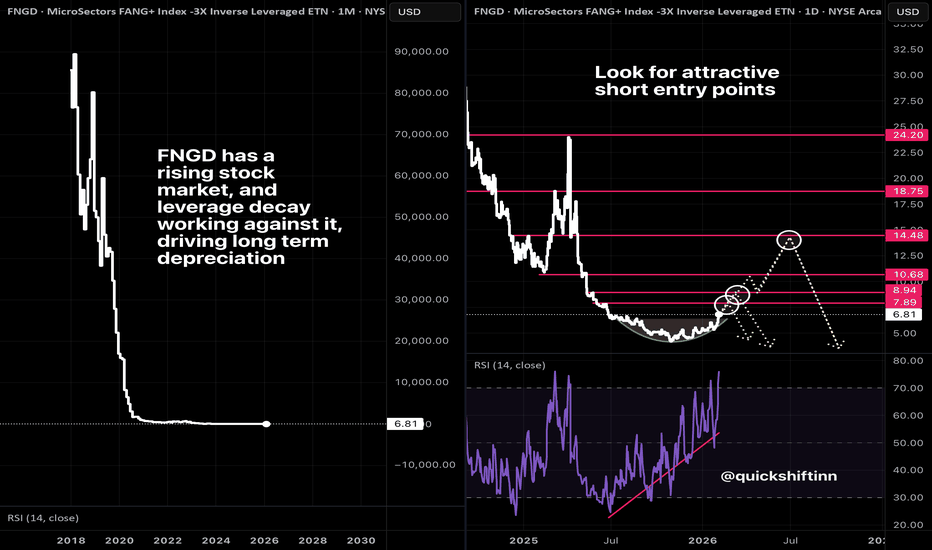

Still believe in big tech? Short $FNGDThe tech sell-off may not be done yet, but if you're starting to think about how to play it, I've got a setup for you to consider -- short $FNGD.

This is part of a theme I trade which roughly to short leveraged ETFs to capitalize on the underlying decay .

As you can see on the left chart here, a monthly chart, AMEX:FNGD goes down over time. That's because the stocks it bets against go up over time, and it suffers from rebalancing like all leveraged ETFs.

The instrument is up something like 40% over the past few months. While the move may not be done yet, it's something to keep an eye on and maybe start nibbling at. Long term, the trend is clear :D

MPCO rebounded from the 200 MA &broke out of the triangle patterMPCO rebounded from the 200 MA 📐🔄 and broke out of the triangle pattern with strong volume 📈🔊.

The main resistance to watch is 1.72 🧱.

A break and close above this level would open the way toward the first target at 1.9 🎯, followed by the second target at 2 🚀.

⚠️ Note: RSI is showing a bearish divergence 📉, so some consolidation or a retest remains possible before continuation.

⚠️ Disclaimer: This is general information only and not financial advice. For personal guidance, please talk to a licensed professional.

RMDA rebounded from the fair value gap & gained momentumRMDA rebounded from the fair value gap 🔄📊, gained momentum, and broke the triangle pattern 📐✔️.

Price will now hit a strong resistance at 2.27 🧱.

A pullback is possible to retest the triangle pattern again, especially with a bearish RSI divergence in place 📉⚠️.

A deeper retest toward the fair value gap around 2.25 could also occur to rebuild momentum before a continuation toward 3.566 📈🚀.

⚠️ Disclaimer: This is general information only and not financial advice. For personal guidance, please talk to a licensed professional.

Gold (XAUUSD) — Pullback Before Continuation?After a strong sell-off, gold has entered a consolidation phase, where oversold signals appeared on higher timeframes.

This corrective structure allowed price to rebound, and gold is now pausing around the 5000$ zone.

🧠 Technical Perspective

• Higher timeframes showed oversold conditions, suggesting selling pressure was exhausted

• Price reacted upward and is now consolidating after the impulse move

• On the 1H timeframe, a bullish convergence is forming, signaling weakening bearish momentum

📉 Expected Scenario

I expect one more pullback toward the 48xx$ area before price continues higher.

This zone stands out as a potential demand area, where price is likely to find support.

Why?

🔍 Volume Insight

• Historical trading volume around the 48xx$ zone is relatively low

• Markets often reverse in low-interest areas, where liquidity is thin and sellers lose conviction

• This makes the zone a strong candidate for price rejection, rather than continuation lower

📌 Trading Idea

At current levels, price offers an opportunity to accumulate small buy positions, rather than entering aggressively.

This is a positioning zone, not a FOMO entry.

🎯 Key Takeaway

Gold often reverses where the market pays the least attention.

By combining:

• Higher timeframe oversold conditions

• Volume behavior

• Lower timeframe convergence

This pullback appears to be a healthy correction within a larger bullish structure, not a trend reversal.

⚠️ Always manage risk properly and wait for confirmation.

Dow Jones: Something’s Got to Give as Triangle TightensSomething’s got to give in our Dow Jones contract, with the price continuing to coil within an ascending triangle. Bulls are lurking beneath trendline support established in early December, while bears are parked above 49580. It’s a real stalemate, and the longer price continues to coil, the more it feels like we could see an explosive breakout once the structure breaks.

Convention suggests we’re more likely to see a bullish breakout, putting fresh record highs on the table, with a move above 51000 possible given where the triangle formed. If we were to see a break and close above 49580, longs could be set above the level with a stop beneath for protection. 50000 will naturally be eyed closely given its significance, but I’d be more inclined to wait for a notable topping pattern before considering whether to cut, reduce or hold.

Of course, convention doesn’t always work, especially in an era where there are ample concerns about lofty valuations, so traders should also be alert to the risk of a bearish break from the triangle.

As things stand, the December uptrend is running near parallel with the 50-day moving average, providing a zone to establish both longs and shorts around, depending on the price action should we see another unwind.

If we see a test and bounce, longs could be established seeking a retest of 49580 resistance. But if we see a break and close beneath the zone, that setup could be flipped, allowing for shorts to be set with a stop above the trendline for protection. 47840 looms as an initial target, coinciding with where price bounced on numerous occasions in December. Beyond that, 47200 was where the uptrend started, putting it on the radar, along with 46875 which saw plenty of two-way price action in the final quarter of 2025.

Possibly improving the prospects for a bullish breakout, RSI (14) has broken its downtrend and remains above 50, suggesting waning upside momentum has stalled for the moment. MACD is sending a similar signal, curling back towards the signal line from below while holding in positive territory. It’s more a neutral message on directional bias than anything, although bulls remain marginally in the ascendency.

LAES Bullish Bat with Three Rising Valleys ReversalPattern Identified: Bullish Bat with strong confluence at Potential Reversal Zone (PRZ).

Key Confluence:

Harmonic PRZ: D aligns with 0.886 XA extension

Price Action: Three rising valleys forming at PRZ - showing accumulation and higher low structure

Momentum: Bullish divergence present on MACD

Apple Bearish Macro May Warrant Caution in Coming MonthsThis is a Macro technical analysis of Apple. Its on the 1 Month timeframe.

So note that February candle just began and will close 28th of Feb so we still have long ways to go.

And note moves on 1 Month are usually powerful ones indicating Macro trends.

So starting off, notice the Ascending Channel i've lined out.

We've been bound to this channel since 2020. Therefore the channel has a Macro hold on price action. And we can use previous interactions with channel as reference.

So previous touches of the Upper Border of Channel, has been met with price declines that push price back to lower border of channel.

So lets take a look at our recent touch in December 2025. We have to ask if we repeat history or is this a pullback to further highs?

Lets notice the big Upper Wick of December candle. This Indicates Sell pressure.

January candle however printed with a Large lower wick indicating Strong Buy pressure. Will it be enough to allow for continuation?

Well we need to look for more clues. And see how the lower timeframes are holding up and potentially how they may, if at all influence the larger timeframes like 1 Month.

I like to use Momentum indicators to see if what kind of momentum exists, whether Bullish Or Bearish.

Notice STOCH RSI has crossed Bearish last month below the 70 lvl. If previous history is any indication, it is likely bearish momentum will continue and chance of downtrend exists. Unless ofcourse we get a Bullish Cross. Which could happen if lower timeframes show enough buy pressure/ demand to influence the 1 Month.

On top of that we got our second Momentum indicator showing signs of waning Bullish momentum with a smaller, lighter colored Histogram bar print and Lower High found in the lines of MACD. We would need to see Darker Green larger histogram bar print.

RSI is also showing signs of Divergence with Lower High prints. TO invalidate potential for bearish continuation we need a Higher High in RSI to mitigate this bearish trend in it.

But all in all, though still early. Its time to pay attention to APPLE price action and macro movements as we could be at a critical cross roads. Maybe signs exist in the 1 Week or 3 Day to understand further where price may go in this Ascending channel.

Stay tuned for more updates.

Solana: ready for a bounce? key levels and targets to watchSolana. Tired of watching this thing bleed or are you secretly hunting that oversold bounce? Altcoins have been under pressure lately as traders de-risk on macro jitters and rotate back into majors, and SOL got hit extra hard after the recent run-up. That flush cleaned out a lot of late longs, which is exactly where bounces often start.

On the 4H chart price is parked around 102-105, right on a chunky volume node that acted as support before. RSI is still near oversold but curling up, and we have a small sideways range after the waterfall - classic pause after panic. I lean to a corrective move up toward 112-118 as long as this local base holds, with sellers likely waiting at the previous breakdown zone. I might be wrong, but this looks more like quiet accumulation than a dead cat to me. ✅

My plan: watch for a sweep of 100 and quick reclaim as a long trigger, targeting that 112-118 pocket where I’d start taking profit. If 100 breaks and price starts closing below 98 with momentum, the idea is invalidated and opens room to 92-94, where the next demand zone sits. For now I’m flat and waiting for either a clean reclaim for longs or a breakdown to fade the bounce.

BNB: are sellers finally tired? key levels and targets aheadBinance Coin. Who else is watching this post‑crash chop and wondering if the sellers are finally tired? Exchange tokens are still under pressure after the latest regulatory headlines, and BNB just printed a proper elevator‑down move, so everyone’s nerves are fried.

On the 4H chart price got smashed through the 840 support and is now ranging in the 750‑780 pocket where we’ve got a fat horizontal volume node. RSI bounced out of oversold with a small bullish divergence, so I’m leaning toward a relief pop into the first supply band around 810‑830. I might be wrong, but this looks more like capitulation than the start of Armageddon.

My base plan: look for longs on dips while BNB holds above 760, with targets into 810‑830 and a tight invalidation below 740 ⚠️. If 740 gives way on strong volume, I drop the long idea and expect a slide toward 700‑680 with shorts on a clean retest of broken support. I’m waiting for a clear 4H candle confirmation before committing size.

USDT: are we due for a relief rally? key levels to monitorMarket Cap USDT Dominance. Ready for a crypto relief rally or is fear just getting started? While majors cooled off after the latest macro jitters and profit taking, traders have been hiding in stables, and dominance spiked hard according to market data. Now price is stalling right at the local highs, so this level suddenly matters a lot.

On the 4H chart we’ve got a vertical pump into 7.1–7.3% plus RSI sitting in overbought and already curling down – classic “too much, too fast” vibes. Biggest volume shelf is down around 6.3–6.4%, so any unwind of fear can send dominance back into that value zone, which usually means a bounce for BTC and alts. I might be wrong, but current structure looks more like a blow‑off than the start of a calm uptrend.

My base case ✅ rejection below 7.2% and a pullback toward 6.4% and possibly 6.2%, where I’d look to add risk on strong coins. Trigger for me is a 4H close back under 7.0% with RSI dropping from overbought. ⚠️ If buyers smash through 7.3% and hold above, then I’ll respect the squeeze, expect 7.5%+ on dominance and stay defensive on alt exposure.