Aptos Bullish Divergence: Targeting $4.3–$15 Range Aptos has stabilized above the last weekly support; currently, there is a bullish divergence on the weekly chart, so all signals point to a likely upward push. The current range to play is $4.3–$15, and the risk-reward in this case is really good. Thanks to everyone for your attention.

Oscillators

Possible Long Trade in USDJPY 1 HR TimframeReading raw price action has given us an impression that Buyers have taken control of the market. Advance Technical Analysis tools used.

1. Price Action Reading

2. Pitchforks

3. Market Manipulation techniques

4. Relative Strength Index

5. Frequency Shifting

A Thesis Of A Trade: Developing A Story For Each TradeThe plan is the same, but each pair has a different story and different thesis. Previously, I have reported that I open a batch of trades and closing them all when I reach a certain profit percentage based on the Stochastic Plan.

Last week the batch stayed negative, but all are still within the plan and not a single one broke the idea of the reason why they were opened. This opened the door for me to start treating each trade on its own instead of opening and closing batches. This is something that I wanted to implement but did not have the heart for it, especially that this is the first time for me to trade the scary daily time frame.

Today is Monday, and accidentally it is the 1st of the month, and the 1st of December. This month I am going to try to keep at the methodology of treating each trade independently and create a thesis for each trade.

Such a methodology with a thesis for each trade allows, as one of the comments of one of my previous videos here suggested, to create structural Stop Loss and Take Profit points. The thesis will tell a story of the pair. Why I opened the trade and where do I see it going based on the stochastic trigger and the chart elements.

The thesis will also show when is the thesis going to be negated and no more stands and therefore needs to be stopped even at a loss. A break of thesis means that the reason why a trade was opened no longer exists and I need to get out of it.

In the same manner, the thesis will look at the chart elements and see potential areas where the price might stop moving in my direction and this is again a point where I would close the trade in my favor.

Everyday now I feel closer to reaching a solid Forex trading plan that I can depend on, and the day of funding a live account is getting closer. I am looking at funding an account by the end of this month to start the year 2026 trading live.

Improving My Win Loss Ratio In Forex TradingWell, Some good news, actually great news. The experiment worked and in this video I show how I am improving my win loss ratio in Forex trading.

From a disastrous Win Loss ratio using only SMC now with combining the classical school along with the Stochastic I have been nailing it for the past 20 days with 22 trades and 8.6% increase on my balance.

In many cases, especially with advantageous RRR, it is Ok to have the win loss ratio in favor of the Loss, as the RRR will compensate and the balance would increase, but in this case I have the win rate higher and the RRR if it was calculated is also higher.

I depend on opening multiple trades and closing them all at once once they hit an acceptable percentage. In the video I said I will close them around 2%, but to tell you the truth, even if it was 1% I would close because no business I know of would bring 1% profit in a day.

The concern now with this Forex Trading Plan is that it does not use Stop Loss nor Take Profit. I feel that I am hanging in the air, which is not a good feeling and this might get me inside an emotional imbalance in the long run.

Still, the test is going on to evaluate all that.

My Steps On how To Improve Forex Trading Win / Loss Ratio In this video we talk about the three elements of the new plan that I have designed based on different types of schools and educational sources.

The plan elements consist of SMC (Smart Money Concepts), Classical School (Support & Resistance, Trend Lines, Febonacci Retracement (not all the time)), and the Stochastic Indicator.

The stochastic is of two timeframes, One is weekly and the other is daily but both are shown on the daily timeframe. This is something that I loved here about TradingView; is the ability to show an indicator of a different timeframe.

Last week I opened a couple of positions based on the new plan, but one of them was opened with haste and not totally adhered to my trading Plan rules.

I show the exact trading rules that I am using and how this will affect my risk management plan.

How to Trade with Stochastics in TradingViewMaster Stochastics using TradingView’s charting tools in this comprehensive tutorial from Optimus Futures.

The Stochastic Oscillator is a momentum indicator that helps traders identify potential turning points in the market by comparing the current closing price to the recent high–low range. It’s designed to show when momentum may be shifting from buyers to sellers — or vice versa.

What You’ll Learn:

- Understanding the Stochastic Oscillator as a momentum tool plotted from 0 to 100

- How the %K line represents the current close relative to the recent high–low range

- How the %D line acts as a moving average of %K and serves as a signal line

- Key thresholds: readings above 80 suggest overbought conditions, while below 20 suggest oversold conditions

- Why overbought and oversold levels are not automatic buy or sell signals — and how strong trends can keep Stochastics extended

- Identifying bullish and bearish crossovers between %K and %D

- Spotting bullish and bearish divergence between price and momentum

- Using Stochastics to confirm trend direction across different timeframes

- How to add Stochastics on TradingView via the Indicators menu

- Understanding the default settings (14, 3, 3) and how adjusting them affects responsiveness

- Practical examples on the E-mini S&P 500 futures chart

- Applying Stochastics across multiple timeframes — daily, weekly, or intraday — for confirmation signals

This tutorial will benefit futures traders, swing traders, and technical analysts who want to incorporate Stochastics into their trading process.

The concepts covered may help you identify momentum shifts, potential reversal zones, and trend confirmations across different markets and timeframes.

Learn more about futures trading with TradingView:

optimusfutures.com

Disclaimer

There is a substantial risk of loss in futures trading. Past performance is not indicative of future results. Please trade only with risk capital. We are not responsible for any third-party links, comments, or content shared on TradingView. Any opinions, links, or messages posted by users on TradingView do not represent our views or recommendations. Please exercise your own judgment and due diligence when engaging with any external content or user commentary.

This video represents the opinion of Optimus Futures and is intended for educational purposes only.

Chart interpretations are presented solely to illustrate objective technical concepts and should not be viewed as predictive of future market behavior. In our opinion, charts are analytical tools — not forecasting instruments.

Visa (V) Buy Signal: 3-Step Rocket Booster StrategyVisa (V) Buy Signal – Daily Trigger + Weekly Pullback + Rocket Booster 🚀💳📈

Visa Inc. (V) NYSE:V is flashing a compelling buy signal, supported by daily price action, weekly momentum readings, and long-term trend confirmation via the Rocket Booster Strategy.

Step 1 – Daily Candlestick: Bullish Signal

On the daily chart, Visa is showing bullish candlestick formations, including long lower shadows that confirm buyers are stepping in to defend support. This provides the entry trigger.

Step 2 – Weekly Oscillators: Sell / Strong Sell

The weekly oscillator rating is currently in Sell / Strong Sell territory. This highlights short-term momentum weakness, which in the context of a bigger

uptrend often creates an ideal buy-the-dip scenario. Traders can use this temporary pullback as an opportunity to position before momentum flips back upward.

Step 3 – Monthly Moving Averages: Rocket Booster Strategy (Strong Buy / Buy)

On the monthly timeframe, Visa shows a Strong Buy / Buy rating on moving averages. This is the Rocket Booster Strategy in action: the long-term trend is

powerful and acts like a booster, propelling prices higher once short-term weakness fades.

The Buy Case for Visa

Daily Candlestick → Bullish trigger (buyers defending support)

Weekly Oscillator → Pullback offering better entry levels

Rocket Booster (Monthly MAs) → Long-term trend remains strongly bullish

This multi-timeframe alignment makes Visa a high-probability candidate for further upside.

Trade Idea

Entry Zone: Near current levels or on dips

Stop-Loss: Below recent daily lows

Profit Targets: Previous swing highs and psychological resistance levels

The combination of a daily entry trigger, weekly pullback, and monthly Rocket Booster creates a textbook buy setup.

⚠️ Disclaimer: This analysis is for educational purposes only and not financial advice. Trading and investing carry risks. Always practice on a demo account first , and develop solid risk management and profit-taking strategies before committing real capital.

Charts In 3 Steps-Bitcoin (BTC/USD) Buy Signal – Trend Resumes Bitcoin (BTC/USD) Buy Signal – Trend Resumes After Pullback ₿🚀

Bitcoin is also flashing a buy signal when viewed with the same 3-step system, showing strong confluence across timeframes.

Step 1 – Daily Candlestick: Bullish Reversal

On the daily chart, Bitcoin has printed a bullish engulfing/rejection candle, suggesting buyers have stepped in aggressively after a recent pullback. This is a strong reversal signal.

Step 2 – Weekly Oscillators: Sell / Strong Sell

The weekly oscillator rating is showing Sell / Strong Sell. This may appear bearish at first glance, but in the context of Bitcoin’s structural uptrend, it

signals a short-term dip that may provide an attractive entry zone before momentum turns bullish again.

Step 3 – Monthly Moving Averages: Strong Buy / Buy

On the monthly chart, Bitcoin remains firmly in a Strong Buy / Buy rating above its key moving averages. This confirms that the long-term uptrend remains strong, and pullbacks should be treated as buying opportunities.

✅ Daily Candlestick → Bullish reversal

✅ Weekly Oscillator → Temporary weakness offering entry

✅ Monthly MAs → Long-term bullish structure

Trade Idea: Traders may look for long entries on confirmation candles, with

stops below the daily reversal low. Profit targets could be staged toward recent highs and key psychological levels like $75,000 and beyond.

Disney (DIS) Buy Signal – Pullback Creates Opportunity 🎬📈

Disney (DIS) is flashing a fresh buy opportunity backed by multi-timeframe alignment in the 3-step trading system.

Step 1 – Daily Candlestick: Bullish Pattern

On the daily chart, Disney has printed bullish candlestick signals, including rejection wicks showing buyers defending support levels. This confirms demand is stepping in at lower prices.

Step 2 – Weekly Oscillators: Sell / Strong Sell

The weekly oscillator rating is in Sell / Strong Sell territory. This reflects short-term momentum weakness, but in the context of a bullish backdrop, this

pullback is often the perfect setup for positioning early before momentum swings back upward.

Step 3 – Monthly Moving Averages: Strong Buy / Buy

On the monthly timeframe, moving averages are firmly in Strong Buy / Buy mode. This confirms that the long-term trend is bullish and the bigger picture supports higher prices ahead.

✅ Daily Candlestick → Bullish trigger

✅ Weekly Oscillator → Short-term weakness = buy-the-dip setup

✅ Monthly MAs → Long-term trend intact and rising

Trade Idea: Traders may consider entering on dips with stops below recent daily lows. Potential upside targets include previous resistance zones and long-term highs.

⚠️ Disclaimer: These analyses are for educational purposes only and not financial advice. Trading stocks, forex, or crypto carries risks. Always test strategies on a demo account first , and make sure to use proper risk management and profit-taking strategies to protect your capital.

The 3 Step Rocket Booster "Once you master this strategy ..."When you watch this video i want you to think of the

the 3 step rocket booster strategy.

Once you master this strategy then it will

be easy for you understand the other indicators

and how they work.

This video is very very advanced and i dont expect you to understand

unless you are a trading expert.

But the point am trying to make to you

is that everything is connected.

Even understanding one strategy is better than

understanding not even one.

understanding one strategy is the building block.

So in this video am taking you through

the building blocks of trading.

My strategy is very advanced but i want to show you

that even in this advanced strategy

the Rocket booster strategy

is a building block.

So watch this video to learn more now.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please learn risk management and profit taking strategies also feel

free to use a simulation trading account

before you trade with real money.

EURUSD Sell Explained...+100 pips, 3 TPS, 1 StrategyHey Rich Friends,

Happy Wednesday. I wanted to updated you on the EURUSD sell idea I posted a few days ago:

All of my TPs were hit and I was able to secure more than 100 pips in this trade.

Here is a synopsis of my strategy:

- Draw support and resistance lines on 2-3 time frames

- Wait for a break of structure above or below previous support or resistance to enter

- Check confirmations on the stochastic (buy = if stoch is facing up and the blue line is on top. sell = if stoch is facing down and the orange line is on top)

I will make a full strategy video soon, but that is basically it. I follow the same process over and over again because it works.

If this video was helpful or you have any questions, let me know below in the comments.

Peace and Profits,

Cha

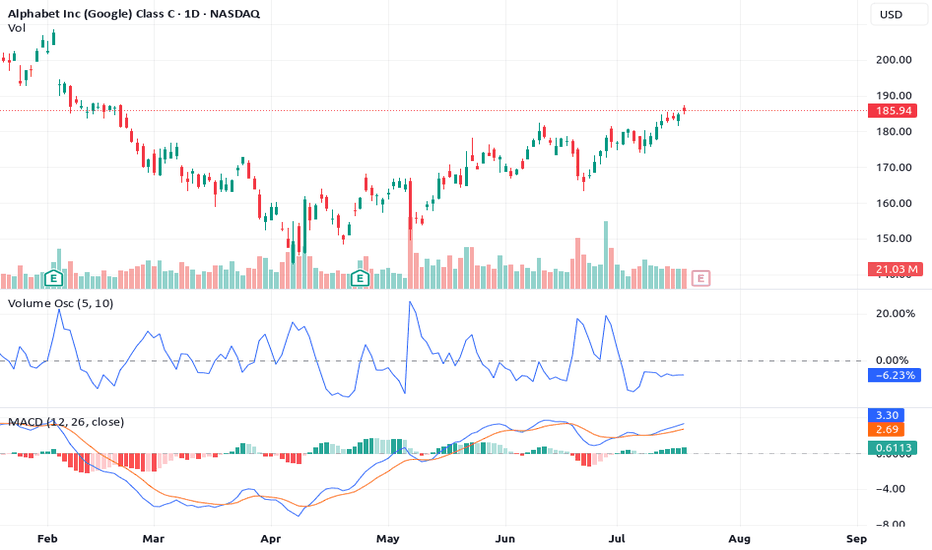

"These 3 power signals boost the 3-step rocket booster strategy"Am lubosi forex and i would like to welcome you.This is where i share with you technical analysis strategies.

I started trading in 2017 and learning about it has not been easy.My hope for you is that this channel will shape your trading journey and help you

Find a path to making money on your own terms.

In this video am showing you the rocket booster strategy

using 3 indicators and catalysts as follows:

1-Volume Oscillator

2-MACD Indicator

3-Earnings Report Catalyst

These 3 power signals boost

the 3-step rocket booster strategy

Watch this video

to learn more

Disclaimer:Trading is risky please use a simulation trading account before you trade with real money

also learn risk management and profit taking strategies.

Better MACDWhat is the MACD?

The MACD (Moving Average Convergence Divergence) is a momentum and trend-following indicator. It’s based on the difference between two EMAs (Exponential Moving Averages) and helps spot:

Trend direction

Momentum shifts

Reversals

Entry/exit points

✅ Basic MACD Techniques

1. Signal Line Crossovers

Bullish Crossover: MACD line crosses above Signal → buy signal

Bearish Crossover: MACD line crosses below Signal → sell signal

🔸 Works best in trending environments, 200 SMA as a filter.

🔸 Combine with volume or trend filters for best results

2. Zero Line Crossovers

When MACD crosses above 0, the shorter EMA is above the longer EMA → bullish. This is typically the sign of a larger trend than crossovers.

When MACD crosses below 0, shorter EMA is below → bearish

🔸 Zero line = baseline momentum direction

🔸 Cross above = bullish trend confirmation

🔸 Cross below = bearish confirmation

3. Histogram Momentum

The histogram is often the first sign of a shift before a crossover happens.

Read it like this:

Histogram growing: Increasing momentum in that direction

Histogram shrinking: Momentum is fading

Histogram changing color (in many indicators): Potential reversal

🔸 Use histograms to get early signals, even before crossovers. Confirmed with volume surge and Price Action.

🔍 Advanced MACD Tricks

📉 4. Divergence Detection

Divergence occurs when price and MACD move in opposite directions.

🔸 Bullish Divergence:

Price makes lower lows

MACD makes higher lows

→ Hidden buying pressure, trend reversal likely

🔸 Bearish Divergence:

Price makes higher highs

MACD makes lower highs

→ Trend weakening, reversal likely

🔹 Confirm with:

RSI, when the lower timeframe RSI is oversold and the higher timeframe MACD is rising, then it's a good sign, and the opposite is true for bears.

Support/resistance zone: draw trendlines either on the volume or price and watch out for retests on the breakout.

Candlestick reversal patterns: some bearish patterns are bullish on indexes because of dollar cost averaging.

Futures RSII will go through why I prefer the 63 RSI to be OHLC4 or HLC3. That's because I think Volume Weighted MA is influenced by the high, low, and close price, so I use either that or OHLC4 after double smoothing it. Watch the 70-30 and oversold levels as a potential reversal play; typically, everything above 35 is bullish and everything below 65 is bearish, with 50 as TP. The most powerful aspect of the RSI lies in finding divergences from the strength of the RSI and the direction of price; that's where the largest trades I have taken were made.

Bitcoin Holding Strong! Key Levels & Entry PointsWeekly Chart: BTC still holding above $78,000, maintaining the overall uptrend despite short-term breakdowns.

🔍 4-Hour Chart: Temporary breakdown below trend line, but volume is low—likely a shakeout before resuming upward.

📊 Two-Pole Oscillator: Showing strength in oversold territory—potential sign of a bounce.

💰 Entry Point: Current levels are likely as close to bottom as it can get, barring external factors like politics or tariffs.

🚨 Key Level to Watch: Weekly close above $78,000 will reinforce bullish trend.

⚠️ Remember to DYOR (Do Your Own Research)!

ACH/USDT - Potential Bounce Incoming 30%+ Gains PossibleI'm analyzing the ACH/USDT 4-hour chart and spotting signs of a potential rebound. Here’s what I’m seeing:

✅ Support Zone: Price is testing a key support level around $0.02119, which has held strong in the past. The market appears to be accumulating in this area.

✅ EMA Crossovers: The chart shows a bearish crossover between the 12 EMA and 20 EMA, but watch for a bullish reversal as price approaches this support. Potential for a rebound if the EMAs cross back to the upside.

✅ Volume Delta Analysis: There's a notable increase in volume with a Delta Volume of 28.42%, indicating heightened interest at these levels.

✅ Reversal Probability: The chart shows an impressive 85.6% reversal probability, suggesting a strong chance of a bullish move soon.

✅ Targets: Looking for a potential 30%+ bounce towards key resistance levels at $0.02559, $0.02657, and $0.02845.

📉 Risk Management: Setting a stop loss slightly below the $0.02119 support level to minimize risk in case of further downside.

📈 If support holds and momentum shifts, a strong move upward could follow. Stay vigilant!

🚨 Not financial advice. Always do your own research.

Free Report #2:The SImple Guide To Trading Stock OptionsThis is the 3 Step Strategy

Am going to show you in this video

to help you with trading stock options.

Watch it to learn more.

#1-Wait for Momentum/Rate Of Change/ Bull Power indicator

#2-Wait for a candlestick chart pattern confirmation

#3-Use the Rocket Booster Strategy

If you want to learn more check out the resources and rocket boost this content

Disclaimer: Trading is risky please learn

risk management and profit taking strategies.

Also feel free to use a simulation trading account.

Nasdaq short-term long: Bounce off Trendline, RSI DivergenceIn summary, I think that there is a good odds that Nasdaq will rebound in the short-term because it has bounced off a 2-year trendline and RSI has diverged with price. Using QQQ to gauge volume, I can also see that there is a healthy volume to support a reversal. However, take note that as of now, I will still consider this to be a corrective wave up and not a major trend reversal to the upside. Meaning, the major trend is still down.

Most overbought in 10 years !? I've used 3 forms of technical analysis to make a case for a major top forming in the European markets. If this turns around, it could lead to a 10% selloff very quickly and if this transforms into a bear market then 20% drop is totally on the cards. Nothing goes up forever.

How I Secured 100+ Pips on NZDUSD Sell This WeekHey Rich Friends,

Happy Friday. Today, I will dive deep into the NZDUSD sell I took this week. Fortunately, my analysis was correct, and with patience, I was able to secure 100+ pips. Here is what I did:

First, I used session breaks on the 1HR time frame to help me identify the previous days' high and low. This is important because based on how the market reacts in these areas, it will help me determine what to do. For example:

- rejection at PDH = SELL, break out above PDH = BUY

- support at PDL = BUY, break out below PDL = SELL

In this case, there was a break below the PDL which was my first indicator to go short.

Next, I used horizontal lines to mark additional lows for potential TPs since I was selling and I used a previous high for my SL.

The only indicator that I used was the stochastic. You can find a very detailed breakdown of how I use the Stochastic in my previous Editors' Pick video here: www.tradingview.com

I hope this was helpful. If you made it this far, comment a "7" and let me know what you've learned.

Peace and Profits,

Cha

How to Set Multiple TPs...for BeginnersHey Rich Friends,

I wanted to share how I find multiple TPs for my Forex trades using free tools and only 1 technical indicator. This strategy is perfect for beginners because it is easy to follow and has clear confirmations for entering and exiting a trade in profit, even if it hits your Stop Loss.

I keep my charts clean and let price action do the talking. Here's my setup:

✅ Session Breaks & Horizontal Lines – I mark the previous day’s highs, lows, and key levels to identify potential areas of interest.

✅ Stochastic for Entries & Exits – I use the Stochastic indicator to time my trades when the price reacts at my key levels (80 and 20 are very important here!)

✅ Horizontal Lines = Potential TPs – Instead of setting a take profit, I let the market tell me when to exit based on price action around these levels.

Less noise, more precision. Drop a "7" if you made it to the end of the video and let me know if it was helpful!

Peace and Profits,

Cha