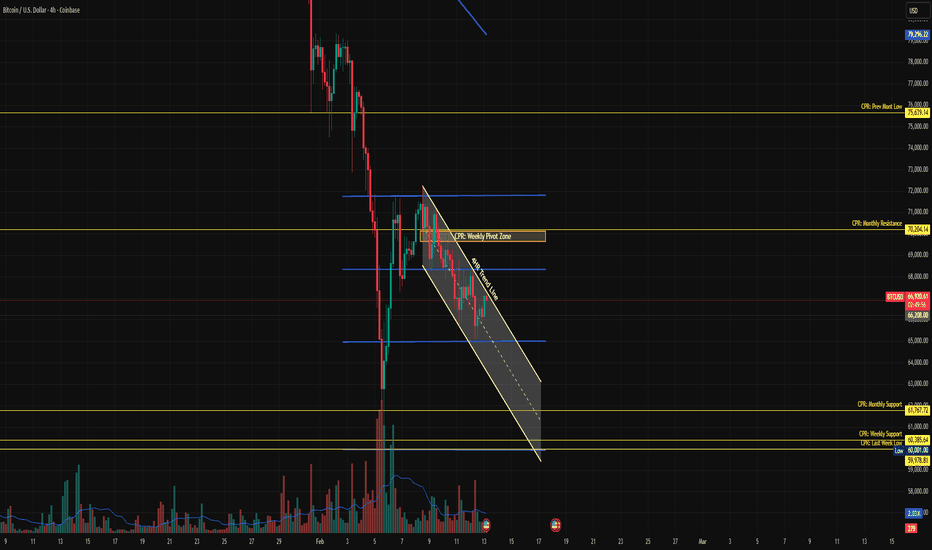

The Great 2026 Shakeout: $60k Support or $50k Capitulation?1. Technical Analysis: The 4H Blueprint

As shown in the attached chart, Bitcoin is currently navigating a high-stakes "correction phase" within a textbook Descending Channel.

Resistance Confluence: BTC is currently testing the upper boundary of the channel. This level is reinforced by the Weekly Pivot Zone (orange box) and the heavy Monthly Resistance at $70,204. Until we see a decisive 4H candle close above $71,000 with surging volume, the local trend remains firmly bearish.

The Horizontal Pivot: We are currently hovering around the $65,000–$66,000 range. This is the "no-man's land" where bulls and bears are battling for control.

Support Floors: The ultimate "Line in the Sand" sits at the Monthly CPR Support ($61,767) and the psychological $60,000 floor. A breach here would likely trigger a liquidation cascade, as it marks the last major defense before the channel's lower extension.

2. Market Sentiment & Global Situation

The macro-environment has turned frosty, and the "Extreme Fear" on-chain is palpable.

The "Warsh" Factor: The recent nomination of Kevin Warsh as the next Fed Chair (set to replace Powell in May) has sent shockwaves through risk assets. The market anticipates a "Hawkish Pivot" focused on shrinking the Fed's balance sheet, which is currently draining liquidity from the crypto ecosystem.

Extreme Fear & Realized Losses: The Fear & Greed Index has plummeted to 9/100, the lowest since the 2022 collapse. Data shows nearly $2.3 billion in realized losses this week alone, suggesting we are in a major capitulation phase.

The ETF "Tourist" Exit: With the average entry price for Spot ETF holders sitting near $90,000, a significant portion of institutional "tourists" are now underwater. We are seeing sustained net outflows as these players de-risk in the face of global uncertainty.

Standard Chartered Warning: Leading analysts have slashed their 2026 targets, with some warning that Bitcoin could drop to $50,000 (a 50% retracement from the 2025 highs) before finding a structural bottom.

3. Conclusion: The Two Scenarios

Scenario A (The Bounce): If BTC can reclaim the $70,204 resistance and break the descending channel, it would invalidate the bearish thesis and likely lead to a short-squeeze back toward $80k.

Scenario B (The Flush): Failure to hold the $60,000–$61,700 support will likely result in a "capitulation wick" down to $50,000–$52,000. This would be the final "cleansing" of the market before a late-2026 recovery.

The verdict: Patience is key. Watch the $60k level like a hawk—it is the only thing standing between us and a deeper correction.

CAUTION: This analysis is for educational purposes only. Trading cryptocurrencies involves high risk. Please conduct your own assessment and trade only with capital you are prepared to lose. Market conditions in 2026 remain highly volatile.

Pivot Points

Downside Targets on BTC. But Im Still BULLISH!Its simple, I mentioned it in my previous video.

BTC to around SUB 50K. Doest matter where everything else goes.

This is a psychology game. Main thing here is to be patient, the market will continue testing you. Bitcoin, Ethereum, and altcoins are under pressure, and many are calling for a full bear market. But I don’t agree that we’re officially in a bearish cycle just yet.

Ask yourself:

-When have we ever entered a true bear market while everyone was already calling for one?

-How can this be a full bear cycle if many altcoins are already sitting near historical lows?

We are entering areas that historically act as reversal territory, not necessarily immediate reversal, but zones where smart money builds positions quietly.

USDJPY: Bullish Push to 157.55?FX:USDJPY is eyeing a bullish reversal on the 4-hour chart , with price rebounding from support after forming lower highs in a downward trendline, converging with a potential entry zone that could ignite upside momentum if buyers break resistance amid recent volatility. This setup suggests a recovery opportunity post-downtrend, targeting higher levels with approximately 1:5.5 risk-reward .🔥

Entry between 152.25–152.85 for a long position. Target at 157.55 . Set a stop loss at a close below 152 , yielding a risk-reward ratio of approximately 1:5.5 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the pair's potential rebound near support.🌟

Fundamentally , USDJPY is trading around 152.8 in mid-February 2026, with key events next week potentially driving volatility. For the US Dollar, Monday February 16 at 08:25 AM ET features Fed Bowman Speech , which could strengthen USD if hawkish on rates. Tuesday February 17 at 08:15 AM ET brings ADP Employment Change Weekly, where strong hiring data may bolster USD amid labor resilience. For the Japanese Yen, Monday February 16 at 10:35 PM JST includes the 5-Year JGB Auction, with higher yields potentially weakening JPY if demand softens. Wednesday February 18 at 06:50 AM JST features Trade Balance (Jan), where a widening deficit could pressure JPY further. 💡

📝 Trade Setup

🎯 Entry (Long):

152.25 – 152.85

(Entry from current price is valid with proper risk & position sizing.)

🎯 Target:

• 157.55

❌ Stop Loss:

• Close below 152.00

⚖️ Risk-to-Reward:

• ~ 1:5.5

💡 Your view?

Is this the beginning of a broader USDJPY recovery toward 157.55, or will resistance cap the bounce and extend consolidation? 👇

GBPNZD: Bullish Reversal Is Now Inevitable. Big Move In Making! Dear Traders,

The GBPNZD pair is currently in a swing sell. The price has failed to reverse and continue breaking support zones. This presents a great opportunity to swing buy GBPNZD. The price is likely to fall around our buying zone and then reverse nicely towards our take profit. Please manage your risk accurately when trading GBPNZD. Wait for the price to reach our area and then for it to be rejected in a smaller timeframe.

Team Setupsfx_

ONDS 1D: Drones at the structural runwayOn the daily chart Ondas continues to develop within a rising channel after a deep but technically healthy pullback. Price is holding the higher timeframe trendline that has supported the move since the initial impulse and is now returning to the 7.85–8.00 area, where prior accumulation was visible.

This zone aligns with multiple technical factors. The 0.702 Fibonacci retracement sits at 7.98. The rising trendline support intersects the same region, along with a previously formed order block. Price is not breaking through impulsively but testing the level with deceleration. ADX remains subdued, signaling compression rather than directional pressure. Volume between 7.80 and 8.20 reflects accumulation rather than aggressive distribution.

Structurally , higher lows remain intact within the expanding rising channel. The pullback into trendline support reads as a technical retest rather than a structural breakdown. As long as the 7.85–8.00 zone holds, the base scenario allows for a move toward 14.00 as the first liquidity reaction area. Above that, 17.72 represents the upper boundary of the channel and the prior extreme. These are not forecasts, but logical structural reaction zones.

Fundamentally , the company remains in a growth phase. Q3 2025 revenue reached 10.10M USD versus 7.03M USD estimated. Q4 2025 revenue is projected at 27.49M USD. Q3 2025 EPS came in at -0.03 USD, with Q4 estimated at -0.04 USD. Operating and free cash flow remain negative on a TTM basis, reflecting ongoing expansion and investment. Q3 financing cash flow of 394.23M USD indicates active capital raising to scale operations.

As long as price respects trendline support and the 7.85–8.00 zone, the structure suggests base formation within a rising channel rather than a breakdown.

Sometimes the runway matters more than the takeoff.

ARK Boosts Crypto Bets After PullbackARK Invest once again signaled strong conviction in the digital asset space. The firm expanded its exposure to several crypto related stocks despite market turbulence. While many investors reacted cautiously to volatility, ARK chose to lean in. This move reflects a broader strategy that prioritizes long term innovation over short term noise.

Recent filings show that ARK crypto investments increased through new purchases in Bitmine and Bullish. The firm also added $12.4 million worth of Robinhood shares after the stock dropped nine percent in a single day. Instead of stepping back, ARK used weakness as an entry opportunity. This strategy aligns with its historical pattern of buying innovation during pullbacks.

Market participants often interpret such moves as confidence signals. When a high conviction investor doubles down, it reshapes sentiment across sectors. ARK crypto investments therefore carry weight beyond portfolio allocation. They send a message about where disruptive growth may emerge next.

How ARK Is Expanding Its Crypto Related Stocks Exposure

ARK Invest expanded positions in Bitmine and Bullish, two companies deeply tied to digital asset infrastructure. These firms operate within segments that benefit from rising blockchain adoption and trading activity. By increasing exposure to crypto related stocks, ARK reinforces its belief in the long term utility of blockchain technology.

Crypto related stocks offer indirect access to digital assets without holding tokens directly. Companies like mining firms, exchanges, and trading platforms capture value from broader ecosystem growth. ARK appears to favor businesses that build infrastructure rather than speculate purely on token prices. This strategy reduces direct price volatility while preserving upside exposure.

ARK crypto investments reflect a thematic approach. The firm identifies technological shifts early and builds positions across complementary businesses. By accumulating crypto related stocks, ARK strengthens its portfolio’s alignment with digital finance transformation.

Why The Robinhood Dip Became A Buying Opportunity

The most eye catching move involved Robinhood shares. The stock fell nine percent in a single trading session. Many investors interpreted the drop as a warning sign. ARK interpreted it as value.

The firm purchased $12.4 million worth of Robinhood shares following the decline. This decision underscores ARK’s conviction in platforms that bridge retail investors with digital assets. Robinhood plays a central role in democratizing trading access, including cryptocurrencies.

ARK crypto investments frequently include companies that connect retail users with emerging technologies. Robinhood shares fit that thesis perfectly. As retail participation in digital assets grows, platforms facilitating that access stand to benefit. By adding Robinhood shares during weakness, ARK signaled confidence in its long term revenue potential.

What This Signals About Institutional Crypto Conviction

Institutional behavior influences market psychology. When firms expand positions in crypto related stocks, they reinforce belief in sector durability. ARK crypto investments demonstrate that institutional players still see structural growth ahead.

Despite regulatory uncertainty and price swings, blockchain adoption continues expanding globally. Financial firms integrate tokenization, custody, and digital asset trading into core services. Infrastructure providers scale operations. Retail engagement remains strong during market cycles.

ARK crypto investments align with this broader institutional trend. The firm builds exposure not only to asset price appreciation but also to ecosystem expansion. That distinction matters. Companies generating transaction fees and platform revenues can grow even during sideways markets.

The Bigger Picture For ARK

Digital finance continues reshaping global markets. Blockchain technology enhances settlement speed, transparency, and cross border transfers. Trading platforms integrate new financial products. Retail access expands across geographies.

The crypto investments reflect belief in this transformation. Rather than chasing token momentum, ARK builds exposure through operating companies. Crypto related stocks offer diversified revenue streams tied to ecosystem growth. Robinhood shares provide retail engagement leverage.

This portfolio structure allows ARK to capture multiple layers of digital asset expansion. Infrastructure growth supports miners and exchanges. Increased participation benefits trading platforms. Innovation compounds across segments.

If digital finance continues maturing, companies within this ecosystem may experience sustained demand. ARK appears positioned accordingly.

Moodng Forms a Strong Bottom | Is a Bullish Reversal Coming?Here is an extended, SEO-friendly English version suitable for TradingView and traders:

It appears that Moodng has formed a significant and important bottom, indicating a potential trend reversal or accumulation phase. Recently, the price moved below a long lower shadow (wick), showing strong selling pressure, but it immediately rebounded upward. This reaction suggests that buyers are actively defending this area and that demand is present at lower price levels.

At this stage, the main Change of Character (CH) has not yet been fully formed, and the price has not confirmed stability or consolidation above the key support zone. This means that the market is still in a sensitive phase and may experience further volatility before establishing a clear bullish structure.

However, if the price revisits lower levels, it can provide a good opportunity for traders to enter at more favorable prices. In such scenarios, it is essential to strictly respect the invalidation level, as proper risk management remains a priority. Since the asset is currently trading in a relatively cheap zone and the long lower wick has been filled, the risk-to-reward ratio appears attractive for potential long positions.

For more conservative and risk-averse traders, it is recommended to wait for clear confirmation. This includes strong consolidation above the key level and the formation of a valid CH. Entering after confirmation may reduce risk and increase the probability of success, even if it means missing part of the initial move.

All target levels are clearly marked on the chart and should be followed according to your trading plan. These targets are based on technical structure, key resistance zones, and potential liquidity areas.

It is important to note that a daily candle close below the invalidation level will invalidate this bullish scenario and cancel the current analysis. In that case, traders should reassess market conditions and avoid holding long positions.

As always, traders are advised to combine this analysis with their own strategies, proper risk management, and market context before making any trading decisions.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

If the price continues to respect the support zone and confirms bullish momentum, we may see a strong upside move toward higher liquidity levels and major resistance zones.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

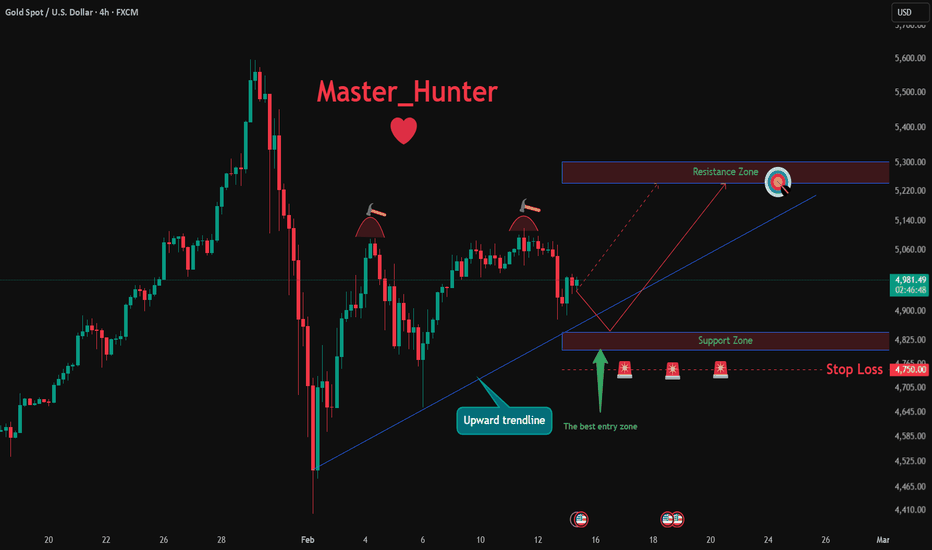

XAUUSD: Bullish Push to 5250?FX:XAUUSD is eyeing a bullish breakout on the 4-hour chart , with price rebounding from the upward trendline after recent pullback, converging with a potential entry zone near support that could ignite upside momentum if buyers defend amid volatility. This setup suggests a continuation opportunity in the uptrend, targeting higher resistance levels with more than 1:4 risk-reward .🔥

Entry between 4800–4850 for a long position (entry from current price with proper risk management is recommended). Target at 5250 . Set a stop loss at a close below 4750 , yielding a risk-reward ratio of more than 1:4 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging gold's resilience near the trendline.🌟

Fundamentally , gold is trading around $4,976 in mid-February 2026, with today's key US Dollar event being the CPI release for January at 8:30 AM ET (13:30 UTC), forecast at 0.3% MoM and 2.5% YoY, where hotter-than-expected inflation could strengthen USD and pressure gold lower, while softer readings boost safe-haven demand. 💡

📝 Trade Setup

🎯 Entry (Long):

4800 – 4850

(Entry from current price is valid with proper risk & position sizing.)

🎯 Target:

• 5250

❌ Stop Loss:

• Close below 4750

⚖️ Risk-to-Reward:

• > 1:4

💡 Your view?

Does gold extend toward 5250 after defending trendline support, or will CPI volatility trigger a deeper correction first? 👇

Gold Recovery Alert! Entry 4910, Watch 5107/5410Bias: Bullish above 4850

Entry Zone : 4910 – 4940 (wait for H1/H4 bullish candle)

Stop-Loss : 4780 (protects against deeper drop)

Take-Profit:

TP1 → 5107

TP2 → 5410

TP3 → 5593

Path: Expect minor dip to 4850–4860 before strong push to 5107 → 5410 → 5593.

Risk Notes : High volatility – reduce position size by 50%. Watch 5000–5050 for possible fakeout.

Summary : Buy above 4850, ride the bullish recovery. Keep SL tight, scale out at resistance levels. 🚀

⚠️Disclaimer: 👇

This is not a financial advice, trade your own Analysis

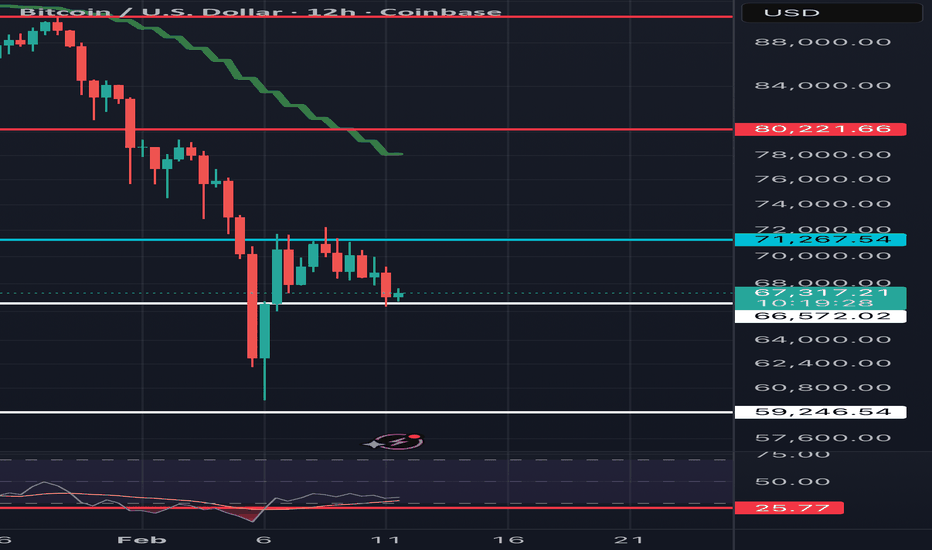

Eliana | BTCUSD · 15M – Range at Resistance | Decision ZoneCOINBASE:BTCUSD BITSTAMP:BTCUSD

After a strong bullish impulse from the 60k liquidity sweep, BTC formed a distribution range near 71.5k resistance. This behavior indicates smart money indecision: either a liquidity grab above range for continuation or a breakdown toward deeper supports if trendline fails.

Key Scenarios

✅ Bullish Case 🚀 →

• Clean breakout and acceptance above range resistance

• 🎯 Target 1: 72,200

• 🎯 Target 2: 73,000

❌ Bearish Case 📉 →

• Rejection from resistance + trendline breakdown

• 🎯 Downside Target 1: 67,800

• 🎯 Downside Target 2: 65,000

• 🎯 Downside Target 3: 60,250

Current Levels to Watch

Resistance 🔴: 71,400 – 71,600

Support 🟢: 70,000 → 67,800

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

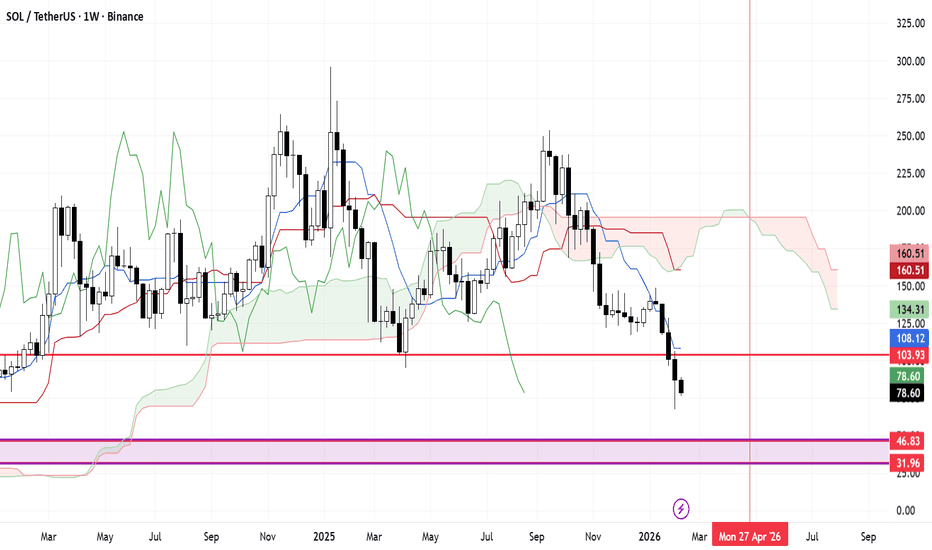

Solana doesn't look goodBINANCE:SOLUSDT

Solana is a weird one. The memes are developing interesting structures. It has broken the previous support so now the $103 level is a resistance. From the looks of it, probably on it's way dying to $30-$45. Also, a time pivot on the 27th of April to keep an eye.

EURUSD Daily: Bullish Continuation & S/R Flip Overview:

Following a strong bullish breakout in early February, EURUSD is currently undergoing a healthy corrective phase. The pair has returned to test a major structural level that previously acted as a ceiling (Resistance), which we now expect to act as a floor (Support).

Technical Highlights:

The S/R Flip: Price is currently hovering inside the 1.1820 – 1.1860 value zone. This area alignswith previous peak levels from late last year, suggesting a high concentration of buy orders.

Market Structure : The daily timeframe remains firmly bullish, characterized by higher highs and higher lows. This retest is a classic "Buy the Dip" opportunity within an established trend.

Price Action : We are looking for a bullish rejection candle (like a pin bar or engulfing candle) on the Daily or 4H timeframe to confirm the bounce.

Trade Parameters:

Entry Zone: 1.1850 - 1.1880

Target 1: 1.1971 (Prior resistance/liquidity tap)

Target 2: 1.2084 (Recent swing high / Yearly high)

Invalidation (Stop Loss): A daily close below 1.1790 would invalidate this bullish thesis, as it would signal a return into the previous range.

Trader's Note: Always wait for price action confirmation before entering. Since this is a Daily (D1) setup, patience is required as the move to the final target may take several trading sessions. Manage your risk accordingly!

BNBUSDT 4HThe consolidation phase appears to be ending, and price is showing signs of a short-term bullish move. However, the overall structure is still bearish, so this is likely a relief rally rather than a full trend reversal.

It also appears that the volume released during the last short-term bearish leg has proportionally contributed to strengthening the consolidation phase, which is a positive sign for stabilization.

As long as price remains below the key resistance zone, upside moves should be considered corrective. A confirmed breakout and successful retest of resistance would be required to signal a true bullish shift.

In short: short-term bullish momentum is possible, but the higher-timeframe trend remains bearish. Trade smart and manage risk.

ING - Critical Area of Interest This is a valid long setup with mixed cues. Price swept the 22 Sep lows and printed a clean hammer back inside the range, offering either a trade or a longer‑term dividend play. The Aug–Oct pullback came on rising volume (not ideal), but the silver lining is the narrowing candle spreads into the low with high volume, signaling demand stepping in and absorption rather than panic.

Liquidity and composite operator read

- Early reversal risk: It’s still early to call the low. The November sweep wasn’t deep, so the Composite Operator may engineer one more push to harvest liquidity.

- If another flush occurs: A sharp retest toward the yearly S2 pivot could set a monthly bullish hammer/doji, then rotate higher back into the range.

Trade Plan

Scenario 1 – Higher risk, price action led

• Initial target: Mid‑range EQ, aligning with the monthly FVG EQ and the local 50% level

• Extended target: $3.50 if price accepts above the range midpoint and holds retests

• Invalidation: November low (tight SL to respect the risk)

Scenario 2 – If November low breaks

• Entry: Look for a bullish hammer/doji close above the yearly S2 pivot

• Confirmation: Add to the position once price closes back inside the range

• Targets: Same as Scenario 1, but with improved risk‑reward if the flush plays out

Bottom Line

Conflicting signals remain, but the structure is tradable. Respect the downside via the November low, and let the chart dictate whether this is absorption turning into rotation.

US30: The Correction is Coming? (Dump) US30 just swept the 50,250 liquidity and is showing a clear rejection. After such an aggressive rally, a retracement is overdue to rebalance the market.

The Setup:

Target: The 8H Order Block (OB) at 48,650.

Reason: Price left a massive imbalance/gap that acts like a magnet. 🧲

Invalidation: A daily close above 50,300.

The Play:

Looking for a smooth ride down to the gray zone. If we hit the OB, I'll be looking for a potential long reversal, but for now, the bears are in control.

AUDNZD: One Hour Timeframe, Possible Intraday Buying Setup! Dear traders,

The AUDNZD dropped in the hourly timeframe today following a heavy sell-off in metals like gold and silver. However, we anticipate a bullish trend for AUDNZD to begin next week as the market settles down. Please manage your risk accurately while trading in these current conditions. Good luck and trade safely!

If you enjoy our work, please like and comment on our ideas.

Team Setupsfx_

GOLD(XAUUSD): Distribution Started Price Heading Towards $5400?Dear Traders,

Gold has completed accumulation phase and its now has started the distribution phase which is likely to take price to $5400 where we could see strong resistance. So use the accurate risk management while trading gold and other financial instruments.

Like and comment for more!

Team Setupsfx_

Selena | XAUUSD – 30M | Intraday Recovery From DemandFOREXCOM:XAUUSD PEPPERSTONE:XAUUSD

After a strong bearish impulse, XAUUSD reached a major intraday demand zone and printed a sharp rejection. Price is now attempting a corrective recovery, but upside remains capped by a descending trendline and supply zone around 4,900–4,930. The move currently looks like a pullback within a broader corrective phase.

Key Scenarios

✅ Bullish Case 🚀 (Intraday)

Holding above 4,760–4,780 support

🎯 Target 1: 4,900

🎯 Target 2: 4,930–4,960 (trendline + supply zone)

❌ Bearish Case 📉 (Failure Scenario)

Breakdown below 4,760

🎯 Downside target: 4,640–4,600 demand zone retest

Current Levels to Watch

Resistance 🔴: 4,900 – 4,960

Support 🟢: 4,760 → 4,640

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.