Silver have more room to surgeSilver briefly surged to a new record high, exceeding 116 USD/ounce, before consolidating around 110 USD/ounce, propelled by escalating geopolitical tensions initiated by the US. Markets anticipate a "polycrisis" as the new paradigm, disrupting the post-World War II global order. Consequently, investors are diversifying away from Gold into other precious metals, such as Silver and Palladium.

The Gold/Silver ratio collapsed from a peak of 110 to 46, trending toward the 2011 low of 32. Persistent geopolitical risks could drive prices to the 160–200 USD/ounce range. Silver maintains a high correlation with Gold but exhibits a higher standard deviation, which may amplify price gains—particularly as supply deficits loom due to surging demand from the energy transition and AI infrastructure.

Technically, XAGUSD retreated to test the EMA21 before rebounding above both expanding EMAs, signaling a continued uptrend.

If price surpasses the recent swing high, XAGUSD could target the 227.2% Fibonacci extension at 131.

Conversely, failure to sustain levels above the EMA21 may trigger a retest of the lower trendline boundary.

By Van Ha Trinh - Financial Market Strategist at Exness

Silver

Silver Inflation AdjustedHow much is the market willing to pay in real (inflation-adjusted) terms?

Roughly 20 times its historical real average ($3), which puts silver around $60 inflation-adjusted.

That means silver can still double from here—and do it faster than most expect.

Would I hold the entire position to those levels? No.

Would I let a small runner ride using house money? Yes.

Here are other Valuation metrics I have posted for your review.

That’s how you participate in upside without turning a trade into a belief system

If you enjoy the work: 👉 Drop a solid comment. Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

#GBPJPY , Another Short ??📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GBPJPY

⚠️ Risk Environment: High

📈 Technical Overview:

Maybe , We can have GJ again but this time would be so Risky.

🚀 Trading Plan:

• Check Momentum around Entry point . if it be high momentum , SKIP IT

• LTF ENTRY NEEDED

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

Silver drops after biggest nominal rallySilver rose nearly $14.5 dollars from its opening price to its highest point today, making it the biggest nominal daily gain ever...percentage wise the gain was 14% at one stage. The metal then hit supply at $117.74 from where it sold off around 8% to dive back below $109.00. This is the bears' first real attempt at trying to create a top. The long legged 4H doji candle certainly looks bearish. Let's see where silver closes today's session. Was this a blow off top, or a mere correction before the next up leg? Keep an eye on the key levels shown on the chart.

By Fawad Razaqzada, market analyst with FOREX.com

Silver Bells, Silver Bells, Silver all the way...Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Silver Bells, Silver Bells

Silver all the way

Oh what fun it is to ride

"in a One Horse" open sleigh

Dashing through the snow

"In a One Horse" open sleigh

Over the hills we go

Laughing all the way

Bells on Bobtails ring

Making spirits bright

What fun it is to ride and sing

A Silver song tonight...

Happy Silver New Year!

Everyone is staring at silver 🤯 Everyone is staring at silver. As if silver just woke up one morning and decided to go vertical.

Nope.

This isn’t just silver.

🥇 Gold

🥈 Silver

🥉 Platinum

All three started moving together back in May 2025 and in the first weeks of 2026, they didn’t trend. They snapped vertical.

Here’s the illusion that needs to die first ☠️

This is not calm long-term investing.

This is not pension money patiently buying for the next 20 years.

If it were, the charts wouldn’t look like they were drawn after three espressos and zero sleep ☕️📈

When an entire metals complex goes vertical at once, it’s rarely about “confidence.”

It’s about pressure 🔥

Positioning.

Crowding.

And someone stuck on the wrong side, watching exits disappear.

The daily and weekly candles look… beautiful. Almost too beautiful 👀

And that’s usually where risk hides, not where it disappears.

Moves like this don’t fade gently.

They end one of two ways ⬇️⬆️

Either a final blow-off where everyone suddenly believes this is the new normal…

Or a sharp deflation, where weeks of progress vanish in one or two sessions 💨

This isn’t bearish.

It’s not bullish.

It’s just how markets behave.

Metals aren’t meme stocks 🤡

They don’t need hype.

But when they start acting like meme stocks, something is being squeezed hard 🧨

So the real question isn’t:

“Where is silver tomorrow?” ❌

It’s:

What happens when this pressure releases? ⚠️

Because vertical charts aren’t gifts 🎁

They’re stress tests.

And markets reward those who know when not to fall in love with a chart ❤️🔥📉

I am now Long PUTS IN SLV and Silver 2027 lateThe wave structure is now complete as into the cycle high and fib relationship The US$ is about to Bottom in wave B low we should then see a huge rally in DXY and a sharp decline in all metals and the sp 500 is in wave c up in wave 5 of the diagonal 5th wave all coming into the 5 spirals due 2/9 event best of trades WAVETIMER

Silver bullish breakout supported at 9900The Silver remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 9900 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9900 would confirm ongoing upside momentum, with potential targets at:

11200 – initial resistance

11617 – psychological and structural level

12070 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 9900 would weaken the bullish outlook and suggest deeper downside risk toward:

9468 – minor support

9010 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 9900. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

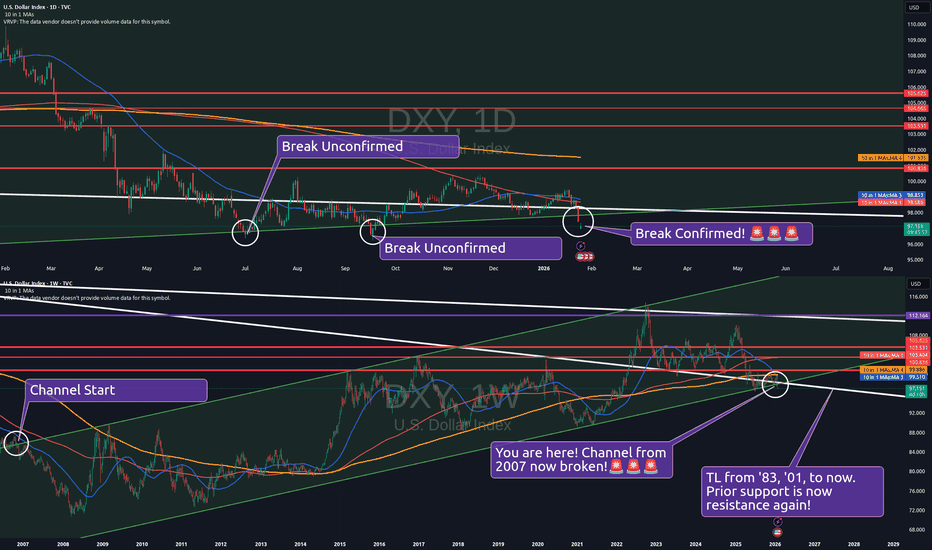

WARNING!!! 19 Year Dollar Channel is Now Broken!Trading Fam,

The title is NOT clickbait. If you’ve been following me for any length of time, you’ll know I have been warning you about this exact moment for some time. We’ve had many signs. Many clues. But the price of gold and silver rising exponentially was our crystal ball. And now, price movement on the U.S. dollar has confirmed to us that the dollar will continue its descent. For the first time in 19 years, the dollar has dropped from its ascending channel. The price of everything is about to increase. Be prepared.

Let’s take a look at our chart.

In the upper rectangle, you’ll see the U.S. dollar on the daily. We have existed inside this channel for 19 years. And for 8 months now, we’ve been consistently hammering away at the bottom of our channel, which has been acting as strong support. 19 years’ worth of strong support. Today, we finally confirmed a break below this support.

Two times in the past, once in July of last year and once in Sept., we did break the bottom of the channel. But we received no confirmation. We were looking for a lower low closing candle, but we never received that, and somehow we escaped back into our “safe” zone, the channel. Today, the break from our channel is looking like it will be confirmed. Yes, we do have to wait and see where our candle will close. But the reason I am confident this is our move is mainly because of that overhead trendline (white) coming all the way from 1983, drawn through a couple of tops in 2001, and extended through today. This will now act as major resistance. And it intersects almost precisely with the bottom of our 19-year channel!

This is not good. It means the price of everything is about to inflate even more than it already has. Any student of monetary history will know that all fiat currency always only ever ends in hyper-inflationary recession/depression. I’m not saying we are at that point yet. But maybe we are? Or is this time different? Whatever the case may be, we can’t cling to hopium to preserve our cash. We must take steps to hedge against this massive deterioration of our dollar that will continue to occur.

So, what do we do? Where do we go from here?

My suggestion is to concentrate on acquiring assets that the FED cannot print! This would include things like physical gold and silver. I have long been a proponent of the 4 “G’s” in investing/hedging strategy. Each “G” is symbolic of a larger class of commodities that will do well to keep one safe in both times of inflationary pressures as well as deflationary pressures. The 4 “G’s” are these:

Gold - anything categorized as precious metals

Ground - real estate providing tangible value and income potential

Guns - again, not literal. So, don’t let this scare you. But to keep the alliteration alive, guns stand for anything physical that can be used to protect your wealth. Usually, this comes in the form of something metal. Whether that be a safe, a tractor, or an iron tool that is hard to get, these tools can be used to protect your property, your precious metals, and anything else that is considered of value. Some may interpret this to be defensive type stocks.

Gas - energy related stocks and investments

How you acquire the above-listed and by what means is entirely up to you. But I don’t think you can go wrong. In the great depression, these categories saved people. In any sort of inflationary recession/depression, they are also most likely to do the same, and they will always hedge against a currency devaluation and an economy that can no longer be controlled.

✌️Stew

Silver TVC MASSIVE 40 YEAR CUP AND HANDLE $600 Target!As you can see Silver has been in this long 40 year plus cup and handle formation. It looks like its playing out perfectly. It may take 5 to 10 years but Silver will go to $600 plus in my opinion, possibly over $1000. Let me know what you think, and leave a comment below. Follow me for more analysis and updates. This is not financial trading advice, just my thoughts and opinions. Thank you.

Silver at $110 in Fierce Rally, Gold Tops $5,100. What’s Behind?(What a chart.)

Silver OANDA:XAGUSD is on a tear. Actually, scratch that — silver is on a mission. Prices have surged more than 250% over the past year, including a blistering 50% jump in January alone, lifting the metal to around $109 an ounce and placing the $110 level firmly in sight .

That performance puts silver ahead of nearly every major commodity and even ahead of gold, the traditional anchor of the precious-metals complex. Momentum has been relentless, headlines have grown louder, and price action has moved from steady to explosive.

When markets accelerate this quickly, attention follows. So does risk.

🪙 Gold Climbs with Purpose

Gold OANDA:XAUUSD has also started 2026 in strong form, trading above $5,100 an ounce for the first time in history. The move builds on a powerful rally that delivered a 60% gain in 2025, driven by familiar macro forces that continue to shape investor behavior.

Compared with silver’s all-over-the-place sprint, gold’s climb looks measured and deliberate. That difference highlights the contrasting roles the two metals play in portfolios. Gold behaves like a heavyweight asset, absorbing large flows with relative calm. Silver responds more sharply to changes in sentiment and positioning.

⚙️ Silver’s Fundamental Case Gains Strength

Silver’s story extends beyond safe-haven demand. Industrial use now forms the backbone of the market. As one of the most efficient conductors of electricity, silver plays a central role in electronics, solar panels, circuit boards, and energy infrastructure.

According to Metals Focus, industrial demand now accounts for around 60% of total silver consumption, up significantly from a decade ago. That shift has aligned silver with long-term trends in electrification and renewable energy investment.

Supply dynamics add further pressure. Roughly three-quarters of new silver supply comes as a byproduct of mining other metals such as copper and zinc. Production responds slowly to price signals, and demand has exceeded supply every year since 2018. Last year’s deficit reached nearly 20%, with another shortfall expected in 2026.

📈 Speculation Takes the Wheel

But also, price behavior suggests fundamentals alone no longer explain silver’s trajectory. Speculative positioning has become a dominant force.

The silver market carries a total value of roughly $5.3 trillion, far smaller than gold’s $33 trillion footprint. That size difference amplifies volatility and accelerates moves when capital flows surge.

Intraday swings have grown aggressive. Moves of several dollars within minutes have become common, shifting hundreds of billions of dollars in market value in short bursts. Traders accustomed to slower commodity cycles have found themselves navigating price action that resembles high-beta equities.

🌍 Politics Add Energy to the Trade

Geopolitical tension is adding support for another leg up. President Donald Trump’s renewed trade and military rhetoric toward Europe, including commentary around Greenland , has reinforced demand for real assets.

At the same time, the administration clarified that tariffs on silver and other critical minerals remain off the table. That clarification did little to slow momentum, raising questions about how much of the rally rests on positioning rather than policy.

🥇 Gold’s Rally Follows Familiar Lines

On the other hand, gold’s advance reflects a broader macro backdrop. Elevated inflation, a weaker US dollar , and continued central-bank buying have supported demand.

Expectations for further Federal Reserve rate cuts in 2026 strengthen the case, as lower yields reduce the appeal of fixed-income alternatives. (Make sure you watch the economic calendar to catch any surprise announcements.)

Gold also benefits from deep scarcity. According to the World Gold Council, total gold mined throughout history amounts to approximately 216,265 tons, enough to fill just about four Olympic-size swimming pools.

The US Geological Survey estimates another 64,000 tons remain underground, though production growth is expected to level off as accessible deposits diminish. That constraint continues to anchor gold’s role as a long-term store of value.

⚖️ Valuation Questions Surface

Debate has shifted toward valuation. Very few analysts expect silver to revisit the $20-to-$30 range last seen in late 2022. Structural demand and supply dynamics suggest a higher baseline.

Prices above $100, however, place silver in rare territory where momentum and leverage exert significant influence. In such environments, price discovery becomes less orderly and reactions grow sharper.

🎁 The Takeaway

Silver and gold are rising for different reasons and behaving in distinct ways. But one thing unites them. Right now, it’s more about speculation than anything else.

Off to you : Are you sleeping on the rally or you’ve bet on either of these metals? Share your approach in the comments!

GBPJPY: targets at 214 and 216🛠 Technical Analysis: On the H4 chart, GBPJPY remains in a clear ascending channel, keeping the broader bullish structure intact. Price is currently in a pullback toward the 211.8–210.9 support area, where buyers previously defended momentum. The SMA cluster (50/100) is nearby and can act as a pivot—holding above support favors a continuation push. A sustained rebound from this zone opens the path back toward the 214.25 resistance, with the channel top as a potential extension.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 212.238

🎯 Take Profit: 214.249

🔴 Stop Loss: 210.874

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

BRIEFING Week #4 : Look for the Dollar SignalHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

SILVER: Bears Will Push

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the SILVER pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Silver Target Within a Parallel TrendCan silver extend its rally into 2026? How should investors manage the increase in volatility as silver margins rise?

As long as the US dollar remains in a downtrend, precious metals are likely to continue their bullish trend.

Video version:

Mirco Silver Futures

Ticker: SIL

Minimum fluctuation:

0.005 per troy ounce = $5.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

SILVER Will Collapse! SELL!

My dear subscribers,

This is my opinion on the SILVER next move:

The instrument tests an important psychological level 10329.7

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 9758.7

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Backing Up The TruckIt seems silver is heating up. Better shine up your bullion and get ready for some crypto-like swings. From a macro perspective it looks very similar to the bullish cupping pattern on many other charts. Starting with the Fibonacci extensions measured out from the past major bull run it looks like once again, price clings to the levels like a magnet.

During the 2003-2011 bull market the most notable swings range from 65 to over 100%. The pullbacks sometimes just as violent. The 50 week EMA looks like it was a relatively solid support level and will likely remain so in the future.

Silver has already made it's first 75% move from off the 50 week EMA and has pulled back to the 0.236 fib. It looks like that could be the floor for now. Another 75ish% move would put it up between the 0.5 and 0.618 level around $40.

It will likely take some time to get there with a lot of chop. There is still a risk of the DXY having a technical relief rally especially if new starts rolling out of 'stimulus' disappointments. This is how I've been playing it considering these risks...

After it broke $20 - accumulating bits and pieces on dips, building a core long term position. Trimming and booking some profits into the larger swings.

Fib targets to watch for now:

0.382 --- 31.50

0.5 --- 37.45

0.618 --- 43ish

Trading is risky, don't do it.

Long (6% of portfolio)

Silver bullion and coins

SLV, PSLV, CEF

$TSLA Earnings Surprise? Sub $400 perhapsWell... Hope everyone has been good since I've last seen everyone. I'm doing alright, thanks for asking. Had my first profitable year trading options and it feels fantastic. With that said, lets start the new year with a bang! I've got this bar pattern here, a direct bearish match. Invalidation with a close above the gap at $475. Any close below the gap fill will be considered bearish into Earnings where the pattern matches up for a mean drop sub $400 by the end of the first week of February. I'll be looking forward to catching this $70 move if possible.

SILVER $400 - UNIQUE OPPORTUNITY📣 Hello everyone!

Here is the global chart of XAG/USD and directly my long-term trading idea, time frame 1 month. Here is the story from 1802, but in fact this is not even a complete timeline.

I believe we are “close” to completing the Elliott Global Five on the silver chart. The first primary impulse wave, in my opinion, ended in 1864, the second corrective primary wave ended in 1932. From 1932 to 1980, the most powerful third Elliott wave of the primary level was formed - in 48 years, silver increased in price by 170 times. Then from 1980 to 1991 there was a bear market in the correctional wave-4 of the primary level. Further, from 1991 to the present day, the global impulse wave 5 of the primary level of the cycle has been developing.

Within the framework of my Elliott idea, we should expect that wave-5 of the primary level will be fully formed within 45-74 years, that is, from 2036 to 2065. Taking into account the dollar charts, US inflation, government bond yields and other important macroeconomic data, I am more inclined to believe that the cycle will end in 2036. Therefore, my goal is $400 per ounce of silver by 2036. This is an increase of approximately 18 times from the current price. This is great news for long-term investors.

As for this relatively short-term outlook for Silver, in the first half of 2024 there is still a chance, within the bullish flag, to descend to the zone of 14-16 dollars per ounce. Either way, I believe that in the longer term, silver is already incredibly close to breaking through its twelve-year downtrend resistance. As soon as the bullish flag and, accordingly, trend resistance are broken upward, then after a long period of consolidation, vigorous growth will begin and silver will quickly return to the highs of 2011. Be prepared for this.

❌ It is also necessary to understand that according to my current wave marking, under no circumstances should the price fall below $7.28, this is the completion level of wave 1 of the secondary level. If this happens, then it will be necessary to look for an error and make serious changes to the Elliott price movement marks in this trading idea.

⚠️ As always, I wish you good luck in making independent trading decisions and profit ✊

Goodbye!