SILVER - What Happened and Why Did It Dump So HardTLDR; Because it Ran so Hard.

In a recent Silver Minds post @mojo42391138 asked "what happened to the circuit breakers?" which got me thinking about whether Silver did indeed have mechanisms to try and halt trading in a similar way to stocks when things started to get out of control. So I went off and asked Dr Google.

Below is the result of some searches I did and some of my own thoughts so don't take it as any clever insights on my part. I just thought it was interesting so thought Id share it.

Yesterday was indeed a historic bloodbath for the precious metals market with both silver and gold both dumping. While gold fell significantly, silver lived up to its reputation as "gold on steroids" , plummeting roughly up to 30% (depending on the exchange and contract) after hitting record highs near $120 earlier in the week.

The answer to my question in terms of why did it dump so hard and what happened to the circuit breaker (if any) was yes it does have them, but they function differently than the ones you see on the New York Stock Exchange.

1. Why it felt like there were no breakers

In the stock market (like the S&P 500), a 7% drop of the whole market triggers a mandatory 15-minute "time-out" for the entire market. In the silver market (specifically the COMEX/CME Group), they use Dynamic Circuit Breakers.

How these work: Instead of stopping the whole market for a 7% drop, these breakers look at a rolling 60-minute window . If the price moves +/- 10% within that hour, trading pauses for just 2 minutes to allow liquidity to reset. Nothing! (IMO).

The Result: Because the pauses are so short, the price can continue to "cascade" downward after each brief restart. Yesterday’s move was driven by a "perfect storm" of the dollar strengthening and massive profit-taking, which often happens too fast for a 2-minute pause to stop the bleeding.

2. Why Commodities are treated differently than Stocks

Regulators generally allow commodities to move more freely than stocks for a few reasons:

Global Nature: Unlike Apple or Tesla stock, which primarily trades in the US, silver trades 24/7 in London, Shanghai, and New York. If one exchange (like the COMEX) shuts down for an hour, trading just shifts to another global hub, which can lead to "price gaps" and more chaos when the first exchange reopens.

Price Discovery: Commodities are used by industrial manufacturers (solar, electronics). These buyers need to know the real price to hedge their costs. Artificially freezing the price can prevent people from actually getting the metal they need.

Price Limits vs. Halts: Many commodity exchanges prefer "Price Limits" over halts. For example, some silver contracts have a 10% limit. Once hit, you can still trade, but nobody is allowed to bid lower than that limit for the rest of the day, unless the exchange decides to expand the limits (which they often do during "limit-down" events).

3. What triggered yesterday's "Reality Check"?

The collapse wasn't just random; it was a collision of technical and fundamental factors:

The "Warsh Effect": News of Kevin Warsh being nominated for Fed Chair signaled a "hawkish" shift (higher interest rates), which is kryptonite for silver.

Technical Gravity: Silver had gained over 50% in January alone. It was "overbought" by almost every mathematical standard, making it ripe for a "liquidity flush."

So that all makes sense - especially the globally traded silver not being able to be taken offline, but SLV which a heap of us hold is an ETF traded on the exchange, so I also thought it would be interesting to see how the silver ETFs (eg our SLV) handled the drop compared to the physical metal and why they didn't halt or get a time out.

Again, it turns out that while both crashed, they did so in different ways and under different rules.

Here is how the major silver ETF, SLV, handled the drop compared to the physical market.

1. Did SLV have circuit breakers?

Yes, but they are "Stock Market" breakers. Because SLV trades on the NYSE Arca (an equity exchange), it is subject to the standard Limit Up-Limit Down (LULD) rules of the stock market.

The Mechanism: If the price of SLV moves 5% or 10% within a 5-minute period, the stock exchange pauses trading for 5 minutes.

The Reality: Yesterday, while the physical silver price in London and the COMEX futures were "cascading" with only 2-minute pauses, SLV was hitting these 5-minute equity halts repeatedly. This meant that for several stretches of the morning, you couldn't sell your SLV even as the spot price of silver was continuing to fall.

2. SLV Performance vs. Physical Silver

A major issue yesterday was the tracking error. During extreme crashes, ETFs often "disconnect" from the metal they are supposed to represent.

While physical spot silver saw a violent intraday drop of 13% to 18%, SLV shareholders faced much steeper reported losses ranging from 28% to 40% driven by a wave of panic-selling and forced liquidations on the NYSE.

This discrepancy was exacerbated by liquidity mismatches: while physical silver trades on a global 24/7 basis, SLV was tethered to stock market hours and hit by repeated five-minute LULD (Limit Up-Limit Down) halts that locked investors in while the underlying price continued to crater.

Consequently, while physical coins maintained a "safety premium" of 10% or more at dealers, the paper trust plummeted to a significant discount, proving that in a true silver bloodbath, the "paper game" can't always keep pace with the bars in the vault.

The "Panic Discount": At the height of the crash, SLV shares were actually selling for less than the value of the silver held in the vault. This happens because "paper" investors (who can sell with a click) panic faster than physical bullion holders.

3. The "Paper Trap" Risk

Yesterday also highlighted a growing concern for 2026: Physical Backing. There were reports that the massive volume in SLV was putting pressure on the trust to prove it actually had enough silver in the vaults to cover the new shares. This "counterparty risk" often causes ETFs to drop harder than the metal itself during a crisis.

So - that was all a bunch of stuff I personally didn't know before. That whole disconnect between paper silver and physical silver and the difference in how they get halted created a mess :)

Trick is whether now that it is at such a deep discount and you can see its back pretty close to that more realistic 20 day support, and that wick didn't get through the 50 day, maybe now is a good time to buy if you FOMO'd before...

Who knows, who knows...

Silver

Short on Silver CFDTVC:SILVER

Short on Silver

Technicals:

- oscillators like RSI and other on weekly and monthly timeframes are in extreme overbought territory, signaling an imminent need for a correction.

- large institutional players (Smart Money) typically begin taking profits at peaks, and the current environment presents an ideal window for this.

- price neared 3.618 on fibo (120$ per OZ), whereas asset prices rarely breakout this level.

- target 0.382 on fibo

- scenario invalidated if two bars close above 122.00

Fundamentals:

- the massive influx of retail investors and extreme market hype often precede a "flush out" of positions and a sharp collapse.

- commodity has shown anomalous growth, gaining about 150% in 2025 and another 40% in the first weeks of 2026; however, no rally can last forever.

- high asset prices will trigger an increase in secondary market supply (scrap/recycling), which will ultimately lead to a cooling of demand and price suppression.

⚠️ Signal - Sell ⬇️

✅ Entry Point - 112.75

🛑 SL - 122.34

🤑 TP - 84.62

⚙️ Risk/Reward - 1 : 3.2 👌

⌛️ Timeframe - 3 months 🗓

Good Luck! ☺️

SLV - Parabolic Exhaustion Play - $100 Puts Feb 13📉 Pattern Recognition Setup

AMEX:SLV just completed a 68% run from $65 to $110 in under 3 months. This isn’t normal commodity ETF behavior - this is meme-stock price action.

Key Observation:

The current parabolic structure mirrors the prior $30→$48 spike that collapsed violently after hitting exhaustion (see bar pattern overlay on daily). Same RSI divergence, same volume behavior, same exhaustion signature.

Technical Confluence:

• RSI: 74 (overbought with multiple bear divergence signals)

• Structure: Double top at $110 resistance zone

• Volume: 8h chart shows peak Volume surges mark local Tops/Bottoms

• Pattern Target: $88.91 measured move

• Historical Precedent: Prior parabolic collapse followed identical setup

Trade Details:

Entry: $100 Puts, Feb 13 expiration

Trigger: Close below $105 on 4H timeframe

Target: $88-90 zone

Stop: Reclaim and hold above $110 invalidates pattern

Risk Management:

This is a defined-risk speculation on technical pattern completion. When parabolic runs exhaust at resistance with stacked divergence, retracements are swift and violent - not gradual. Size accordingly.

Timeline: 11 trading days for execution

This is my own thoughts put together by Claude.ai

This is my own charting and my own words and thoughts gathered into a presentable form.

Massive Paper Attack on Silver! The Con Game Won't Last.Trading Fam,

Gold and Silver liquidated over 10 trillion dollars in less than 24 hours! To put that into perspective, that's the entire crypto market cap multiplied by over 3 times! What we witnessed in today's metals crash was truly historic! But was it real or an illusion?

I called "bluff" and bought SILVER. If you're a believer in scaling into your entries, today could have been a great start. Could SILVER go lower? Yes. Of course. However, recent demand for its utility in technology suggests that buying demand will resume quickly.

In more recent history, paper trading contracts have massively suppressed the true value of gold and silver, but silver has often taken the brunt of the hit. Today was a prime example. If we were to ever return to true historical values on silver, we should see a price of $200-$250 per oz. silver for every $5000 per oz. gold. We're nowhere near that. But I think we will get there soon. The collapse of the U.S. dollar further strengthens my conviction in this thesis. What we witnessed today in the precious metals market was unprecedented. The level of coordination by large institutions was both amazing and terrifying. However, their con game can't last.

We'll take a closer look at what the charts are showing us for SILVER, the U.S. dollar, the SPX, and Bitcoin.

Please enjoy this week's update.

✌️Stew

Silver... what on earth is going on?The data from the January 20 and January 27 reports reveals a classic "institutional distribution" phase, where the "smart money" was quietly exiting while retail traders were still buying the peak.

1. Managed Money: The "Reluctant" Longs

Institutional speculators (Hedge Funds and CTAs) were the primary drivers of the run-up to $120, but the COT data shows they were losing conviction long before the crash.

Trimming Longs: In the week ending January 27, Managed Money reduced net-long exposure to its lowest level since early 2024. They weren't just "selling"; they were aggressively taking profits into the parabolic move.

Rising Gross Shorts: For the first time in nearly two years, institutions began adding gross short positions (up ~18% in mid-January). This suggests they were actively betting on a "mean reversion" back toward the 50-day moving average.

2. Commercials: The "Massive Short"

The "Commercials" (Bullion banks and producers) held a massive net-short position as silver crossed $100.

The Hedge: Commercials typically short silver to hedge their physical inventory. However, at $120/oz, their paper losses became so extreme that they were essentially "trapped."

The "Kill Switch": When the CME hiked margins by 47% to $32,500 per contract this week, it forced a "deleveraging." Many smaller institutional players who couldn't meet the new margin requirements were forced to liquidate their long positions instantly, adding fuel to the fire.

3. The Retail Trap (Non-Reportables)

The most telling part of the COT report was the "Small Speculators" (retail).

While institutions were selling, small traders were record-long.

Retail sentiment was in the "extreme euphoria" zone. Historically, when the gap between "Institutional Net-Longs" (falling) and "Retail Net-Longs" (rising) reaches a certain width, a violent correction follows.

The "Warsh" Catalyst

The heavy institutional selling on Friday was accelerated by the Kevin Warsh Fed nomination. Because institutions use algorithms tied to "real yields" and the "US Dollar Index," the moment the dollar surged on the news, institutional sell-stops were triggered simultaneously. This turned a "correction" into a 31% liquidation event.

What's next?

Retracement to trendline and POC HVN of current volume profile at 90usd. At this point decision time, price may bounce going bearish or continue bullish to around next point of approximately 100usd.

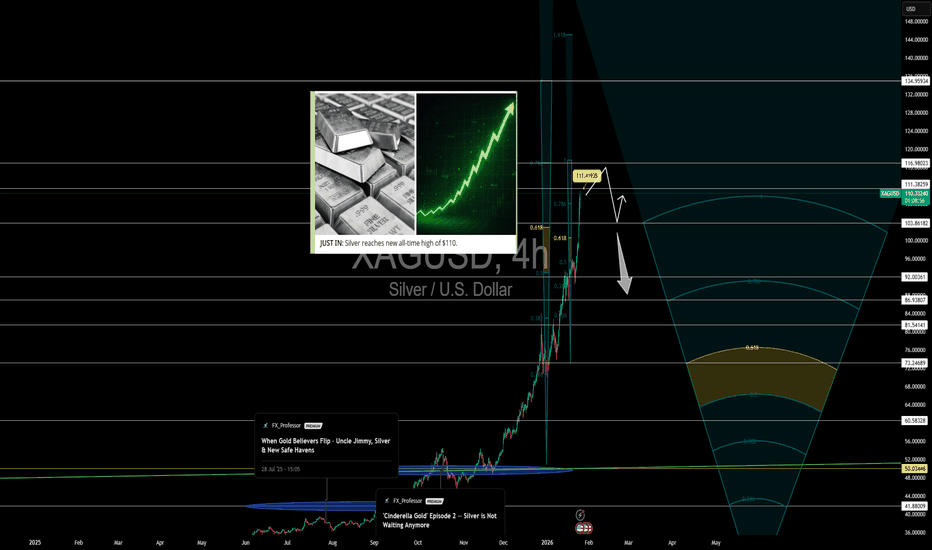

Silver Breaks $110 — Time to Rotate Out? Silver just printed a new all-time high at $110.25 — a clean Fibonacci extension rally that’s now entering major resistance zones :

• $111.40

• $116.98

• $134.95

The move from $50 to $110 has been explosive. But parabolic advances don’t last forever , and this chart now outlines a potential local top formation .

We could see a rejection at $111–116 and a retest of key zones below :

• $103.86 (previous resistance)

• $92 and $86 if things accelerate

📺 All of this was broken down in the full macro video — along with why Bitcoin might be next in line to move:

🔗 Silver $110, Gold $5K — Bitcoin Pump Next?

Silver bulls have feasted. Now it’s time to ask — are you late to the party, or early to the rotation?

Perspective Shift 🔄

Every rally ends with FOMO — and that’s often your exit cue. Silver's rally is historic, but the rotation clock is ticking. With BTC sitting on macro support , this could be the last leg before capital flows shift.

Disclaimer: I'm not a financial advisor — I'm a master of Prognosis. These are my personal views. I read charts like a poet reads the stars. You still gotta trade at your own risk. 🧠💥

One Love,

The FXPROFESSOR 💙

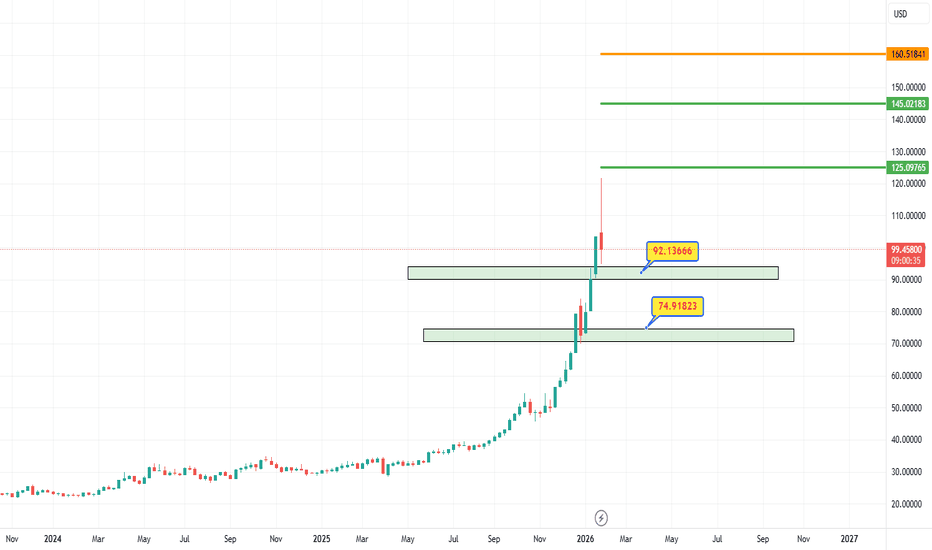

Will silver take a breather at $84?Silver has gone on a large run, however it looks like it has the potential to slow down or correct soon. I think once it hits the $84 resistance it has the possibility of rejecting there and making a move back to the $39 or $32 support on the chart.

There's a possibility it can extend a bit higher to the $87 resistance as well but unless that level is flipped as support, I lean towards a correction before continuation.

I've marked off higher resistance levels, but due to how we're already in a parabolic move, I lean towards a correction before continuation up to the higher targets.

Let's see how it plays out.

Updated January 14 Volatility Event BreakdownThis video will help you understand how the markets are playing out related to my original prediction of a big volatility event on January 14.

Watching the markets swing up and down over the past two weeks while almost perfectly following my predicted price trends has been incredible.

But, I'm not always this accurate in my predictions - no one is.

I believe this market move is following my longer-term prediction of a moderate breakdown in Q1/Q2 of 2026. If my research is correct, we will continue to see an ABC or ABCDE wave structure where price continues to move downward and attempts to find a base near July 2026.

The one thing I really wanted to point out is the use of Fibonacci Defense Levels and how you can use them to better determine when and how price is breaking from a moderate pullback into an extended or deeper pullback/trend reversal.

I've been using these Defense Levels for quite a while, and I find they work well.

Please take a minute to watch this video.

I also highlight Gold/Silver and Natural Gas in this video.

Hope all of you are GETTING SOME today.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SILVER: the Top is finally in!!Silver futures once again saw extreme volatility in yesterday’s trading session. In line with our primary scenario, prices reached a new all-time high for blue wave (y) just below the key resistance at $123.08, before facing a significant sell-off. Looking ahead, blue wave (x) is likely to bottom out within the green long target zone, which ranges from $77.19 to $64.67. From that point, we anticipate the start of the final upward phase, represented by green wave . There is also a chance that silver could continue rising directly. In this alternative scenario—green alt. —the $123.08 level acts as a key hurdle that must be cleared (probability: 40%).

Has Silver topped this week? Did the silver bullet train just reach it's final stop?

If silver has topped, I anticipated it will follow this pattern down to a 30-50% drop. I've been riding this silver parabolic wave up with silver miners (Coeur mining -CDE), but sold all my positions this week.

If this is the top for silver, then I will buy CDE back at $14 (currently $21)

Trade safe with precious metals. Even if I'm wrong, and silver has another leg up...there is no sense in taking a chance on picking up pennies in front of a bulldozer.

May the trends be with you

Silver $110, Gold $5K — Bitcoin Pump Next?Silver at $110, Gold at $5K, Bitcoin at Support — The Rotation Has Begun

New all-time highs for silver at $110 mark a historic moment. From $50 in November 2025 to blasting through $70, $80, $90 — and now triple digits — this has been one of the most aggressive moves in precious metals history .

Next resistance? $111.40 , followed by $116 and potentially $134.

Yes, I shorted at $103 and got smashed — life goes on. We adapt. 👊

But this video and analysis isn’t just about silver. It’s about where we are in the macro rotation — across silver, gold, and Bitcoin.

Gold is holding firm above $5,000 , with $5,405 as the next upside target. $5K now acts as psychological support. The metal remains strong — but the key question is: how much longer can gold outperform?

Bitcoin still looks weak — but the BTC/Gold ratio tells a different story . We’re hitting major long-term support from a 2020 ascending channel , backed by positive divergences . From here to the channel midpoint, there’s 73% room for corrective upside . That’s no small move.

The Gold/Silver ratio , using nearly 100 years of history, shows that sharp drops in gold’s relative value happen fast — and reverse just as fast . We’re at 46 now, with 41 as a possible floor. So yes — silver may still squeeze out another 10% outperformance … but exhaustion is near.

BTC/Silver reflects the same dynamic: silver still has the upper hand, but we're nearing major support levels . And when these ratios snap back, they do so hard.

These aren’t trades to chase blindly. They’re rotations to observe, prepare for, and trade with precision. Momentum is shifting — in real time.

Trading Wisdom 📜

When one market peaks, another prepares to rise. Silver's breakout is historic and undeniable — but century-old ratios don’t lie. Bitcoin is approaching key support against both gold and silver simultaneously . If the shift comes, it won’t be slow. It’ll be sharp, fast, and violent. Stay sharp, stay reactive, examine everything.

Disclaimer: What you read here is not financial advice — it’s high-level market philosophy from the FXPROFESSOR himself. Risk is real, and your capital is your responsibility. Learn, adapt, evolve.

One Love,

The FXPROFESSOR 💙

Metals Update: Why Gold & Silver Are Pumping Right NowHere's my latest take on metals and why they're surging: gold and silver are leading the pack in early 2026, up big YTD amid "asset class drama" with crypto and stocks.

Key drivers include geopolitical tensions (wars and uncertainty driving safe-haven flows), a softer dollar making them cheaper globally, and dovish central banks signaling easier money ahead.

Gold, silver and crypto are all trying to be the main character right now. This “asset class drama” might actually be bullish for everyone, just not all at the same time.

Metals Are No Longer Just for traditional investors

For years, gold was treated like that weird cousin at family dinners where everyone knew it was there, few wanted to sit next to it.

Now, metals have turned into a mainstream power asset, helped by three forces working together: geopolitical tension, a softer dollar, and friendlier central banks.

The twist: this isn’t necessarily bearish for stocks.

If metals are sniffing out weaker dollar + dovish policy, that cocktail usually lifts all asset prices, not just shiny rocks.

Silver Goes Parabolic. Now What?

Silver’s recent move has gone full “crypto mode”. Fast, vertical, and slightly insane. Parabolic moves usually mark the end of a run, not the start.

That doesn’t mean you insta‑short it, because parabolas can go further than your sanity.

But it does mean you treat the metals run as a late‑stage sprint, not a fresh marathon, even while acknowledging they deserve a place in portfolios.

Where to Be Long

* Energy & basic materials

* Still bullish on the Mag 7, financials, industrials and small caps.

Crypto: Fundamentals Say “Up”, Flows Say “Wait”

Crypto is not exploding yet because gold and silver are currently “sucking oxygen out of the room” – traders are chasing the shiny parabolic thing while a delevered crypto market lacks its usual rocket fuel.

How to Read This Environment Without Losing Your Mind

* Metals ripping = confirmation of weaker dollar + dovish central banks + rising risk appetite.

* That backdrop is friendly to stocks, especially multinationals, cyclicals and select financials.

* Crypto is temporarily lagging, not because fundamentals are dead, but because the space delevered and metals stole the FOMO.

* Once the “metal mania” cools, the same macro mix that helped gold can easily rotate into Bitcoin, Ethereum and broader risk assets.

So instead of viewing this as “gold vs. crypto” or “metals vs. stocks,” it’s more useful to see as a rotation of risk appetite.

First metals, then broader equities, and eventually if history rhymes a fresh leg where digital assets step back into the lead.

SILVER | Heavy Volatility After 21% DropSILVER | Sharp Profit-Taking Triggers Deep Pullback After Record Rally

Silver prices plunged more than 21% to around $95.20 per ounce, as aggressive profit-taking swept across precious metals following the recent record-breaking rally. The sharp decline reflects exhaustion after an extended upside move, with traders locking in gains amid heightened volatility.

Despite the sell-off, silver remains a highly volatile asset, and the next directional move will depend on how price reacts around key technical levels.

Technical Outlook

Silver maintains a bearish structure while trading below 99.11.

As long as price remains below 99.11, downside pressure is expected toward 95.35, followed by 93.11.

The 93.11 zone is a key demand area where a bullish reaction may emerge.

On the upside, a recovery and hold above 99.11 would invalidate the bearish bias and support a bullish move toward 103.35, with further upside risk toward 107.45.

Key Levels

• Pivot: 98.00

• Support: 95.35 – 93.11 – 91.00

• Resistance: 103.35 – 107.45

Gold SellMy previous idea didn't got so well as i predicted sell in gold earlier but now what i am seeing is a rally downward 👇 from now on as i have placed this fibb tool on daily TF so what i am seeing is a retracment towards 78.6% level of fibb i will be watching market closely and avoid taking any trade as of now FOMO is getting over and market is being very volatile these days so it will be the time to keep watching from here

Silver corrective pullback support retest at 9900The Silver remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 9900 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9900 would confirm ongoing upside momentum, with potential targets at:

11200 – initial resistance

11617 – psychological and structural level

12070 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 9900 would weaken the bullish outlook and suggest deeper downside risk toward:

9468 – minor support

9010 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 9900. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

update of xagusdSilver – Key support zones suitable for potential entries, along with new short- and mid-term targets, have been identified.

Important question: Will the marked support zones definitely be tested?

Not necessarily.

This is only a low-probability scenario.

Estimated time frame to reach the targets: up to four months.

Gold’s Parabolic Move: The Deadly Mean ReversionYesterday and today we witnessed a mean reversion happening on Gold and silver where price dumped hundred of pips in minutes. There were massive red displacement candles where price begun snapping violently back down. It was not cause by unemployment news claims or FOMC news on Thursday, price managed to fill three gas in a matter of 30 minutes and it has continued today 30th Jan 2026. Before the mean reversion happened yesterday, there was a double bottom pattern where most people would be waiting for a breakout NYSE session to enter buys, but when I checked the lower TF, the 5 min to be specific, there were very many red candles that were clustered around one area which made me hesitant to enter buys. When price broke out of the 5 minute range, it started selling. I thought it would sell to the days Asian low, but when price got there it started melting.

So why has the mean reversion happened after Gold's parabolic moves? To be honest, I don’t think yesterday’s and today’s mean reversion was a technical one where price was simply overbought and was due for a pullback. It was a flow-based parabolic move, the one of the type where the system itself gets stretched too thin and needs to snap back.

I drew the chart after the meltdown best I could with my excellent drawing skills 😂 to show how Gold has been parabolic for the last few weeks, accelerating higher with increasingly steep candles and shallow pullbacks before the drop.

Some traders have been thinking that this big reversal is about the news on Democrats threatening a government shutdown over immigration enforcement funding in the U.S. over the protests and the killing of Alex Pretti by federal immigration agents in Minneapolis. That incident immediately has drawn political criticism across both parties and led to potential showdown threats over whether Senate Democrats would support funding for the Department of Homeland Security (DHS) unless major reforms to Immigration and Customs Enforcement (ICE) are included. Many Dems have publicly vowed not to approve the DHS portion of the budget until changes like body cameras for agents and new warrant requirements have been enacted, raising the odds of a partial government shutdown.

Days after the shooting and the protests, Democrats even blocked a key spending package in the Senate to force negotiations and bring pressure for those reforms, pushing the shutdown deadline closer. However, by the time the market started its violent downward move, much of this risk had already been reflected in asset prices, traders were forward-looking and positioning for potential political gridlock well before the headlines hit. Expectations for a shutdown were already elevated by midweek based on previous reporting and the markets had priced in uncertainty around ICE funding and DHS negotiations long before the weekend claims data. The question would be, are government shutdowns usually priced in???

So when the price started ripping lower, it wasn’t reacting to the wording of a press release or the latest TV headline, it was reacting to flow dynamics, liquidity demands, and positioning adjustments across multiple markets. In other words, today's “mean reversion” that has happened was driven by how money managers and leveraged players were forced to adjust exposure and lock in profits after an extended parabolic run, not by a classic technical overbought signal.

This helps explain why gold sold off even though a shutdown threat is typically considered a risk-off. If uncertainty and volatility spike while leverage is high, the mechanics of market participants needing cash and risk reduction can outweigh simple narrative expectations about safe havens. In that sense, the reversal is less about political causality and more about market structure and flow reaction in a high-leverage, low-liquidity environment.

The biggest lesson from yesterday and today is that mean reversion does not always look technical, and it definitely does not respect indicators when markets are unwinding leverage. Gold and silver did not dump because they were overbought on RSI, they dumped because the parabolic structure broke, flows flipped, and price was forced to snap back toward equilibrium.

XAG/USD: Analyzing the Corrective Phase within an Ascending StruSilver (XAG/USD) is currently displaying a significant technical pattern on the 15-minute timeframe. After a period of aggressive bullish expansion that saw the price breakout from its previous consolidation, the market has entered a corrective phase. The current price action is characterized by a series of tests against the upper and lower boundaries of a broad ascending channel.

Technical Insights:

Trend Context: The primary trend remains bullish, as evidenced by the series of higher highs and higher lows. However, the recent price action near the 120.251 level indicates that the market is currently in a "Price Discovery" phase, attempting to establish a new base for the next impulsive leg.

Projected Corrective Path: As indicated by the black forecast trajectory, we anticipate a multi-wave corrective sequence. This pattern suggests a "lower high" formation, followed by a decline to test the strength of the previous breakout zone.

Key Support Targets:

Primary Objective: 118.000 - 118.500 – This level represents a major previous resistance area and is now expected to act as a significant foundational support floor.

Secondary Objective: 114.833 – A deeper retracement target that aligns with a historical institutional supply zone that has now flipped into a major support area.

Risk Management: The bullish bias is maintained as long as the price trades above the 114.000 region. A decisive close below this level would signal a potential "Fake-out" and shift the outlook toward a more bearish sentiment.

Trading Strategy: The current approach favors "Buying on Dips." Traders should monitor for bullish price action confirmation, such as a strong rejection wick or an engulfing candle at the 118.000 support level, before targeting a continuation toward the 125.000 psychological mark.

XAG/USD: Corrective Pullback Following Parabolic ExpansionSilver (XAG/USD) is currently undergoing a technical retracement on the 15-minute timeframe after reaching localized highs near the 124.000 region. Following a powerful bullish breakout that saw the price trade above the primary ascending channel, the market is now seeking to rebalance through a corrective sequence.

Technical Deep-Dive:

Trend Status: The primary trend remains bullish, as evidenced by the series of higher highs and higher lows established over the last several sessions. However, the current price action (indicated by the black forecast path) suggests a temporary shift in momentum as buyers take profits at these premium levels.

Forecasted Trajectory: The projected path indicates a "lower high" formation followed by a multi-wave decline. This is a classic corrective move designed to test the strength of the previous breakout zone.

Key Support Targets:

Primary Objective: 118.000 - 118.500 – This level represents the previous major resistance area and the most significant pool of buy-side liquidity for a potential "Buy on Dip" entry.

Secondary Objective: 116.000 – A deeper retracement that aligns with the lower boundary of the extended ascending structure.

Risk Management: The bullish bias for the long term remains intact as long as the price maintains its structural integrity above the 114.833 level. A decisive break below this point would suggest a more significant trend reversal.

Trading Strategy: Patience is advised during this corrective phase. Traders should monitor the 118.000 region for bullish confirmation signals—such as a long-wick rejection or a bullish engulfing candle—before considering new long positions toward the next extension target of 125.000.

BTCUSD: continuation of the fall🛠 Technical Analysis: BTC is trading below the 90K psychological zone after the recent pullback, with price compressing near the MA cluster (dynamic resistance). The rising support line and the 88,335 area act as the key “trigger” zone: a clean breakdown can open the way for a deeper correction. Nearest resistance is 92,193 . Key downside support/target zone is 80,820.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: 88335.83

🎯 Take Profit: 80820.02

🔴 Stop Loss: 92193.50

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

SILVER Will Go Down! Sell!

Here is our detailed technical review for SILVER.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 11,885.9.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 11,523.9 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!