Silver

Is Silver in Trouble?On 26 January this year, silver experienced a drop of more than 13% within a four-hour period—potentially the largest intraday decline in its history.

The daily chart also closed with an inverted pattern.

So what am I seeing from this move?

And what is my strategy for these precious metals for the rest of 2026?

100-Ounce Silver Futures

Ticker: SIC

Minimum fluctuation:

0.01 per troy ounce = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Gold Weekly Levels: Break above 5055/5065 → 5210/5220🔱 GOLD WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ Bulls remain in control as price pushes toward overhead liquidity

🟡 Key unlock level: 5055–5065 — a clean break and acceptance above opens continuation fuel

🚀 Breakout continuation objective: 5210–5220 primary upside objective and overshoot zone

🧲 Fresh overhead sell-side liquidity: 5055–5065 then 5210–5220 high-probability magnet zones

🔄 Expectation after 5210–5220: profit-taking wave and corrective rotation lower into fresh buy-side pools

🛡 Transition pivot: 5210–5220 where longs should be exiting and reversal stalking begins

⚠️ Bears’ post-extension objectives: 4875–4885 then 4775–4785 — fresh buy-side liquidity targets below

🎯 Strategy this week: trade the breakout into 5210–5220, then shift mindset to correction timing

🏦 Core play: don’t chase highs inside 5210–5220; scale out into target, then stalk confirmed reversal

🗳️ Gold Weekly Scenarios — What’s Your Play?

Which path do you have for XAUUSD next week?

🅰️ Hold above and accept through 5055–5065 → breakout triggers → run to 5210–5220

🅱️ Early-week stall at 5055–5065 → brief pullback → reclaim and acceptance → squeeze into 5210–5220

🅲 Direct drive into 5210–5220 → reversal confirmed → correction targets 4875–4885 then 4775–4785

🅳 Your key level: 5055–5065

THE DOLLAR IS CRACKING | HISTORIC 4-YEAR LOWS 🚨 THE DOLLAR IS CRACKING | HISTORIC 4-YEAR LOWS 🚨

The TVC:DXY (USD Index) has officially reached a critical tipping point. We haven't seen these levels in 4 years, and the global markets are feeling the heat. This is the definition of a "Make or Break" zone.

📉 THE CRITICAL LEVEL: 94

The dollar is currently hovering at 96. If we see a weekly candle close below 94, the dollar officially enters a structural breakdown.

* If it breaks: It will be "hard" to ever recover that ground.

* The Result: A massive capital flight into hard assets—most notably GOLD.

💰 MARKET SNAPSHOT (TODAY):

* 💵 USD Index: 96.00

* 🟡 GOLD: $5,266

* ⚪️ SILVER: $115.2

* 📈 Nasdaq: 26,210

* 💷 GBP/USD: 1.3812

* 🇦🇪 XAU/AED: 19312

THOUGHTS: The inverse correlation is screaming. As the Dollar loses its grip, Gold and Silver are entering a new era of price discovery. This week's close determines the next decade of macro trends.

Stay sharp. Stay hedged. 🛡

---

✨ ✨

The pulse of the markets.

Stop!Loss|Market View: SILVER🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for SILVER ☝️

Potential trade setup:

🔔Entry level: 115.78874

💰TP: 92.94021

⛔️SL: 125.46576

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: Metals are still considered for short-term buy, but given today's Fed meeting and its interest rate decision, prices could reverse sharply based on Powell's potential rhetoric. Rhetoric favoring keeping rates unchanged would allow buyers to lock in after the rally, thereby triggering a correction in silver toward the 95 level. Selling is only considered in this scenario, and most likely during the Fed press conference itself.

Thanks for your support 🚀

Profits for all ✅

The "Grinding" Bull—High Noise, Low EfficiencyUnlike the smooth Gold rally, Silver is struggling. The Neural Brain identifies a trend that is moving up but fighting heavy resistance every step of the way.

1. THE PHYSICS: Efficiency Score (0.05)

Status: Critical Inefficiency

The Data: For every $1 the price gains, it travels $20 in total path ($0.91 Net Move vs. $18.05 Total Noise).

The Meaning: The market is "churning." Buyers and sellers are in a violent tug-of-war. The price isn't gliding; it's clawing its way up.

2. THE MIND: Conviction (LOSING)

Status: Repelling Risk

Conviction: LOSING. The AI sees the chaotic volatility and determines the probability of a clean move is dropping.

Mode: FLAT (REPELLING). The system is mathematically rejecting new entries because the "Micro Action" is too messy.

3. THE STRATEGY: "HOLDING (Ignoring Noise)"

Status: Sit on Your Hands

Macro: Strong Bullish (Trend is up).

Micro: Noisy/Chop (Price action is messy).

Action: HOLD. The trend hasn't broken, so don't sell—but the "cost" of movement is too high to buy more. Wait for the Efficiency Score to recover (>0.30) before adding size.

Parabolic / Blue Sky BreakoutThe SLV chart depicts a massive "blow-off top" or hyper-growth phase. The momentum is aggressively to the upside, but the distance from the nearest technical support (27.66) indicates the asset is significantly over-extended from its mean.

Bull Case: Momentum is dominant. With no overhead resistance, the price can theoretically run until buyer exhaustion occurs.

Bear/Risk Case: The vertical ascent leaves the asset vulnerable to sharp, volatile corrections, as there is little established market structure between 101 and 30 to catch a falling price.

Silver XAG/USD - Breakout + Retest Signals Upside Continuation📝 Description🔍 Setup (Market Structure) FX:XAGUSD

XAG/USD is forming a well-defined Triangle Breakout pattern on the M30 timeframe.

After a strong bullish move, price consolidated with lower highs and higher lows, compressing volatility — a classic sign of an upcoming expansion.

Price has now broken above the triangle resistance and is showing a healthy breakout & retest, supported by EMA and holding above the structure.

This favors a bullish continuation scenario.

📍 Support & Resistance

🟨 Support Zone: 104.70 – 106.00

🟢 1st Resistance: 123.90

🟢 2nd Resistance: 130.00 – 130.20

⚠️ Disclaimer

This analysis is for educational purposes only.

Commodities are volatile — always use proper risk management and position sizing.

💬 Support the Idea👍 Like if you’re bullish on Silver

💬 Comment: Clean breakout or fake move?🔁 Share with traders watching XAG/USD

#XAGUSD #Silver #CommodityTrading #TriangleBreakout #PriceAction #TechnicalAnalysis #TradingView #Kabhi_TA_Trading

SILVER(XAGUSD): Price Heading Towards $109! Dear Traders,

Silver has made a slight correction and then reversed nicely. Now we’re seeing a significant surge in market volume. There’s only one take-profit and entry point. The stop-loss can be placed below our blue-marked entry box. This move could be substantial if it goes our way.

This trade could be completed within this week or next, assuming the volume remains constant.

Team Setupsfx_

GBPUSD: consolidation at 1.37🛠 Technical Analysis: On the H1 chart, GBPUSD remains bullish after a strong impulse move and is now compressing beneath the marked resistance zone around 1.37000. Price is holding inside a rising structure, with the steep trend channel still intact and suggesting continuation if buyers defend the pullbacks. The moving averages are angled higher and sit below price, reinforcing the upward bias. A clean push above the resistance area opens the way toward the next upside target, while a drop back below the consolidation base would signal a deeper retracement into the nearest support zone.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 1.36872

🎯 Take Profit: 1.37532

🔴 Stop Loss: 1.36438

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

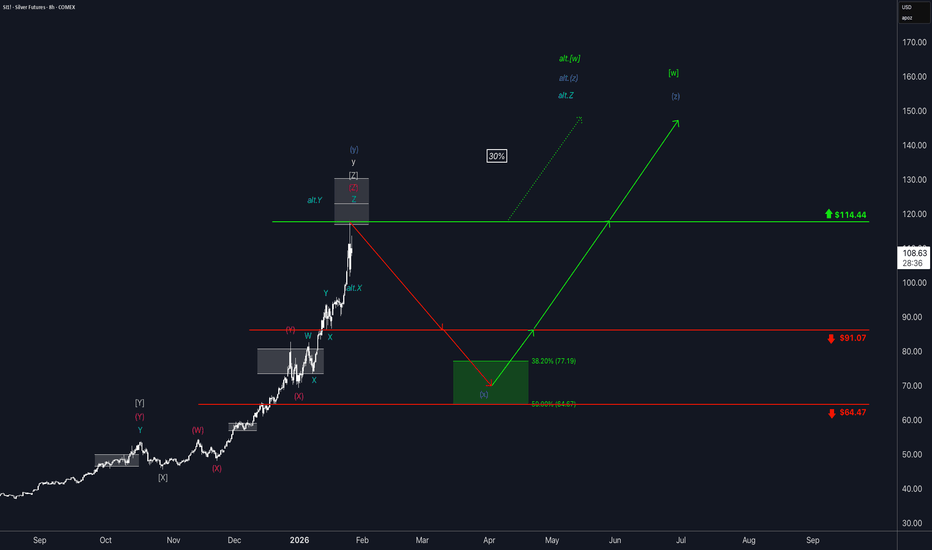

Silver: Finally Topped Out?Silver futures start the trading week with extreme volatility, reaching our now deactivated and therefore greyed-out short target zone (coordinates: $116.91 – $130.31).

If a short position was already initiated within this zone, it may now be appropriate to trail existing stop-loss levels.

At this stage, the primary assumption is that only the high of blue wave (y) has been completed within this area. Under our primary scenario, a more pronounced corrective move is considered imminent. We expect the termination of the corresponding wave (x) within our green long target zone (coordinates: $77.19 – $64.67), where we also anticipate the start of the final upward leg of green wave .

Alternatively, silver may have recently formed the high of wave alt.Y, while the latest counter-move established the local low of alt.X. This would argue in favor of a direct continuation of the bullish advance within green alt. , extending beyond the resistance level at $114.44.

Literally 50-years-old pattern that you can't miss

The Cup & Handle pattern formation in OANDA:XAGUSD is now fully completed. As clearly shown on the chart, price has already advanced by approximately +124% following the breakout.

I'm not trying to be too optimistic and fall to the overall market sentiment towards silver. My only goal here is to understand the scale of this trend and how we might act.

The previous comparable formation in silver developed over 106 years. The breakout phase began in 1973, launching a 6-year bull market that gained approximately +820% versus the USD.

This is a 3-month timeframe chart, and of course there will be a huge pullbacks along the way. The full realisation of this analysis may take years. This setup should therefore be approached as a long-term investment thesis, with strategy construction aligned to a multi-year horizon.

Key structural support is now located in the $47–71 per ounce range, where a Fair Value Gap (FVG) from Q4 2025 is present. This zone acts as a critical demand area and potential base for further continuation.

If the upside is similar to the 'Handle', silver could extend toward $224 per troy ounce.

Do you think my projections are true? Can wу get $220+ per ounce of silver? Should I run to the nearest bank department?

#silver #investing #longterm #tariffs

SILVER Will Go Lower! Sell!

Please, check our technical outlook for SILVER.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 11,161.4.

Taking into consideration the structure & trend analysis, I believe that the market will reach 10,315.0 level soon.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

XAG/USD: Assessing Distribution Phase and Potential Trendline BrSilver (XAG/USD) ki halia price action 15-minute timeframe par aik mazzboot "Ascending Channel" ke andar trade karne ke baad ab aik critical junction par khari hai. Price ne channel ki oopri satah (resistance) se mazzboot rejection li hai, jo ke market mein buyers ki thakawat (exhaustion) ko zahir karti hai. Hum ab aik "Distribution Phase" dekh rahe hain jahan sellers control dobara haasil karne ki koshish mein hain.

Key Technical Observations:

Channel Exhaustion: Price action ne channel ki upper boundary ko multiple times test kiya hai lekin wahan hold karne mein nakam rahi hai. Ye aik classic sign hai ke market ab ooper jane ke liye mazeed liquidity dhoond rahi hai.

Structure Shift: Black path se wazeh hota hai ke hum aik "Lower High" formation ki tawaqqo kar rahe hain. Agar price channel ki lower trendline ko decisively break karti hai, to ye market structure ka bullish se bearish mein tabdeeli (Change of Character) ka signal hoga.

Liquidity Targets: Niche ki taraf hamara pehla target 106.000 ka level hai, jo aik intermediate base hai. Agar bearish momentum barkaraar rehta hai, to price mazeed niche 102.500 ke major support area tak gir sakti hai taaki purani liquidity ko clear kiya ja sakay.

Risk Parameters: Ye bearish view tab tak valid hai jab tak Silver 112.500 ke halia peak ke niche trade kar raha hai. Is level se ooper ki closing is setup ko invalidate kar degi aur trend continuation ka ishara degi.

XAUUSD: false breakout setup🛠 Technical Analysis: On the 4-hour timeframe, XAUUSD remains in a strong uptrend, but the price is currently squeezing below a clearly defined resistance band in the 5080-5100 region. A probable breakout above this zone could potentially form a "false breakout," trapping buyers before a corrective move begins. The key trigger is the rising trendline support: a confirmed break below it would confirm a bearish correction scenario. The price is still above the 50/100/200 SMA, but a loss of the trendline + SMA50 area will likely accelerate the downward momentum. The next important demand zone is near 4900. A sustained hold above the resistance zone (and especially above the 5184 area) would invalidate the sell signal and maintain the bullish trend.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a confirmed false breakout at 5,080–5,100 followed by a break below the rising trend support (approx. 5,050–5,070)

🎯 Take Profit: Support near 4,900

🔴 Stop Loss: 5,184

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Silver (XAG/USD): Bearish Reversal Potential at Parallel ChannelSilver filwaqt 15-minute timeframe par aik mazzboot ascending channel ke andar trade kar raha hai, lekin price action ab exhaustion (thakawat) ke signs dikha raha hai. Market ne channel ki upper boundary ko touch kiya hai jo ke aik major resistance zone hai, aur yahan se aik bearish reversal ka imkan nazar aa raha hai.

Technical Analysis & Strategy:

Channel Resistance: Price ne channel ki oopri satah (upper rail) par resistance li hai. Ye area buyers ke liye thora mushkil sabit ho raha hai kyunke yahan supply mazzboot hai.

Projected Bearish Path: Black arrows se wazeh hota hai ke market aik "Lower High" structure banane ki koshish kar rahi hai. Agar price channel ki midline ko break karti hai, to ye niche ki taraf aik barri move ka signal hoga.

Key Targets:

TP 1: 106.000 (Internal support level)

TP 2: 102.500 (Major structural demand zone)

Risk Management: Setup tab tak valid hai jab tak price halia swing high yaani 112.500 ke niche rehti hai. Is level ke ooper closing bullish trend ko dubara activate kar degi.

Market Sentiment: Filwaqt sellers control gain karne ki koshish kar rahe hain. Trendline ka breakdown is setup ki confirmation ke liye zaroori hai.

Fundamental Note: DXY(USD) 26 Jan 2026DXY starts the week hovering near the 97 handle and around four-month lows as investors reassess the dollar’s “safe-haven” role amid rising policy/geopolitical uncertainty and increased FX-hedging by foreign holders of US assets. The key event is the Fed’s Jan 28 FOMC meeting, where rates are widely expected to be kept unchanged and the market will trade off Powell’s tone rather than new projections. Beyond the policy statement, the Fed-independence narrative is a real macro risk premium now, with political pressure and legal/probe headlines potentially impacting USD confidence and rate expectations simultaneously. US Treasuries are the second big driver: this week’s heavy auction slate (2Y/5Y/7Y) can swing front-end yields and the curve, which usually feeds directly into DXY momentum. However, if investors demand higher term premium because of Fed credibility/fiscal-policy concerns, long yields can rise without a “clean” USD bid (a classic setup for choppy, headline-driven DXY). Geopolitics remains two-sided: Greenland-linked US–EU tariff threats and Middle East/Iran risk can spark haven demand, but recent bouts have also pushed flows into gold and other havens while the dollar softened.

Bottom line: DXY is set for a volatility week where Fed communication + Treasury yields + geopolitical headlines decide whether the dollar bounces or stays “sold on rallies.”

🟢 Bullish factors:

1. Fed holds rates and sounds less dovish than market pricing → yields/USD rebound.

2. Firm US data (e.g., durable goods) supporting growth/real yields.

3. Risk-off spikes can still generate short-term USD demand via liquidity preference.

🔴 Bearish factors:

1. Any dovish tilt from Powell (or clearer “cuts by mid-2026” guidance) pressures DXY.

2. Fed-independence/policy uncertainty → more FX hedging / “Sell America” diversification flows.

3. FX-intervention talk around USDJPY can weigh on broad USD sentiment.

🎯 Expected targets: Base-case range trading 98.0–100.0 into/through the FOMC; a hawkish-hold + firmer yields scenario can lift DXY toward 99.8–100.6 , while dovish messaging or renewed Fed-independence headlines risk a slide toward 97.5–96.8 .

Silver Buy Trading Opportunity SpottedH1 - Strong bullish move

Currently it looks like a pullback is happening.

Until the two support zones hold I expect bullish continuation.

👉 If you enjoy this analysis, please Like, Follow, and Support the profile! Your engagement motivates us to share more quality setups.

Silver - Looking To Buy PullbacksH1 - Strong bullish move.

Currently it looks like a pullback is happening.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------

AGQ projects to $405 SILVER 2X ETFYet to breakout from this W pattern.

What Is the W Pattern?

The W Pattern is a bullish harmonic pattern found on most stock charts at some point in time. Think of the letter “W” and imagine what this pattern might look like. It is characteristic of a bounce and retest of a key support area, commonly referred to as a double-bottom formation.

When this pattern forms on a chart, it usually indicates a trend reversal. Between the two bottoms, there is a level of resistance about halfway between the two tops. As a result, this is key, as it indicates a retest of the bottom support before rising higher into the newly formed uptrend.

Now you see it.

What do you think of this chart pattern and price targets?

Stop!Loss|Market View: EURUSD🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the EURUSD currency pair☝️

Potential trade setup:

🔔Entry level: 1.19043

💰TP: 1.19701

⛔️SL: 1.18587

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: The US dollar remains under pressure early this week, and this trend is likely to continue until at least mid-week. Against this backdrop, euro buyers are effectively pushing toward resistance at 1.18960, which will likely lead to an upward breakout toward 1.19 and 1.2. A buy entry is being considered through a breakout.

Thanks for your support 🚀

Profits for all ✅

Silver have more room to surgeSilver briefly surged to a new record high, exceeding 116 USD/ounce, before consolidating around 110 USD/ounce, propelled by escalating geopolitical tensions initiated by the US. Markets anticipate a "polycrisis" as the new paradigm, disrupting the post-World War II global order. Consequently, investors are diversifying away from Gold into other precious metals, such as Silver and Palladium.

The Gold/Silver ratio collapsed from a peak of 110 to 46, trending toward the 2011 low of 32. Persistent geopolitical risks could drive prices to the 160–200 USD/ounce range. Silver maintains a high correlation with Gold but exhibits a higher standard deviation, which may amplify price gains—particularly as supply deficits loom due to surging demand from the energy transition and AI infrastructure.

Technically, XAGUSD retreated to test the EMA21 before rebounding above both expanding EMAs, signaling a continued uptrend.

If price surpasses the recent swing high, XAGUSD could target the 227.2% Fibonacci extension at 131.

Conversely, failure to sustain levels above the EMA21 may trigger a retest of the lower trendline boundary.

By Van Ha Trinh - Financial Market Strategist at Exness