EUR/JPY Market Analysis: Macro + Structure [MaB]1. The Macro Context (The "Why") 🌍

Hi traders! Before looking at the candles, let's look at the money.

My fundamental scoring table speaks clearly: there is a huge differential that we cannot ignore.

Key Factor Analysis:

🏦 Rate Expectations: Explanation: The BCE remains neutral with a trend holding stance and no clear bias in recent decisions, while the BOJ is the only hawkish central bank in the G7 with a recent +25bp hike and an aggressive stance. Score EUR: 0 Score JPY: +2

🎈 Inflation: Explanation: Eurozone inflation is at 2.14%, close to the 2% target, representing a controlled situation. JPY inflation at 2.91% is above target, justifying the BOJ's hawkish stance. Score EUR: 0 Score JPY: +1

📈 Growth/GDP: Explanation: Europe is facing worrying economic stagnation with a GDP of 0.7%. Japan's growth is also weak at 0.5%, which limits the space for overly aggressive rate hikes. Score EUR: -1 Score JPY: -1

🏭 PMI Data: Explanation: EUR PMI is neutral (weighted 50.65). JPY shows manufacturing expansion with a weighted PMI of 52.66. Score EUR: 0 Score JPY: +1

⚖️ Risk Sentiment: Explanation: Market is currently in a neutral regime; EUR is semi-cyclical and JPY is a safe-haven, but no significant risk-off flows are present. Score EUR: 0 Score JPY: 0

🗞️ News Catalyst: Explanation: Recent EUR CPI came in at 1.9% vs 2.0% expected, a moderate negative surprise. JPY benefits from exceptional hawkish policy momentum. Score EUR: 0 Score JPY: 0

Currency Score Summary:

Total Score EUR: -1 ( ) Total Score JPY: +2 ( )

Synthesis:

EUR (Weak, Score -1): The Euro is under pressure due to economic stagnation and a neutral central bank. JPY (Strong, Score +2): The Yen is strong, supported by a hawkish BOJ that stands out as an outlier in the G7. Conclusion: With this scenario, we are only looking for .

Going against this bias would be statistical suicide.

2. The Technical Setup (The "Where") 📉

Timeframe: 4h | Pair: EUR/JPY

The SMC Market Structure + Price Zones indicator gave us the confirmation we needed for our statistical edge.

Here is where the indicator makes the difference. Look at the dashboard on the right, numbers don't lie:

🚀 Continuation Rate (60%): We are exactly at the 60% threshold.

This tells us the market is in a healthy, directional trend.

Statistically, betting on continuation pays off more than looking for a reversal.

🔥 Streak (0) & Streak Pct: 2 We are at the start of a potential new leg after a period of correction.

It's a mature trend (we are in the 2nd percentile of trend extension), so watch those stop losses, but as long as the music plays, we dance.

🔄 Retest (85.4%): The indicator tells us that statistically, when price creates a new Break of Structure (BOS), it retraces into the previous zone 85.4% of the time.

Therefore, it pays to wait for a deep retracement into the supply zone to maximize our Risk/Reward ratio.

💥 BOS/Ret Rate (41.5%): This parameter tells us that once price retraces inside the previous zone, it has a 41.5% probability of reacting and creating a new BOS.

🎯 Extension Rate (1.82x): The algorithm projects an ambitious target.

We expect this move to extend 1.82 times the current pullback leg. That's where we'll take profit.

3. Execution Plan on Chart

Moving to the chart, the SMC Market Structure + Price Zones indicator supports us in pinpointing liquidity to define entry and stop loss:

Entry and Stop Loss: We place a limit entry in the Supply Zone 4h (Red Band) and the stop loss a few pips above the zone.

Take Profit: We leverage the asset's statistical analysis offered by the Extension Rate and place the target by measuring with Fibonacci at 1.8x relative to the pullback leg.

Trade Parameters:

Entry Price: 185.416 Stop Loss: 186.181 Take Profit: 178.850

⚠️ Disclaimer: This analysis is based on a proprietary algorithm and is shared exclusively for educational and didactic purposes.

It does not constitute financial advice or investment solicitation in any way. Trading involves significant risk.

Supply Zone

USDCAD - From Sellers to BuyersLast week, the focus was clear:

price was trading inside the orange supply zone, and that was a clean area to look for shorts. Sellers did their job perfectly there.

Fast forward to now, and the context has changed.

USDCAD has pushed lower and is retesting a strong demand zone, an area where buyers have previously stepped in.

As long as this demand holds, the bias shifts again, this time toward looking for longs, not chasing, but waiting for price to show rejection.

Let price confirm… then react📈

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

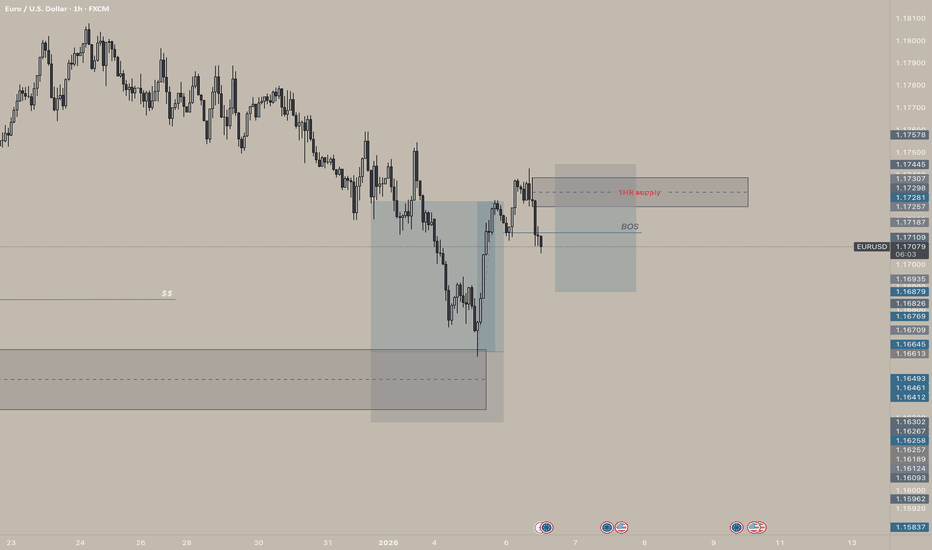

BNBUSDT M15 HTF Supply Reaction and Bearish Continuation Setup📝 Description

BNB has pushed into a short-term premium zone after a corrective bounce and is now showing hesitation below a 15-minute Fair Value Gap. The recent upside move lacks strong bullish continuation, and price is reacting from a supply-aligned area, increasing the probability of a downside rotation.

________________________________________

📉 Signal / Analysis

Primary Bias: Bearish below the 15m FVG and intraday highs

Preferred Setup:

• Entry: 872.61

• Stop Loss: Above 874.33

• TP1: 870.90

• TP2: 868.10

• TP3: 864.90

________________________________________

🧠 ICT & SMC Notes

• Price reacting from 15m FVG in premium

• Weak bullish follow-through after mitigation

• Internal buy-side liquidity already tapped

• Downside targets aligned with BPR and lower imbalance zones

________________________________________

📌 Summary

As long as price remains capped below the 873–874 resistance area, the bearish continuation scenario remains favored. Current price action suggests a corrective pullback has likely completed, with expectations of a rotation toward lower liquidity pools.

________________________________________

🌍 Fundamental Notes / Sentiment

No strong bullish catalyst is currently present for BNB, and broader crypto sentiment remains vulnerable to short-term pullbacks. This environment supports mean-reversion and liquidity-driven downside moves rather than sustained upside continuation.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

USDCAD - Back Into Supply, Sellers Watching CloselyUSDCAD is now hovering around a clear resistance and supply zone.

This area has already proven itself in the past, and price is once again reacting to it.

As long as this zone holds, the bias remains to the downside, and we’ll be looking for short setups, ideally confirmed on lower timeframes.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

EURCAD - Anticipating the Price to FallThis image displays a technical analysis chart, specifically for the EUR/CAD (Euro/Canadian Dollar) currency pair, illustrating a potential trading setup. 💴

The chart uses common trading terms to show a transition from a potential bullish (uptrend) to a bearish (downtrend) market bias, suggesting an opportunity to initiate "short" positions.

Chart Analysis 📊

Bullish Phase: The price initially moved in an upward-sloping channel or triangle, indicating buying pressure.

Bearish Transition: The price hit a "supply" zone, an area where selling interest is strong enough to potentially reverse the upward momentum. 📉

Recommendation: The chart suggests that as the price respects this resistance area, traders should "look for shorts," meaning they anticipate the price to fall (a bearish move) and can position their trades to profit from this decline. ⬇️

BTCUSD NEXT MOVE (READ CAPTION)Hi trader's what do you think about btcusd

BTCUSD is currently maintaining a bullish market structure, with price holding above a key support zone and buyers remaining active on pullbacks. The overall price action suggests a potential continuation toward higher levels, while risk is clearly defined below.

🔹 Support Zone: 92,000–91,000

This zone represents the primary bullish demand area, where buyers have repeatedly stepped in.

As long as BTC holds above 91,000, the bullish bias remains valid.

🔹 Risk Level: 90,000

This level acts as the invalidation and risk management level.

A sustained break below 90,000 would weaken the bullish setup and signal caution or trend change.

🔹 Supply Zone: 94,800

This is the near-term upside target and supply area.

If bullish momentum continues, price is likely to move toward 94,800, where sellers may attempt to slow the advance or cause short-term rejection.

📈 Market Outlook

Holding above 92,000–91,000 → Bullish continuation expected

Break below 90,000 → Bullish setup invalidated

Upside target → 94,800 supply zone

Overall, the structure supports a bullish pullback followed by continuation, with clearly defined risk control.

please don't forget to live come follow

XAUUSD READY FOR NEW HIGHER HIGH (READ CAPTION)Hi trader's what do you think about gold

Gold (XAUUSD) is currently maintaining a bullish market structure, with price holding above key support levels and buyers remaining active on pullbacks. The overall price action suggests a strong probability of continuation toward higher levels.

🔹 Support: 4630

This is the primary bullish support level, where buyers have recently defended price.

As long as Gold holds above 4630, the bullish bias remains intact.

🔹 Support Zone: 4600–4585

This zone represents a strong demand and accumulation area.

If price retraces into 4600–4585, it is considered a high-probability buy zone within the bullish trend.

🔹 Resistance: 4682

This level acts as the key near-term resistance.

A confirmed breakout and close above 4682 will strengthen bullish momentum and validate continuation.

🔹 Supply Zone: 4730

This is the main upside target and supply area.

If Gold breaks above 4682, price is likely to extend toward the 4730 supply zone, where sellers may attempt to react.

A strong breakout above this zone could open the door for further bullish expansion.

📈 Market Outlook

Holding above 4630 / 4600–4585 → Bullish continuation expected

Break above 4682 → Opens path toward 4730 supply zone

Supply zone reaction will define the next directional move

Overall, the structure supports a bullish pullback followed by continuation scenario.

please don't forget to like comment and follow

XAUUSD BUYER WANT (READ CAPTION)Hi trader's what do you think about gold

Gold (XAUUSD) is maintaining a bullish market structure, with price holding above key support zones and buyers showing strength on pullbacks. The current price action suggests a higher probability of upside continuation toward the next resistance and supply areas.

🔹 Support Zone: 4600

This level acts as the primary bullish support, where buyers are actively defending price.

Holding above 4600 keeps the bullish bias intact.

🔹 Support Zone: 4580–4567

This is a strong demand and accumulation zone.

Any deeper retracement into 4580–4567 is considered a high-probability buying area, where strong bullish reactions are expected.

🔹 Resistance: 4673

This is the key near-term resistance.

A confirmed breakout and close above 4673 will strengthen bullish momentum and confirm continuation.

🔹 Supply Zone: 4710

This zone represents the main upside target and supply area.

If Gold breaks above 4673, price is likely to move toward 4710, where sellers may attempt to slow or reject the move.

A strong breakout above this zone could signal further bullish expansion.

📈 Market Outlook

Holding above 4600 / 4580–4567 → Bullish continuation expected

Break above 4673 → Opens path toward 4710 supply zone

Supply zone reaction will define the next major move

Overall, the structure supports a bullish pullback followed by continuation setup.

please dont' forget to like comment and follow

GBPUSD - From Bullish to Bearish, keeping it simpleGBPUSD has shifted gears.

After losing its bullish structure, price is now trading inside a falling red channel, keeping the broader bias bearish.

As GBPUSD retests the upper bound of the falling channel, and that retest lines up perfectly with the orange supply zone. This is a classic area where sellers tend to step back in.

As long as this intersection holds, the plan is simple:

wait for lower timeframe confirmation and look for trend-following short setups, aiming for continuation back toward the lower side of the channel.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

XAUUSD BULLISH SETUP(READ CAPTION)Hi trader's what do you think about gold

Gold (XAUUSD) is currently showing a bullish market structure, with price holding above a key support zone and buyers actively defending pullbacks. The overall price action supports a continuation toward higher levels.

🔹 Support Zone: 4455–4430

This zone represents the primary bullish demand area where buyers have previously stepped in strongly.

As long as Gold holds above 4430, the bullish bias remains valid.

🔹 Resistance: 4518

This is the key near-term resistance level.

A confirmed breakout and close above 4518 will strengthen bullish momentum and signal continuation.

🔹 Supply Zone: 4550

This is the main upside target and supply area.

If Gold breaks above 4518, price is likely to move toward the 4550 supply zone, where sellers may attempt to slow or reject the move.

A strong breakout above 4550 could open the door for further bullish expansion.

📈 Market Outlook

Holding above 4455–4430 → Bullish continuation expected

Break above 4518 → Targets 4550 supply zone

Supply zone reaction will define the next directional move

Overall, the structure supports a bullish pullback followed by continuation setup.

please don't forget to like comment and follow thank you

BTCUSD READY FOR FLY (READ CAPTION)Hi trader's what do you think about btcusd

BTCUSD is currently maintaining a bullish market structure, with price holding firmly above a strong support zone and showing consistent buyer interest on pullbacks. The overall price action supports further upside continuation toward higher levels.

🔹 Support Zone: 89,000–88,000

This zone represents the primary bullish demand area where buyers have repeatedly stepped in.

As long as BTC holds above 88,000, the bullish bias remains intact.

🔹 Resistance Zone: 95,000

This is the key resistance area where price may face temporary rejection or consolidation.

A strong breakout and close above 95,000 will confirm bullish continuation.

🔹 Supply Zone: 99,000

This is the major upside target and supply area.

If BTC breaks above 95,000, price is likely to extend toward the 99,000 supply zone, where sellers may attempt to slow the move.

A decisive breakout above this zone could signal further upside expansion.

📈 Market Outlook

Holding above 89,000–88,000 → Bullish continuation expected

Break above 95,000 → Opens path toward 99,000 supply zone

Supply zone reaction will determine the next major directional move

Overall, the structure favors a bullish pullback followed by continuation scenario.

please don't forget to like comment and follow

USDCAD | Strategic SELL Opportunity🔻💼 USDCAD | Strategic SELL Opportunity (Multi-Target Setup)

Overview:

USDCAD is displaying bearish continuation behavior, with price reacting near a well-defined supply area, favoring further downside movement.

Sell Zone (Focus Area):

🔴 1.3920 – 1.3915

This zone acts as a strong resistance area where selling pressure is expected to dominate.

Downside Objectives:

🎯 1.3900 – First reaction target

🎯 1.3880 – Momentum extension

🎯 1.3860 – Structure continuation

🎯 1.3840 – Deeper downside move

🚀 1.3820 – Possible stretch target if selling accelerates

Why This Setup Works:

✔ Price reacting from a clear supply zone

✔ Bearish market structure remains intact

✔ Momentum aligns with downside continuation

Trade Management Insight:

Step-by-step profit booking helps secure gains while keeping exposure for extended moves. Capital protection remains the priority.

Execution Guidance:

Wait for price rejection or confirmation within the sell zone before execution. Avoid chasing price.

Final Note:

As long as price respects the resistance area, downside continuation toward lower targets remains the higher-probability scenario.

⸻

✨ Special Note for Serious Traders

If you believe in clean levels, disciplined execution, and professional risk control rather than noisy signals, feel free to connect. I work with traders who value clarity, patience, and long-term consistency.

🔒 Trade with structure. Manage risk. Stay consistent.

Dr. Reddy's Bearish view

This setup is based on a clean break of the prior pivot low around the level (₹1,246.61), confirming bearish momentum. Defined short entry zone just below ₹1,241.09, aligning with a weekly supply zone from the higher timeframe.

The zone confluence with a weekly 50 EMA also.

🔻 Entry: Short on retracement into the supply zone

🛡️ Stop Loss: Above the zone with a buffer of 15% DATR

🎯 Target: 1:3 Risk-Reward, aiming toward the ₹1,200 region

⚠️ Caution: Profit booking advised near the weekly demand zone and the orange-shaded caution area

This trade respects multi-timeframe confluence and risk management principles. Ideal for traders seeking structured short opportunities with clear invalidation and reward zones.

XAUUSD SHOULDER HEAD (READ CAPTION)Hi trader's what do you think about gold

Gold (XAUUSD) is currently forming an Inverse Head & Shoulders pattern, which is a classic bullish reversal structure. This setup indicates that sellers are losing control and buyers are gradually stepping into the market.

🔹 Support Zone: 4310–4300

This zone represents the base of the pattern, where price has formed the right shoulder and buyers are actively defending the market.

As long as Gold holds above 4300, the bullish setup remains valid.

🔹 Pattern Structure (Inverse Head & Shoulders)

Left Shoulder: Initial rejection from support

Head: Deeper low near the 4300 zone

Right Shoulder: Higher low, confirming buyer strength

This structure signals a potential trend reversal from bearish to bullish.

🔹 Resistance (Neckline): 4402

The level 4402 acts as the neckline resistance of the pattern.

A confirmed breakout and close above 4402 will validate the Inverse Head & Shoulders and confirm bullish continuation.

🔹 Supply Zone: 4460

Once the neckline is broken, the next upside target is the 4460 supply zone, where sellers may attempt to react.

A strong breakout above 4460 could open the door for further bullish expansion.

📈 Market Outlook

Holding above 4310–4300 → Bullish bias intact

Break above 4402 → Pattern confirmation

Upside target → 4460 supply zone

Structure favors bullish reversal → continuation

Overall, this setup supports a bullish trade based on Inverse Head & Shoulders confirmation.

please don't forget to like comment and follow

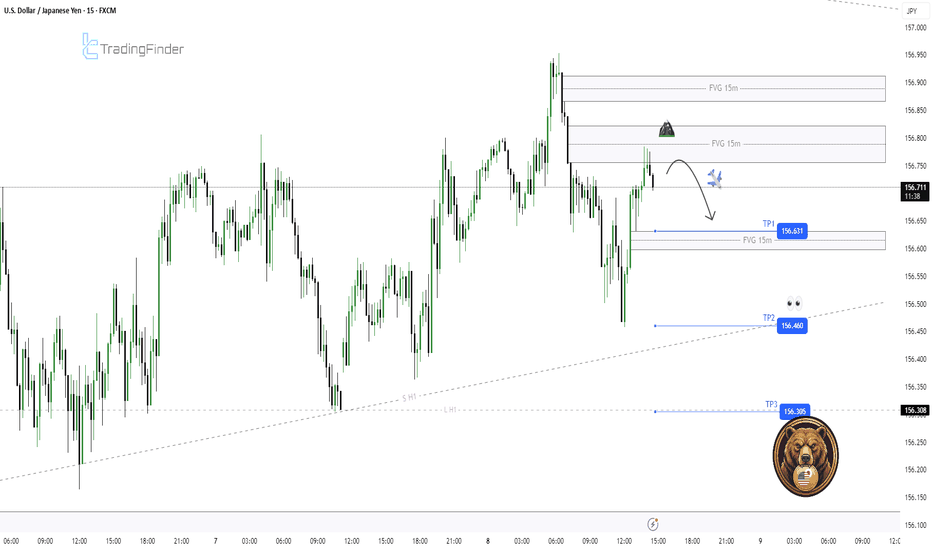

USDJPY M15 FVG Rejection and Short-Term Bearish Rotation Setup📝 Description

USDJPY on M15 is trading inside a corrective pullback after a recent bullish push. Price has moved into the 15M FVG and is showing rejection from the upper imbalance, suggesting weak acceptance at higher prices. This behavior points to a liquidity-driven pullback rather than continuation.

________________________________________

📈 Signal / Analysis

Primary Bias: Short-term bearish while below 156.80

Short Setup (Preferred):

• Entry (Sell): 156.73

• Stop Loss: Above 156.82

• TP1: 156.63

• TP2: 156.46

• TP3: 156.30 (sell-side liquidity)

________________________________________

🎯 ICT & SMC Notes

• Price rejected from 15M FVG

• Failure to hold premium pricing

• Sell-side liquidity resting below recent lows

________________________________________

🧩 Summary

As long as USDJPY remains capped below the 15M FVG, the higher-probability path is a downside rotation toward 156.46 and 156.30 liquidity. Acceptance above the imbalance invalidates the short idea.

________________________________________

🌍 Fundamental Notes / Sentiment

Short-term moves remain sensitive to US yield fluctuations and BoJ expectations. In the absence of strong USD momentum, technical rejection zones are likely to guide price action.

________________________________________

⚠️ Risk Disclosure

Trading involves substantial risk and may result in capital loss. This analysis is for educational purposes only and does not constitute financial advice. Always apply proper risk management, predefined stop-loss levels, and disciplined position sizing aligned with your trading plan.

#GBPUSD TradeNow that we had our potential reversal move (short term) . We should continue to the bullish trend and continue to take out old highs. If the pullback remains above the 0.5 Fibonacci level this will let me know that the trend still strong to the buyside. If it falls below the 0.5 simply means the trend is getting weaker. The Fibonacci 0.8 Level is a very strong area; it will be though to break that zone unless is caused by a red folder news tomorrow. So, my bias for this pair is bullish, but price perhaps fall to the 0.8 Fib level if the 0.5 - 0.7 levels isn't strong enough. Theres also and order block between the 0.8-1 Fibonacci level making the 0.9 Fibonacci level the sweet spot. A quick sell in order to buy by the market maker, so price will eventually target this area but for now, i see that we are targeting new highs we need more conformation, and this usually happens when we get closer to the Open Session of London . I will put the Risk to reward tool just for educational purpose and opportunity i will put one for current price and one more conservative position which is a pending buy limit around 1.34450.

ASTER $1 NEXT DO NOT WAIT OR MISS!Aster has CZ from #Binance interest. There is value here in my opinion based off that alone!

Next we have my analysis which shows the next draw on liquidity which should be around $1.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.