EUR/USD Is Not Trending — This Is a Controlled Liquidity RangeMarket Analysis (EUR/USD – H1)

EUR/USD is currently trading inside a well-defined sideways range, with price repeatedly rotating between support around 1.1760–1.1770 and resistance near 1.1804, while the upper extension at 1.1819 remains untouched. The structure is clear: lower highs capped by resistance and consistent demand absorption at support, signaling balance rather than directional conviction.

From a technical perspective , the repeated rejections at 1.1804 confirm the presence of resting sell liquidity, while buyers continue to defend the support zone aggressively, preventing a breakdown. Volume remains relatively stable without expansion, reinforcing that this is range rotation driven by liquidity sweeps, not trend continuation.

Macro-wise, EUR/USD remains sensitive to USD yield stability and expectations around Fed policy normalization. With no fresh catalyst shifting rate differentials, price action reflects indecision and positioning cleanup, not a new macro leg. Until either USD strength accelerates or Euro demand improves via data surprise, this range is likely to persist.

Key takeaway:

As long as price holds above 1.1760, downside remains limited. However, a clean breakout above 1.1804–1.1819 with volume is required to unlock bullish continuation. Until then, EUR/USD remains a mean-reversion environment, favoring patience over prediction.

Technical Analysis

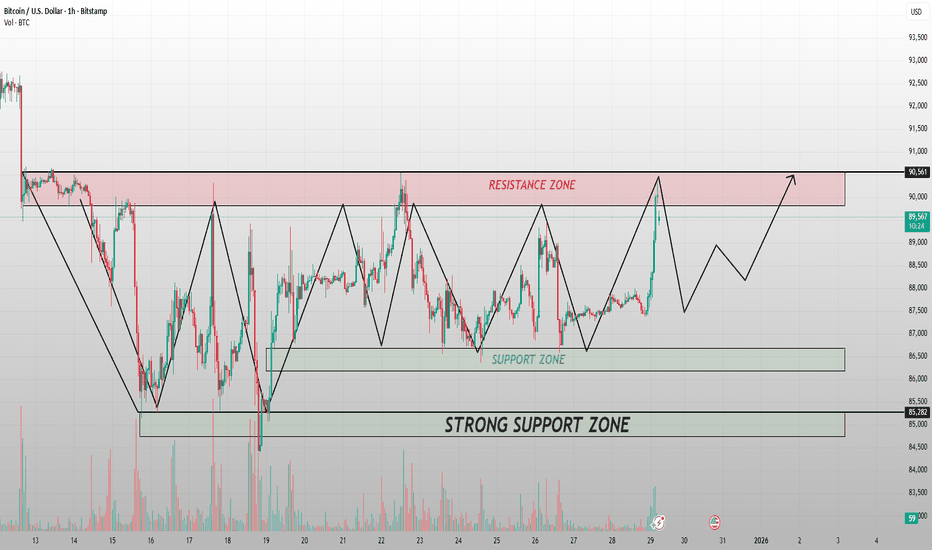

What the Market Is Actually Doing Right NowBitcoin continues to trade inside a clearly defined horizontal range, and the latest 1H price action reinforces that this market is still in distribution–accumulation rotation rather than trend continuation.

Price is currently reacting just below the $90,000–$90,500 resistance zone, an area that has repeatedly capped upside attempts over the past sessions. Every impulsive move into this zone has been met with immediate rejection, indicating that sell-side liquidity remains heavy and that larger players are using this level to offload positions rather than chase breakout momentum. Importantly, these rejections are occurring without follow-through volume, confirming the absence of strong bullish commitment.

On the downside , Bitcoin continues to respect the $86,500–$86,000 support zone , with a deeper strong support area around $85,200–$85,500 . Each rotation lower into these zones has attracted responsive buying, but notably buyers are not pushing price to new highs, only back toward range highs. This behavior confirms a mean-reversion environment , where price oscillates between liquidity pools instead of forming a directional trend.

Structurally, Bitcoin is printing lower highs within the range, while lows remain defended. This creates internal compression and signals that the market is waiting for a catalyst. Until either side of the range breaks decisively, both bullish and bearish narratives remain incomplete. A clean hourly and daily close above $90,500 would invalidate the range and open the path toward higher continuation targets. Conversely, a break and acceptance below $85,200 would expose downside expansion toward lower demand zones.

From a macro perspective, this consolidation aligns with the broader market context. Risk assets are currently lacking fresh drivers as Federal Reserve rate-cut expectations remain uncertain , and liquidity conditions are stable but not accelerating. Without a strong shift in macro liquidity or a surge in institutional inflows, Bitcoin is behaving exactly as expected rotating, absorbing orders, and building a larger move.

In summary, Bitcoin remains neutral and range-bound , not weak, but not ready for sustained upside yet. Traders should respect the range, remain patient, and avoid chasing moves in the middle. The real opportunity will come only after a confirmed breakout , not before.

Bitcoin Rejects the Ceiling — Liquidity Is Pulling Price BTCUSD (1H) — Market Outlook

Bitcoin is currently rejected from a major resistance zone near 90,000, confirming that sellers remain active at premium prices.

Key Market Structure

The recent impulsive move up failed to hold above resistance, signaling a lack of breakout strength.

Price is still trading inside a broader range, not a confirmed trend.

This rejection suggests bullish momentum is weakening short term.

Probable Scenario

The higher-probability path is a pullback toward the support zone around 86,500–87,000.

This move would allow the market to rebalance liquidity and test real demand.

Only strong buyer reaction at support would justify renewed upside attempts.

Invalidation

A clean H1 close above the resistance zone with follow-through would invalidate the pullback scenario.

Macro Context

Strong USD and elevated bond yields continue to cap risk assets.

With no immediate bullish macro catalyst, Bitcoin rallies into resistance are likely to be sold.

Bottom Line:

Bitcoin remains range-bound. Until resistance is clearly broken and accepted, expect downside probing before any sustainable upside continuation.

EURUSD Is Pulling Back Not ReversingEURUSD – 1H |

Structure: Higher highs & higher lows remain intact → trend still bullish.

Current Move: Healthy pullback after rejection near 1.1804 (profit-taking, not breakdown).

Key Support: 1.1760 – 1.1770 → expected demand reaction zone.

Scenario:

Hold above support → continuation toward 1.1804 → 1.1820.

Clean break below support → deeper correction, bias pauses.

Macro Bias:

USD still capped by expectations of Fed rate cuts in 2025.

EUR supported as USD momentum weakens → pullbacks favored for continuation.

➡️ Bias: Buy-the-dip while above 1.1760.

EURUSD Is Coiling — One Clean Break Will Decide the Next MoveEURUSD (1H)

1) Market Structure

Price is in a sideways accumulation range after a prior bullish leg.

Repeated higher reactions from the same base indicate buyers are absorbing supply near support.

Upper wicks near 1.1800+ show sell pressure overhead → market needs a clean break to expand.

2) Key Levels

Support Zone: 1.1760 – 1.1770

Structural base of the range. Holding this zone keeps bullish scenarios valid.

Target 1 / Resistance: 1.18040

First breakout trigger. Needs a clear H1 close above to confirm strength.

Target 2 / Resistance: 1.18197

Range ceiling. Acceptance above this level confirms a true breakout.

3) Trading Scenarios

Scenario A (Preferred): Buy from Support

Condition: Price sweeps 1.1760–1.1770 and reclaims 1.1775–1.1780 with rejection.

Targets:

TP1: 1.18040

TP2: 1.18197

Scenario B (Breakout Buy):

Condition: H1 close above 1.18040, followed by a shallow pullback holding above 1.1800.

Target: 1.18197, then reassess for extension.

Invalidation:

A clean H1 close below the support zone invalidates bullish structure and opens downside risk.

4) Macro Drivers to Watch

USD strength: Rising US yields, hawkish Fed tone, strong US data → EURUSD capped or pushed lower.

EUR strength: ECB staying restrictive, improving Eurozone data, risk-on sentiment → supports breakout.

High-impact catalysts: CPI, PCE, NFP, PMI, FOMC/ECB speeches, and moves in DXY & US10Y.

Bitcoin Trapped in the Holiday Range — Breakout Comes BITCOIN (BTC/USD) – 1H MARKET ANALYSIS

Market Context

Bitcoin is currently trading in a well-defined range, trapped between a strong support zone around 85,000 USD and a major resistance zone near 90,000 USD. The current structure reflects consolidation and accumulation, not distribution.

1. Price Structure

Price continues to form higher lows near the support area, indicating that buyers are still actively defending this zone.

Each approach toward 89,500 – 90,000 is met with strong selling pressure, confirming this area as a valid resistance zone.

The EMA 34 and EMA 89 are flattening and overlapping, a typical sign of a sideways market.

➡️ No confirmed breakout = no new trend yet.

2. Market Behavior

The price is moving in a controlled zigzag pattern inside the range, which is characteristic of:

Liquidity accumulation

Market makers controlling both sides of the range

Sharp intraday spikes without follow-through suggest liquidity sweeps, not trend continuation.

3. Key Scenarios (Outlook)

Scenario 1 – Range Continuation (High Probability)

Price continues oscillating between 85,000 – 90,000.

Best approach:

Buy near support

Sell near resistance

Avoid chasing price in the middle of the range

Scenario 2 – Bullish Breakout (Confirmation Required)

Trigger conditions:

Strong H1/H4 candle close above 90,000

Clear increase in volume

If confirmed:

Range is broken

Next upside targets: 92,000 – 95,000

Scenario 3 – Bearish Breakdown (Lower Probability)

Only valid if price breaks below 85,000 with strong momentum.

In that case:

Deeper correction may follow

Next key demand zone: 82,000 – 83,000

4. Summary

Market state: Sideways / Accumulation

Primary trend: Pausing, not reversing

Optimal strategy: Trade the range or wait for confirmation

Risk note: Avoid entries in the middle of the range poor risk-to-reward

👉 The market rewards patience and discipline, not impatience.

The Calm Before the Break: EUR/USDEUR/USD on the 1H chart is trading in a well-defined range environment, with price currently around 1.1775 and repeatedly rotating between a support band near 1.1760–1.1765 and a resistance band near 1.1800–1.1810. The structure is not trending cleanly; instead, it is showing mean-reversion behavior—buyers step in aggressively on dips into support, while sellers defend the upper supply zone, producing the repeated “up-down” swings visible on the chart. Technically, this is reinforced by the moving averages compressing around price: the EMA 34 (~1.1775) and EMA 89 (~1.1773) are almost flat and overlapping, a classic signature of consolidation rather than directional expansion.

From a macro perspective, this type of tight range is typical when the market is waiting for clarity on rate expectations and yield differentials. EUR/USD tends to move higher when U.S. yields soften or the USD weakens, and it tends to stall or pull back when U.S. yields reprice upward or risk sentiment deteriorates. As long as traders are uncertain about the next policy steps from the Fed vs. ECB, price often remains trapped inside these liquidity bands, with both sides fading extremes rather than committing to trend continuation. The practical takeaway is simple: 1.1760–1.1765 is the “line in the sand” for bulls, while 1.1800–1.1810 is the ceiling that must break for upside expansion. A clean hold and rebound off support keeps the range rotation intact and opens the path back toward the top of the box; a decisive break and acceptance below support would invalidate the bullish rotation and shift focus to lower demand zones.

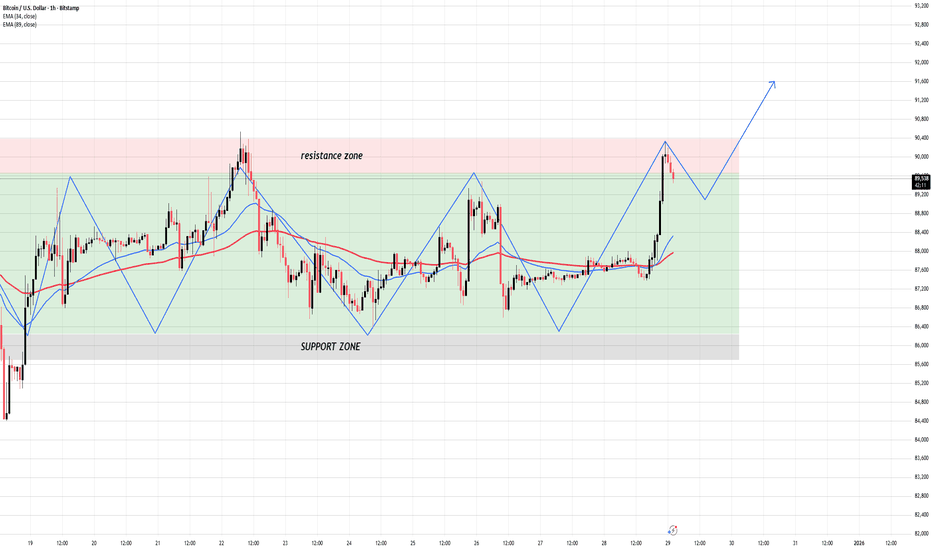

Breakout Ahead or Another Trap Inside the $85K–$90K Range?Bitcoin is currently trading inside a well-defined consolidation range between $85,000 and $90,000, and the latest price action confirms that this zone remains highly respected by both buyers and sellers. On the 1H timeframe, price was aggressively pushed into the upper boundary near $89,500–$90,000, but the immediate rejection shows that sell-side liquidity and profit-taking are still concentrated at this resistance zone. This behavior is typical of a mature range market, where impulsive moves toward the extremes are often faded unless strong follow-through volume appears.

From a technical structure perspective, Bitcoin has failed to establish a clean series of higher highs above resistance. Instead, the market continues to print range highs with weak continuation, while the EMA 34 and EMA 89 remain relatively flat, reinforcing the sideways environment. The lack of trend expansion indicates that momentum is being absorbed rather than extended. As long as price remains below the $90,000 supply zone, upside attempts should be treated as range tests, not trend breakouts.

On the downside, the $86,000–$85,500 support zone remains the key level to monitor. This area has repeatedly attracted buyers and represents the lower liquidity pool of the range. The projected move on the chart suggests that, after rejection from resistance, price may rotate lower toward this support zone to rebalance liquidity. A reaction from this area would likely result in another mean-reversion move back toward mid-range or resistance, keeping the market rotational rather than directional.

From a macro standpoint, Bitcoin is currently lacking a strong catalyst to break out decisively. U.S. macro data remains mixed, with Federal Reserve rate-cut expectations still uncertain, keeping risk assets in a cautious state. Liquidity conditions are stable but not expanding aggressively, which aligns with Bitcoin’s current consolidation rather than trend acceleration. Without a clear shift in monetary policy expectations or ETF inflow momentum, the market is more likely to continue respecting this range.

In conclusion, Bitcoin remains neutral and range-bound, not bearish but also not yet bullish. Traders should remain disciplined, focusing on selling near resistance and buying near support until a confirmed breakout occurs. A daily close above $90,000 with strong volume would invalidate the range and open the door toward higher targets. Until then, patience is key, the market is building structure, not direction.

EUR/USD Is Resting — The Break Comes After the TrapEUR/USD – 1H |

Structure: Price is in a sideway consolidation after a bullish leg → trend is still up, not reversed.

Range:

Resistance: ~1.1805–1.1810

Support: ~1.1760–1.1770 (EMA + demand)

Behavior: Rejections at the top suggest liquidity sweep risk before continuation.

Scenarios:

Preferred: Dip toward support → bounce → breakout toward 1.1820+.

Invalidation: Clean breakdown below 1.1755 → range expansion lower.

Bias: Bullish continuation after consolidation. Patience before the move.

Bitcoin Is Compressing — The Bigger the RangeBTC/USD (4H) — Market Analysis

Market State

Bitcoin remains range-bound between $85,000 and $90,000, showing classic high-liquidity consolidation after a strong prior move. Price is not trending it is building energy.

Key Zones

Resistance Zone: $89,500 – $90,500

→ Repeated rejections confirm strong supply and profit-taking.

Support Zone: $85,500 – $86,500

→ Buyers consistently defend this area.

Mid-Range Magnet: ~$87,500

→ Price frequently rotates back here, signaling balance.

Structure Insight

EMAs are flattening and overlapping → clear sideways regime.

Wicks on both sides show liquidity sweeps, not directional commitment.

This is range trading, not accumulation completion yet.

Probable Scenarios

Primary (Higher Probability):

Continued range rotation between support and resistance.

Bullish Breakout:

A clean 4H close above $90,500 opens upside toward $92,000+.

Bearish Breakdown:

Loss of $85,500 exposes downside toward $83,000–82,000.

Macro Context

Market is waiting for a catalyst (rates, USD move, ETF flows).

Until macro momentum returns, BTC favors patience over aggression.

Bottom Line

Bitcoin is not weak it’s coiling.

The longer price stays trapped, the more violent the eventual breakout.

Until then, discipline beats prediction.

EURUSD Is Trapped — One More Sweep Before the Real Move?EUR/USD – 1H Market Analysis

EUR/USD is currently trading inside a well-defined range, capped by a resistance zone around 1.1800–1.1820 and supported by a key demand zone near 1.1760–1.1745. Multiple rejections from resistance and repeated reactions at support confirm that the market is rotational, not trending.

Structurally, price is forming lower highs within the range, while buyers continue to defend support aggressively. This signals distribution and liquidity balancing, not a bullish breakout. Each push higher is sold, and each drop into support attracts short-term bids — classic range behavior.

High-Probability Scenarios Ahead:

Primary scenario: Price rotates lower to sweep liquidity below 1.1760, potentially extending toward 1.1745, before stabilizing.

Bullish invalidation: A clean 1H close and acceptance above 1.1820 would shift the structure bullish.

Bearish continuation: Failure to hold 1.1745 opens downside toward deeper demand levels.

Conclusion:

This is not a market to chase. EUR/USD is compressing inside a box, and the edge lies in patience and precision, not prediction. Wait for liquidity to be taken that’s where the real move begins.

Bitcoin Isn’t Breaking Out — This Range Is Most Trader Get TrapBTC/USD – 1H Market Analysis

Bitcoin is still trading inside a well-defined range, not a trending market. Price continues to oscillate between the support zone around 86,000–86,500 and the resistance zone near 89,800–90,500, confirming that the market is in consolidation rather than expansion. Despite recent impulsive candles, structure remains intact and controlled.

From a technical perspective, EMA 34 and EMA 89 are compressing and overlapping, signaling equilibrium. This behavior typically appears before a larger move, but until price decisively exits the range, directional bias remains neutral-to-range-based. Every push into resistance has been met with selling pressure, while dips into support continue to attract buyers — classic range rotation.

Key Scenarios Ahead:

Primary scenario: Price pulls back toward the mid-range or support zone, absorbs liquidity, and attempts another rotation higher.

Bullish continuation: A clean hourly close above 90,500 with follow-through volume opens the path toward 91,800–92,500.

I nvalidation: Loss of 86,000 would shift structure bearish and negate the current range thesis.

Bottom line:

This is not a breakout market yet it’s a patience market. Traders who chase candles will get chopped; traders who respect structure will be positioned when volatility finally expands.

EUR/USD Trapped in a Tight Range — Breakout or Another False EUR/USD is currently trading in a clear consolidation structure, bounded by a well-defined resistance and support zone. Price action shows repeated reactions at both boundaries, confirming that the market is rotational rather than trending at this stage.

Technical Analysis

On the 1H timeframe, the resistance zone around 1.1800–1.1820 continues to cap upside attempts. Multiple rejections from this area indicate strong sell-side liquidity and a lack of bullish acceptance above resistance. Conversely, the support zone near 1.1755–1.1765 has held firmly, with buyers consistently stepping in to defend this level.

The internal structure between these zones is characterized by lower momentum swings and overlapping candles, which is typical of a range environment. Until price decisively breaks and closes outside this box, directional bias remains neutral. A clean breakout above 1.1820 would open the door toward the next upside objective around 1.1880–1.1900, while a loss of 1.1755 support would likely trigger a downside move toward 1.1700, where previous demand is located.

Market Behavior & Liquidity

Recent moves into both support and resistance appear to be liquidity-driven probes, not trend initiations. This suggests larger participants are accumulating or distributing positions while keeping price contained. Traders should be cautious of false breakouts, especially during low-volume sessions.

Macro Context

From a macro perspective, EUR/USD remains heavily influenced by USD-side expectations. Markets are closely monitoring:

Federal Reserve rate path expectations, with easing priced further into 2025–2026

Eurozone growth concerns, which continue to limit sustained EUR strength

Thin year-end liquidity, increasing the probability of range-bound and deceptive moves

At present, there is no strong macro catalyst to justify a sustained trend breakout, reinforcing the technical range thesis.

Conclusion

EUR/USD remains range-bound between 1.1755 and 1.1820. Until a decisive breakout and acceptance occurs, the higher-probability approach is to respect the range rather than chase directional moves. Patience is key the market is signaling balance, not conviction.

Most Traders Think This Is a Breakout — It’s Actually a LiquiditBITCOIN (BTCUSD) – 1H MARKET STRUCTURE ANALYSIS

1. Current Market Context – Sideways Is Not Weakness

Bitcoin is currently trading inside a clearly defined sideways (range-bound) structure.

This type of market often confuses traders because:

- Price moves frequently

- No clean trend is visible

- Fake breakouts appear on lower timeframes

However, sideways movement is not randomness it is order accumulation and distribution.

2. Key Price Zones on the Chart

🔴 Resistance Zone (Upper Range)

Price has been rejected multiple times from this area

Sellers consistently defend this level

Breakout attempts fail without structure confirmation

🟢 Support Zone (Lower Range)

Price repeatedly finds buyers in this area

Long wicks and strong reactions confirm demand

Smart money absorbs sell pressure here

3. Sideway Zone = Liquidity Zone

The highlighted sideway zone is where:

- Retail traders overtrade

- Emotions dominate

- Stop-losses are clustered on both sides

Professionals use this phase to:

- Accumulate positions quietly

- Create false breakouts

- Prepare for a high-momentum expansion later

This is why most losses occur inside ranges.

4. Price Behavior Inside the Range

Notice the repeated pattern:

- Push up → rejection

- Drop down → strong reaction

- Higher volatility near range edges

- Compression near the middle

This behavior confirms:

- No trend confirmation yet

- Market is waiting for liquidity completion

5. Breakout Logic – Not Guessing, Only Confirmation

A valid breakout requires:

- A clean close outside the range

- Structure continuation, not a single candle

- Acceptance above resistance or below support

Until then:

- Every move inside the range is noise

- Every early entry is risk exposure

6. Professional Trading Mindset

In a sideways market:

- Patience is a strategy

- Waiting is a position

- Capital preservation > prediction

Conclusion – Read the Market, Don’t Fight It

This chart is a textbook example of range accumulation.

Until price proves otherwise:

Respect the range

Trade only confirmed reactions

Ignore emotional breakouts

The market always shows its intention only disciplined traders are calm enough to see it.

Bitcoin Rejected at Resistance — Is This a Santa Rally Trap?Bitcoin has just delivered a textbook rejection from the upper resistance zone around 90,300–90,500, confirming that this level remains a major supply area rather than a breakout point. The impulsive move into resistance was strong, but the immediate bearish reaction signals that buyers are failing to sustain acceptance above this range.

Technical Structure

From a market structure perspective, BTC is still trading inside a well-defined sideways consolidation range.

Resistance: 90,300–90,500

Range Midpoint / Balance Area: ~87,800–88,000

Primary Support Zone: 86,300–86,600

Secondary Support: ~85,100 (range low)

The recent push higher looks like a liquidity sweep above range highs, followed by rejection — a classic range expansion failure. This behavior often precedes a mean reversion move back toward the lower boundary of the range, especially when no strong follow-through volume appears above resistance.

As long as price remains below 90,300, bullish continuation is technically invalidated. Short-term price action now favors lower highs and corrective pullbacks, with downside targets resting first at 86,500, then potentially 85,100 if selling pressure accelerates.

Momentum & Price Behavior

The structure on the right side of the chart shows weakened upside momentum, characterized by:

- Shallow bullish pushes

- Increasing overlap between candles

- Failure to hold above prior highs

This suggests distribution rather than accumulation. Any bounce from current levels is likely to be corrective, unless BTC can reclaim and hold above 90,500 with strong volume, which would flip the bias back to bullish.

Macro & Fundamental Context

From a macro standpoint, Bitcoin is being influenced by:

Year-end positioning and reduced holiday liquidity, which increases volatility and false breakouts

Stabilizing U.S. Treasury yields, reducing speculative risk appetite

Markets pricing in Fed rate cuts later in 2025–2026, which is supportive long term, but not yet a short-term catalyst

Importantly, no fresh macro trigger is currently strong enough to justify a clean breakout above resistance. In thin holiday conditions, liquidity-driven moves often fade — exactly what we are seeing here.

Conclusion

Bitcoin remains range-bound, and the latest move into resistance has failed convincingly. As long as price stays below 90,300, the higher-probability scenario is a pullback toward 86,500 → 85,100, where buyers previously defended structure.

Until a clean breakout and acceptance above resistance occurs, traders should treat upside spikes as liquidity grabs, not trend continuation. In this environment, patience and range discipline are far more valuable than chasing breakouts.

Ethereum Isn’t Breaking Out — It’s Building Pressure Inside Hello everyone,

On the H1 timeframe, the key focus right now is not the recent rebound, but the fact that Ethereum remains structurally range-bound after a failed breakout attempt. The market has not transitioned into a new trend yet; instead, it is continuing to rotate between clearly defined supply and demand zones.

After pushing aggressively into the upper resistance zone around 3,040–3,070, ETH was rejected sharply, producing a fast sell-off back into the middle of the range. Importantly, this drop did not trigger a broader breakdown. Price stabilized and began to trade sideways again, which tells us that sellers were able to defend resistance, but buyers are still active at lower levels.

From a structural perspective , COINBASE:ETHUSD is printing overlapping candles and compressed swings, a classic sign of balance rather than trend. There is no sequence of higher highs to confirm bullish continuation, and no lower-low expansion to suggest bearish control. This is a market in rebalancing mode, not directional movement.

Technically , the 2,880–2,910 support zone continues to act as a firm demand base. Each approach into this area has been absorbed quickly, preventing further downside expansion. On the upside, the 2,980–3,000 resistance zone is the first ceiling to clear, followed by the major supply zone near 3,050–3,070, where sellers have previously stepped in aggressively.

The projected price path on the chart reflects this logic well: short-term oscillation inside the range, followed by a potential liquidity sweep before any meaningful expansion. Only clear acceptance above the upper resistance zone would confirm a bullish breakout and open the door for continuation higher. Conversely, a decisive breakdown below the support zone would invalidate the accumulation narrative and shift the bias lower.

Until one of those conditions is met, Ethereum is not trending. It is building pressure inside a range, and patience remains the highest-probability strategy.

Wishing you all effective and disciplined trading.

This Is Distribution — Not a PullbackOANDA:XAUUSD has shifted into a bearish structure on H1 after failing at the 4550 supply. The strong impulsive sell-off broke prior higher lows, confirming a clear change in market character.

Price is now consolidating inside the 4320–4380 reaction zone, suggesting distribution and rebalancing rather than a simple pullback.

Resistance: 4370–4380, 4450–4480

Support: 4320–4300, 4280–4265

➡️ Primary: lower highs → sell rallies → continuation toward 4300 → 4280.

⚠️ Risk: strong reclaim above 4380 on H1 opens a corrective rotation toward 4450.

If this idea resonates with you, traders, share your view in the comments.

This Is a Range — Not a Breakout YetCOINBASE:ETHUSD remains in a range-bound structure, respecting a clear support–resistance box. Price continues to rotate between the 2,900 support zone and the 3,050–3,100 resistance area, with repeated swing highs failing to break higher. This behavior signals range trading and liquidity rotation, not a trending expansion yet.

Recent upside attempts into resistance have been rejected, while buyers remain active near support, keeping the structure balanced. Until a decisive breakout occurs, ETH is likely to continue oscillating inside this range.

Resistance: 3,050 – 3,100

Support: 2,900 – 2,880

Range focus: 2,900 – 3,100

➡️ Primary: hold above 2,900 → range continuation → rotation back toward 3,050–3,100.

⚠️ Risk: clean break below 2,900 → downside extension toward the lower demand zone.

$SPY & $SPX Scenarios — Tuesday, Dec 30, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Tuesday, Dec 30, 2025 🔮

🌍 Market-Moving Headlines

• Fed minutes day: Markets parse December FOMC minutes for confirmation on rate-path confidence and inflation risks.

• Housing and activity check: Home prices and Chicago PMI give late-cycle reads on demand and regional momentum.

• Thin year-end liquidity: Expect exaggerated moves on headlines due to low participation.

📊 Key Data & Events (ET)

9 00 AM

• Case-Shiller Home Price Index (Oct): 1.1 percent

9 45 AM

• Chicago Business Barometer PMI (Dec): 36.3

2 00 PM

• Minutes of the December FOMC Meeting

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #FOMC #FedMinutes #housing #PMI #markets #trading

ETH Just Printed a “Fake Breakout” Into ResistanceETH/USD (4H)

Ethereum is currently behaving like a textbook range market: aggressive wicks into supply, quick pullbacks, and price rotating around moving averages. The chart shows a strong resistance band overhead and a well-defined demand zone below, meaning the next high-probability trades come from reaction points, not prediction.

1) Technical Structure: Sideways Range With a Supply Rejection

ETH is trading inside a broad consolidation after the prior drop, and the latest push into the upper band has been rejected (large wick / immediate retrace). That is classic “liquidity grab into resistance”: buyers chase the breakout, sellers absorb, then price mean-reverts back into the range.

Key read:

When price repeatedly fails to hold above resistance, the market is telling you upside needs a clean acceptance close, not just a spike.

2) Levels That Matter

Resistance (Sell-side pressure)

3,050–3,080: Primary supply zone (where rejection is occurring).

3,100–3,110: Upper cap / “hard ceiling” (major range high on the chart).

Support (Buy-side defense)

2,900–2,880: Primary support zone (first area buyers must defend).

2,800–2,760: Lower demand (if 2,880 breaks, this becomes the next magnet).

Practical implication:

Inside 3,050–3,110, risk is skewed toward pullback unless bulls can close and hold above the band.

Inside 2,900–2,880, risk is skewed toward bounce unless price breaks and accepts below it.

3) Scenarios (High-Probability Map)

Scenario A — Rejection Continues (preferred while below 3,050–3,080)

If ETH remains capped under the supply band:

Expect a rotation lower into 2,900–2,880.

A weak bounce there can still be sold again back into ~3,000–3,050.

A clean breakdown below 2,880 opens the door to 2,800–2,760 (range expansion).

Scenario B — Bull Breakout (only if acceptance happens)

If ETH breaks and holds above the supply:

Confirmation is a 4H close above 3,080–3,110 and then holding on retest.

That flips the band into support and typically triggers momentum buying (short-cover + breakout buyers).

4) Macro Drivers: Why ETH Is Choppy Right Now

ETH is not trading in isolation. This range behavior matches the current macro mix: rate expectations, yields, and the dollar are still the dominant volatility levers for risk assets.

Dollar and yields are the immediate headwind/tailwind

The U.S. dollar index (DXY) has been soft overall, reported around 98.44, down roughly 0.6% on the week and about 1.1% lower in December at that time. A softer dollar typically supports risk assets on the margin, including crypto.

Reuters

Meanwhile, U.S. 10-year yields were referenced near 4.178% in mid-December. When yields drift lower, financial conditions ease and risk appetite improves; when yields spike, ETH tends to retrace.

Reuters

Year-end liquidity amplifies fake moves

Late December markets often see thinner liquidity and sharper stop-runs. That increases the probability of wicky breakouts that fail—exactly what this ETH chart is signaling at resistance.

5) What Traders Should Watch Next

Bearish trigger:

Failure to reclaim 3,050–3,080 + breakdown back toward < 2,980–2,960 (momentum rolls over).

Bullish trigger:

4H close above 3,080–3,110 + successful retest (acceptance, not a wick).

Risk note:

In range markets, the edge comes from trading edges of the box (support/resistance), not the middle.

Gold Just Absorbed a Sharp Sell-Off — This Is a PullbackGOLD (XAUUSD) — 1H Market Analysis

Gold remains firmly within a primary bullish structure , despite the recent aggressive bearish candle. The current price action is best interpreted as a technical pullback into dynamic support , not a breakdown. The market is resetting momentum after a strong impulsive leg higher.

1) Market Structure: Bullish Trend Still Intact

The broader structure continues to show:

- Higher highs and higher lows on the intraday trend

- Price still trading above the 89 EMA, which is acting as a medium-term trend support

- The recent sell-off failed to break the last structural higher low

This confirms that buyers remain in control, and the decline is corrective rather than impulsive.

2) Key Technical Levels (Execution Zones)

Support Zone 4,470 – 4,450

Confluence of:

- EMA 89 (~4,476)

- Prior breakout structure

The long lower wick shows strong buy-side absorption at this level.

If this zone holds, the bullish trend remains valid.

Resistance & Upside Targets

- Target 1: 4,505 – 4,520

First reaction zone after the bounce

- Target 2: 4,525 – 4,550

Previous consolidation high

- Target 3: 4,580 – 4,600

Measured move extension + psychological round number

High probability zone for partial profit-taking

3) Momentum & Moving Averages

- EMA 34 has been briefly lost but price is attempting to reclaim it

- EMA 89 remains unbroken → trend bias stays bullish

- Momentum reset is healthy after the prior impulsive rally

In strong trends, price often pulls back to EMA 89 before expanding again.

4) Macro Context: Why Gold Is Still Supported

- Gold strength is not random it is backed by macro tailwinds:

- U.S. Dollar weakness continues to support precious metals

- Expectations of future rate cuts keep real yields under pressure

- Ongoing geopolitical uncertainty sustains safe-haven demand

- Central bank gold accumulation remains structurally supportive

These factors limit downside risk and favor dip-buying behavior rather than trend reversal selling.

5) Scenarios Going Forward

Bullish Continuation (Primary Scenario)

Price holds above 4,450

Reclaims 4,500

Extension toward 4,550 → 4,600

Bearish Invalid Scenario

Clean breakdown and acceptance below 4,450

Would expose 4,420 – 4,400

Only then would the bullish structure be compromised

Final Assessment

This move is a controlled pullback within a strong uptrend, not a bearish signal. As long as price holds above the EMA 89 and structural support, the path of least resistance remains upward.

Smart money buys pullbacks — not tops — and the current zone is exactly where trend continuation setups usually form.

ETH/USD – H1 Technical Analysis DetailETH/USD – H1 Technical Analysis

Ethereum has just delivered a strong impulsive breakout from the consolidation structure around 2,950–2,980, pushing price decisively above the prior balance area and reclaiming the psychological $3,000 level. This move is technically significant because it comes after an extended period of compression, where liquidity was building on both sides of the range.

From a structure perspective, ETH has flipped the former resistance zone around 2,980–3,000 into a new support zone. The impulsive bullish candle was accompanied by a clear volume expansion, confirming that this was not a false breakout but rather active participation from buyers. As long as price holds above this reclaimed support, the bullish structure remains intact.

The next key levels are clearly defined:

Immediate support: 2,980–3,000

Resistance 1: ~3,033

Major resistance: ~3,073

A healthy pullback into the 3,000 zone would be structurally bullish, allowing the market to build a higher low before attempting continuation toward 3,030 → 3,070. A clean break and acceptance above 3,073 would open the door for a broader upside expansion on higher timeframes.

On the macro backdrop, ETH is benefiting from a stable risk-on environment, with crypto sentiment supported by expectations of easier monetary conditions in 2026, declining US real yields, and continued institutional positioning in large-cap digital assets. As long as Bitcoin holds its higher range and the USD remains capped, Ethereum retains upside potential.

Conclusion:

This is no longer a range trade. ETH has shifted into a bullish continuation phase, with pullbacks likely to be corrective rather than trend-reversing. The market now favors buying dips above $3,000, not chasing breakouts blindly, while respecting that failure back below 2,980 would invalidate the bullish scenario.