The Trade Desk Inc | TTD | Long at $27.16Technical Analysis

The stock price for The Trade Desk NASDAQ:TTD entered my selected "crash" simple moving average area (green lines). This area is often a location where algorithmic buying / share accumulation occurs. This zone currently extends to $21 and I anticipate further declines to (a minimum) $24-$25 to close the open price gap within the "crash" area. While this could signal a short-term bottom, I am very weary of the existing price gaps that extend into the "major crash" simple moving average area (gray lines). These gaps, between $3 and $10, could be filled via a major economic recession announcement. Regardless of bottom predicting, a starter position was made at $27.16 and another entry is planned near $21-$22 if the price reaches that low. A major crash flash drop post-earnings in late February is a possibility if the company shows continued signals of economic weakness or world turmoil emerges.

Growth

As of this writing, annual earnings-per share and revenue growth starts again after 2025 and continues to rise into 2028

Health

Debt-to-equity: 0.1 (very healthy)

Quick ratio / short-term debt: 1.7 (very good)

Altman's Z Score / bankruptcy risk: 5.4 (very low risk)

Action

Pending no major economic recession announcement, NASDAQ:TTD entered a personal buy zone at $27.16. The stock price is now within my "crash" simple moving average zone with further entries planned in the $20s - as long as fundamentals stay strong. If the economy really shifts, this could absolutely trickle down into the "major crash" area under $10. Never say never. Time will tell.

Targets into 2028

$35.00 (+28.9%)

$50.00 (+84.1%)

Technical Analysis

Gold Daily Trend Shows Strong Momentum With Volatility RisingDespite the recent selloff, Gold continues to trade within a well-established bullish trend on the daily timeframe, highlighted by a strong series of higher highs and higher lows. Price remains decisively above both the 50-day and 200-day SMAs, with the 50-day SMA trending sharply higher and acting as dynamic support throughout the advance. The wide separation between price and the long-term 200-day SMA underscores the strength of the broader uptrend.

Recent price action reflects a sharp impulsive rally followed by increased volatility and a brief corrective pullback. Former resistance levels in the mid-range of the structure have transitioned into support, suggesting that the market is consolidating gains rather than reversing trend. Despite the pullback from recent highs, price continues to hold above key structural levels, keeping the bullish framework intact.

Momentum indicators align with this view. RSI pushed into overbought territory during the rally and has since cooled back toward the mid-50s, indicating a reset in momentum without a loss of trend strength. MACD remains firmly positive, with the histogram elevated, reflecting sustained bullish momentum even as short-term momentum moderates.

Overall, gold is displaying strong trend continuation characteristics with signs of digestion after an extended rally. As long as price remains supported above rising moving averages and prior breakout zones, the technical picture continues to favor a bullish bias within a volatile but constructive market environment.

-MW

USDMXN Daily Trend Remains Under Bearish PressureUSD/MXN continues to trade within a clearly defined bearish structure on the daily timeframe, characterized by a sequence of lower highs and lower lows. Price remains firmly below both the 50-day and 200-day simple moving averages, with the 50-day SMA acting as dynamic resistance and reinforcing the prevailing downtrend. The long-term 200-day SMA is also sloping lower, highlighting sustained downside pressure rather than a short-term correction.

From a structure standpoint, recent price action shows a sharp impulsive move lower followed by a modest rebound. This bounce has so far lacked follow-through and appears corrective, with price still holding beneath prior support zones that have now transitioned into resistance. The inability to reclaim these levels keeps the broader bearish bias intact.

Momentum indicators support this view. RSI recently dipped toward oversold territory and is now attempting to recover, but remains below the neutral 50 level, suggesting that bearish momentum has eased slightly without signaling a trend reversal. MACD remains in negative territory, with the signal and histogram reflecting ongoing downside momentum, even as selling pressure shows signs of slowing.

Overall, USDMXN is displaying a bearish trend with short-term stabilization after an extended decline. Unless price can meaningfully recover above key moving averages and former support levels, the technical picture continues to favor a cautious, downside-leaning bias within the broader trend.

-MW

USD/JPY Daily Structure Holding Within Rising ChannelUSDJPY continues to trade within a well-defined ascending channel on the daily timeframe, highlighting a broader bullish market structure that has been in place for several months. Price action remains above the 200-day SMA, which is gradually turning higher and reinforcing the longer-term trend bias. The recent pullback appears corrective rather than impulsive, with price stabilizing near the midline of the channel.

From a moving average perspective, the 50-day SMA is acting as a dynamic reference point. After a sharp downside spike, price has rebounded back toward this average, suggesting dip-buying behavior within the prevailing uptrend. As long as daily closes remain above the lower boundary of the channel and the 200-day SMA, the broader structure remains intact.

Momentum indicators show mixed but stabilizing signals. RSI has recovered from near the lower end of its recent range and is moving back toward the neutral 50 level, indicating easing downside momentum rather than strong bearish pressure. MACD remains slightly negative but appears to be flattening, which can be consistent with consolidation within an established trend rather than trend reversal.

Overall, USDJPY is displaying signs of short-term consolidation within a larger bullish channel. The technical picture suggests the market is digesting recent volatility while respecting key trend-defining levels, keeping the medium-term bias constructive unless the channel structure is decisively broken.

-MW

GPSUSDT.P: long setup from daily resistance at 0.008500SETUP SUMMARY

BINANCE:GPSUSDT.P is holding well below the level, considering yesterday’s strong rally. Usually, a correction is expected, but we see the asset sticking nearly to the level and consolidating clearly and calmly, without sharp moves — this is a sign of a confident buyer.

About 2 hours ago, there was a false breakout, and this is now the key factor to watch: whether a correction follows it. If not, it is a strong long signal. If a correction occurs, it means sellers are blocking the upside, and we will need to wait for a new approach and re-evaluate the overall picture. Therefore, the shallower the correction and the faster the re-test of the level, the better.

PRO-THESIS FACTORS:

volatility contraction on approach

impulse absorption at the level

close retest

price compression (Squeeze) (4h)

lack of rejection after false break

at-level close ADVERSE FACTORS:

overhead congestion

lack of accumulation Leave your thoughts on the setup in the comments. Follow this profile to monitor all upcoming ideas

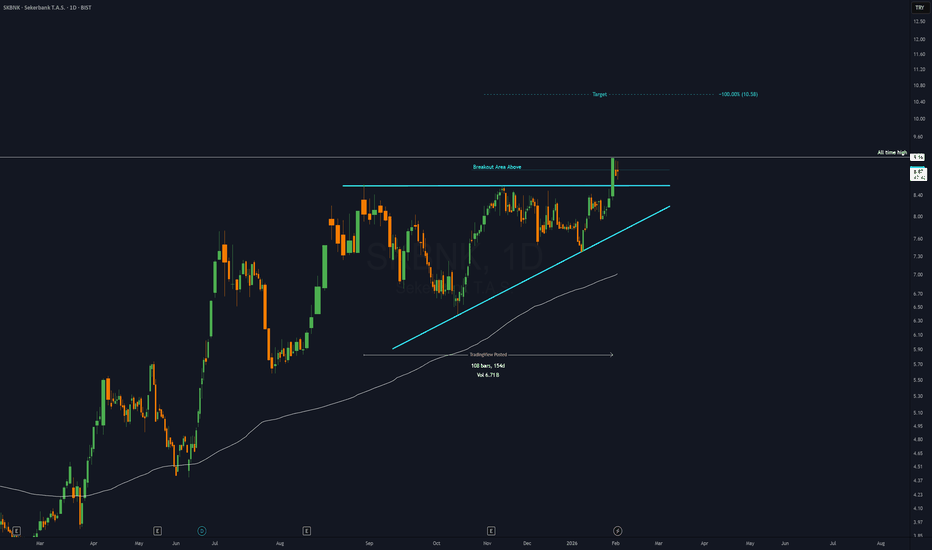

SKBNK - 5 months ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

KO - 17 months ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

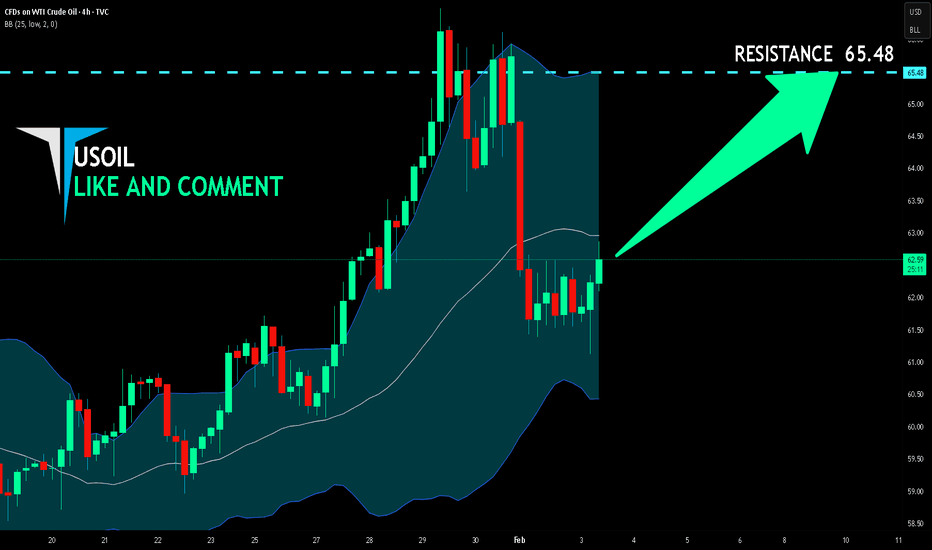

USOIL BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

Bullish trend on USOIL, defined by the green colour of the last week candle combined with the fact the pair is oversold based on the BB lower band proximity, makes me expect a bullish rebound from the support line below and a retest of the local target above at 65.48.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

CSX - 4 months ASCENDING TRIANGLE══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

AKFYE - 16 months HEAD & SHOULDERS SLOPING DOWN══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

The Elephant Jungle Page 8Today looks like another resting day in the Wild.

So the question remains...Who will prevail, the Bulls or the Bears?

I’ll be ready for whatever situation presents itself, and I hope you will be too.

Like always, stay safe out there. Use good risk management. Wait patiently for your levels and your confirmations.

The Elephant Jungle Page 7So now we’ve dropped down to the 15m timeframe, and wouldn’t you know it, we’ve got a 15M range forming. Two taps at the low. One tap at the high. That alone puts a Wyckoff Accumulation on the table. The real question is which model the market wants to play. Model 1 Accumulation: Price sweeps the range low a third time, then pops back up toward the range high. If this plays out, the Macro Range Low could get swept as well, opening the door for a move into the 1M Demand Range. And if that move holds... I’d say there’s a real chance we could eventually see ATHs again off that bounce. The second play is a Model 2 Accumulation, which would show up as an inverted head and shoulders. All the criteria are there. We’ve got a 45m Internal Demand Range to bounce from, and there’s even a clean 15m order block sitting above it. This could be the area where the Bulls plan to pop off just enough to push price back up into the 1W Supply Range. Now let’s put on another pair of glasses.

If price sweeps the high of the range again before touching the demand zones, that would give us a second tap on the high. And at that point a Wyckoff Distribution enters the chat.

From there, it’s a clean 50/50.

Accumulation or Distribution.

Continuation or collapse.

Looks like London might leave the decision up to New York.

The Elephant Jungle Page 6Now things are starting to get interesting.

On the last leg of the 4H market structure, we also have 1H structure in play. And depending on who you ask, some will say the Bulls broke structure back to the upside on the 1H.

If you’re asking me... Then no, they didn’t. Here’s why. If you actually look at the candlesticks, you’ll notice that the so called “break” is made up almost entirely of wicks. The Bulls never managed to get a clean body close above the 1H high. And this is where a little trick comes in.

If you take the trendline tool and draw it from the first wick that “broke” to the next candle, you’ll see that the following candle SFP’d the previous one. Do it again with the next candle forward, and you’ll notice the same thing, it SFP’d the candle before it. This process is called staircase-ing.

Staircase-ing helps you identify whether you have a true structural break or just price stepping over itself with wicks.

With that being said, the 1H low is technically weak, and in theory, price should be heading back down. But, this is the Jungle.

The Bulls don’t always play by the rules. They could find some internal demand somewhere below, bounce price back up, sweep the equal highs, and finally push into that FVG.

Until then, wick breaks don’t impress me.

Body closes do.

GBPCHF: Supply Zone Breakout 🇬🇧🇨🇭

GBPCHF broke and closed above a key daily supply cluster.

A breakout occurred with a high momentum bullish candle.

We see a retest of a broken structure now.

With a high probability, the pair will resume growing

and reach 1.0682 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD at Key Resistance | Fed Warsh Boosts DollarHey Traders,

In today’s trading session, we are monitoring EURUSD for a selling opportunity around the 1.18500 zone.

EURUSD remains in a clear downtrend and is currently undergoing a corrective pullback, with price approaching the descending trendline and the 1.18500 key support–resistance zone. This area could act as a strong technical rejection zone in line with the broader bearish structure.

Fundamentally, the recent nomination of Kevin Warsh as the new Fed Chair is supporting a stronger US dollar bias in the short term. Warsh is widely viewed as a more hawkish and fiscally disciplined choice, which may reinforce expectations of tighter monetary conditions — adding further pressure on EURUSD to the downside.

As always, wait for price action confirmation at the zone before execution and manage risk accordingly.

Trade safe,

Joe

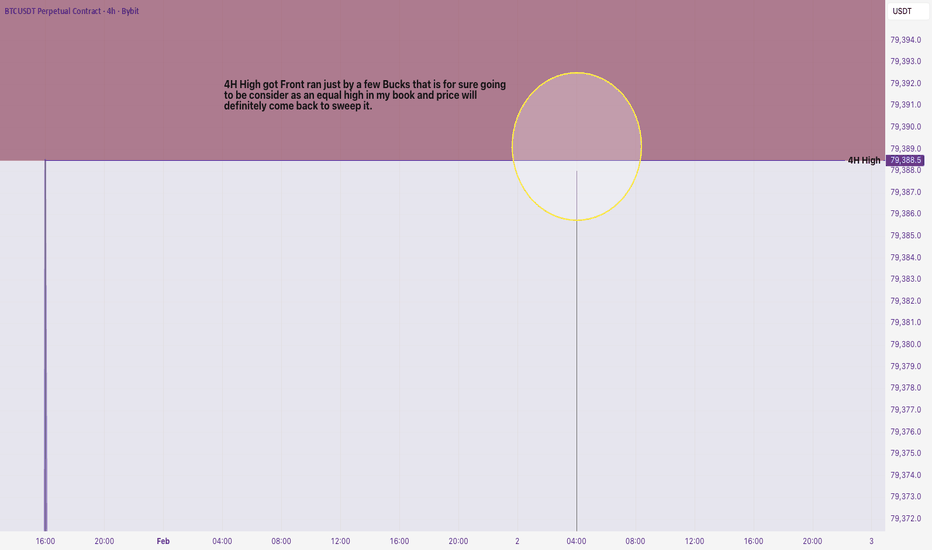

The Elephant Jungle Page 5So we SFP’d the 4H low, which instantly made the 4H high weak.

The Bulls tried to push up and take that high, but it looks like they came up short. The level didn’t get taken, it got front ran by a few dollars.

That’s the part people need to pay attention to.

So now we’ve got a real question in the Jungle, Is this the Bears taking an early stance, stepping in ahead of the level and getting ready to make a serious run at the Macro Range Low? Or… Is this the Bulls intentionally letting a retrace happen allowing more liquidity to be grabbed so they can come back with a stronger push, to finally take the 4H high, and drive price up into the FVG?

This is where patience matters. Front runs don’t happen by accident. Failed highs don’t either. One side is positioning early. The other is reloading. And the next clean move will tell us exactly who’s lying.

EURUSD Outlook | Downtrend Pullback Meets USD StrengthHey Traders,

In today’s trading session, we are closely monitoring EURUSD for a potential selling opportunity around the 1.19000 zone. EURUSD remains in a well-defined downtrend and is currently undergoing a corrective pullback, approaching a key trendline confluence and the 1.19000 support-turned-resistance area, which may act as a strong rejection zone for bearish continuation.

From a fundamental perspective, the recent nomination of a new Federal Reserve Chair is expected to support the US Dollar in the short term, as markets anticipate a more conventional and fiscally disciplined policy stance. This near-term USD strength could add further downside pressure on EURUSD and is also short-term bearish for Gold, reinforcing the broader risk-off bias.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

Gold Under Pressure | Fed Chair Warsh Fuels Sell Zone at 4,800Hey Traders,

In today’s trading session, we are closely monitoring XAUUSD (Gold) for a potential selling opportunity around the 4,800 zone. Gold was previously trading in a strong uptrend and is now undergoing a corrective phase, approaching a key retracement level and the 4,800 support-turned-resistance area, which may act as a strong reaction zone.

From a fundamental perspective, the recent nomination of Kevin Warsh as the new Federal Reserve Chair has reinforced expectations of a more hawkish and fiscally disciplined policy stance. This development is providing short-term strength to the US Dollar, which tends to be bearish for Gold, especially during corrective phases.

With both technical resistance and near-term USD strength aligning, Gold may face additional downside pressure before any broader trend continuation.

As always, wait for confirmation and manage risk responsibly.

Trade safe,

Joe.

The Elephant Jungle Page 4So far, we’ve front ran the Macro Range Low, and now price is starting to look like it wants to clean up some unfinished business.

Translation... Imbalances.

We’ve got a couple of Fair Value Gaps sitting overhead that could easily get filled to complete the prophecy of a dump from the 1W Supply Range. Here’s how the Jungle could play it:

The Bulls push price up and punch through the first FVG. From there, the Bears have two choices.

Option 1: They reject price directly from the 1W Supply Range Low, and remind everyone who actually controls the field.

Option 2: and this is the more deceptive play. The Bears let the Bulls go a little deeper. They allow price to mitigate the second FVG, pulling in late buyers and building confidence. But that confidence doesn’t last long. Because the Bears drops price right inside the 1D Internal Demand Range, which just so happens to be confluent with a back test of the Macro VAL.

In the Jungle, imbalances don’t get ignored forever.

They get filled right before the real move begins.

The Elephant Jungle Page 3But honestly, none of that is what really matters right now. What matters is this, The Bears are sitting around the 1 yard line, right around the Macro Range Low, and they’re having a harder than expected time getting a clean close below it.

Like I said before: “Bulls just let the Bears get to your 1M demand zone already and catch a fresh start from there.” But it’s starting to look like the Bears might be cooking up something more strategic.

Since the 1W market structure created a fresh Supply Range, the Bears may let the Bulls push price up into supply, give them a little hope, let the confidence build and catch them in their Bear trap to dump the market to at least the 1M Demand Range.

In the Jungle, the most dangerous moves don’t start with panic.

They start with hope.

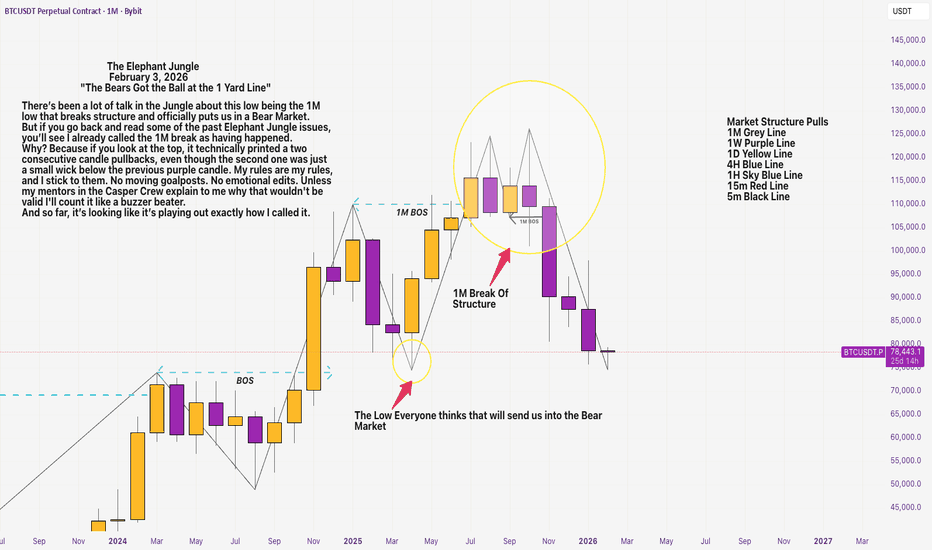

The Elephant Jungle Page 1So a few days ago, we were watching for the 1M candle to close below the previous month’s candle.

Not only did we get that close, we also closed below the candle before that too.

That alone cancels out all the noise about whether the Bears are really in control.

No side conversations.

No excuses.

No “yeah, but it didn’t break the November wick low” talk.

The Bears handled all of that and made it loud and clear to the Jungle that they’re back with a vengeance.

I guess the Bulls should’ve taken more than an inch when they had the chance, because right now, the Bears are sitting at the 1-yard line, and everybody in the stadium knows what play is coming next.

The Elephant Jungle Page 2There’s been a lot of talk in the Jungle about this low being the 1M low that breaks structure and officially puts us in a Bear Market.

But if you go back and read some of the past Elephant Jungle issues, you’ll see I already called the 1M break as having happened.

Why? Because if you look at the top, it technically printed a two consecutive candle pullbacks, even though the second one was just a small wick below the previous purple candle. My rules are my rules, and I stick to them. No moving goalposts. No emotional edits. Unless my mentors in the Casper Crew explain to me why that wouldn't be valid I'll count it like a buzzer beater.

And so far, it’s looking like it’s playing out exactly how I called it.