XAUUSD LONGGreetings traders,

This is a professional institutional market structure analysis and trade plan for XAUUSD (Gold Spot / US Dollar) on the 30-minute chart. The framework is structure-driven, order-flow based, and intended for reactive, confirmation-based entries.

XAUUSD – Institutional Market Structure & Trade Plan (M30)

Timeframe: 30-Minute bias, M15/M5 execution

Stop Loss: 4937

Take Profit: 5400

1️⃣ Market Structure Overview (M30)

Price is currently maintaining a bullish market structure, forming a clear sequence of higher highs (HH) and higher lows (HL).

A Break of Structure (BOS) to the upside has been confirmed on the M30 timeframe, indicating institutional buying pressure and continuation potential.

The last Higher Low (HL) at 4937 is the structural invalidation level.

As long as price stays above this HL, the long-side bias remains dominant. A decisive close below this level would signal a structural shift and potential short scenario.

2️⃣ Key Liquidity Zones

Primary Buy-Side Liquidity: Located near previous swing highs and equal highs above the current market.

Supply / Resistance: Areas of clustered historical highs and order blocks serving as liquidity targets.

Demand / Support: Trendline confluence with HL at 4937, acting as a robust support.

Fair Value Gap (FVG): Formed by the last impulsive bullish leg, around 5000–5050, providing an optimal institutional re-entry zone.

Liquidity mapping indicates price is likely to continue toward external buy-side liquidity (~5400 TP) if HL holds and structure remains intact.

3️⃣ Fair Value Gap & Order Flow Analysis

Impulse leg created a bullish Fair Value Gap (FVG) between 5000–5050.

This FVG aligns with prior demand and trendline support, forming a high-probability re-entry zone.

Entries should only be considered if price respects the FVG and maintains HL structure.

Execution is reactive, based on structural confirmation, not prediction.

4️⃣ Trade Execution – LONG (Primary Plan)

✅ Entry Conditions:

Enter near bullish FVG or trendline support

Confirm price respects HL and M30 BOS

M15/M5 structure aligns with continuation

🛑 Stop Loss: 4937 (below the last HL and key structural support)

🎯 Take Profit: 5400 (external liquidity / prior swing high)

💹 Risk/Reward: ~1:3 minimum

Capital preservation is priority

Partial profits can be taken at intermediate highs if needed

5️⃣ Alternative Scenario – SHORT (Conditional Only)

Short positions are only valid if:

Price decisively breaks and closes below 4937 (structural HL)

M30 Change of Character (CHoCH) is confirmed

Bearish retest occurs before entry

Until these conditions are met, selling is counter-trend and low-probability.

6️⃣ Risk & Trade Management

Maximum risk per trade: 1–2% of account

No breakout chasing without retest

Only take trades aligning with structure, liquidity, and FVG confluence

Stop Loss is strict and non-negotiable

Take Profit targets correspond to liquidity levels; trailing stops optional

7️⃣ Market Expectation

Above 4937 HL: Bullish continuation toward 5400 TP is favored

Below 4937 HL: Market structure shifts; short scenario becomes valid

This analysis follows the institutional order-flow framework:

Structure → Liquidity → Fair Value Gap → Execution

Trades are confirmation-based, reactive, and strictly structure-driven.

No predictive or speculative entries are suggested.

Dear Traders let me know what do you think ,like and comment i will be glad

Trend Analysis

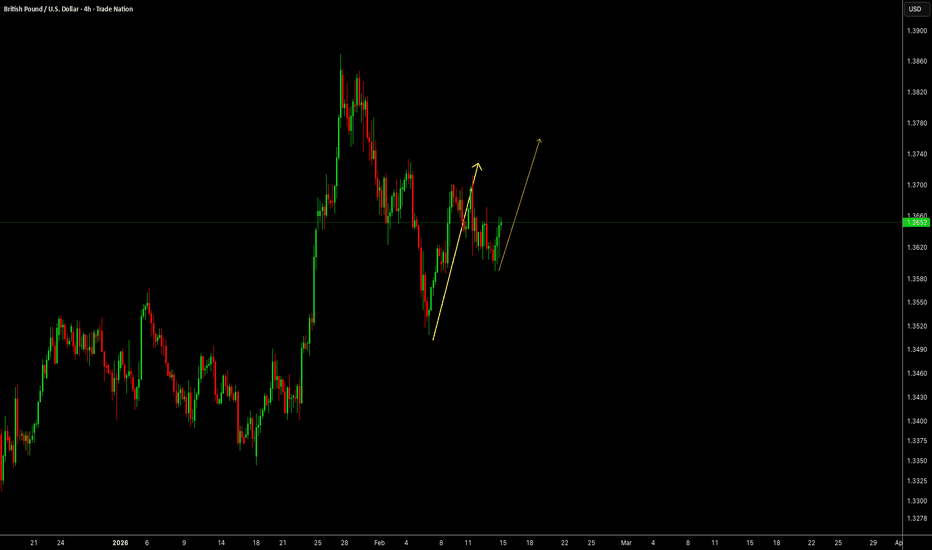

head and shoulders pattern formedThe GBP/USD pair has formed a Head and Shoulders pattern on the chart. Price action is currently approaching the neckline area, and a confirmed breakout above this level would validate the pattern and support a potential long position.

Let me know your opinion in the comments

DJI 15M – Range Manipulation Into Expansion1️⃣ The Higher Timeframe Context

Price was trading inside a clear range:

🔼 Range High: ~50,450

🔽 Range Low: ~49,400

⚖️ Mid-level equilibrium around 49,930

Market was in consolidation after a sharp selloff — meaning liquidity was building on both sides.

When price compresses like this, smart money prepares for a liquidity grab before the real move.

2️⃣ The Manipulation Phase (Sell-Side Liquidity Sweep)

Price dipped below the equal lows around 49,400.

What happened?

Took out resting sell stops

Triggered breakout shorts

Created panic selling

Printed a sharp lower wick (rejection)

This is classic sell-side liquidity raid inside a range.

Important detail:

It did NOT continue trending lower. That’s your first clue.

3️⃣ Reclaim + Shift

After sweeping the lows:

Strong displacement candle up

Market reclaimed the range low

Internal structure shifted bullish

That reclaim is the confirmation.

Manipulation → Reclaim → Expansion.

Without the reclaim, there is no trade.

4️⃣ The Expansion Target

Once manipulation is complete inside a range, price usually targets:

Range equilibrium

Opposite side liquidity (range high)

Arrows on your chart show the projection toward:

→ 49,930 mid-range

→ 50,450 range high

That’s logical draw on liquidity.

🎯 Trade Model

Entry:

After reclaim of 49,400 with displacement confirmation.

Stop:

Below sweep low.

Targets:

TP1: Mid-range (EQ)

TP2: Range High

RR is strong because entry happens AFTER manipulation, not during it.

NPL buying opertunity 🚀 NPL READY FOR BIG MOVE?

🎯 100 → 110 → 118 INCOMING?

🟢 BUYING ZONE: 85 – 89

🛑 STOP LOSS: 79 (Daily Close)

🎯 TARGET 1: 100

🎯 TARGET 2: 110

🚀 LONG TARGET: 118

stop loss daily close below 79.

Manage risk accordingly.

📊 Risk–Reward Analysis (Approx)

Agar entry 88 pe lein:

Risk = 88 → 79 = 9 rupees

Reward T1 = 88 → 100 = 15 rupees → RR ≈ 1:2.5

Reward T2 = 88 → 110 = 25 rupees → RR ≈ 1:4.1

Reward LT = 88 → 118 = 33 rupees → RR ≈ 1:5.5

GBPJPY next MoveGBPJPY on the 4H timeframe has delivered a clean bearish market structure shift after failing to hold above the prior demand zone, with strong impulsive selling breaking support and confirming sellers in control. The sharp rejection from the upper range followed by continuation candles signals distribution and bearish momentum, while the current consolidation below broken support suggests a classic pullback before potential continuation lower, keeping downside liquidity and previous lows in focus. Fundamentally as of 15 Feb 2026, the pair is pressured by risk-off sentiment, steady Japanese yen demand as a safe haven, and ongoing uncertainty around UK economic growth, inflation trajectory, and Bank of England policy expectations, while yen strength is supported by shifting yield dynamics and cautious global outlook. As long as price remains below the broken support zone, bearish continuation setups, pullback sells, and trend-following strategies remain favored, aligning technical breakdown with macro-driven momentum for high-probability downside opportunities.

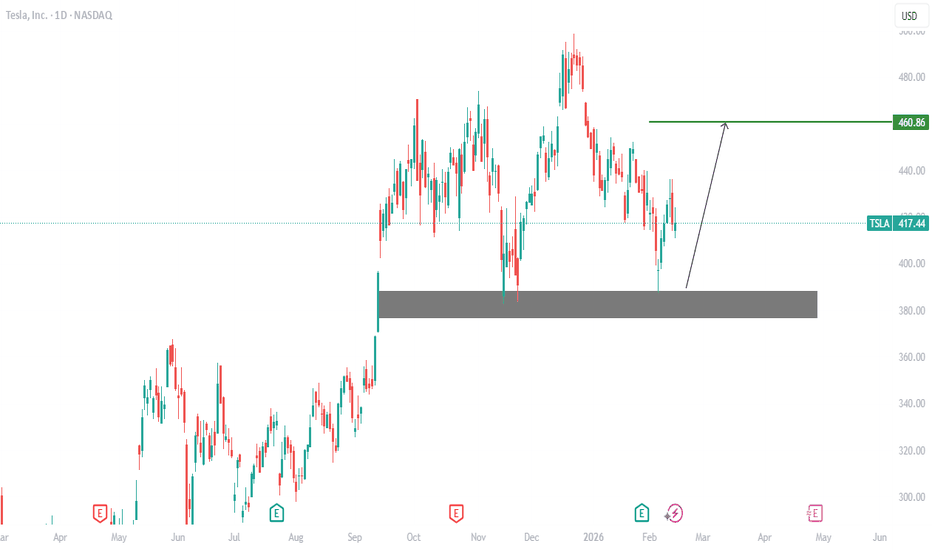

Tesla, Inc (TSLA) Market Update, Price Approaches Demand AreaTesla Inc TSLA closed at $417.44 on Friday. price have been dropping down due to lack of new products, according to what Cox Automotive director of industry insights "Stephanie Valdez" told Bloomberg, that any automaker that doesn't have new products is going to lose market share. which Tesla needs new products to improve it's market value.

The price has faced pressure following 45% drop in china vehicle sales and 17% decline in the U.S for January 2026.

Technical outlook:

Price is gradually approaching the demand zone at $388.20, a strong reversal confirmation above this level would push and trigger bullish rise eyeing $460.86 as potential target.

Meanwhile, a sustained breakdown below the support zone, could signal further bearish momentum.

Thanks for reading.

ARPAK – TECH INVESTMENT SET-UP | W | 15 FEB 2026 | By TCAARPAK – TECH INVESTMENT SET-UP | W | 15 FEB 2026 | By The Chart Alchemist

• Buy 1: Rs. 67.17 (current price)

• Buy 2: Rs. 62.15

Target Prices:

• TP1: Rs. 86

• TP2: Rs. 106

• TP3: Rs. 128

• TP4: Rs. 149

• TP5: Rs. 169

• TP6: Rs. 191

• TP7: Rs. 212

• TP8: Rs. 236

SL (closing): Below Rs. 54 | R:R: 1:11.8

📢 Disclaimer: All trade setups are shared for informational purpose.

Do your own research before taking any position - No claim, No blame

SMCI Weekly Update – Short Put Plan Recap (2/20/2026 Exp.)

Position: Short $27.50 Put

Expiration: 2/20/2026

Entry Date: 2/13/2026

Premium Collected: $0.25

Effective Cost Basis if Assigned: ~$27.26

📊 Market Structure

SMCI finished the week down 12.92%, closing near the lower portion of its defined range.

Range remains intact:

Support (Weekly & Daily): $29

Resistance (Daily): $34.03

Resistance (Weekly): $35.60

Despite the large red candle, volume decreased compared to the prior green week. This suggests selling pressure, but not aggressive institutional liquidation.

RSI moved from 45.78 to 41.29—weakening but not oversold.

At this time, the structure still reflects a range retest—not a confirmed breakdown.

🎯 Why the $27.50 Strike?

The strike was selected:

Below is defined weekly support

Below the recent panic wick zone

~10% below entry price

With only 7 DTE to maximize theta decay

This is a probability income trade, not a directional bet.

📉 Distance to Strike

Current close: ~$30.54

Strike: $27.50

Price would need to fall another ~9.83% in four trading days to threaten the strike.

The cushion remains intact.

🔒 Management Plan

No adjustment is needed at this time.

However, a structured contingency plan is in place:

If $29 Support Holds

Let theta decay work.

Close at 60–70% profit target.

If $29 Breaks with Follow-Through & Volume Expansion

Consider rolling down and out to maintain probability.

OR accept the assignment if the structure stabilizes near $27–28.

If Assigned

Effective basis ~$27.26.

Transition to the covered call strategy above the resistance.

Final Note

As long as weekly support holds, the range remains intact.

We monitor $29 closely next week.

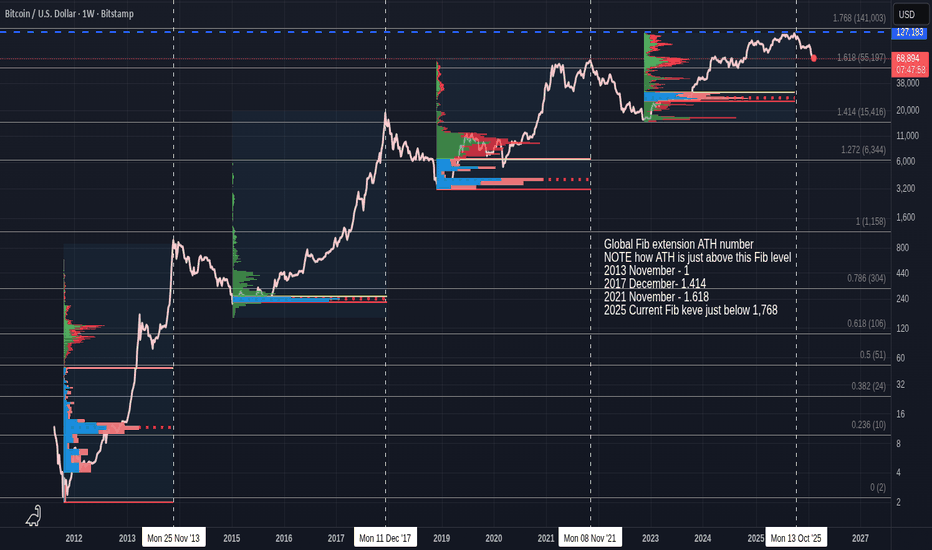

Interesting Bitcoin Cycle Volume Data since 2011 - Change ahead?

The Main Chart is using Fixed Range Volume Profiles.

These are based on the Low from the previous High, till the Next ATH, showing us the Volume profile for Each "Cycle"

OR, Where were people most interested in Buying Bitcoin in a cycle.

As we Look at each cycle Closer. you will also be seeing the Fixed VWAP.

Volume-Weighted Average Price (VWAP) is a technical analysis indicator that calculates the average price a security has traded at throughout the day, weighted by trading volume. It provides a more accurate representation of true market activity than simple averages because it gives greater importance to prices at which larger volumes were traded.

I will start these Zooomed in charts from the 2015 cycle but it is interesting to see how the Volume was from the 2011 low. The was A Bitcoin for $2 !

You will see 2 Horizontal lines , Yellow and Red, This is the VALUE AREA Range....High ( Yellow ) and LOW ( Red )

This Vakue Area shows you were 70% of the trading took place in the Given Range selected ( Low to ATH ).

Value area in 2011 -> 2013 = 2 - 47 usd

Note how Tall this Range is in the chart and how it is mostly traded Low and then traders waited till the ATH was reached.

These people were probably the creators of Bitcoin, Friends and interested parties that were offered a cheap gamble on something that May be "Big value" one day.

I bought my first Bitcoins at $33 and Lost the address,,,,,,,,,,,,,,,,NO COMMENT ( I had seen a TV program talking about it and so spent £1000 at Mt Gox, thinking I could be Rich one day)

2015 to 2017 Profile

See the 2 Horizontal yellow lines....~This is the Value Area. ( I forgot to change lower line to Red)

See how much smaller this is compared to previous.

This shows that people KNEW where the Bottom was, When to Buy and then Wait.

The Value area this time was 2015 -> 2017 = 225 - 255

a $30 range !!!!

We can see a vastly reduced Volume of trading as Price rose.....Again, Showing people understanding what to do and WAITING>

Another thing to see here is those VWAP lines,,,the Yellow and Red

The Yellow is the VWAP and the others are Multiples of that....

I'll not go into details here but Note how that VWAP (yellow ) line progresses and PA hit it at the Bottom and marked the beginning of the Next Cycle.

2019 to 2021 Profile

Again, see the 2 Horizontal yellow lines, the Value Area.

2019 -> 2021 = 3419 - 6344 usd , this time, a $3000 usd range

See how Most of the trading was done AT THE BOTTOM, where that VWAP met the PA line.

See how the VMAP line Rose, with PA above it. It is generally considered bullish when PA is above VMAP.

We did see PA drop below the VWAP line in Late 2022 and this was certainly triggered by the FTX Scam coming to light.

This scared traders and we now see more and more Professional traders entering the Bitcoin world. But as we can see on the next Profile, the FTX problems Scared traders.

2023 - 2025 profile

See how much higher the Value Area is this time ? People did trade the Bottom, the Risk was high after the previous year of Companies collapsing etc.

The Value are this time was 24812 - 31093 usd. The Low was around 15K !

People were nervous, waited and entered slowly.

BUT what makes this So Very different is looking at the amount of trading Higher up. Confidence returned when the USA decided to NOT demonise Bitcoin

This is the ETF Arrival.........The Corporate arrival and maybe the Change of cycle dynamics.

And Look were that VWAP line is NOW......PA has bounced off it already............Was that the Bottom ?

But is this the End of one Cycle and the start of another ?

I am not sure yet.

For a start, PA usualy reaches ATH by reaching above the upper band of the VWAP ( 2nd Red line)

We have not done that yet.

What is also interesting to see is how the ATH's are All Just above the Next Fib Extension , except for the current ATH, Showing that, Maybe, this cycle is NOT over yet.

Global Fib extension ATH number

NOTE how ATH is just above this Fib level

2013 November - 1

2017 December- 1.414

2021 November - 1.618

2025 Current Fib keve just below 1,768 - Are we going to see a push over that line before Real Cycle Close?

Or have we entered a Super cycle ?

So, we do seem to have a change in the making............

Early reach down to VWAP line, so far, not even a -50% drop from ATH compared to the usual -80%

Not reaching above the next Fib extension

High trading Volume late in cycle

PA Not reaching above the 2nd line high on VWAP

And so much more.

Interesting days.............................

For me, We have reached A Bottom, Not THE Bottom and I am not to sure we will ever see a real Bottom agaain...We WILL see LOWS.....

But I think Cycle dynamics have changed and this is discussed in charts I have posted about the Fibonacci Arc that has rejected every ATH

Time Will tell

IGV SOFTWARE 2026 CORRECTIONIGV (1D) is in a bearish re-pricing after rejecting the 95 gap area and losing the 90–95 supply. The flush through ~87.5 signals distribution overhead, with price now trying to stabilize near 81–80 (short-term demand/absorption).

Key zones

Rejection/Supply: 90–95 (gap area / prior support turned resistance)

Distribution cap: ~87.5

Near-term demand: 81–80

Major supports: 72.3 (weekly), 62.9 (monthly)

Targets

Target up: 87.5 first, then 90–95 (only if 81–80 holds and price reclaims 87.5)

Target down: 72.3; extension 62.9 if weekly support fails

ETH PERPETUAL TRADE SELL SETUP Short from $2060ETH PERPETUAL TRADE

SELL SETUP

Short from $2060

Currently $2060

Targeting $1975 or Down

(Trading plan IF ETH

go up to $2130 will add more shorts)

Follow the notes for updates

In the event of an early exit,

this analysis will be updated.

Not a Financial advice

Stock Market Forecast | BTC TSLA NVDA AAPL AMZN META MSFTWelcome to your essential weekly guide for navigating the dynamic stock market!

0:00 Weekly Stock Market Outlook (SPY, QQQ, Bitcoin, MAG 7) CME_MINI:ES1! CME_MINI:NQ1! CRYPTOCAP:BTC

0:18 Sector Rotation & Market Sentiment Breakdown

1:34 Semiconductor ETF PSI – Largest Dark Pool Since 2008

2:31 MAG 7 Dark Pools (Vanguard Growth ETF Breakdown)

3:24 PSQ Short ETF – Is Smart Money Positioning Bearish?

4:47 SPY Technical Analysis – Key Range & Breakout Levels

5:06 QQQ Technical Analysis – Lower Highs, 589 Support Watch

6:19 Bitcoin Technical Analysis – Bear Flag or Trend Reversal?

7:54 Tesla Stock Analysis – 388 Breakdown Risk?

9:39 Meta Stock Analysis – 620 Major Support Level

10:24 Amazon Stock Analysis – 200 Psychological Support

11:23 Microsoft Stock Analysis – 400 Key Breakdown Zone

13:40 Google NASDAQ:GOOGL Stock Analysis – Running Out of Momentum?

15:16 Apple Stock Analysis – 250 Support & Range Trade

17:01 Nvidia Stock Analysis – Critical Channel Break Watch

18:15 Market Outlook & What Could Trigger Volatility

US30 Technical Analysis! BUY!

My dear friends,

Please, find my technical outlook for US30 below:

The instrument tests an important psychological level 49438

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 49916

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Forming Bearish TriangleIn this scenario, there's a massive indication of a bearish run. We all know that it will dump towards the 45,000 USD level, but for now, it is gaining Bearish Momentum, creating a massive Bearish run. It's printing 2 Bearish legs. One is a Bearish Triangle, and the other is a Bearish Leg inside another Bearish Leg

WHR ready to runGreat chart for using Momentum Wave oscillator.

WHR is ready to run. It just needs to break that yellow down-slopping trend line. As soon as it does...off to the races.

Here is an interesting summary for each of the "buy" signals and the results. It is on the weekly chart. You can see the green vertical lines. It is when the momentum oscillator goes below -60.

As of now, we have hit the yellow trend line again. But the big support line was hit (white line), so we are probably consolidating to gain strength to break the yellow resistance line. Look for a median move average of 35% from when the signal was given. Could be more depending on the overall S&P market, tariffs, etc. Remember that the average move is 88.5%

Entry: If not already in, look for a small pull back on the 1 hour chart for a good entry.

Metric Result

Total signals: 13

Wins: 12

Losses: 1

Win rate: 92.3%

Average move: 88.5%

Median move: 35%

11/1/74, 100%

2/1/78, 14%

4/2/79, 11%

4/1/80, 235%

12/3/90, 90%

11/1/20, 99%

4/1/09, 212%

1/3/12, 327%

11/1/18, 35%

11/1/22, 18%

1/2/24, -30% (negative)

7/1/24, 14%

1/2/26, 25% (current and end results pending)

BTCUSD : Bullish Expansion After Short SqueezeThe arrows reflect strong upside continuation following aggressive short liquidations, with price reclaiming momentum and holding gains above recent consolidation. The move is impulsive rather than corrective, suggesting buyers are driving this leg higher rather than just covering. As long as momentum remains firm, continuation pressure stays favored in the near term.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.

BLS international is good to buy around 244 BlS international is good to buy around 244 after confirmation of reversal, till then we can watch this stock, as this stock already grabed all buyers liquidity and ready to move upside,

so if it gives confirmation the stock will give best results in very short time. so just watch observe and grab if it reverses

ethusdt longAttention followers!

Attention followers!

Entry point: yellow

SL: red

Take profit: black

Hello dear followers.

I'd like to point out that I primarily trade with 20x leverage, and my tp1 (Target 1) is placed 2.5% from the entry point and 2.5% from each other.

I'd also like to point out that my stop-loss (SL) is also 2.5% from the entry point.

Therefore, we will lose 50% of our margin if the stop-loss is triggered, and we will gain 50% at tp1 (Target 1), 100% at tp2 (Target 2), and 150% at tp3 (Target 3) if the trade is successful.

Invest what you can afford to lose, which is between 1% and 5% of your margin.

Thank you.

ethusdt

long

Ethereum Rejected at VWAP as $2,140 Resistance Caps PriceEthereum price action is currently trading at a critical technical zone, with price reacting around the VWAP after a clear rejection from daily resistance near $2,140. This area has acted as a strong supply zone, and the inability to reclaim it suggests that bullish momentum remains limited in the short term.

From a structural perspective, as long as Ethereum continues to trade below the $2,140 resistance, downside risk remains elevated. The rejection at this level reinforces the broader range-bound environment, where price oscillates between established support and resistance rather than trending decisively.

The VWAP now acts as a pivot point. Acceptance below this level would indicate that sellers remain in control, increasing the probability of a rotational move lower within the range. In this scenario, the next major downside target sits near the $1,800 region, which represents the lower boundary of the current trading range and a key area of historical demand.

Until Ethereum can reclaim $2,140 with strong volume and acceptance above VWAP, rallies are likely to be treated as corrective. From a technical and price action perspective, this setup favors continued range rotation rather than trend continuation. Traders should remain cautious at current levels, as rejection from resistance keeps the risk skewed toward a move back into lower support zones.

USDT.DOMINANCE CHART ANALIYSIS USDT.D is breaking down from the triangle structure.

Clean rejection from descending resistance

Lost rising trendline support

Now trading around 7.69%, sitting on horizontal support

Support: 7.65–7.70%

If breakdown continues → 7.50% next

Reclaiming above 7.95% would neutralize the downside

Falling USDT dominance = capital rotating back into crypto.

This supports short-term strength in BTC & Altcoins if the breakdown confirms.

Bearish dominance → Bullish crypto (while below 7.95%).

⚠️ Watch 7.65% closely — reaction here will define next move.

GBPUSD Holding Higher Lows : Buyers in ControlThe arrows show price respecting higher lows after each pullback, with bullish structure remaining intact. Momentum is rotating upward rather than breaking down, and dips are being absorbed quickly. As long as this sequence continues, the bias stays tilted toward further upside expansion.

Disclosure: We are part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in our analysis.