Predictions and analysis

Indonesia tried to print value for the currency as #MMT prescribed. Now it costs 30,000 IDR to buy an cup of espresso! Soon it will cost 40,000 as the dollar will likely rise from here.

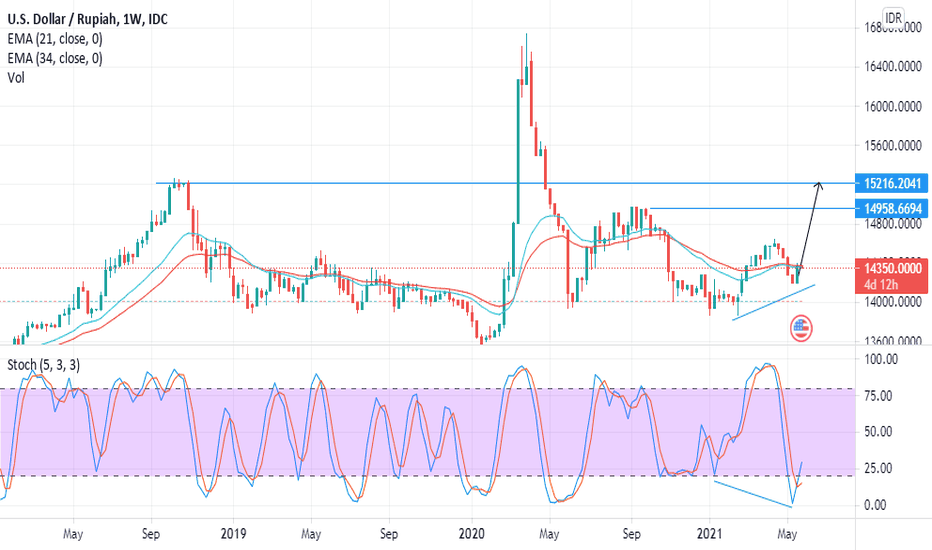

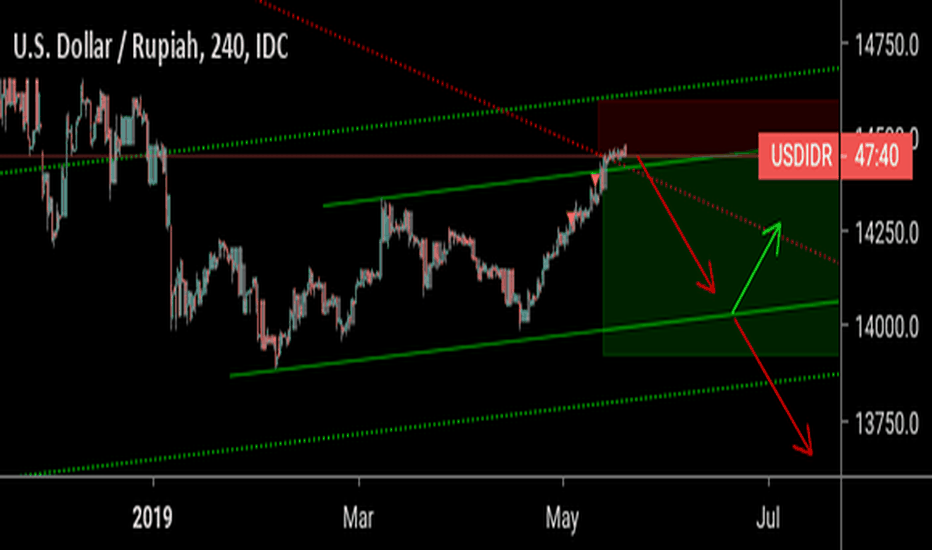

since map years ago, many pple said goes to 16k. and now will fall down deep. for me, good chance to buy USD arround 14400 hold till end of the year also divergen MN as long as it doesnt break 14000 lvl

It takes 14,840 Indonesia Rupiah to purchase $1. Let me put this in a different way so people may understand it better. Imagine needing HKEX:14 ,840 to buy 1 IDR. Or TASE:TASECTORBALANCE ,520 to buy 1 espresso at Starbucks. Let that sink in for a moment. #MMT at its finest.

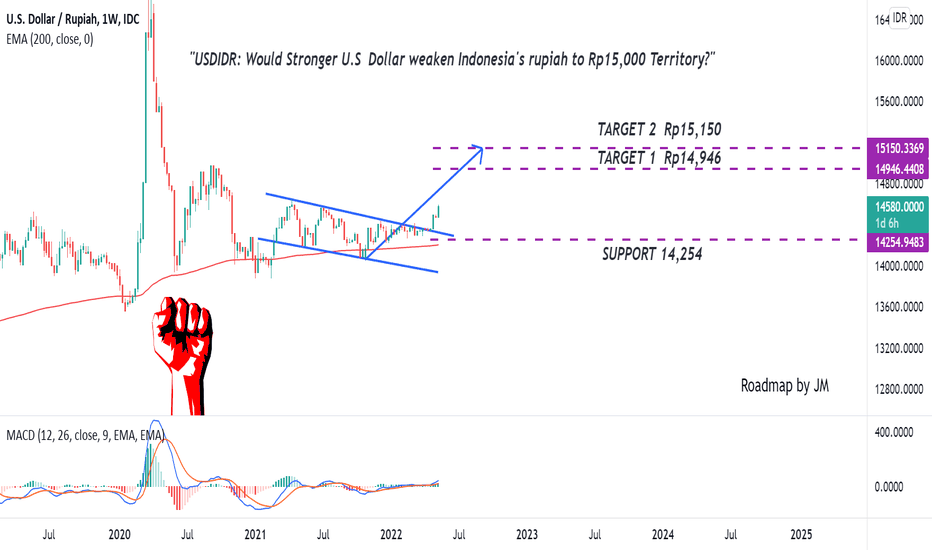

The inflation rate has reached above 8% territory in the U.S. Higher Inflation Rate forced the Fed to raise the interest rate again by 50 basis points in May 2022 and it seems the Fed will remain hawkish for stabilizing inflation to a more normalized level. Commonly, the Increasing interest rate will make a stronger dollar because it will attract investment...

Rupiah tends to move flat despite the strengthening of the US dollar against major currencies. In addition, the demand for the dollar has increased, and the demand for other safe haven assets has also increased, as indicated by the increase in gold prices and also followed by an increase in the yield of the US Treasury to the level of 2.88%. In addition, the...

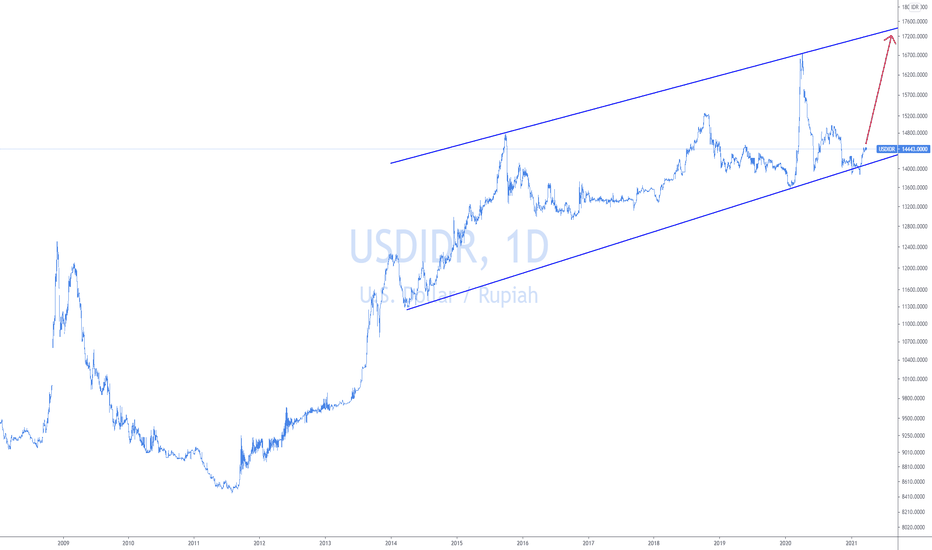

nice picture , strong uptrend on usd/idr if breakout from bearish trend

Indonesia rupiah would like to weakening since we've got a pennant pattern on this market as their bullish continuation signal. Buy on break should be your consideration with the supply area as price target and 14300 as a bullish invalidation if the price goes down and close below it

usdidr potensially bull with stochastic divergence. target price 2 peak as last resitance.

amid covid-19 virus pandemic, the rupiah feel highest high, and also lowering from that high.

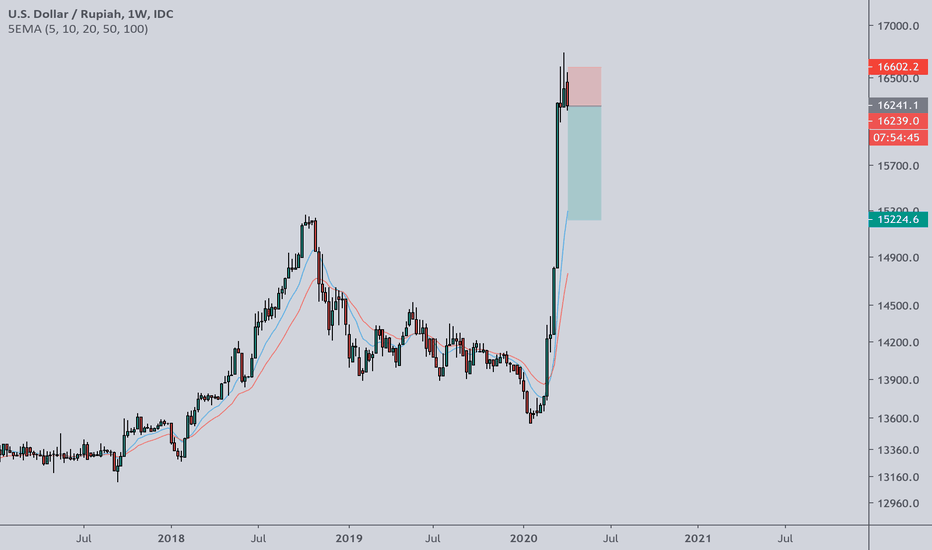

The market is probably shifting the downside for retracement till the previous high which is the main target to get profit.

Overall bisa dilihat usd idr ada didalam formasi big triangle dengan retest ath sebelumnya di area 6700 rupiah, kemungkinan pullback dalam beberapa minggu kedepan ada di area 15600 - 15400 rupiah atau line 0.786 area fibonacci retracement . Perhatikan faktor fundamental khususnya terkait krisis yg sedang terjadi, jika usd mampu menembus area 17000 rupiah per...

NOTE: IT WILL GO UP FIRST!!!! i don't know the target up must monitor the rejection down target to 95.4

Jika banyak sekuritas mendowngrade target IHSG, kami masih dalam posisi dengan target IHSG kami dari sejak awal tahun. Siapa yang akan benar? Market is always right. IHSG saat ini menguji area - area resistennya di kisaran 6350 - 6470. Jika area - area ini dapat dilampaui, terbuka peluang bagi IHSG untuk kembali bergerak bullish dengan target kenaikan di 6900...

The movement of US Dollar to Rupiah seems in the end of consolidation? After 3x the price breaks the trend line, according to the fan principle theory, the third will be a strong confirmation. We see that US dollar will strengthen toward Rupiah to upper consolidation range 14525 - 14550. If US Dollar then breaks 14550, seems the USDIDR will rally. #galerisaham |...

- Currently the price is moving inside the Rising Wedge on weekly timeframe and looks like it trying to broke the 1st trendline. Invalidated if the price managed to hold 13200 price for a long time and expect a sideway price movement in between fibonacci line . - Breaking the 2nd up trend line (bright yellow line) would be devastating for this currency.. let see...

The USDIDR also trends with its peers in Singapore and Thailand for continued downward movement. Although weakness in the past week is showing weaker signals in RSI and the bull bear crowd sentiment indicator, nearly all exponential moving averages suggest further continuation of the trend. In spite of this, price action is fast approaching a 2018 trend line which...

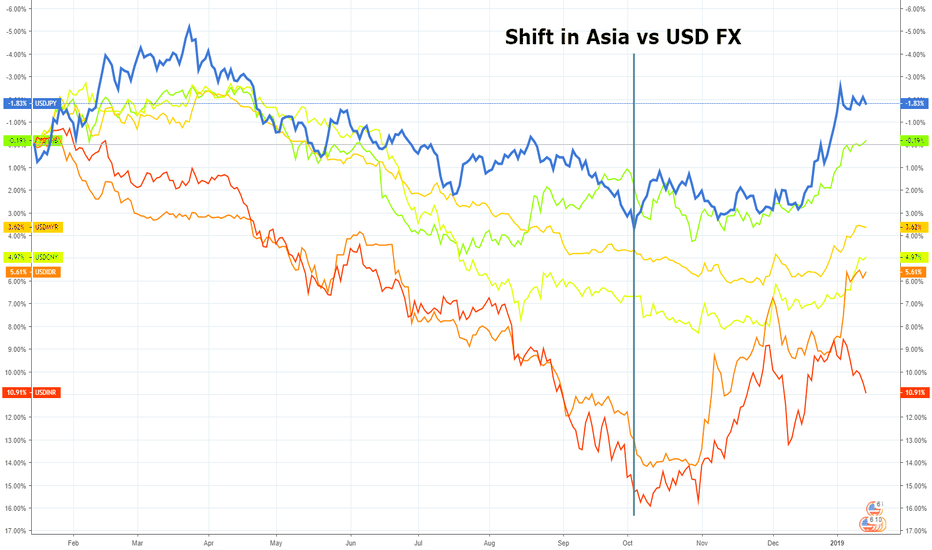

For the purposes of taking a broader view of movements in forex markets... Chart: 1-year performance of JPY, THB, MYR, CNY, IDR, INR vs the USD (inverted) Since October, there has been a marked improvement in the performance of Asian currencies. The change means Asian currencies have paired losses over the last 12 months, with the yen and Tai bot entering the...