PFE 1M Long Trend TradeNo set up

- neglected one bar rule for the 1Y context

+ long impulse

+ 1/2 correction

Calculated affordable stop limit

1 to 2 R/R take profit

1Y Trend

"+ long impulse

+ 1/2 correction

+ SOS level

+ support zone

- exhaustion volume too big"

1D Situation

"+ long impulse

- neutral zone 1

+ above consolidation volume"

VSA

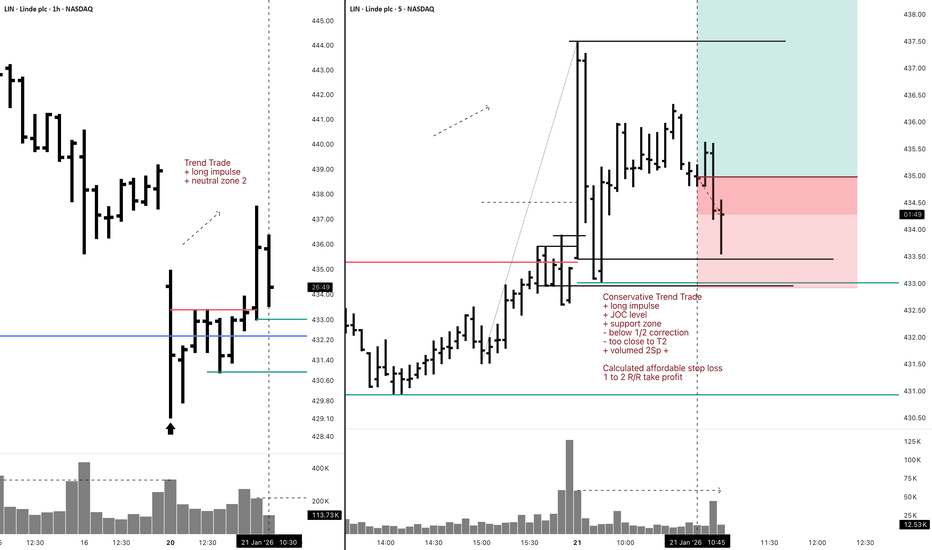

LIN 5M Long Conservative ConterTrend TradeConservative Trend Trade

+ long impulse

+ JOC level

+ support zone

- below 1/2 correction

- too close to T2

+ volumed 2Sp +

Calculated affordable stop loss

1 to 2 R/R take profit

1H Trend

"+ long impulse

+ neutral zone 2"

1D Trend

"+ long impulse

- SOS above JOC

+ support zone

- above 1/2 correction

- unvolumed manipulation bar"

1M Trend

"+ long balance

- below 1/2 correction

+ expanding ICE

+ biggest volume 2Sp+

- neutral zone 1"

1Y Trend

"+ long impulse

+ neutral zone 2

- far beyond rotation point

? exhaustion volume"

FANG 5M Short Aggressive Trend DayTradeAggressive Trend Trade

- long impulse

+ biggest volume T1

+ exhaustion volume Ut

+ resistance zone

+ weak test

+ above first bearish bar close entry

Calculated afforable stop loss

1 to 2 R/R take profit beyond 5M and 1H range

1H Trend

"+ short impulse

+ volumed BUI test / T2 level

+ resistance zone

- weak approach ?

+ volumed manipulation bar"

1D Trend

"- long impulse

+ volumed TE / T1

+ resistance zone

- strong approach

+ volumed no result breaking bar"

1M Trend

"+ short impulse

- resisting bar below BUI level

+ resistance zone

- strong approach

+ 1/2 correction

+ volumed Ut

+ test"

1Y CT

"- long impulse

+ correction

- neutral zone 2

- 1/2 correction"

AMD Short Swing 1H Conservative CounterTrend TradeConservative CounterTrend Trade

+ short impulse

+ SOS level

+ resistance zone

+ 1/2 correction

- strong approach

+ exhaustion volume Ut?

- incomplete test

+ above Ut close entry

Calculated affordable stop loss

1 to 2 R/R take profit within 1H range

1D CT

"- long impulse

+ volumed TE / T1

+ resistance zone

- strong approach

+ volumed no result breaking bar"

1M CT

"- long impulse

+ volumed T1

+ resistance zone

+ weak approach

+ exhaustion volume 2Ut-

+ weak test"

1Y CT

"- long impulse

- unvolumed T1 level

+ resistance zone

= unvolumed manipulation bar without result"

TROW Long Investment 1D Conservative CounterTrend TradeConservative Trade

+ long balance

+ volumed T2

+ support zone

+ 1/2 correction

+ weak approach

+ biggest volume 2Sp-

Calculated affordable stop limit

1 to 2 R/R take profit

1M CT

"'- short balance

+ volumed expanding ICE

+ support zone

+ weak approach

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

1Y T

"+ long impulse

+ 1/2 correction

- strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

TROW Long Investment 1M Aggressive TradeAggressive Trade

- short balance

+ volumed expanding ICE

+ support zone

+ weak approach

+ biggest volume 2Sp+

+ weak test

- first bullish bar close above entry

+ 1/2 correction

Calculated affordable stop limit

1 to 2 R/R take profit

1T Trend

"+ long impulse

+ 1/2 correction

- strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

FANG 5M Aggressive Short DayTradeAggressive Trade

- long impulse

+ volumed T1

+ resistance zone

+ weak approach

+ biggest volume 2Ut-

+ weak test

+ very strong resumption?

+ first bearish bar close entry

Calculated affordable stop loss

1 to 2 R/R take profit

1H CounterTrend

"- long impulse

+ volumed TE / T1

+ resistance zone

+ weak approach

+ volumed manipulation bar"

1D Trend

"+ short impulse

- manipulated T2 level

+ resistance zone

+ 1/2 correction"

1M Trend

"+ short impulse

- resisting bar below BUI level

+ resistance zone

- strong approach

+ 1/2 correction

+ volumed Ut

+ test"

1Y CounterTrend

"- long impulse

- neutral zone 2

- 1/2 correction"

XOM 5M Short Aggressive DayTradeAggressive Trade

- long impulse

+ volumed T1

+ resistance level

+ biggest volume irregular 2Ut+

+ weak test

- below first bearish bar close entry

Calculated affordable stop loss

Less than 1/2 R/R take profit

1H CT

"- long impulse

- unvolumed TE / T1

+ resistance zone

+ weak approach

+ biggest volume Ut

+ test"

1D CT

"- long impulse

+ volumed T1

+ weal approach

+ resistance zone"

1M CT

"- long balance

+ expanding CREEK

+ resistance level"

1Y CT

"- long impulse

+ neutral zone 2"

ACN Short 5M Aggressive DayTradeAggressive Trade

- long impulse

+ volumed T1

+ resistance zone

+ volumed irregular 2Ut-

+ weak test

+ first bearish bar close entry

Calculated affordable stop loss

1 to 2 R/R take profit

1H T

"+ short impulse

+ impulse 1/2 correction

+ SOS test level

+ resistance level

+ weak approach"

1D CT

"- long balance

+ expanding biggest volume CREEK

+ resistance zone

+ biggest volume 2Ut-

+ weak test"

1M T

"+ short impulse

- exhaustion volume SOS level

+ resistance level

- strong approach?

- before 1/2 correction"

1Y "- long impulse

- 1/2 correction

- exhaustion volume?"

KHC Short 5M Aggressive Trend DayTradeAggressive Trend Trade

- long impulse

- unvolumed T1

+ resistance zone

+ biggest volume 2Ut+

+ weak test

+ first bearish bar closed entry

Calculated affordable virtual stop loss

Bought puts

1 to 2 R/R take profit

1H Trend

"+ short impulse

+ BUI level

+ resistance zone

+ 1/2 correction

- strong approach"

1D Trend

"+ short impulse

+ BUI test / T2 level

+ resistance zone

+ volumed 2Ut+"

1M Trend

"+ short impulse

= neutral zone 2"

1Y

Trend

no context

MDLZ Swing Long 1H Aggressive TradeAggressive Trade

- short impulse

+ exhaustion volume T1

+ support level

+ exhaustion volume 2Sp+

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

1 to 2 R/R take profit

1D CounterTrend

"- short impulse

+ volumed TE/T1

+ support level

- below volume buildup

+ reverse volume weak approach

+ exhaustion volume Sp"

1M CounterTrend

"- short impulse

+ exhaustion volume TE/T1

+ support level

+ weak approach

+ exhaustion volume manipulation bar without result"

1Y Trend

"+ long impulse

+ 1/2 correction

- SOS above JOC level

+ support level

- ultravolumed manipulation bar"

AAPL Long 1D Investment Conservative TradeConservative Trade

+ long impulse

+ 1/2 correction

+ SOS level

+ support level

+ volumed 2Sp+

? technical volume

Calculated affordable stop market

1 to 2 R/R take profit within 1D range

Monthly Trend

"+ long impulse

+ neutral zone 2

+ long volume distribution"

Yearly Trend

+ long impulse

+ neutral zone 2

- beyond rotation point

+ long volume distribution

TROW Long 1D Investment Conservative TradeConservative Trade

+ long impulse

+ 1/2 correction

+ SOS level

+ supporting zone

? ultravolume 2Sp+

= perforated T2

+ 1/2 correction

+ volumed 2Sp+

Calculated affordable virtual stop limit

1 to 2 R/R take profit

- outside 1D

+ inside 1M

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support zone

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

Yearly Trend

" '+ long impulse

+ T2 level

+ support zone

- deep correction

+ volumed interacting bar"

Long 1H Swing Conservative TradeConservative Trade

+ long balance

+ 1/2 correction

+ ICE level

+ supporting zone

+ biggest volume old spread Sp

Calculated affordable stop limit

1 to 2 R/R take profit

- outside 1H range

+ within 1D main and perforated ranges

Daily Trend

"+ long impulse

+ 1/2 correction

+ SOS level

+ supporting zone

? ultravolume 2Sp+

= perforated T2

+ 1/2 correction

+ volumed 2Sp+

? weak test"

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support zone

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

Yearly Trend

"+ long impulse

+ 1/2 correction

? strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

Long 1H Swing TROW Conservative TradeConservative Trade

+ long balance

+ 1/2 correction

+ ICE level

+ supporting zone

+ biggest volume old spread Sp

? weak test

+ first bullish bar closed entry

Calculated affordable stop limit

1 to 2 R/R take profit

- outside 1H range

+ within 1D main range

Daily Trend

"+ long impulse

+ 1/2 correction

+ SOS level

+ supporting zone

? ultravolume 2Sp+

= perforated T2

+ 1/2 correction

+ volumed 2Sp+

? weak test"

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support zone

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

Yearly Trend

"+ long impulse

+ 1/2 correction

? strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

Long 1D Investment TROW Conservative TradeConservative Trade

+ long impulse

+ 1/2 correction

+ SOS level

+ supporting zone

? ultravolume 2Sp+

= perforated T2

+ 1/2 correction

+ volumed 2Sp+

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

1 to 2 R/R take profit

- outside 1D range

+ inside 1M range

Monthly CounterTrend

"- short balance

+ expanding ICE

+ support zone

+ biggest volume 2Sp+

+ weak test

+ 1/2 correction"

Yearly Trend

"+ long impulse

+ 1/2 correction

? strong approach

+ T2 level

+ supporting zone

+ volumed interaction bar"

AAPL 1H Long Swing Conservative TradeConservative Trade

+ long balance

+weak approach

+ 1/2 correction

+ SOS test / ICE level

+ support zone

+ biggest volume 2Sp=

Calculated affordable stop market

1 to 2 R/R take profit

1D Trend

"+ long impulse

+ 1/2 correction

+ SOS level

+ support level

+ volumed 2Sp+

? technical volume

+ weak test"

1M Trend

"+ long impulse

+ neutral zone 2

+ long volume distribution

+ before rotation point"

1Y Trend

"+ long impulse

+ neutral zone 2

- beyond rotation point

+ long volume distribution"

BTCUSDT – Intraday Long Setup After Capitulation MoveBTC shows signs of seller exhaustion after a sharp sell-off and high-volume capitulation. Price reacted strongly from the demand zone, suggesting absorption by buyers and a potential mean-reversion move.

Structure: Short-term breakdown with failure to continue lower → local bottom forming

Volume: Capitulation volume followed by reduced selling pressure

Momentum: RSI recovering from oversold, bullish curl developing

Trade Idea:

Bias: Long

Entry: Demand zone / bullish confirmation

SL: Below recent low

TP: Upper liquidity / resistance zone

RR: ~1:3

As long as demand holds, upside continuation toward higher liquidity is favored.

⚠️ Not financial advice.

MRK 1H Conservative Short SwingTradeConservative Trade

+ short impulse

+ 1/2 correction

+ BUI test level (exhaustion volume?)

+ weak approach

+ biggest volume Ut?

+ weak test

+ first bearish bar close entry

Calculated affordable virtual stop

(bought puts)

1 to 2 R/R take profit

1D Trend

"+ short impulse

+ short volume distribution

+ neutral zone 2"

1M Trend

"+ short impulse

+ 1/2 correction

+ resisting bar level

+ resistance level

- strong approach from far

+ volumed manipulation bar"

1Y CounterTrend

"+ long impulse

+ 1/2 correction"

MGNT Short 5M Conservative CounterTrend DaytradeConservative CounterTrend trade

+ short impulse

+ resisting bar test level

+ 1/2 correction

+ weak approach

+ biggest volume 2Ut-

- manipulation signal configuration needs a test

Calculated affordable virtual stop

1 to 2 R/R take profit

1H Countertrend

"- long impulse

+ volumed TE / T1

+ weak approach

+ biggest volume 2Ut-"

1D Trend

"+ short impulse

+ BUI level

+ 1/2 correction

+ resistance level

- volumed retest"

1M

Trend

"+ short impulse

= neutral zone type 2

+ continuation of the trend"

1Y CounterTrend

"- long impulse

- T2 level

- support zone

- 1/2 correction

- biggest volume Sp?

+ model doesn't work"

Fractal Range Analysis (FRA) for Bitcoin (11/13/25)Fractal Range Analysis for BTC (11/13/25): At ICE (AVWAP) & under microtrend support. Look for short consolidation in this area as buyers attempt to hold the ICE (102.8). If not, we are falling back to 99K for SCLX mitigation. See video for details.

DTM Investment 1D Conservative CounterTrend TradeConservative CounterTrend Trade

+ short impulse

- unvolumed T2 level

+ resistance level

+ 1/2 correction

+ weak approach?

+ biggest volume 2Ut-

- interaction bar bigger volume

Calculated affordable virtual stop loss

1 to 2 R/R take profit

Bough put

Monthly CounterTrend

"- long impulse

- unvolumed T1

+ resistance level

+ biggest volume 2Ut-

+ more volume on reaction bar"

Yearly CounterTrend

"- long impulse

- neutral zone 2

- continuation if the trend

+ exhaustion volume?"

IREN 5M Short Conservative Trend DayTradeConservative Trend Trade

+ short impulse

+ unvolumed T2

+ resistance zone

- before 1/2 correction

+ strong approach

+ volumed 2Ut+

+ weak test

+ first bullish bar close entry

Calculated affordable virtual stop loss

1 to 2 R/R take profit within 5M range

Bought put

1D Trend

"- short balance

+ volumed T2

+ resistance zone

+ 1/2 correction

- strong approach

+ biggest volume 2Ut-"

1M CounterTrend

"- long impulse

+ volumed T1

+ resistance zone

+ weak approach

+ biggest volume Ut

+ test"

1Y CounterTrend

"- long impulse

= neutral zone

+ exhaustion volume?"