XRP Market OverviewFor two weeks, price has followed our blue scenario perfectly. Currently, we're seeing clear selling pressure and now price below the key weekly reversal level at $3.

Key Expectations:

Primary Scenario: Downside continuation toward $2.72 support (potential new low)

Bullish Invalidation: Requires both:

Clear break above $3

Trendline breakout

Full analysis with chart annotations in this video idea

Markets respect levels until they don't - trade the confirmation, not the anticipation.

Wave Analysis

EURGBP Bullish Momentum Trade PlanWatching EUR/GBP closely 🔍 — after an extended bullish trend 🐂 and a sharp corrective pullback 📉, we’re now seeing renewed upside momentum and signs of bullish continuation 📈. My current bias is long ✅. Price has retraced back into equilibrium, and with movement beginning to pick up, I’m actively hunting for an entry 🎯 — aiming for a retest of the previous high, with stops tucked below the most recent low 🛡️. Everything is broken down in the video and should not be taken as financial advice ⚠️.

LTC/USDT Trade Plan: Litecoin & Nasdaq CorrelationKeeping a close eye on Litecoin (LTC/USDT) ⚡ — after a bullish breakout from a healthy pullback 📈, I’m eyeing the potential for continued upside momentum 🚀. This perspective remains heavily correlated to the performance of the NASDAQ; if equities continue their bullish trajectory 🟢, I’ll be looking to position myself in line with Litecoin strength.

In the video, we also dive into the Fibonacci extension tool to identify potential targets 🎯 and combine this with historical support and resistance levels 📍. Another key component of my analysis is the anchored volume profile, which I’ve demonstrated throughout the walkthrough 📉.

This is all part of my execution plan 📊 — full details are provided in the video and should not be considered financial advice ⚠️.

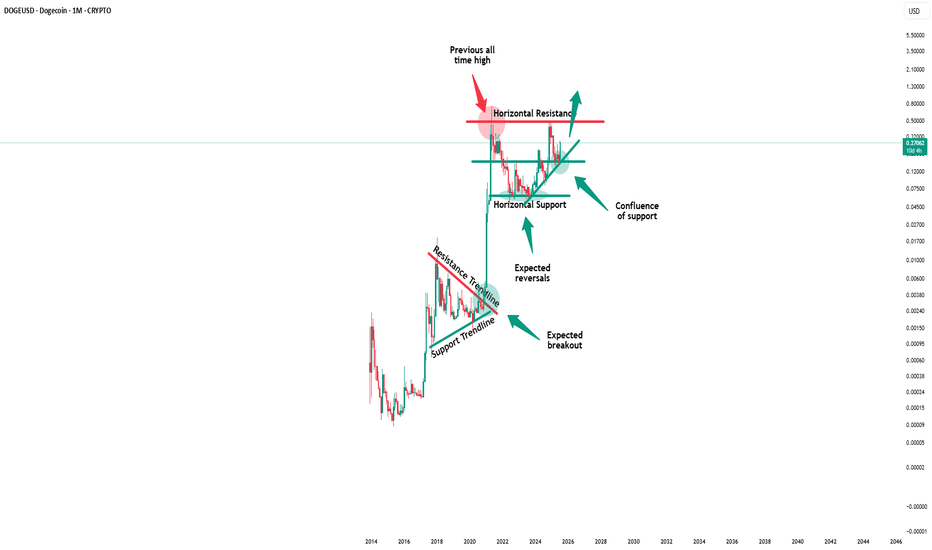

Dogecoin - It is all totally expected!🐶Dogecoin ( CRYPTO:DOGEUSD ) will break out soon:

🔎Analysis summary:

Just this month, Dogecoin perfectly retested a significant confluence of support and is starting the expected rejection. With bullish momentum picking up, there is a very high chance that Dogecoin will break the all time high in the near future.

📝Levels to watch:

$0.5

🙏🏻#LONGTERMVISION

SwingTraderPhil

Weekly trading plan for SolanaPrice is currently testing the weekly pivot point, but significant resistance remains overhead. We could see a fake breakout of the descending channel before a true downside move materializes.

Key Levels & Scenarios:

Primary Target: $136-146 range

Bullish Invalidation: A confirmed break & hold above $182 would shift bias, opening path to $200

Until we clear $182 decisively, the structure remains bearish. Trade the ranges carefully.

Watching Retracement Levels for Potential USDCAD Entry📈 The USDCAD remains firmly in a bullish trend following a sharp pullback on the 4-hour timeframe. Price continues to print higher highs and higher lows, showing sustained upward momentum. I’m watching for a retracement back into equilibrium of the previous price swing — if price dips and then breaks structure to the upside, I’ll be eyeing a potential long entry 🔍📊 (not financial advice).

Nasdaq and S&P500 Short: A multi-factor analysisIn this long video, I go through why I think the equity markets are going to crash in August.

Here are the important points:

1. I talk about the stealth liquidity which is the reverse repo balance being drawn down and almost emptied.

2. The risk-off asset classes rising: Gold, Japanese Yen.

3. The risk-on asset classes falling: Nasdaq, Bitcoin, Ethereum.

Here's my outlook for the markets from now till September FOMC:

1. The equity markets, USDJPY, Bitcoin, and Ethereum will crash.

2. 3-month treasury yield will fall below 4.25% and even below 4%.

3. Fed will cut target rates to be within the 3-month treasury yield.

As usual, good luck in your trading and keep your risks tight!

#NIFTY50 View for 5th AugNSE:NIFTY We see Nifty cycle from April low have ended, and currently correcting the rally. The first leg of the rally seem to have ended and currently should bounce in 3 waves higher and should potentially reverse for one more leg lower.And where it can find some potential buyers. We don't recommend Selling.

Some stocks are showing potential reversal signal like NSE:INDIANB Indian bank, NSE:PIDILITIND Pidilite, NSE:TATAPOWER Tata Power, NSE:TATASTEEL Tata steel to suggest the above view.

US500 Bearish Idea: Waiting for Structure Break ConfirmationWatching the SPX US500 right now 📈 — it’s rallied hard with strong momentum and is pushing into a key resistance level ⚠️. Since price is overextended, I’m expecting a pullback towards equilibrium on the current move 🔄. My bias is bearish from this level 🔻, with entry dependent on a break in structure on the 30-min timeframe ⏳.

All is explained in the video 🎥 (not financial advice).

NAS100 Trade Idea: Liquidity Sweep & Bullish Reversal Potential📊 NASDAQ 100 (NAS100) Trade Outlook 📈

The NASDAQ 100 is holding a strong bullish trend on the higher timeframes 🟢. However, we’re currently seeing a notable pullback into a key support zone ⚠️ — price has dipped beneath previous lows, tapping into what appears to be an institutional accumulation range 🏦.

This move is likely targeting the liquidity resting below those lows 💧, where sell stops are positioned. Price is also reacting off a significant bullish order block 🧱 — a confluence area that could produce a strong reversal.

🎯 What to look for next:

Wait for a bullish break in market structure 🔁 to confirm a potential entry. If that occurs, consider a long setup with your stop loss below the swing low 🛑 and a 1:2 risk-to-reward target 🎯.

🚫 This is for educational purposes only and not financial advice.

BITCOIN CRASH PREDICTED! HERE’S WHAT HAPPENS NEXT! (scary)Yello Paradisers, Bitcoin crashed exactly as we predicted in the previous videos that it will happen with the highest probability.

In this video I am explaining to you what's gonna happen next.

Head and shoulders, neckline, is be breaking to the downside, we need a clear confirmation of a reclaim Our channel on high timeframe is getting breakout to the downside and confirmation was that a reclaim was already successful.

In this video I'm sharing with you Elliott Way theory on low timeframe and what needs to be done for confirmation perspective in order for us to continue to go to the downside or have a reversal to the upside.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Weekly trading plan for EthereumLast week, BINANCE:ETHUSDT mirrored Bitcoin's moves, hitting all three of our targets. While we're seeing strong recovery now, the overbought RSI suggests a pullback may be coming soon.

Key Takeaways:

Recent longs opened yesterday during the trend shift → Consider managing risk

Better re-entry post-correction than sitting through volatility

Last week's pullback was shallow → Downward continuation remains possible

Markets reward patience - don't force trades in overbought zones

Weekly trading plan for BitcoinBINANCE:BTCUSDT Price has shown recovery over the past 24 hours, but now faces a critical test at the weekly reversal level ($115,300). The inability to establish sustained footing above this level may trigger a deeper correction

Key Scenarios:

Bullish: Hold above $108K maintains ATH potential

Bearish: Failure to consolidate above $115.3K opens downside risk to 110k

Let the market confirm its direction first

#GOLD #XAUUSD Seems to have ended the correction FX_IDC:XAUUSD Gold Spot might have completed the correction as a complex 3-3-5 FLAT, and is currently turning higher in wave (ii), however this get invalidated if THE LAST LOW OF 3268.19 BREAKS. Till the pivot 3268.19 stays strong, the move should be impulsive and take us to new high near term.

BRIEFING Week #31 : S&P ATH may have been a TrapHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

WHO WILL WIN BITCOIN'S RANGE BATTLE? In this weeks analysis, Bitcoin has been stack in a tight range for almost two weeks now. Trading range between $115k and $120k. Trend is still holding up for Bullish continuation but indicators strongly cautions loud Sirens. A decisive daily close above $120,200 could be the winning whistle for Bullish Continuation, while I see selling pressure to continue to the Support Block of about 113k. Also the selling Volumes are huge but prices are always quickly absorbed suggesting an accumulation is happening more than a distribution. So my thesis for Bitcoin is sideways range bound until there is a clear market winner. I will be paying much attention to the bearish alarm and a breakdown will be confirmed when daily price decisively close below $115k confirming the divergences on the chart. Trading between the range is high risk.

Gold long: Completion of Cycle degree Wave 4Hello, in this video, I go through Gold Elliott Wave structure on a cycle level (again) before zooming in on the latest 5-waves structure that is Cycle level wave 4. I talk about using existing broken trendlines and how that allows me to determine the strength of a move when there are false breakouts, whether to the upside or the downside.

Lastly, I discuss on how to trade this on the short-term using lower timeframe and price action. Most importantly, where to set the stop and the rationale for it.

Good luck!

Bitcoin Long: Completion of wave 4 (5-wave instead of 3-wave)In this video, I updated the wave counts for Bitcoin, primarily the change is in wave 4 where I believed that it has formed in 5-waves instead of 3-waves.

Because of the new low, both our stop loss and take profit are now lowered:

SL: $113,858.

TP: $124,000

Good luck!