Market Cap USDT Dominance, %

No trades

What traders are saying

MY OPINION IN CRYPTO MARKET NOWADAYSas we see, the chart is in the 3d timeframe but also in the 1d and weekly timeframe. in usdt dominance we can see the golden cross happening again. now, the last time it happened was in 2022. so in my opinion, until this usdt dominance meets the resistance, which is near 8% or above that, crypto will not see good days. it broke one resistance level, which was 7%. so now, if it goes to the 8% resistance, my opinion is that from that point we see massive green days. thanks. (just my honest opinion, not financial advice) #TRYING HARD TO SURVIVE IN THIS CRUEL MARKET #BTC #USDT

Potential Tether Dominance in PlayStablecoin dominance in general seems to be persistently rising over the past few months.

As of now, Tether's market cap seems to be potentially approaching the last key historical resistance zone.

It may also be a possibility that the last resistance zone does not sustain and new highs may be seen (if the last resistance zone does not hold).

This may lead to further bleeding in the overall crypto market.

A potential range of 8.28% - 11.548% may be possible estimates of Tether's Dominance based on previous characters of Tether Dominance bull rallies.

However, characters are subject to change so a dynamic approach would serve crypto bulls better.

Where do you think Tether Dominance takes a break?

Bear Market Blues (USDT.D says more pain ahead!)USDT.D measures the % of USDT (stablecoin) vs total crypto market cap. It is essentially inversely correlated to crypto, and is therefore useful for trend confirmation. i.e. When this trends down, market is bullish (people selling USDT for crypto), when it's trending up, market is bearish (people are selling crypto for stables)

This just broke above major resistance and is aiming for "Deep Bear Market" territory, which is an area I marked a few years ago I think. This still has 10-20% to go before we get there, and I think it makes sense that we go lower before a new cycle into crypto begins.

My one small caveat is that the precision / relevance of exact price targets of this chart gets somewhat diluted over time from competition/usage of other stablecoins. i.e., this chart may never reach my "Deep Market Territory" again, but if this measured all stables, it would. Speaking of which, is there a chart like this for Stablecoin dominance? Let me know in comments. Regardless, Tether is still the most popular stablecoin, so directionally this chart is still very useful.

I'm no expert (who is?) but based on this I think we can guesstimate that BTC/crypto can and likely will go down 10-20% (to roughly $70k or $67k). Fortunately, I exited around 115k and will mostly stay in stables and non-crypto assets until then.

Remember, with crypto, it can always go higher AND lower than you expect.

keep stops in place!

CD

USDT Dominance Liquidity ReachAs I predicted months ago ( October 2025), the market needed to absorb a significant amount of liquidity before a sustainable move to the upside.

At this point, most of the required liquidity has been absorbed. With proper risk management, I believe this is a good area to enter a long position with at least 70% of the intended size. With higher risk tolerance, I will personally enter the final tranche, targeting a minimum 6-month outcome.

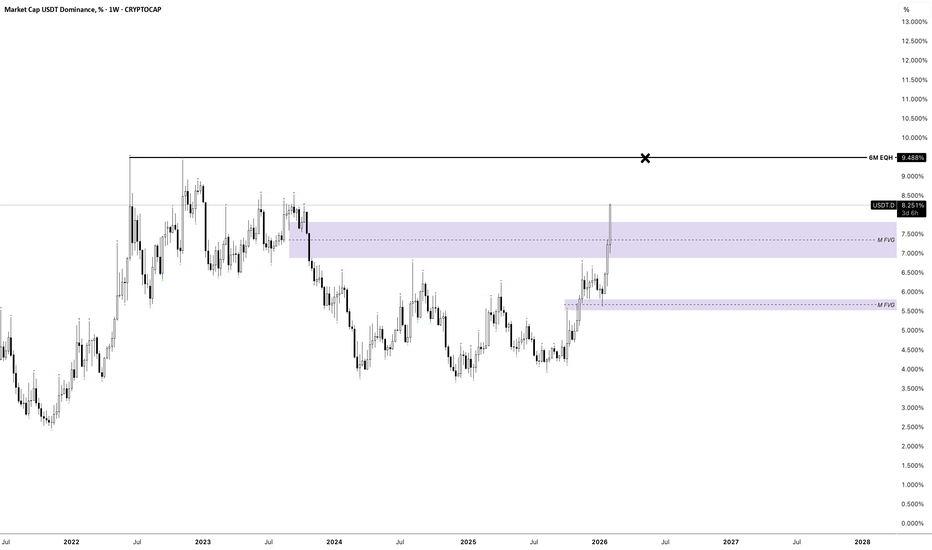

USDT.D Rising Strongly: Global EQH and ATH AheadUSDT dominance is rising aggressively.

I would like to see a sweep of the global EQH, which also represents the ATH of USDT dominance.

Local pullbacks are possible along the way, but overall there are strong reasons for price to reach this target.

For this reason, I am not considering crypto longs at this stage, even on pullbacks, until a clear and confirmed reversal model appears.

USDT.D at HTF Resistance — 4H Execution, Daily Bias in ContextContext

This analysis is based on the 4H chart shown. The Daily chart is not displayed, but the higher-timeframe bias is inferred from structure and location. USDT Dominance (USDT.D) is currently trading at a key HTF resistance zone, acting as a major decision point for overall crypto risk.

Higher-Timeframe Bias (Daily – Not Shown)

From a Daily perspective, USDT.D is extended into a historically sensitive resistance area.

This zone typically represents peaks in risk-off behavior rather than continuation points.

Unless Daily acceptance occurs above this zone, my macro bias remains for a pullback in dominance.

A Daily pullback in USDT.D supports sustained risk-on conditions across BTC and Altcoins.

Execution Timeframe (4H – Chart Shown)

Key HTF resistance / supply zone: 7.16% – 7.23% .

This area is treated as a rejection-or-acceptance zone, not an entry by itself.

First downside reaction / demand zone: 6.70% – 6.76% .

If this zone fails with acceptance, lower HTF magnets come into play.

Primary Scenario — Rejection from HTF Supply (Risk-On)

4H rejection from the 7.16–7.23% supply zone.

Bearish displacement away from the zone, ideally leaving imbalance / FVG.

Price should not immediately reclaim the supply; acceptance back inside invalidates weakness.

Expectation: continuation toward the green demand zone first, then potentially lower HTF levels.

Market implication: declining USDT.D = capital rotating from stables into crypto (bullish for BTC/ALTS).

Invalidation / Alternative Scenario — Acceptance Above Supply (Risk-Off)

4H candle closes and holds above 7.23% .

Successful retest of the zone as support confirms acceptance.

This opens the path for further dominance expansion.

Market implication: sustained risk-off conditions; crypto upside becomes limited or corrective.

Notes

USDT.D is used strictly as a macro risk filter, not a standalone trade signal.

Best conditions occur when BTC and Altcoin structures confirm the same directional bias.

As always, acceptance vs rejection is more important than wicks or single candles.

Tether Dominance Tether dominance (`USDT.D`) has been correcting in a Wave 4 pattern, and after a period of sideways movement, it appears to be preparing for the commencement of Wave 5. In this scenario, `USDT.D` may initially retrace to the 5.78 level, which could trigger a short-term upward movement in the broader crypto market. Subsequently, Tether dominance is highly likely to ascend to the 7.77 level. During this potential Wave 5, Bitcoin could potentially reach the $70,000 mark. Finally, a possible correction for `USDT.D` down to 6.74 might occur, followed by a prolonged period of consolidation within that range.

Trading Recommendation: It is advisable to look for suitable short positions at price peaks during bullish rallies. Avoid entering long positions until significant support levels for Tether dominance are firmly established.

USDT Dominance - Wyckoff AccumulationCRYPTOCAP:USDT.D could be mirroring Tesla’s 2022–2024 Wyckoff structure. From 2022 to late 2024, NASDAQ:TSLA formed a clear Wyckoff Accumulation on the weekly chart: a Selling Climax set the range, an Automatic Rally confirmed resistance, and a brief Spring in early 2023 shook out bears before prices recovered on strong volume. The stock then established a Last Point of Support, followed by a Sign of Strength breakout in late 2024, signaling institutional accumulation and the start of a new uptrend.

USDT.D - This is the main of reason why BTC Crash!#USDTD

One of the main reasons behind the recent BTC dump is the move in USDT.D.

When USDT dominance goes up, BTC usually goes down, and vice versa.

Over the past few weeks, USDT.D clearly broke out and moved higher, which pressured BTC and led to the drop. When BTC reached around 60k earlier, USDT.D was also hitting a major resistance zone and got strongly rejected. That rejection is what allowed BTC to bounce back toward the 71k area.

Right now, there’s still a chance USDT.D pushes a bit higher into the supply zone and then turns down. If that happens, it would be supportive for BTC and could lead to a move back toward the 80k–83k area.

The negative scenario is if USDT.D continues higher and breaks above resistance. If that plays out, BTC would likely see another strong leg down, with downside risk much lower and USDT.D potentially making new highs above 10%.

For now, everything depends on how USDT.D reacts around this resistance area.

Could $BTC Slip Below 60k?I’m flat for now and mainly watching the CRYPTOCAP:USDT dominance chart.

If USDT.D continues to grind higher and retests the 8.2–8.5% zone, that usually lines up with risk-off flows sticking around. In that case, it wouldn’t be surprising to see CRYPTOCAP:BTC drift lower and test the 64k-57k area before any meaningful stabilization.

For now, this still looks like a patience game — letting dominance show its hand before committing again.

USDT.D AnalysisCRYPTOCAP:USDT.D is the clearest “risk gauge” for crypto in my view. When dominance rises, money is moving into stablecoins, and the market usually tightens; when dominance falls, money leaves stables and BTC—especially altcoins—tends to breathe. That’s why I always keep this on my radar.

On this 4H chart, the bigger picture is a descending channel. So CRYPTOCAP:USDT.D has been struggling to push higher for a while. Recently, a clear Head & Shoulders structure has formed near the top: left shoulder, head, and right shoulder are all visible. The red horizontal level around 6.53% is my key resistance. As long as that level isn’t reclaimed, the “top formation → move down” scenario stays in control.

The main area I’m watching is the neckline. Price is around ~6.18% now and sitting close to that zone. If the neckline breaks and we get acceptance below it, my expectation is a drop back into the channel—bringing 6.00% and lower into play. That scenario is generally positive for crypto: when stablecoin dominance drops, risk appetite increases and altcoins usually perform better.

Of course, the invalidation is clear too: if the neckline doesn’t break and CRYPTOCAP:USDT.D regains strength—especially if it reclaims 6.53% and holds above it—then this H&S idea fails. In that case, “risk-off” conditions become more likely, and CRYPTOCAP:BTC /altcoins could face renewed downside pressure.

In short: as long as 6.53% isn’t broken, I’m treating this as a setup that favours lower $USDT.D. For me, confirmation is a neckline break, with a close below it.

USDT Dominance: an indicator to forecast Bitcoin’s directionUSD Tether, or USDT, came into existence as a digital version of the U.S. dollar, and it succeeded. USDT is pegged to the U.S. dollar and is the top and most used stable coin in the crypto market. USDT is also being used for transferring money or other means of payment, although mostly in the crypto market. Many others tried to capture a piece of this huge market: USDC, BUSD, DAI, TUSD, and UST. We all know what happened to the last one, UST (Terra USD) depegged from the U.S. dollar and crashed.

Anyway, since USDT is the most used stable coin in the crypto market, its dominance can reveal important info about the crypto market, and mostly about the Bitcoin.

So, let's start with the plain USDT Dominance chart; it shows the percentage of the total crypto markets in the form of USD Tether. As can be seen, the USDT Dominance chart shows two ascending channels. The first is steeper than the second, and the reason for that is Tether's totalitarian nature, as back then there were no other worthy competitors, and most notably its quick acceptance by the crypto community—the traders.

Now, the second ascending channel is closer to the norm and, as such, can be used as a revealing indicator. It's easy, 1) when USDT Dominance goes down, that means most people are buying Tether, so there is a shortage of Tether in the market. 2) When USDT Dominance goes up, that means most people are selling Tether, so there is a surplus of Tether in the market. So what do these mean?

When people are buying more Tether than before, USDT Dominance decreases, and that means they are converting their fiat money, such as U.S. dollars, Euro, British Pound, Franc, etc., to Tether in order to buy crypto assets such as Bitcoin. Now, here is the important part: If more people are converting their fiat money into Tether to buy crypto coins, the demand for crypto assets will go up, and when demand goes up, so does the price.

When people are selling their crypto assets more than before, they are converting their crypto assets, such as Bitcoin, into Tether, so there is a surplus of Tether in the market, and as a result, the USDT Dominance increases. This happens when traders/people want to save profits or think the market could go into a downtrend/correction, so they sell their crypto assets and prefer to hold a stable coin like Tether.

Here, the USDT Dominance chart is compared with the Bitcoin price chart. As can be seen, when USDT Dominance went down, the Bitcoin price went up, and vice versa. So, when the Bitcoin price was decreasing, more people were selling Bitcoin and converting their crypto assets into Tether; thus, more Tether became available in the market, and as a result, the USDT Dominance went up.

The USDT Dominance chart can be used as a simple indicator to forecast Bitcoin's possible future movements.

USDT Dominance(USDT.D%) RoadmapUSDT.D% ( CRYPTOCAP:USDT.D ) is one of the crucial indexes in the crypto market. Alongside token analysis, it’s important to consider this metric because an increase in USDT.D% often leads to a decrease in crypto asset prices.

Currently, USDT.D% has successfully broken through its support lines and even created a fake breakout above the resistance lines.

From an Elliott Wave perspective, it appears that USDT.D% has completed its 5 impulsive waves over the past 10 to 12 days, and we can expect a corrective downward movement.

Additionally, we can observe a negative Regular Divergence(RD-) between two consecutive peaks.

I anticipate that USDT.D% will begin to decline, potentially reaching the Fibonacci support levels. This decline could lead to an increase in crypto asset prices, especially Bitcoin .

Notes: If USDT.D% drops below the support zone(6.234%-6.090%), we can expect a significant upward trend in the crypto market.

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Market Cap USDT Dominance% Analyze (USDT.D%), 8-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Usdt.d is a short - Btc/crypto as a whole is a long!USDT.d trades inversely to BTC price.

-Occasionally I use this as a tool, to find inverse leading indicators against BTC.

-The accumulation range from early 2023 shown here related inversely to Bitcoins bottom.

Expecting this retest to confirm the accumulation range breakdown.

This equates to a confirmed lower high on USDT.d and inversely, a confirmed higher low for BTC.

Once this is confirmed, I expect aggressive capital rotation into crypto.

If there was ever a time to buy crypto, it is now.

USDT.D MIDTEARM TEARM IDEA"This is my opinion about the current moment based on a 1D and a week's time frame. This analysis has been done using Malaysian SNR and SMC concepts. At this time, I see the crypto market is ready for a good buy movement." Because the crypto market moves on the other side of the USDT.D chart.

SNR (Malaysian Support and Resistance)

SMC (Smart Money Concepts)

Looking at the daily chart

And you believe the market is setting up for a buying opportunity

"In this area, I am carefully watching to see if a candle is created in the CRT model. Further, I am watching to see if a divergence is forming. If a divergence doesn't form, I will catch the buy trade using the next QM that forms." At that time, the market reacts in a daily time frame, in the QM area

✅ Educational purposes only - For learning and discussion

✅ Not financial advice - Not recommending anyone to invest

✅ DYOR (Do Your Own Research) - Everyone should do their own analysis

On-Chain Markets looking Defensive Normally, I just mark up charts and don't publish them ( I figure a lot of us do this ).

With all the fervor going on in the markets, I decided to see how capital is rotating on Chain; Lo' & behold, USDT and USDC ( Largest USD-Pegged Stablecoins by market cap ) are seeing dominance. Surely one could say that because BTC price is going down, other crypto's dominance will rise - The dollar tends to be inversely correlated to Crypto so It only makes sense that those profit-taking are moving money onchain.

Not sure what the next catalyst will be but Stablecoins on this chart look bullish ( which is probably a tell-tale sign crypto might be taking a dip in the near future...

NOT FINANCIAL ADVISE

USDT DOMINANCE Is Still Bullish (4H)This analysis is an update to the previous one, which you can find in the related publications section.

First of all you should know that "USDT Dominance" is always moving inverse of BTCUSDT .

This index provides a good roadmap for Bitcoin and high volume altcoins.

For the next phase, the demand zone has been updated. Once price reaches this demand area, another upside move in USDT dominance is expected, which would likely put further downside pressure on the overall crypto market.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

USDT DOMINANCE Analysis (4H)We are currently observing a well-defined and complete market structure on USDT Dominance. The presence of a bullish Change of Character (CHoCH), along with a strong and decisive break of the bearish trendline, clearly suggests that buyers have stepped into the market and that selling pressure from bears is weakening.

From a technical perspective, this shift in structure indicates a potential trend reversal or at least a strong corrective move to the upside in USDT dominance. As expected in such scenarios, price is likely to pull back toward the identified support zone before continuing its movement toward the previously marked targets. This pullback can be seen as a healthy retracement and a possible opportunity for confirmation rather than immediate continuation.

An increase in USDT dominance typically signals risk-off behavior, meaning capital is flowing out of riskier assets. Therefore, if this scenario plays out, it strongly implies that Bitcoin and most altcoins may experience further downside pressure, leading to more red candles across the crypto market.

For traders, this index can be a valuable macro-level confirmation tool. It is crucial to manage risk carefully, avoid overexposure, and adjust your trading plan in alignment with USDT dominance behavior. Always wait for confirmation, respect key levels, and make sure your position sizing and risk management strategy reflect the current market conditions.

Trade smart, stay disciplined, and let the market confirm the move before committing.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

USDT D. breaking out - crypto about to nuke (again)- almost a two year long range on Tether dominance (see previous posts on it on my feed)

- target of the range is around 10%

Until that target is reached sharp, strong downside is expected, possibly in line with macro, geopolitical events such as an attack on Iran.