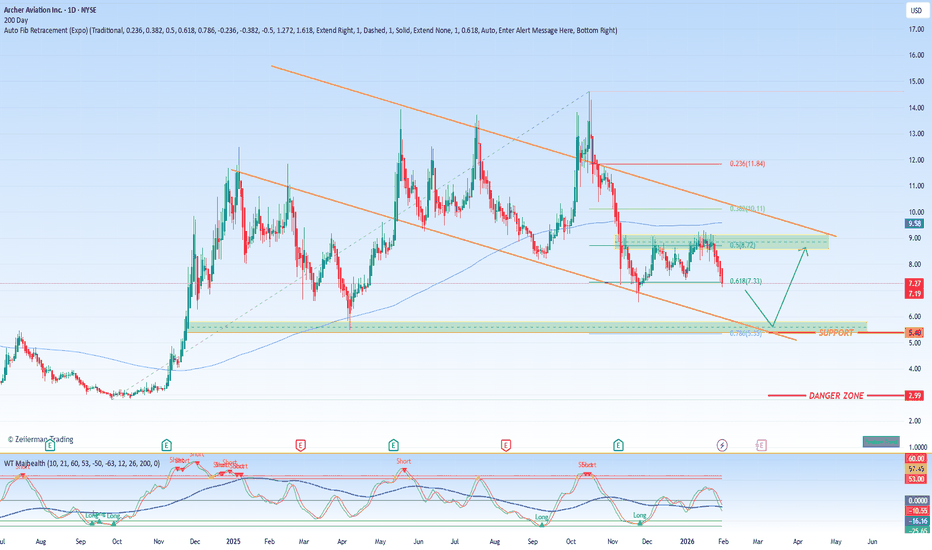

ACHR primed for breakoutArcher Aviation is balancing on a strong weekly support. My average is around $7.50 on this stock so I will be adding if we can touch the $6 range this week. High r/r setup if it will hold this $7 level on the weekly chart. Expecting bullish catalysts in the coming months to send this up 100%+ and c

Archer Aviation Inc.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.18 USD

−536.80 M USD

0.00 USD

617.28 M

About Archer Aviation Inc.

Sector

Industry

CEO

Adam Goldstein

Website

Headquarters

San Jose

Founded

2018

IPO date

Oct 28, 2020

Identifiers

3

ISIN US03945R1023

Archer Aviation, Inc. engages in the development of electric vertical take-off and landing (eVTOL) aircraft. The company was founded by Brett Adcock and Adam Goldstein on October 16, 2018, and is headquartered in San Jose, CA.

Related stocks

A High-Stakes,Long-Term Bet on the Urban Air Mobility RevolutionSynthesized Investment Thesis for Archer Aviation (ACHR): A High-Stakes, Long-Term Bet on the Urban Air Mobility Revolution

Archer Aviation represents one of the purest forms of a long-duration, pre-revenue growth investment. The stock embodies the tension between visionary potential and present-day

ACHR (Archer Aviation) – Structured Long SetupTimeframe: Daily

Bias: Long continuation / base breakout

Current Price: ~8.86

This is a technically clean, rule-based long setup built around Bill Williams’ Alligator + Fractal structure, with defined risk and asymmetric upside.

Technical Context

ACHR put in a clear downtrend through Novemb

ACHR QS V4 Weekly: Mean-Reversion Call SignalACHR QuantSignals V4 Weekly 2026-01-27

⬢ KATY AI: MULTI-DAY VECTOR

Bias: Bullish | Probability: 60% | Projected Move: +7.14%

Katy AI forecasts a tactical recovery to $8.70 by Friday's close. This prediction aligns with a broader market "risk-on" sentiment (VIX 16.08) and a weakening dollar, provi

ACHR at Oversold Levels: Why Smart Money Is Buying CallsACHR QuantSignals V4 Weekly 2026-01-29

🛠️ Trade Setup (Preferred)

Primary Contract: $8.00 CALL

Expiration: This Friday (Weekly)

Entry Cost: ~$0.05–0.08

Trade Type: Speculative / Small Size

Edge: High gamma, low capital risk

Alternate (Safer):

$7.50 CALL — lower gamma, higher premium

🎯 Profi

Archer Aviation (ACHR) — Nearing eVTOL CommercializationCompany Overview

Archer NYSE:ACHR is a leading eVTOL developer advancing the Midnight aircraft toward commercial service—front-row exposure to urban air mobility.

Key Catalysts

Early International Launch: Targeting Q1 2026 revenues via UAE & Saudi agreements—airspace-friendly, high-demand corrid

ACHR holding key support as traders position for a weekly upsidCurrent Price: 8.81

Direction: LONG

Confidence level: 60%(Based on limited but slightly bullish trader language, price holding near a well-defined support zone, and early momentum signals despite low overall data volume)

Targets

Target 1: 9.20

Target 2: 9.80

Stop Levels

Stop 1: 8.30

Stop 2: 7.9

Achr LongACHR 4H — compression into a clean breakout level

* Price is coiling in an ascending triangle: higher lows pressing into the same ceiling.

* Breakout level is clearly defined around 9.0–9.1 (multiple taps = liquidity building above it).

* Pullbacks are getting bought quicker (higher lows), which us

ACHR to take flight (again)ACHR is my favourite vertical flight buys. I think JOBY is over-priced, and EVTL just doesn't seem to have enough market visibility.

I've been in and out of ACHR for the better part of 2 years, and it's coming back into a spot where a swing makes a bit of sense.

It's still in the rising wedge (whi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ACHR is 7.30 USD — it has increased by 12.48% in the past 24 hours. Watch Archer Aviation Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Archer Aviation Inc. stocks are traded under the ticker ACHR.

ACHR stock has fallen by −0.68% compared to the previous week, the month change is a −17.05% fall, over the last year Archer Aviation Inc. has showed a −21.00% decrease.

We've gathered analysts' opinions on Archer Aviation Inc. future price: according to them, ACHR price has a max estimate of 18.00 USD and a min estimate of 8.00 USD. Watch ACHR chart and read a more detailed Archer Aviation Inc. stock forecast: see what analysts think of Archer Aviation Inc. and suggest that you do with its stocks.

ACHR reached its all-time high on Feb 18, 2021 with the price of 18.60 USD, and its all-time low was 1.62 USD and was reached on Dec 27, 2022. View more price dynamics on ACHR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ACHR stock is 13.13% volatile and has beta coefficient of 5.45. Track Archer Aviation Inc. stock price on the chart and check out the list of the most volatile stocks — is Archer Aviation Inc. there?

Today Archer Aviation Inc. has the market capitalization of 5.35 B, it has decreased by −13.70% over the last week.

Yes, you can track Archer Aviation Inc. financials in yearly and quarterly reports right on TradingView.

Archer Aviation Inc. is going to release the next earnings report on Mar 4, 2026. Keep track of upcoming events with our Earnings Calendar.

ACHR earnings for the last quarter are −0.20 USD per share, whereas the estimation was −0.30 USD resulting in a 33.79% surprise. The estimated earnings for the next quarter are −0.24 USD per share. See more details about Archer Aviation Inc. earnings.

Archer Aviation Inc. revenue for the last quarter amounts to 0.00 USD, despite the estimated figure of 400.00 K USD. In the next quarter, revenue is expected to reach 0.00 USD.

ACHR net income for the last quarter is −129.90 M USD, while the quarter before that showed −206.00 M USD of net income which accounts for 36.94% change. Track more Archer Aviation Inc. financial stats to get the full picture.

No, ACHR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 8, 2026, the company has 1.15 K employees. See our rating of the largest employees — is Archer Aviation Inc. on this list?

Like other stocks, ACHR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Archer Aviation Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Archer Aviation Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Archer Aviation Inc. stock shows the sell signal. See more of Archer Aviation Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.