Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.2342 USD

37.69 M USD

500.33 M USD

63.93 M

About Alliance Aviation Services Limited

Sector

Industry

CEO

Stewart Tully

Website

Headquarters

Brisbane

Founded

2011

IPO date

Dec 20, 2011

Identifiers

2

ISIN AU000000AQZ6

Alliance Aviation Services Ltd. engages in the provision of contracts, charter, and allied services. It also offers aircraft sales and leasing. The company was founded in 2002 and is headquartered in Brisbane, Australia.

Related stocks

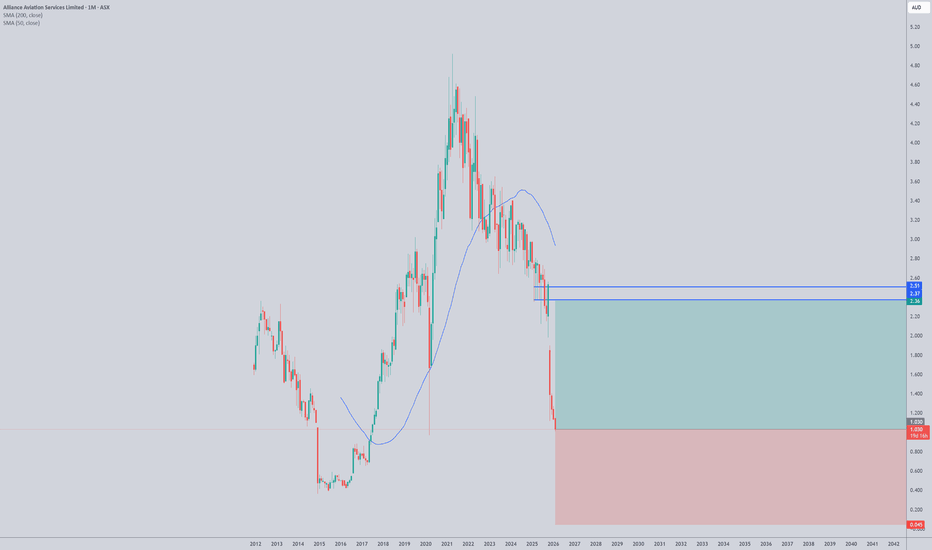

Don’t Sleep on AQZ: Smart Money May Already Be PositionedAQZ — 4-Year Reaccumulation + Bullish Doji = Strategic Long Setup

AQZ is looking primed for a long play. Price has been reaccumulating for ~4 years, and June printed a bullish monthly doji—a classic liquidity sweep. Price pierced the major fair value gap (FVG) from the May 2020 pump candle, tested

Alliance Aviation Services Limited - AQZ short term tradingShares price target 10 per cent or $2.81

Business Summary.

Alliance Aviation Services Limited is an aviation services provider. The Company operates as an air charter operator in Australia, and provides a service various sectors, including tourism, corporate, sporting, entertainment and media, ed

ASX:AQZ Alliance AviationASX:AQZ is now testing the bottom of the trendline. If broken, look for support at $1.685.

Alliance Aviation looks like a good buy now, however, the risk of it falling out of the channel is still present because the RSI has yet to curl up and the 10 and 21 ema(s) are starting to curl downwards. I

$AQZ potential breakout of 6 weeks flat base$AQZ has been in a steady uptrend ever since it broke out of an 8-month long consolidation trading range back in May. The move above the minor pivot of $1.20 on strong volume yesterday may indicate a breakout of the 6 weeks flat base in the short-term. This is also the first time it has come back an

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ALAVF is 0.8600 USD — it has increased by 14.67% in the past 24 hours. Watch ALLIANCE AVIATION SERVICES LTD. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange ALLIANCE AVIATION SERVICES LTD. stocks are traded under the ticker ALAVF.

We've gathered analysts' opinions on ALLIANCE AVIATION SERVICES LTD. future price: according to them, ALAVF price has a max estimate of 1.01 USD and a min estimate of 1.01 USD. Watch ALAVF chart and read a more detailed ALLIANCE AVIATION SERVICES LTD. stock forecast: see what analysts think of ALLIANCE AVIATION SERVICES LTD. and suggest that you do with its stocks.

ALAVF reached its all-time high on Sep 30, 2025 with the price of 1.9800 USD, and its all-time low was 0.5599 USD and was reached on Nov 6, 2025. View more price dynamics on ALAVF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ALAVF stock is 12.79% volatile and has beta coefficient of 1.74. Track ALLIANCE AVIATION SERVICES LTD. stock price on the chart and check out the list of the most volatile stocks — is ALLIANCE AVIATION SERVICES LTD. there?

Today ALLIANCE AVIATION SERVICES LTD. has the market capitalization of 120.44 M, it has increased by 18.46% over the last week.

Yes, you can track ALLIANCE AVIATION SERVICES LTD. financials in yearly and quarterly reports right on TradingView.

ALLIANCE AVIATION SERVICES LTD. is going to release the next earnings report on Feb 19, 2026. Keep track of upcoming events with our Earnings Calendar.

ALAVF earnings for the last half-year are 0.12 USD per share, whereas the estimation was 0.13 USD, resulting in a −7.33% surprise. The estimated earnings for the next half-year are 0.11 USD per share. See more details about ALLIANCE AVIATION SERVICES LTD. earnings.

ALLIANCE AVIATION SERVICES LTD. revenue for the last half-year amounts to 283.29 M USD, despite the estimated figure of 306.53 M USD. In the next half-year revenue is expected to reach 279.34 M USD.

ALAVF net income for the last half-year is 18.72 M USD, while the previous report showed 17.85 M USD of net income which accounts for 4.83% change. Track more ALLIANCE AVIATION SERVICES LTD. financial stats to get the full picture.

Yes, ALAVF dividends are paid annually. The last dividend per share was 0.02 USD. As of today, Dividend Yield (TTM)% is 2.84%. Tracking ALLIANCE AVIATION SERVICES LTD. dividends might help you take more informed decisions.

ALLIANCE AVIATION SERVICES LTD. dividend yield was 1.14% in 2025, and payout ratio reached 8.42%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 14, 2026, the company has 1.45 K employees. See our rating of the largest employees — is ALLIANCE AVIATION SERVICES LTD. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ALLIANCE AVIATION SERVICES LTD. EBITDA is 129.72 M USD, and current EBITDA margin is 26.09%. See more stats in ALLIANCE AVIATION SERVICES LTD. financial statements.

Like other stocks, ALAVF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ALLIANCE AVIATION SERVICES LTD. stock right from TradingView charts — choose your broker and connect to your account.