paper_value

PlusI do not like where the DOW is heading right now. It closed below the 200d EMA last week, this is not looking good. I would be careful with the stock market right now as there are still plenty of volatility. If DOW drops below $52, it might form a cup and handle at $49.50 and if completed, targeting $43. Stay safe.

USDMYR completed a 6 year long ascending triangle. Watch out for target level $5.25

ASX:QAN other than the Covid blip, log chart showing uptrend since Dec 2013. RSI MACD turning bullish on the weekly. Jumping the gun here... will need to see the week's closing on Friday for confirmation. Target: $7 Stop-loss: $5

GEMINI:BTCUSD Bulls are trying to punch through the middle Bollinger band and the band is getting narrower each day. RSI gaining strength MACD curling up and turning green Such an exciting time!

ASX:MPL might be completing a double bottom at the end of this week. If so, target $3.60. A fall below $2.99 invalidates this outlook.

If the inverse cup and handle makes sense then we see a target of $190. Otherwise... i would still stay away from the falling knife until we get a clearer picture/pattern.

About 145 days into the bull flag. Still waiting for a breakout but positive signals are lining up nicely. If we succeed in a breakout these are the levels to look out for: Long Target: $24 This outlook is invalidated below: $18.10

The market is extremely volatile right now. Shorts are getting higher. It's not easy to find a good business with a good technical setup right now. However, NASDAQ:DLTR Dollar Tree looks promising. The breakout last week might give us a shot at $99 conservatively. However, we are treading on ice right now and anything might go south, so keep a lookout and keep...

I am bearish WMT . Horizontal line has been tested for several days and there's a high chance that it will breakdown. Target price below: $117. Chart Invalid: above $123.

Alibaba NYSE:BABA completed an inverse HnS last night. A breakout will bring us to around $262. A break below $210 invalidates this view.

I don't like this 174 weeks double top pattern. Last week's closing had it retested the neckline but failed to turn resistance into support. Proceed with caution. I have a short target of $18 in future. Anything above $50.60 invalidates this view.

I dont like where SGX:C6L Singapore Airlines is heading. This is a very very very long descending triangle. SIA might have bottomed here or it might be facing tougher times ahead. I am leaning toward the latter and I would not catch a falling knife right now. Until there's a clearer picture, i would stay away.

I believe we have a little more to go down. Targeting sub $60 in the coming weeks. Take care. A break above $78 invalidates this outlook.

I really don't like descending triangle for NYSE:CVX . I have fundamental analyst giving me a buy/hold signal but i am still cautious. This 139 weeks descending triangle might play out just be very careful and wait for confirmation before entry.

Not confident in the current diamond top pattern. This pattern usually spells bearish. Daily and Weekly RSI are pointing up so this bearish diamond top might fail. Wait for a confirmed breakout before longing since it might be a bull trap. Take care.

I might be jumping the gun here. Based on Elliot wave forecast, IF Wave 1 and 2 completed, i might be looking at 1.618 - $0.22 target. A break below 0.063 invalidates this outlook and taking shorts at $0.043.

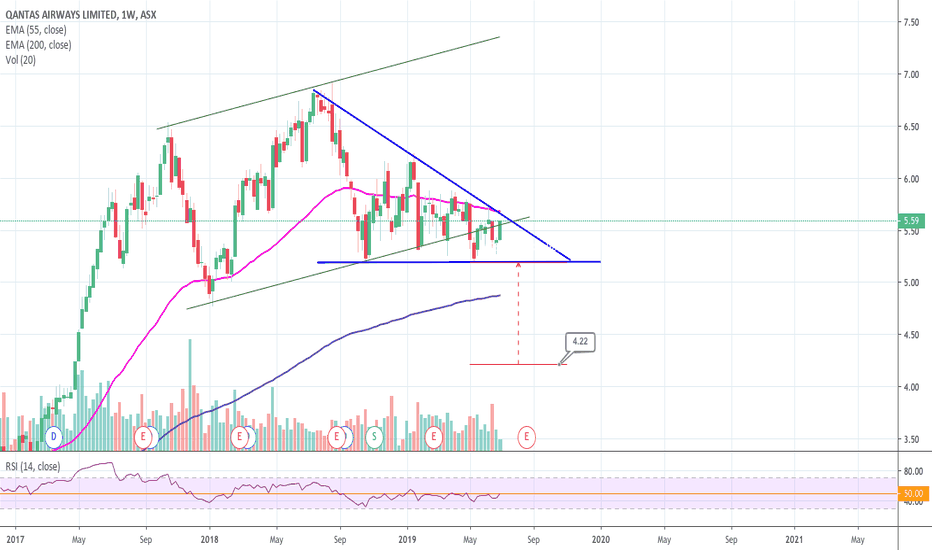

Qantas ASX:QAN is running out of room in what seems like a descending triangle. If there's no break to the upside, expect more downward pressure to $4.22 in the coming months - long term outlook. Due to the uncertainty of the market - trade wars and oil prices - a breakout in the coming weeks should also be taken with a pinch of salt as it might be a bull trap...

Pilbara ASX:PLS has corrected nearly 85% from all time highs since Dec/Jan18. Now it is sitting at the Fib 0.854 @ $0.485. How much more will it continue to be shorted? PLS is one of the most heavily shorted stock on the ASX by the way. The previous bull flag took 69 weeks to complete. Although there might be no correlation but price-action is printing a...