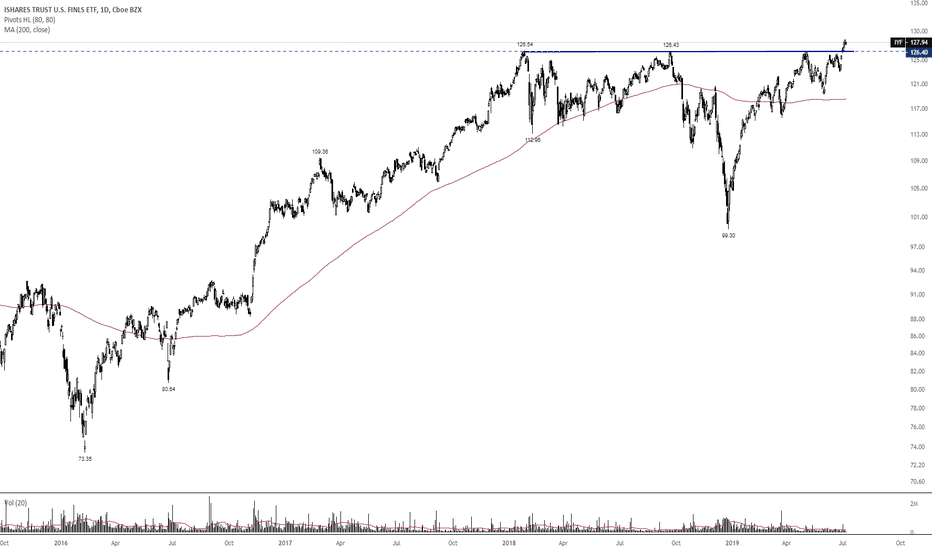

Key stats

About iShares U.S. Financial ETF

Expense ratio

0.40%

Home page

Inception date

May 22, 2000

IYF offers a portfolio specific to the US financials segment, tracking a diversified, market-cap-weighted index for the financial space. The index pulls from a universe covering the top 95% of the market, thus offering broad US financials exposure. The capping methodology limits the sum of the weights of its securities, such that the aggregate weight of all issuers individually exceeding 4.5% are constrained to a maximum of 22.5%. Individual securities are also capped at 15%. The index is rebalanced on a quarterly basis. Prior to September 20, 2021, the fund tracked the Dow Jones U.S. Financials Capped Index.

Classification

What's in the fund

Exposure type

Finance

Stock breakdown by region

See all ideas