"ARB" RBI came out!!!Hello! friends, How have you been?

I brought a VERY attractive chart for you today.

It's the ARBUSDT chart that can reverse the long bearish. If you take a position, It can better attractive position as the RR.

■It is being adjusted after breaking the big downtrend line.

■ Adjustment value is 0.

ARBITRUM SHORT TRADE SETUP - UPDATE

From psychological point of view - price was going high and they was successful convincing literally everyone that it will continue to go up then all of a sudden they nuke on their euphoria, then those who are a little bit brave to take the short of it are being targeted along the ones who are see

Arbitrum ($ARB) Set for a Bullish Breakout soonThe Arbitrum DAO has approved an eight-week pilot M&A program following overwhelming support for the proposal. On-chain metrics suggest that Arbitrum ( AMEX:ARB ) may experience a rally soon, despite a recent 7.5% increase in its value.

The pilot program received over 99% support from DAO members a

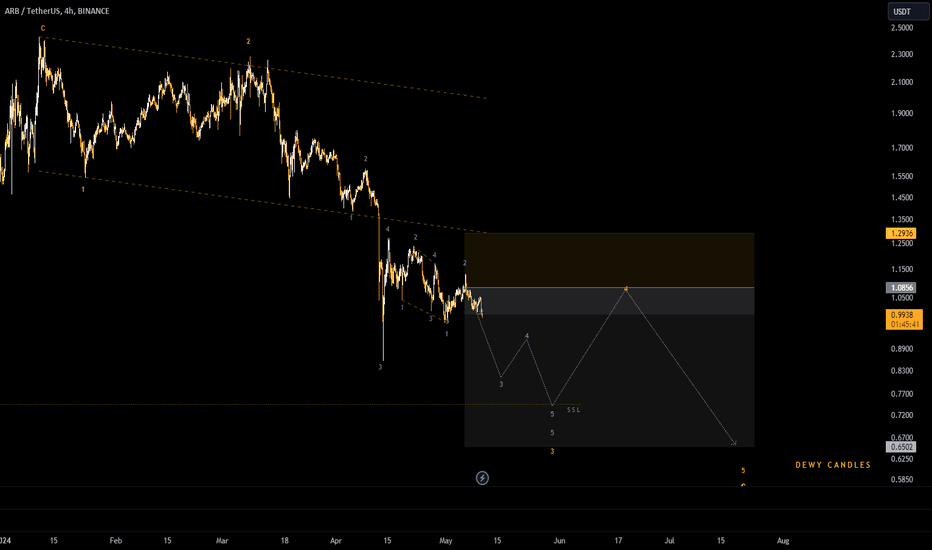

ARBUSDT Elliott Waves Analysis (Local Setup)Hello friends.

Please support my work by clicking the LIKE button👍(If you liked). Also i will appreciate for ur activity.

Everything on the chart.

Entry: Market and lower

Targets: 1.3 - 1.45 - 1.6

after first target reached move ur stop to breakeven

Stop: 0.95 (depending of ur risk).

ALWAYS follow

Arb local swing trade ideaARB followed Ethereum and pumped around 25%! Rumours now around EthereumETF can push the prices to new ath for many coins. BINANCE:ARBUSDT

Possible Targets and explanation idea

➡️Weekly timeframe, after listing still relevant fib. IAP model

➡️We come back and close W October 2023 Fvg in May 20

LONG #ARBUSDT target 1.6$LONG #ARBUSDT from $1.19 stop loss $0.9

1h TF. The asset moves in a parallel channel after the spill. There are horizontal resistance levels. Now we have pushed off from the support level of 0.9$-1$ and are moving in an uptrend. There is also a support level of ~ $1.14, from which you can expect a

See all ideas