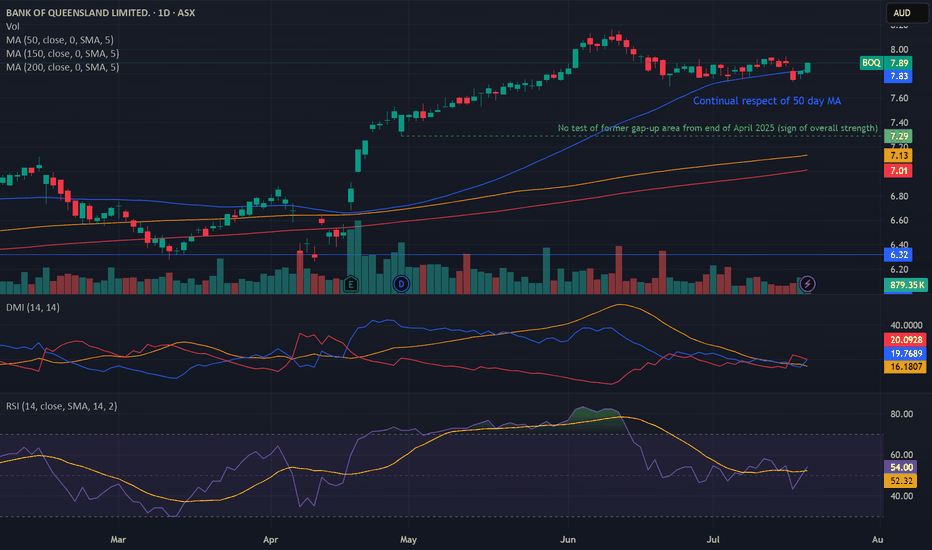

Bullish potential detected for BOQEntry conditions:

(i) higher share price for ASX:BOQ along with swing up of indicators such as DMI/RSI.

Depending on risk tolerance, the stop loss for the trade would be:

(i) a close below the 50 day moving average (currently $7.83), or

(ii) below previous swing low of $7.69 from the low of 23rd

Bank of Queensland Ltd.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.13 USD

86.97 M USD

3.40 B USD

649.11 M

About Bank of Queensland Limited

Sector

Industry

CEO

Patrick Newton James Allaway

Website

Headquarters

Newstead

Founded

1887

IPO date

Aug 24, 1971

Identifiers

2

ISIN AU000000BOQ8

Bank of Queensland Ltd. engages in the provision of financial services to the community. It operates through the following segments: Retail Banking, BOQ Business, and Other. The Retail Banking segment offers retail banking solutions to customers managed through its owner managed and corporate branch network, ME Bank and Virgin Money distribution channels, and third-party intermediaries. The BOQ Business segment is involved in the BOQ branded commercial lending activity, BOQ Finance, and BOQ Specialist businesses. It also provides tailored business banking solutions including commercial lending, equipment finance and leasing, cash flow finance, foreign exchange, interest rate hedging, transaction banking, and deposit solutions for commercial customers. The Other segment refers to the treasury, insurance, and group head office. The company was founded in 1874 and is headquartered in Newstead, Australia.

Related stocks

BULL Put spread on 23 Sept

Picked this up at recent low a few days ago - prbably not the best pick of bank stocks in hind sight ( see WBC)

but good enough follow through to make me less anxious of being exercised at expirey on 15 OCT.

sold 70 contracts ( 7000shares) Put OCT strike 5.75 ( European) for -0.115

buy

Bank of Queensland short-10 Year+ Symmetrical triangle (dubious without a launching pattern)

-Weekly 50/200 SMA pinch

-Weekly volume confirmation on primary pattern breakout

-7 Week symmetrical triangle launching pattern just outside the bounds of larger pattern

-Daily Bollinger band squeeze and expansion

30 basis points

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS248939818

Bank of Queensland Limited 1.839% 09-JUN-2027Yield to maturity

—

Maturity date

Jun 9, 2027

XS308773795

Bank of Queensland Limited 2.732% 18-JUN-2030Yield to maturity

—

Maturity date

Jun 18, 2030

XS282882035

Bank of Queensland Limited 3.3004% 30-JUL-2029Yield to maturity

—

Maturity date

Jul 30, 2029

See all BKQNF bonds

Frequently Asked Questions

The current price of BKQNF is 3.91 USD — it has increased by 0.26% in the past 24 hours. Watch Bank of Queensland Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Bank of Queensland Ltd. stocks are traded under the ticker BKQNF.

We've gathered analysts' opinions on Bank of Queensland Ltd. future price: according to them, BKQNF price has a max estimate of 5.32 USD and a min estimate of 3.20 USD. Watch BKQNF chart and read a more detailed Bank of Queensland Ltd. stock forecast: see what analysts think of Bank of Queensland Ltd. and suggest that you do with its stocks.

BKQNF reached its all-time high on Nov 19, 2014 with the price of 10.60 USD, and its all-time low was 3.34 USD and was reached on May 20, 2020. View more price dynamics on BKQNF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BKQNF stock is 0.26% volatile and has beta coefficient of 0.93. Track Bank of Queensland Ltd. stock price on the chart and check out the list of the most volatile stocks — is Bank of Queensland Ltd. there?

Today Bank of Queensland Ltd. has the market capitalization of 3.26 B, it has increased by 0.96% over the last week.

Yes, you can track Bank of Queensland Ltd. financials in yearly and quarterly reports right on TradingView.

Bank of Queensland Ltd. is going to release the next earnings report on Apr 22, 2026. Keep track of upcoming events with our Earnings Calendar.

BKQNF earnings for the last half-year are 0.19 USD per share, whereas the estimation was 0.19 USD, resulting in a −0.80% surprise. The estimated earnings for the next half-year are 0.19 USD per share. See more details about Bank of Queensland Ltd. earnings.

Bank of Queensland Ltd. revenue for the last half-year amounts to 564.97 M USD, despite the estimated figure of 559.62 M USD. In the next half-year revenue is expected to reach 593.32 M USD.

BKQNF net income for the last half-year is −24.85 M USD, while the previous report showed 106.08 M USD of net income which accounts for −123.42% change. Track more Bank of Queensland Ltd. financial stats to get the full picture.

Bank of Queensland Ltd. dividend yield was 5.23% in 2025, and payout ratio reached 188.03%. The year before the numbers were 5.38% and 78.40% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 14, 2026, the company has 3.56 K employees. See our rating of the largest employees — is Bank of Queensland Ltd. on this list?

Like other stocks, BKQNF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Bank of Queensland Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Bank of Queensland Ltd. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Bank of Queensland Ltd. stock shows the sell signal. See more of Bank of Queensland Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.