$BA has the potential to move toward $300–$400 over the next ~12Bought some NYSE:BA last week and shared this with members.

Here’s why I think it has the potential to move toward $300–$400 over the next ~12 months. As a swing trader, I’ll be trading it in and out, targeting smaller moves along the way.

• Production ramp: Boeing is still ramping up production

Boeing Company

No trades

Key facts today

CFM is developing an 'advanced ducted' engine design that may impact Boeing's strategies. Boeing, backed by Pratt & Whitney and Rolls-Royce, remains skeptical about the open-fan concept.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.14 USD

2.23 B USD

89.46 B USD

784.28 M

About Boeing Company (The)

Sector

Industry

CEO

Robert Kelly Ortberg

Website

Headquarters

Arlington

Founded

1916

IPO date

Sep 5, 1934

Identifiers

3

ISIN US0970231058

The Boeing Co. is an aerospace company, which engages in the manufacture of commercial jetliners and defense, space, and security systems. It operates through the following segments: Commercial Airplanes (BCA), Defense, Space and Security (BDS), and Global Services (BGS). The Commercial Airplanes segment includes the development, production, and market of commercial jet aircraft and provides fleet support services, principally to the commercial airline industry worldwide. The Defense, Space and Security segment refers to the research, development, production and modification of manned and unmanned military aircraft and weapons systems for global strike, including fighter and combat rotorcraft aircraft and missile systems, global mobility, including tanker, rotorcraft and tilt-rotor aircraft, and airborne surveillance and reconnaissance, including command and control, battle management and airborne anti-submarine aircraft. The Global Services segment provides services to commercial and defense customers. The company was founded by William Edward Boeing on July 15, 1916, and is headquartered in Arlington, VA.

Related stocks

Boeing May Be Taking OffBoeing was stuck below a key level for two years, but now it may be taking off.

The first pattern on today’s chart is the $233.84 level, the high on January 8, 2024. (That was a key session when the aerospace giant gapped lower after a 737 MAX 9 in-flight incident.)

BA probed that level last summe

BA – Daily Technical AnalysisBoeing is testing a major long-term descending trendline, acting as a strong supply zone.

Price is reacting right at this resistance, making this a critical decision area.

Technical Structure

• Overall structure: Wide range with descending ceiling

• Price at dynamic resistance

• Moving average

BA Holding Gamma Support (242.5) — Upside Rotation In Play?✈️ BA Intraday Trading Playbook

Market Context

BA is attempting to stabilize after sharp volatility.

Structure shows defensive bounce behavior, not trend confirmation yet.

Gamma remains positive & call-dominated, which favors controlled upside if key supports hold.

This is a decision zone trade, not

Boeing - Lowering HeightsWe are analyzing the move since November 2025, identifying two main impulses, which can be viewed as a three -wave structure of a larger five -wave move.

At this stage, it’s not critical whether this impulse is considered wave 5 or wave B of a larger move.

Currently, a downward move is expec

A turnaround at $BA...or just another false dawn?An excerpt from analysis covered on the @ForexTraderPaul Monday Market Update on YouTube.

I've not been the biggest fan of BA over the last few years - but you have to learn to trade what you see as opposed to what you think or your biases are trying to tell you.

Anyway, BA has been on a tear the

Boeing shares ready to capitalize on recovery momentumNYSE:BA stock took a beating when the twin 737 Max disasters rightly sent the stock reeling a few years ago. It's been a long road to recovery since then, and setting aside the story, and fundamental drivers the technicals point to a big upside move getting underway.

Just look at the monthly chart

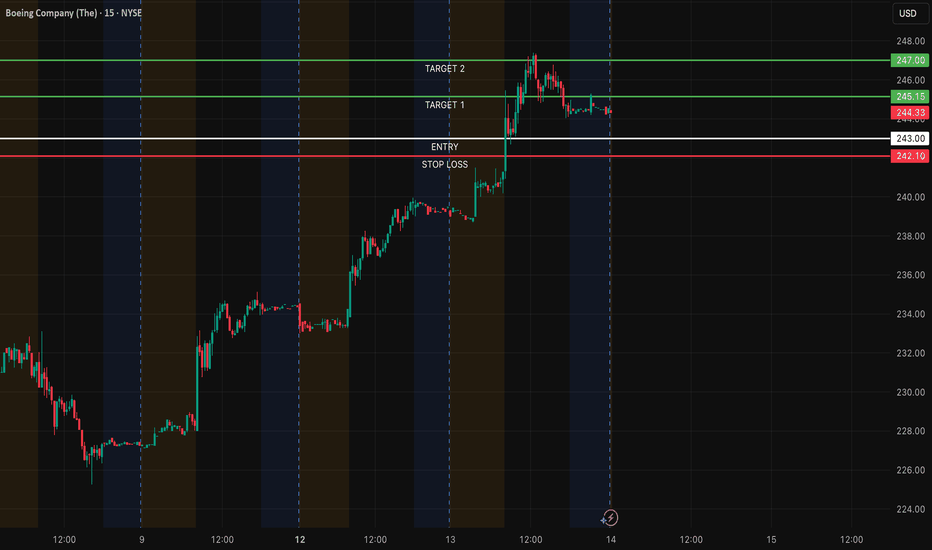

Morning Momentum Trade idea for $BAIf the price of the stock NYSE:BA stays between the entry line and target 1.

It will then quickly hits the entry line in the morning and then go towards the targets upward.

I would suggest to take the majority of the position out in the first target since the overall markets may go lower after

$BA - US Defense Sector Policy Impact on StocksBased on the confluence of recent developments, including President Trump's proposed restrictions on defense contractors and Boeing's latest major order, a detailed technical analysis of Boeing's stock (BA) reveals several critical support and resistance levels that investors should monitor.

Techni

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BA5803372

Boeing Company 7.008% 01-MAY-2064Yield to maturity

6.73%

Maturity date

May 1, 2064

US097023DM42

Boeing Company 6.858% 01-MAY-2054Yield to maturity

6.58%

Maturity date

May 1, 2054

BA5803370

Boeing Company 6.858% 01-MAY-2054Yield to maturity

6.40%

Maturity date

May 1, 2054

BA5803367

Boeing Company 6.528% 01-MAY-2034Yield to maturity

6.28%

Maturity date

May 1, 2034

BA5803365

Boeing Company 6.388% 01-MAY-2031Yield to maturity

6.15%

Maturity date

May 1, 2031

BA5803162

Boeing Company 6.298% 01-MAY-2029Yield to maturity

6.08%

Maturity date

May 1, 2029

BA5803363

Boeing Company 6.259% 01-MAY-2027Yield to maturity

6.05%

Maturity date

May 1, 2027

BA4866210

Boeing Company 3.95% 01-AUG-2059Yield to maturity

5.91%

Maturity date

Aug 1, 2059

BA5946120

Boeing Company 7.008% 01-MAY-2064Yield to maturity

5.89%

Maturity date

May 1, 2064

BA4983331

Boeing Company 5.93% 01-MAY-2060Yield to maturity

5.87%

Maturity date

May 1, 2060

BA4602171

Boeing Company 3.625% 01-MAR-2048Yield to maturity

5.86%

Maturity date

Mar 1, 2048

See all BA bonds

Frequently Asked Questions

The current price of BA is 251.62 USD — it has increased by 0.91% in the past 24 hours. Watch Boeing Company stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BVL exchange Boeing Company stocks are traded under the ticker BA.

We've gathered analysts' opinions on Boeing Company future price: according to them, BA price has a max estimate of 310.00 USD and a min estimate of 215.00 USD. Watch BA chart and read a more detailed Boeing Company stock forecast: see what analysts think of Boeing Company and suggest that you do with its stocks.

BA stock is 0.90% volatile and has beta coefficient of 1.41. Track Boeing Company stock price on the chart and check out the list of the most volatile stocks — is Boeing Company there?

Today Boeing Company has the market capitalization of 187.97 B, it has increased by 0.94% over the last week.

Yes, you can track Boeing Company financials in yearly and quarterly reports right on TradingView.

Boeing Company is going to release the next earnings report on Apr 29, 2026. Keep track of upcoming events with our Earnings Calendar.

BA earnings for the last quarter are 9.92 USD per share, whereas the estimation was −0.44 USD resulting in a 2.36 K% surprise. The estimated earnings for the next quarter are −0.26 USD per share. See more details about Boeing Company earnings.

Boeing Company revenue for the last quarter amounts to 23.95 B USD, despite the estimated figure of 22.60 B USD. In the next quarter, revenue is expected to reach 22.17 B USD.

BA net income for the last quarter is 8.22 B USD, while the quarter before that showed −5.34 B USD of net income which accounts for 254.00% change. Track more Boeing Company financial stats to get the full picture.

As of Feb 13, 2026, the company has 182 K employees. See our rating of the largest employees — is Boeing Company on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Boeing Company EBITDA is −3.37 B USD, and current EBITDA margin is −3.77%. See more stats in Boeing Company financial statements.

Like other stocks, BA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Boeing Company stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Boeing Company technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Boeing Company stock shows the strong buy signal. See more of Boeing Company technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.