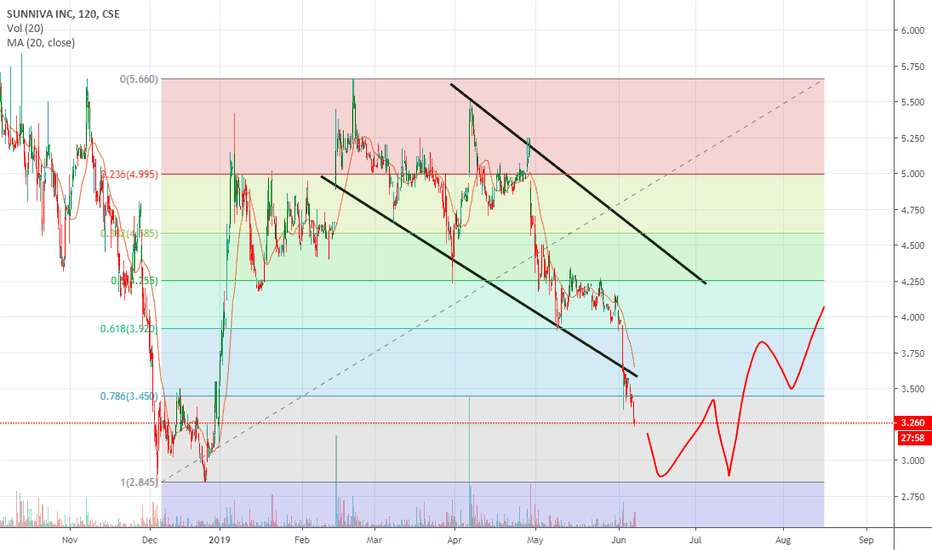

Trying something new...still learningSo, I noticed something about the charts, and on every time frame, I can see certain traits. In this chart the 200ma is way above the candle, the candle formed a very bullish move, the volume was up, the RSI is below thirty and the MACD is descending. I believe that this may be a sign of a rise in

Next report date

Report period

Q1 2024

EPS estimate

—

Revenue estimate

—

38.06 M

About SUNNIVA INC.

Sector

Industry

CEO

Anthony F. Holler

Headquarters

Vancouver

Founded

2014

FIGI

BBG00JQ5GCH6

Sunniva, Inc. operates as a vertically integrated cannabis company, which engages in the provision of products and services to the medical cannabis industry in Canada and California. It also develops streamline data transfer software for physicians, patients, and producers. The company was founded by Anthony F. Holler and Leith Pedersen on August 11, 2014 and is headquartered in Vancouver, Canada.

SNN - Uptrend Broke bearish on Lawsuit news, finding new supportCSE:SNN After 6 weeks of tightening ranges Sunniva broke bearish on news of a data breach and lawsuit. While this stock has promise based on fundamentals, the chart is not set up very well for low risk entries. Some chances here for a bottom fishing play might be possible but, $5.00 is a key level t

SNN - Breakout Imminent, Bullish Pennant, Tightening Triangle After nearly a month long Consolidation following a +80% move off the bottom set christmas eve @$2.85 we have now settled at a 63% gain off the bottom. holding the 9DMA and 50DMA we could now be set for an advance to the 200DMA up near $6. Key support is 4.40, while we have not closed a trading day

SNN - Sunniva Daily Bull Continuation after consolidation.My Take:

We formed an almost perfect "cup" (needing the handle) on the hourly topping at 4.88 on the day with the previous hourly high at 4.89 (double top) before closing lower at 4.76. This ramp could have been part due to the low float and having the equilibrium break up ward as well as the suppor

SNN Daily consolidation under way. Good LONG entries are hereJan 9 SNN:

My take: So volume tapered right back today, declining bear volume. We had a big move up with almost 1 million shares in volume in 8 days and we have not had a big rush to take profits, bulls just needed a breather

Todays range was between $5.00 as the high and $4.75 as the low, with lo

SNN - Sunniva looking to change trend upon daily consolidationMy Take: Ideally I think we would see a push up to 4.80 and possibly love 5's on Monday and then consolidate over 2-3 days in mid to low 4's ($4.20 and 50 dma at ~$4.10) before pushing back above 5. The $5 price range is going to take support and conviction, along with a bunch of new buyers as we ha

If you want to invest into cannabis? You might like Sunniva!

The cannabis sector is like the dotcom or the tech boom that went from explosion to implosion. Now it starts to get interesting in the new market. The extreme speculative and euphoric time is over and now it begins the value pricing. I guess there will be one more leg down and then the blood is a

See all ideas

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.

Frequently Asked Questions

The current price of SNN is 0.155 CAD — it hasn't changed in the past 24 hours.

Depending on the exchange, the stock ticker may vary. For instance, on CSE exchange SUNNIVA INC. stocks are traded under the ticker SNN.

SUNNIVA INC. is going to release the next earnings report on May 31, 2024. Keep track of upcoming events with our Earnings Calendar.

SNN earnings for the last quarter are −0.18 CAD per share, whereas the estimation was 0.05 CAD resulting in a −464.48% surprise. The estimated earnings for the next quarter are 0.10 CAD per share. See more details about SUNNIVA INC. earnings.

SUNNIVA INC. revenue for the last quarter amounts to 5.36 M CAD despite the estimated figure of 69.59 M CAD. In the next quarter revenue is expected to reach 72.56 M CAD.

Yes, you can track SUNNIVA INC. financials in yearly and quarterly reports right on TradingView.

Today SUNNIVA INC. has the market capitalization of 5.90 M, it has increased by 6.90% over the last week.

No, SNN doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

Like other stocks, SNN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SUNNIVA INC. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SUNNIVA INC. technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SUNNIVA INC. stock shows the sell signal. See more of SUNNIVA INC. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.