Job Growth Takes Off but Traders Stay Put. What’s Happening?Are these jobs in the room with us right now?

📊 A Blockbuster Headline

The delayed January jobs report arrived Wednesday. Nonfarm payrolls ECONOMICS:USNFP showed 130,000 new hires , more than double the 55,000 estimate. On paper, that looked like a strong start to the year.

Wall Street’s re

Dow Jones Industrial Average Index

No trades

About Dow Jones Industrial Average Index

Dow Jones* often refers to the Dow Jones Industrial Average, which was one of the first stock indices and is one of the most commonly referred to barometers of equity performance in the United States. The Dow Jones Industrial Average, not to be confused with the Dow Jones Transportation index (which was the first index), is often called, "the Dow" or "DJIA," and consists of thirty stocks which traditionally were industrial-based. But in recent years as the US economy has become more consumer-oriented, the index has seen a change in composition that no longer has much to do with direct industrial investment.

Related indices

DOW JONES 9-month Channel Up is still holding.Dow Jones (DJI) has been trading within a 9-month Channel Up and is currently on its latest Bullish Leg following a 1D MA50 (blue trend-line) bounce. The last two Bullish Legs peaked just below the -0.382 Fibonacci extension. The strongest Sell Signal was given however by the 1D RSI when it hit its

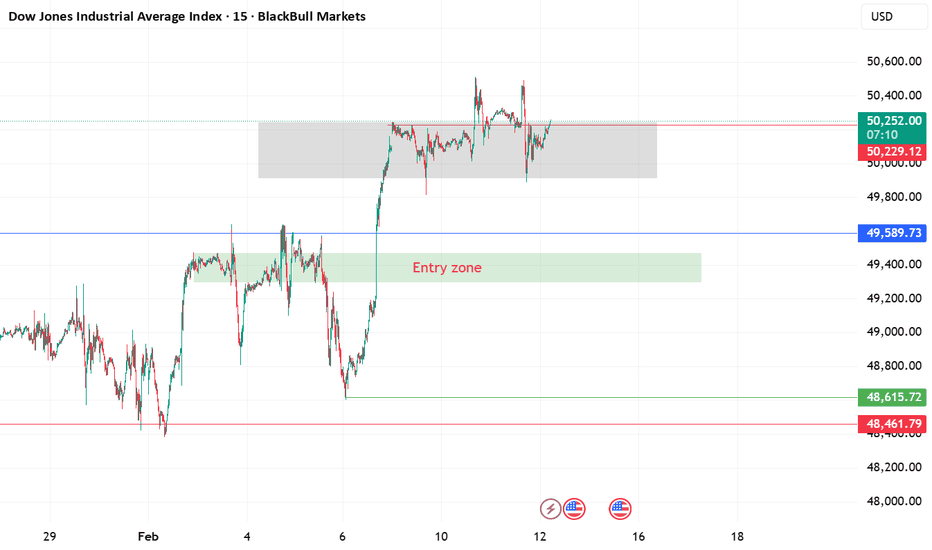

DowJones corrective pullback testing pivotal 49250Key Support and Resistance Levels

Resistance Level 1: 50063

Resistance Level 2: 50425

Resistance Level 3: 50710

Support Level 1: 48925

Support Level 2: 48600

Support Level 3: 48370

This communication is for informational purposes only and should not be viewed as any form of recommendation as

Roadmaps for $20000 Gold and $800 Silver.Roadmaps for $20000 Gold and $800 Silver.

HUGE reaction on that possible 45 year breakdown line for stocks vs silver.

If we get a bounce in Q2, it will OFFICIALLY morph into existence, making it a CRITICAL & VALID line.

BIG moves for Gold, Silver, Oil and friends below that.

US30 Consolidation Growth momentumUS30 trading within a well-defined ascending channel, confirming a medium-term bullish trend. Price has consistently respected both the upper resistance and lower support boundaries of the channel, indicating strong trend structure and controlled momentum.

Recently, price produced a strong impulsiv

Potential Massive Fibonacci Time Cycle TurnToday 02/09/26 the Dow Jones Industrial Average (DJI) made a new all-time high unconfirmed by the Dow Transportation Average, S&P 500, and Nasdaq Composite.

This high comes at the end point of a massive Fibonacci time cycles covering 97 – years.

The starting point is the DJI mania peak made in 19

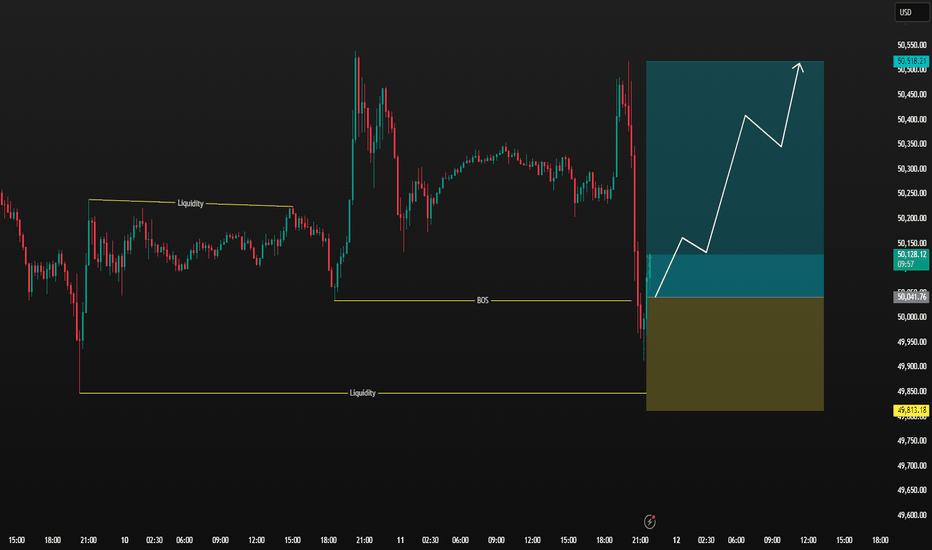

Expected retracement US30Looking at the chart, the Dow Jones is currently sitting right inside a consolidation zone around 50,247, where price is hesitating between buyers and sellers. This grey box i drew marks resistance, showing the market is undecided at this level. My expectation seems to be that price won’t immediatel

US30 : Higher Lows Supporting Further UpsideThe arrows highlight a sequence of higher lows with price continuing to rotate upward after each pullback. Momentum remains constructive and dips are being absorbed rather than accelerating lower. As long as this structure holds, the short-term bias favours continuation to the upside.

Disclosure: W

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of Dow Jones Industrial Average Index is 49,500.93 USD — it has risen by 0.10% in the past 24 hours. Track the index more closely on the Dow Jones Industrial Average Index chart.

Dow Jones Industrial Average Index reached its highest quote on Feb 10, 2026 — 50,512.79 USD. See more data on the Dow Jones Industrial Average Index chart.

The lowest ever quote of Dow Jones Industrial Average Index is 28.48 USD. It was reached on Aug 8, 1896. See more data on the Dow Jones Industrial Average Index chart.

Dow Jones Industrial Average Index value has increased by 0.96% in the past week, since last month it has shown a 0.84% increase, and over the year it's increased by 11.42%. Keep track of all changes on the Dow Jones Industrial Average Index chart.

The top companies of Dow Jones Industrial Average Index are NASDAQ:NVDA, NASDAQ:AAPL, and NASDAQ:MSFT — they can boast market cap of 4.44 T USD, 3.76 T USD, and 2.98 T USD accordingly.

The highest-priced instruments on Dow Jones Industrial Average Index are NYSE:GS, NYSE:CAT, and NASDAQ:MSFT — they'll cost you 905.14 USD, 774.20 USD, and 401.32 USD accordingly.

The champion of Dow Jones Industrial Average Index is NYSE:CAT — it's gained 119.59% over the year.

The weakest component of Dow Jones Industrial Average Index is NYSE:UNH — it's lost −44.77% over the year.

Dow Jones Industrial Average Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Dow Jones Industrial Average Index futures or funds or invest in its components.

The Dow Jones Industrial Average Index is comprised of 30 instruments including NASDAQ:NVDA, NASDAQ:AAPL, NASDAQ:MSFT and others. See the full list of Dow Jones Industrial Average Index components to find more opportunities.