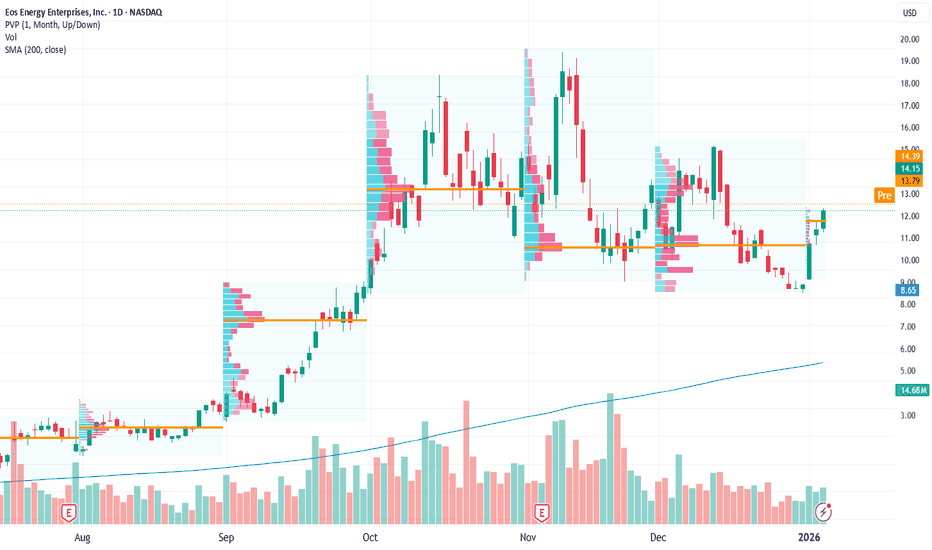

EOSE 1D: Batteries on pauseOn the daily chart EOSE formed a descending wedge following a strong upside impulse. The structure developed through lower highs and lower lows with clear range compression, signaling seller exhaustion rather than the start of a new downtrend. The wedge was broken to the upside and fully worked th

Eos Energy Enterprises, Inc.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−7.73 USD

−685.87 M USD

15.61 M USD

317.31 M

About Eos Energy Enterprises, Inc.

Sector

Industry

CEO

Joseph Mastrangelo

Website

Headquarters

Edison

Founded

2008

IPO date

May 22, 2020

Identifiers

3

ISIN US29415C1018

Eos Energy Enterprises, Inc. designs, manufactures, and deploys battery storage solutions for the electricity industry. It offers the Eos Znyth DC battery system product which designs to meet the requirements of the grid-scale energy storage market. The company was founded in 2008 and is headquartered in Edison, NJ.

Related stocks

EOSE: macro trend structure Price has reached an important mid-term resistance zone and may be setting up for a pullback and consolidation in the coming weeks.

As long as price remains below 21, I’m watching for further downside toward the 13–10 support zone, followed by a potential base formation before the next swing move h

EOS Energy Enterprises defending support as momentum tilts highCurrent Price: 17.11

Direction: LONG

Confidence level: 64%(based on slightly bullish trader language, improving technical structure, and supportive institutional and news flow, despite low social volume)

Targets

Target 1: 19.00

Target 2: 22.00

Stop Levels

Stop 1: 16.80

Stop 2: 16.20

Wisdom of

EOSE(1D) – Sentiment reset within a constructive daily structureEOSE is currently trading within a consolidation phase after a strong prior advance. Following the last impulsive move, price entered a corrective process that helped release excess momentum without damaging the broader daily structure.

From a sentiment perspective, the pullback coincided with a cl

Eos Energy Enterprises, Inc. (NASDAQ: EOSE)Boardroom Transition at a Pivotal Juncture: Eos Energy Enterprises Honors Outgoing Chair and Embraces New Leadership for its Next Growth Phase

Eos Energy Enterprises, Inc. (NASDAQ: EOSE), a prominent American innovator and manufacturer of zinc-based battery energy storage systems (BESS), has announc

EOS Energy Enterprises at risk after sharp pop — lower high setCurrent Price: 12.97 (Analysis was generated on Monday Morning)

Direction: SHORT

Confidence level: 58%(The signal isn’t loud, but the professional trader commentary that did mention EOSE leaned bearish after a fast move. Limited X chatter adds uncertainty, so I’m keeping targets tight.)

Targets

T

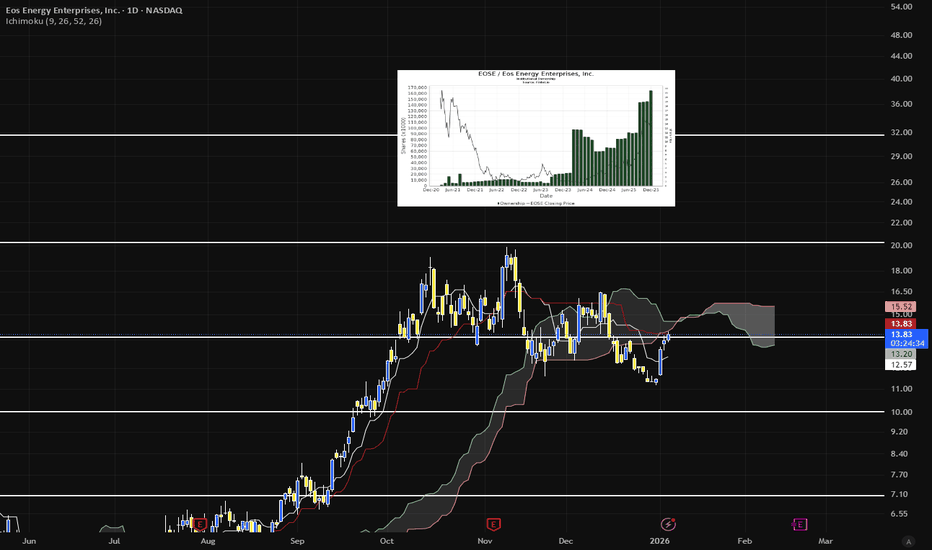

Eos Energy Enterprises IncNASDAQ:EOSE

Trying to break the 0.786 again. Without strong momentum, a clean break of the cloud is unlikely. If 0.786 fails to hold, a pullback toward 0.707 would be normal. Price has touched the Kijun, which typically acts as resistance when above price. I expect more consolidation or a modest p

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

456600

TIMEFOLIO TIME GLOBAL ARTIFICIAL INTELLIGENCE ACITVE ETF UnitsWeight

1.01%

Market value

7.83 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of EOSE is 12.22 USD — it has increased by 7.55% in the past 24 hours. Watch Eos Energy Enterprises, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Eos Energy Enterprises, Inc. stocks are traded under the ticker EOSE.

EOSE stock has fallen by −7.99% compared to the previous week, the month change is a −7.28% fall, over the last year Eos Energy Enterprises, Inc. has showed a 129.27% increase.

We've gathered analysts' opinions on Eos Energy Enterprises, Inc. future price: according to them, EOSE price has a max estimate of 22.00 USD and a min estimate of 12.00 USD. Watch EOSE chart and read a more detailed Eos Energy Enterprises, Inc. stock forecast: see what analysts think of Eos Energy Enterprises, Inc. and suggest that you do with its stocks.

EOSE reached its all-time high on Jan 13, 2021 with the price of 31.95 USD, and its all-time low was 0.61 USD and was reached on May 8, 2024. View more price dynamics on EOSE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

EOSE stock is 9.14% volatile and has beta coefficient of 1.35. Track Eos Energy Enterprises, Inc. stock price on the chart and check out the list of the most volatile stocks — is Eos Energy Enterprises, Inc. there?

Today Eos Energy Enterprises, Inc. has the market capitalization of 4.29 B, it has decreased by −5.84% over the last week.

Yes, you can track Eos Energy Enterprises, Inc. financials in yearly and quarterly reports right on TradingView.

Eos Energy Enterprises, Inc. is going to release the next earnings report on Feb 20, 2026. Keep track of upcoming events with our Earnings Calendar.

EOSE earnings for the last quarter are −4.91 USD per share, whereas the estimation was −0.22 USD resulting in a −2.13 K% surprise. The estimated earnings for the next quarter are −0.17 USD per share. See more details about Eos Energy Enterprises, Inc. earnings.

Eos Energy Enterprises, Inc. revenue for the last quarter amounts to 30.51 M USD, despite the estimated figure of 39.62 M USD. In the next quarter, revenue is expected to reach 93.75 M USD.

EOSE net income for the last quarter is −1.33 B USD, while the quarter before that showed −244.32 M USD of net income which accounts for −445.38% change. Track more Eos Energy Enterprises, Inc. financial stats to get the full picture.

No, EOSE doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 11, 2026, the company has 430 employees. See our rating of the largest employees — is Eos Energy Enterprises, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Eos Energy Enterprises, Inc. EBITDA is −209.59 M USD, and current EBITDA margin is −1.01 K%. See more stats in Eos Energy Enterprises, Inc. financial statements.

Like other stocks, EOSE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Eos Energy Enterprises, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Eos Energy Enterprises, Inc. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Eos Energy Enterprises, Inc. stock shows the buy signal. See more of Eos Energy Enterprises, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.