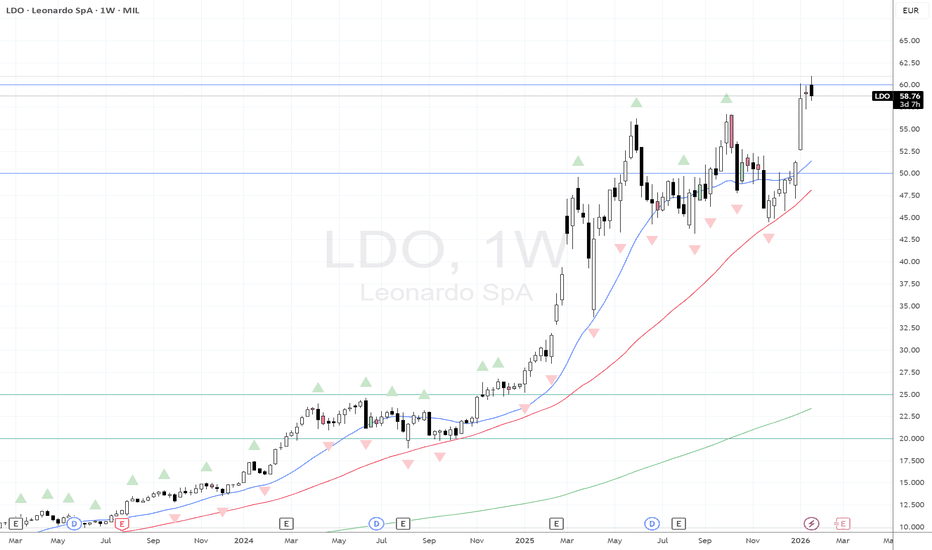

$LDO , Leonardo Milan SetupENTRY : CMP

TP1 : 124.6

TP2 : 146.9

TP3 : Let it Roll !!!!

SL : If you wish

My SL is never a SELL, just an alarm to stop adding money and wait for better dca

Follow, Boost, Thank You !!

⚠️ Financial Disclaimer:

This post is not financial advice. I am not your financial advisor, your life coach

Leonardo S.P.A.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.14 USD

1.11 B USD

18.39 B USD

400.62 M

About Leonardo SpA

Sector

Industry

CEO

Roberto Cingolani

Website

Headquarters

Rome

Founded

1948

IPO date

Jan 1, 1992

Identifiers

2

ISIN IT0003856405

Leonardo SpA engages in the aerospace, defense and security sectors. It operates through the following segments: Helicopters, Defense and Security Electronics; Aeronautics, Space, Defense Systems, and Other Activities. The Helicopters segment designs commercial and military rotorcrafts. The Defense and Security Electronics segment engages in the information management, sensors, and systems integration business, as well as delivers systems for critical missions, military sustainment requirements, and homeland security. The Aeronautics segment produces complete tactical airlifters, combat aircraft, and unmanned air vehicles for both civil and military applications. The Space segment develops satellite systems for navigation, telecommunications, meteorology, environmental monitoring, defense, scientific missions, and earth observation. The Defense Systems segment produces missile systems, torpedoes, naval artillery, and armored vehicles. The Other Activities segment includes financial support, real estate holdings, machinery, and plants for processing aluminum and steel products, contracting services for electricity generation, and primary aluminum production. The company was founded on March 18, 1948 and is headquartered in Rome, Italy.

Related stocks

LDO runs higher off the back of defence stock fervour.A snippet from ForexTraderPaul's YT Channel Monday Market Update #211: Greenland is cold whilst Defence Stocks are hot.

Back in Nov/Dec of last year price across many European defence companies had fallen back to the weekly 50MA (red MA on my chart) on the back of rumours of a Ukrainian Peace deal.

Leonardo Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Leonardo Stock Quote

- Double Formation

* (Uptrend Argument)) | Completed Survey

* 25.00 EUR | Area Of Value | Subdivision 1

- Triple Formation

* Trend Line Mark Up | Area at 22.00 E

LDO Leonardo doing its thangWell, sometimes it helps to realize mistakes by adding some notes.

Just quoting one of my fellow followers here in the bubble who got tricked on that 10% bump.

But lets look at the chart, we see nothing has changed since the initial plan.

Probably will retrace to 1.272-1.618 level before crushing

LDO Dont get fooledSpecial Request from one of my fellow followers again:

1) Dont get fooled by a 10% pump

2) Broke the neckline in 2021

3) Just now failed to reclaim it by a drop below and a backtest

Price action since the 2021 low fully corrective in a crystal clear 3-3-5 pattern (just confirmed by breaking 8.02)

LDO Leonardo: War over?Special request for one of my fellow followers LDO Leonardo

Has been in a bloody downtrend for over 20 years (!)

Lets look at the chart: We are expecting a big ABC correction where as the C wave possibly could have been completed at the yellow arrow but that would be very much truncated.

The rece

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of FINMF is 66.22 USD — it has increased by 5.26% in the past 24 hours. Watch Leonardo S.P.A. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Leonardo S.P.A. stocks are traded under the ticker FINMF.

FINMF stock has risen by 3.16% compared to the previous week, the month change is a −1.74% fall, over the last year Leonardo S.P.A. has showed a 108.30% increase.

We've gathered analysts' opinions on Leonardo S.P.A. future price: according to them, FINMF price has a max estimate of 84.88 USD and a min estimate of 61.30 USD. Watch FINMF chart and read a more detailed Leonardo S.P.A. stock forecast: see what analysts think of Leonardo S.P.A. and suggest that you do with its stocks.

FINMF reached its all-time high on Jan 20, 2026 with the price of 71.25 USD, and its all-time low was 0.68 USD and was reached on Jul 31, 2003. View more price dynamics on FINMF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FINMF stock is 5.66% volatile and has beta coefficient of 0.96. Track Leonardo S.P.A. stock price on the chart and check out the list of the most volatile stocks — is Leonardo S.P.A. there?

Today Leonardo S.P.A. has the market capitalization of 36.44 B, it has decreased by −2.18% over the last week.

Yes, you can track Leonardo S.P.A. financials in yearly and quarterly reports right on TradingView.

Leonardo S.P.A. is going to release the next earnings report on Feb 24, 2026. Keep track of upcoming events with our Earnings Calendar.

FINMF net income for the last half-year is 590.17 M USD, while the previous report showed 567.30 M USD of net income which accounts for 4.03% change. Track more Leonardo S.P.A. financial stats to get the full picture.

Yes, FINMF dividends are paid annually. The last dividend per share was 0.60 USD. As of today, Dividend Yield (TTM)% is 0.98%. Tracking Leonardo S.P.A. dividends might help you take more informed decisions.

Leonardo S.P.A. dividend yield was 2.01% in 2024, and payout ratio reached 27.88%. The year before the numbers were 1.87% and 24.48% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 14, 2026, the company has 60.47 K employees. See our rating of the largest employees — is Leonardo S.P.A. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Leonardo S.P.A. EBITDA is 2.16 B USD, and current EBITDA margin is 10.20%. See more stats in Leonardo S.P.A. financial statements.

Like other stocks, FINMF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Leonardo S.P.A. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Leonardo S.P.A. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Leonardo S.P.A. stock shows the buy signal. See more of Leonardo S.P.A. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.