DDOG: interesting macro potential Interesting large multi-year VCP formation. Earnings are on Nov 6. While there’s still a chance that the correction from the June highs isn’t fully complete and that price is currently in a higher-degree bounce (running flat correction), I’ll be on the lookout for a potential (gap-up) earnings break

Key facts today

Citigroup has maintained a 'Buy' rating for Datadog (DDOG) and raised its price target from $170.00 to $230.00 per share.

Datadog's CEO, Pomel, discussed recent large AI contracts, stating that high-commitment deals provide better pricing and highlighted the potential of Bits AI agents to boost platform use.

Datadog, valued at $69 billion, is speculated to be considering acquiring GitLab, reflecting a rise in tech sector mergers and acquisitions.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.26 EUR

177.49 M EUR

2.59 B EUR

315.83 M

About Datadog, Inc.

Sector

Industry

CEO

Olivier Pomel

Website

Headquarters

New York

Founded

2010

ISIN

US23804L1035

FIGI

BBG00V5LV9V1

Datadog, Inc. engages in the development of a monitoring and analytics platform for developers, information technology operations teams and business users. Its platform integrates and automates infrastructure monitoring, application performance monitoring and log management to provide real-time observability of its customers' entire technology stack. The company was founded by Olivier Pomel and Alexis Lê-Quôc on June 4, 2010 and is headquartered in New York, NY.

Related stocks

DDOG- a Potential for 160% moveDDOG has been consolidating within a large symmetrical triangle pattern that has been forming since the previous peak in November 2021.

In technical analysis, the longer a symmetrical triangle develops, the more powerful the breakout move tends to be once price breaks above the breakout point.

For

DDOG - back to the clouds=======

Volume

=======

- neutral

==========

Price Action

==========

- Latest uptrend line broken and supported with pullback way above trend

- Cup and handle

- Broken out of the latest bull flag

=========

Oscillators

=========

- Ichimoku

>>> price above cloud

>>> green kumo noticed

>>> base + con

peeking at DDOG levelsKey Current Competitors

Dynatrace (DT): A major competitor in the application performance monitoring (APM) and full-stack observability market. Differentiates with a strong focus on AI-driven automation.

Splunk (SPLK): A leader in security and observability, particularly strong in log management a

Datadog (DDOG), NASDAQ, (W)- Moderately bullishStock is in a sideways to bullish recovery phase after a deep correction.

Strong volume spikes observed during both up and down moves → institutional activity.

Key Levels

Support Levels:

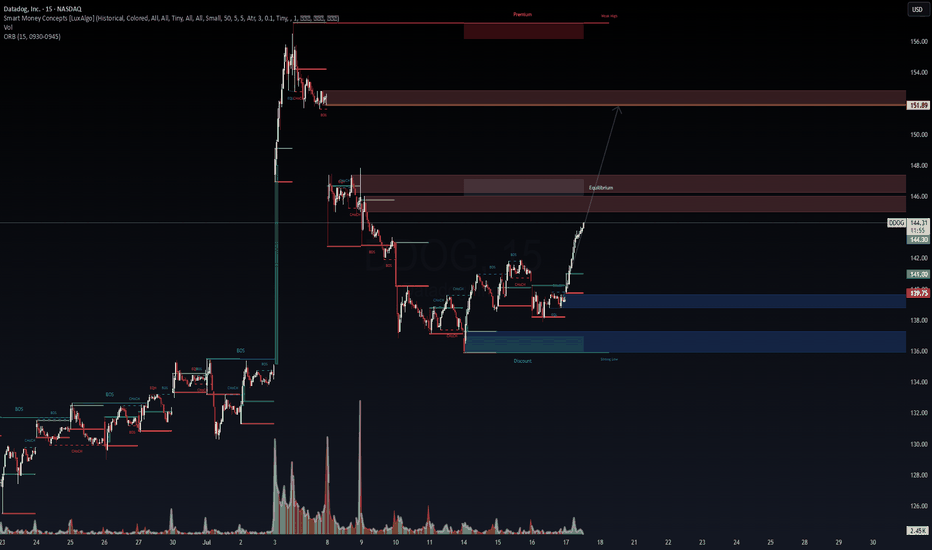

$136.67 (immediate pivot support)

$123.17 (major swing support, must hold)

Resistance / Target Levels:

$1

Last time I played this same set up I made some good money!We all know the markets bullish right now.

If your shorting, your most likely scalping or completely cooking yourself trying to catch big moves.

Trust me, I have spy puts open right now as a hedge and they are down 70%...

Look to the left on my chart. Thats the last time I played DDOG and it was

DDOG | Strong Momentum | LONGDatadog, Inc. engages in the development of a monitoring and analytics platform for developers, information technology operations teams and business users. Its platform integrates and automates infrastructure monitoring, application performance monitoring and log management to provide real-time obse

DDOG eyes on $116.34: Golden Genesis fib to determine the TrendDDOG bounce just hit a Golden Genesis at $116.34

The sister Goldens above and below marked extremes.

This one could mark the orbital center for some time.

It is PROBABLE that we orbit this fib a few times.

It is POSSIBLE that we see a pullback from here.

It is PLAUSIBLE but unlikely to continue non

DDOG 15m – Discount Reversal Targeting $151.89 | VolanX Protocol📈 Datadog (DDOG) has completed a clean bullish structural shift off a deep discount zone, rejecting institutional demand around the $137–139 range. Now breaking above key internal CHoCH and BOS levels, price is accelerating into equilibrium, suggesting momentum is building toward premium inefficienc

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 3QD is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 3QD is 162.68 EUR — it has decreased by −5.21% in the past 24 hours. Watch Datadog, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on FWB exchange Datadog, Inc. Class A stocks are traded under the ticker 3QD.

3QD stock has risen by 19.40% compared to the previous week, the month change is a 16.47% rise, over the last year Datadog, Inc. Class A has showed a 40.68% increase.

We've gathered analysts' opinions on Datadog, Inc. Class A future price: according to them, 3QD price has a max estimate of 219.98 EUR and a min estimate of 129.40 EUR. Watch 3QD chart and read a more detailed Datadog, Inc. Class A stock forecast: see what analysts think of Datadog, Inc. Class A and suggest that you do with its stocks.

3QD stock is 0.92% volatile and has beta coefficient of 1.39. Track Datadog, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is Datadog, Inc. Class A there?

Today Datadog, Inc. Class A has the market capitalization of 57.75 B, it has increased by 26.68% over the last week.

Yes, you can track Datadog, Inc. Class A financials in yearly and quarterly reports right on TradingView.

Datadog, Inc. Class A is going to release the next earnings report on Feb 12, 2026. Keep track of upcoming events with our Earnings Calendar.

3QD earnings for the last quarter are 0.47 EUR per share, whereas the estimation was 0.39 EUR resulting in a 20.20% surprise. The estimated earnings for the next quarter are 0.48 EUR per share. See more details about Datadog, Inc. Class A earnings.

Datadog, Inc. Class A revenue for the last quarter amounts to 754.75 M EUR, despite the estimated figure of 726.72 M EUR. In the next quarter, revenue is expected to reach 790.37 M EUR.

3QD net income for the last quarter is 28.88 M EUR, while the quarter before that showed 2.25 M EUR of net income which accounts for 1.19 K% change. Track more Datadog, Inc. Class A financial stats to get the full picture.

No, 3QD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Nov 13, 2025, the company has 6.5 K employees. See our rating of the largest employees — is Datadog, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Datadog, Inc. Class A EBITDA is 62.03 M EUR, and current EBITDA margin is 6.01%. See more stats in Datadog, Inc. Class A financial statements.

Like other stocks, 3QD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Datadog, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Datadog, Inc. Class A technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Datadog, Inc. Class A stock shows the strong buy signal. See more of Datadog, Inc. Class A technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.