HIMS Earnings prediction(HIMS) looks positioned for a strong earnings reaction as the company continues showing rapid revenue growth, expanding margins, and increasing subscriber counts in its direct-to-consumer telehealth platform. Investors have been rewarding scalable healthcare tech models, and HIMS has been executing

Key facts today

Hims & Hers Health shares fell 14.8% in premarket trading after the FDA warned of possible violations regarding its GLP-1 weight-loss pill, prompting the company to halt the $49 product.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.60 USD

126.04 M USD

1.48 B USD

206.84 M

About Hims & Hers Health, Inc.

Sector

Industry

CEO

Andrew Dudum

Website

Headquarters

San Francisco

Founded

2017

IPO date

Sep 9, 2019

Identifiers

3

ISIN US4330001060

Hims & Hers Health, Inc. operates a telehealth consultation platform. It connects consumers to healthcare professionals, enabling them to access medical care for mental health, sexual health, dermatology and primary care. The company was founded in 2017 and is headquartered in San Francisco, CA.

Related stocks

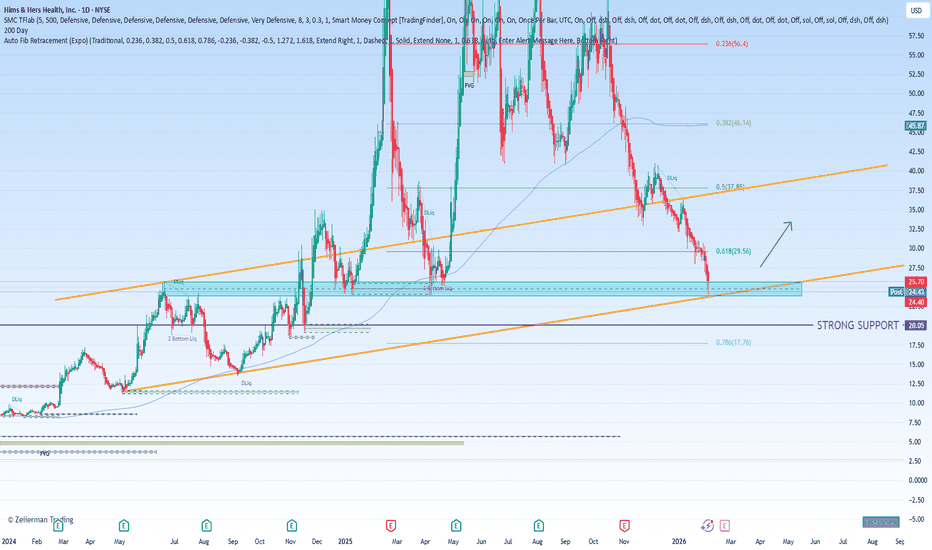

Is this the end of Hims & Hers? Based on the current technical and fundamental analysis of Hims & Hers Health (HIMS) following the severe regulatory and legal headwinds announced on Friday, the stock has entered a period of intense pressure and high uncertainty. The dramatic after-hours sell-off has established a new, lower tradin

Hims & Hers Forges Strategic Alliance with GRAILHims & Hers Forges Strategic Alliance with GRAIL to Broaden Access to Pioneering Cancer Detection, Though Early Share Enthusiasm Fades

Pre-Market Surge Meets Trading Session Reversal as Market Digests Deal Implications

Hims & Hers Health, Inc. (HIMS) experienced a notable, albeit fleeting, surge in

QS V4 ELITE: HIMS Bearish Continuation⚡ QS V4 ELITE: HIMS (WEEKLY)

Buy: HIMS $30.50 Put

Expiry: Jan 30, 2026 (Friday)

Entry: $0.80 – $0.90

⬢ KATY AI: MULTI-DAY VECTOR

Bias: Bearish | Probability: 63% | Projected Move: -2.0%

Katy AI predicts a measured decline to $30.07, signaling a bearish multi-day vector. While confidence is modera

$HIMS - Navigating Volatility Amid Growth and Valuation ConcernsHims & Hers Health, Inc. (HIMS): Navigating Volatility Amid Growth and Valuation Concerns

In the latest trading session, Hims & Hers Health, Inc. (NYSE: HIMS) experienced notable underperformance, closing at $28.89—a decline of -5.19%—against a backdrop of broad market gains. This movement starkly c

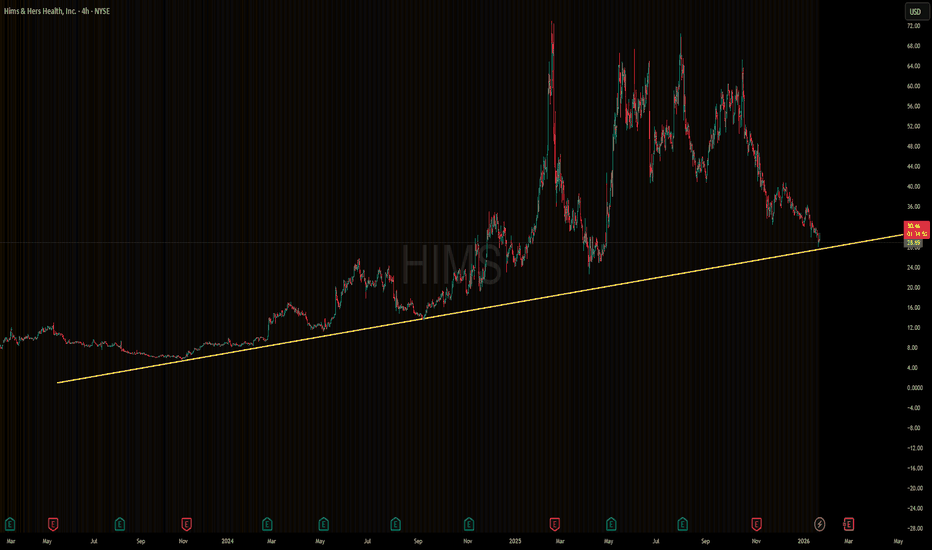

$HIMS TRADE IDEANYSE:HIMS What do you think about this trade idea? This stock has respected this trendline for the past two years and has not broken below it even once during that time. That alone highlights how strong and reliable this level has been. Over the last 12 months, the stock has delivered an impressive

HIMS Call Setup: Breakout Play Before Expiry!📊 HIMS Weekly Trade Signal | 2026-01-22

Trade Type: Speculative Short-Term Weekly Play

Direction: BUY CALLS (LONG)

Confidence: 60% | Conviction: Medium

Expiry: 2026-01-23 (2 days)

Strike Price: $29.50

Entry Price: $0.35 (range $0.34–$0.36)

Target 1: $0.70 (100% gain)

Stop Loss: $0.18 (50% loss)

Pos

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of HIMS is 23.02 USD — it has decreased by −1.96% in the past 24 hours. Watch Hims & Hers Health, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Hims & Hers Health, Inc. stocks are traded under the ticker HIMS.

HIMS stock has fallen by −21.70% compared to the previous week, the month change is a −35.14% fall, over the last year Hims & Hers Health, Inc. has showed a −44.50% decrease.

We've gathered analysts' opinions on Hims & Hers Health, Inc. future price: according to them, HIMS price has a max estimate of 68.00 USD and a min estimate of 16.50 USD. Watch HIMS chart and read a more detailed Hims & Hers Health, Inc. stock forecast: see what analysts think of Hims & Hers Health, Inc. and suggest that you do with its stocks.

HIMS reached its all-time high on Feb 19, 2025 with the price of 72.98 USD, and its all-time low was 2.72 USD and was reached on May 12, 2022. View more price dynamics on HIMS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

HIMS stock is 11.83% volatile and has beta coefficient of 2.06. Track Hims & Hers Health, Inc. stock price on the chart and check out the list of the most volatile stocks — is Hims & Hers Health, Inc. there?

Today Hims & Hers Health, Inc. has the market capitalization of 5.24 B, it has decreased by −13.33% over the last week.

Yes, you can track Hims & Hers Health, Inc. financials in yearly and quarterly reports right on TradingView.

Hims & Hers Health, Inc. is going to release the next earnings report on Feb 23, 2026. Keep track of upcoming events with our Earnings Calendar.

HIMS earnings for the last quarter are 0.06 USD per share, whereas the estimation was 0.09 USD resulting in a −36.40% surprise. The estimated earnings for the next quarter are 0.05 USD per share. See more details about Hims & Hers Health, Inc. earnings.

Hims & Hers Health, Inc. revenue for the last quarter amounts to 598.98 M USD, despite the estimated figure of 580.24 M USD. In the next quarter, revenue is expected to reach 619.22 M USD.

HIMS net income for the last quarter is 15.77 M USD, while the quarter before that showed 42.51 M USD of net income which accounts for −62.89% change. Track more Hims & Hers Health, Inc. financial stats to get the full picture.

No, HIMS doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 9, 2026, the company has 1.64 K employees. See our rating of the largest employees — is Hims & Hers Health, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Hims & Hers Health, Inc. EBITDA is 174.28 M USD, and current EBITDA margin is 5.76%. See more stats in Hims & Hers Health, Inc. financial statements.

Like other stocks, HIMS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Hims & Hers Health, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Hims & Hers Health, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Hims & Hers Health, Inc. stock shows the sell signal. See more of Hims & Hers Health, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.