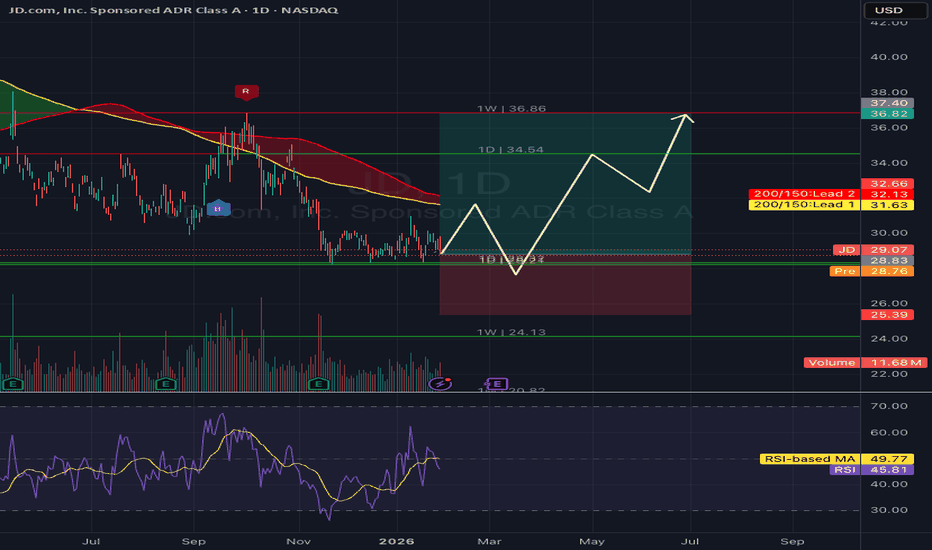

Bought some $JD yesterday - a few reasons why :Bought some NASDAQ:JD yesterday — thanks to a sharp member who brought it to my attention.

A few reasons why the probability vs. risk/reward looks favorable here:

• A large bear wedge — historically these resolve higher roughly 70% of the time

• The China index is forming a double bottom, which

JD.com, Inc.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.55 USD

5.77 B USD

161.68 B USD

2.70 B

About JD.com, Inc.

Sector

Industry

CEO

Ran Xu

Website

Headquarters

Beijing

Founded

1998

IPO date

May 22, 2014

Identifiers

3

ISIN KYG8208B1014

JD.com, Inc. is a technology-driven E-commerce company, which engages in the sale of electronics products and general merchandise products, including audio, video products, and books. It operates in the following segments: JD Retail, JD Logistics, and New Businesses. The JD Retail segment offers online retail, online marketplace, and marketing services. The JD Logistics segment includes internal and external logistics businesses. The New Businesses segment is composed of JD Property, Jingxi, overseas businesses and technology initiatives. The company was founded on June 18, 1998, by Qiang Dong Liu and is headquartered in Beijing, China.

Related stocks

JD.com: Further DownsideWe anticipate that JD.com could dip deeper into the active green Target Zone ($28.97–$23.81). Thus, more attractive buying opportunities may emerge over time. At the same time, the probability of our alternative scenario—in which the zone is breached and a new low of blue wave alt.(II) occurs belo

Short on JD.com Inc (Ticker JD)

NASDAQ:JD

Technicals:

- price in range 28.50 - 30.20 accumulation power for a movement

- as price is in long-term bear trend, the short breakout to the long-term retest zone at 25.50 - 25.80 before rebounce is logical

- put TP 1 on 27.40 in case of squeeze and rebounce.

- slow penetration

China Retail ReboundJD.com is sitting at key technical support around the $29 level, an area that has repeatedly held as demand since the last earnings report. The stock has been chopping between $28–$29, suggesting sellers are losing momentum and a move is building.

A decisive breakout above the $34.54 level would co

JD: Final Wave 2 consolidation (patience before the breakout)Thesis

NASDAQ:JD is still compressing in the final stages of Wave 2, and the longer this base builds, the stronger the breakout typically becomes.

Context

- Weekly timeframe

- Multi-year downtrend transitioned into a base

- Compression phase continues while peers already broke out (BABA, BIDU)

JD Approaching Buy Zone - Excellent Reward/Risk For A LongThis chart has a number of confluent signals that point to a good long setup. From both a trend & momentum perspective, I like it a lot.

Everyone has to manage their emotions in trading. As this looks to be basing above the zone, I'm feeling a strong urge add to my original long. But I know patien

JD: Downtrend Line Break Needed for $70–$108+ Reversal JD: Downtrend Line Break Needed for $70–$108+ Reversal — Or Deeper to $20 on Tariff Risks?

JD.com (JD) remains trapped in a multi-year descending trend line (white) from the 2020–2021 highs (~$108–$128). We're now bouncing right at the deep lows around $28–$29 (current price zone ~$28.90 as shown o

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of JDCMF is 15.99 USD — it has increased by 13.57% in the past 24 hours. Watch JD.com, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange JD.com, Inc. stocks are traded under the ticker JDCMF.

JDCMF stock has risen by 27.92% compared to the previous week, the month change is a 20.23% rise, over the last year JD.com, Inc. has showed a −22.00% decrease.

We've gathered analysts' opinions on JD.com, Inc. future price: according to them, JDCMF price has a max estimate of 24.47 USD and a min estimate of 11.79 USD. Watch JDCMF chart and read a more detailed JD.com, Inc. stock forecast: see what analysts think of JD.com, Inc. and suggest that you do with its stocks.

JDCMF reached its all-time high on Feb 16, 2021 with the price of 51.58 USD, and its all-time low was 10.26 USD and was reached on Mar 5, 2024. View more price dynamics on JDCMF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

JDCMF stock is 11.95% volatile and has beta coefficient of 0.95. Track JD.com, Inc. stock price on the chart and check out the list of the most volatile stocks — is JD.com, Inc. there?

Today JD.com, Inc. has the market capitalization of 42.12 B, it has decreased by −1.67% over the last week.

Yes, you can track JD.com, Inc. financials in yearly and quarterly reports right on TradingView.

JD.com, Inc. is going to release the next earnings report on Mar 5, 2026. Keep track of upcoming events with our Earnings Calendar.

JDCMF earnings for the last quarter are 0.26 USD per share, whereas the estimation was 0.19 USD resulting in a 37.83% surprise. The estimated earnings for the next quarter are 0.05 USD per share. See more details about JD.com, Inc. earnings.

JD.com, Inc. revenue for the last quarter amounts to 42.06 B USD, despite the estimated figure of 41.33 B USD. In the next quarter, revenue is expected to reach 50.31 B USD.

JDCMF net income for the last quarter is 740.53 M USD, while the quarter before that showed 848.91 M USD of net income which accounts for −12.77% change. Track more JD.com, Inc. financial stats to get the full picture.

Yes, JDCMF dividends are paid annually. The last dividend per share was 0.50 USD. As of today, Dividend Yield (TTM)% is 3.58%. Tracking JD.com, Inc. dividends might help you take more informed decisions.

JD.com, Inc. dividend yield was 2.86% in 2024, and payout ratio reached 26.65%. The year before the numbers were 2.64% and 35.32% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 14, 2026, the company has 570.89 K employees. See our rating of the largest employees — is JD.com, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. JD.com, Inc. EBITDA is 3.72 B USD, and current EBITDA margin is 4.14%. See more stats in JD.com, Inc. financial statements.

Like other stocks, JDCMF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade JD.com, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So JD.com, Inc. technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating JD.com, Inc. stock shows the sell signal. See more of JD.com, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.