Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−10.38 USD

−2.71 B USD

807.83 M USD

130.12 M

About Lucid Group, Inc.

Sector

Industry

CEO

Marc Winterhoff

Website

Headquarters

Newark

Founded

2007

Identifiers

3

ISIN US5494982029

Lucid Group, Inc. manufactures electric vehicles. It designs, develops, and builds energy storage systems for electric vehicles and supplies automakers with the battery pack system needed to power hybrid, plug-in, and electric vehicles. The company was founded in December 2007 and is headquartered in Newark, CA.

Related stocks

lCID is about to pump like crazy. IM BUYING NOW.Huge fib level on the monthly that I pulled from a sneaky move in the past. Huge levels on the yearly chart (marked) that we will hopefully pump to. This is a retracement play, this stock is trash, but that doesnt mean we wont retrace to test untested levels.

I am accumulating LCID at these levels. I bought at $12, $11 and $10. I will continue to buy if we go lower. This fib projection which is pulled from a very important past monthly swing has a the level at $12. My levels are very accurate and we often will dip below the level, regain, test and shoot off. This company is way oversold an

LCID - Zoom Zoom !Good Morning,

I hope all is well. Here is another trade idea with LCID!

Scenario 1: Bullish Expansion (Primary / High-Probability)

Narrative:

Accumulation resolves upward as bears fail to regain control. Momentum flips once price reclaims local resistance.

Trigger / Confirmation

Clean bre

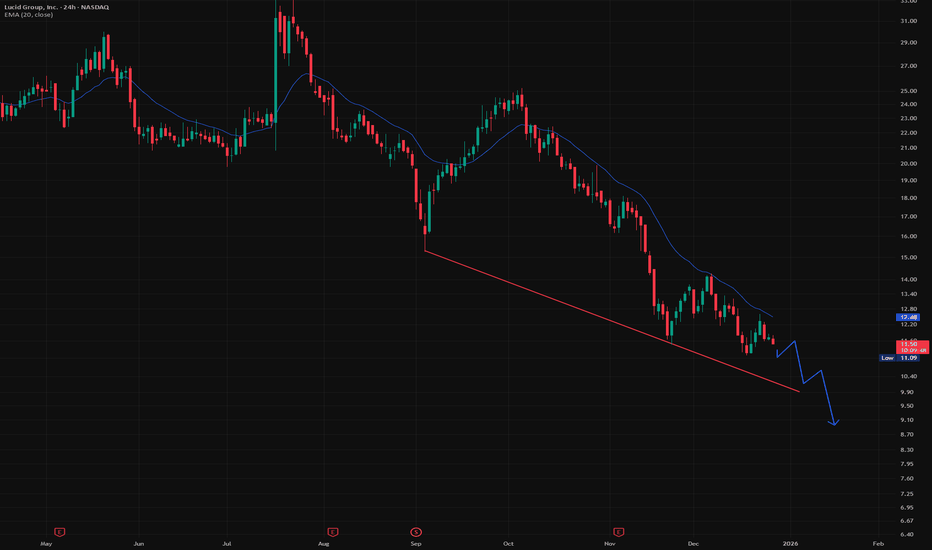

$LCID looks ready to collapse, anytime now.- They just cut production guidance

Lucid lowered 2025 production outlook to ~18,000 vehicles due to supply issues. That’s another reset lower.

- Revenue missed and losses are still huge

Q3 revenue $336.6M vs ~$379M est, and adjusted loss was worse than expected.

Gross margins are deeply negative

-

$LCID short, bear flag and they did just cut production guidanceNASDAQ:LCID short, bear flag, should at least got to $10 in the coming weeks/months.

- They just cut production guidance

Lucid lowered 2025 production outlook to ~18,000 vehicles due to supply issues. That’s another reset lower.

- Revenue missed and losses are still huge

Q3 revenue $336.6M vs ~$3

LCID — WEEK 49 TREND REPORT (2D) | 12/03/2025LCID — WEEK 49 TREND REPORT | 12/03/2025

Ticker: NASDAQ:LCID

Timeframe: TWO DAY

This is a reactive structural classification of LCID based on the weekly chart as of this timestamp. Price conditions are evaluated as they stand — nothing here is predictive or forward-assumptive.

⸻

1) Cur

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US549498AC7

Lucid Group, Inc. 5.0% 01-APR-2030Yield to maturity

—

Maturity date

Apr 1, 2030

US549498AA1

Lucid Group, Inc. 1.25% 15-DEC-2026Yield to maturity

—

Maturity date

Dec 15, 2026

See all LCID bonds

Frequently Asked Questions

The current price of LCID is 11.33 USD — it has decreased by −0.82% in the past 24 hours. Watch Lucid Group, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Lucid Group, Inc. stocks are traded under the ticker LCID.

LCID stock has risen by 9.54% compared to the previous week, the month change is a −3.02% fall, over the last year Lucid Group, Inc. has showed a −58.95% decrease.

We've gathered analysts' opinions on Lucid Group, Inc. future price: according to them, LCID price has a max estimate of 30.00 USD and a min estimate of 10.00 USD. Watch LCID chart and read a more detailed Lucid Group, Inc. stock forecast: see what analysts think of Lucid Group, Inc. and suggest that you do with its stocks.

LCID reached its all-time high on Feb 18, 2021 with the price of 648.60 USD, and its all-time low was 9.50 USD and was reached on Jan 20, 2026. View more price dynamics on LCID chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

LCID stock is 6.12% volatile and has beta coefficient of 1.42. Track Lucid Group, Inc. stock price on the chart and check out the list of the most volatile stocks — is Lucid Group, Inc. there?

Today Lucid Group, Inc. has the market capitalization of 3.54 B, it has decreased by −4.10% over the last week.

Yes, you can track Lucid Group, Inc. financials in yearly and quarterly reports right on TradingView.

Lucid Group, Inc. is going to release the next earnings report on Feb 24, 2026. Keep track of upcoming events with our Earnings Calendar.

LCID earnings for the last quarter are −3.25 USD per share, whereas the estimation was −2.29 USD resulting in a −42.02% surprise. The estimated earnings for the next quarter are −2.66 USD per share. See more details about Lucid Group, Inc. earnings.

Lucid Group, Inc. revenue for the last quarter amounts to 336.60 M USD, despite the estimated figure of 349.51 M USD. In the next quarter, revenue is expected to reach 473.11 M USD.

LCID net income for the last quarter is −978.43 M USD, while the quarter before that showed −539.43 M USD of net income which accounts for −81.38% change. Track more Lucid Group, Inc. financial stats to get the full picture.

No, LCID doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jan 30, 2026, the company has 6.8 K employees. See our rating of the largest employees — is Lucid Group, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Lucid Group, Inc. EBITDA is −2.75 B USD, and current EBITDA margin is −334.87%. See more stats in Lucid Group, Inc. financial statements.

Like other stocks, LCID shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Lucid Group, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Lucid Group, Inc. technincal analysis shows the neutral today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Lucid Group, Inc. stock shows the sell signal. See more of Lucid Group, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.