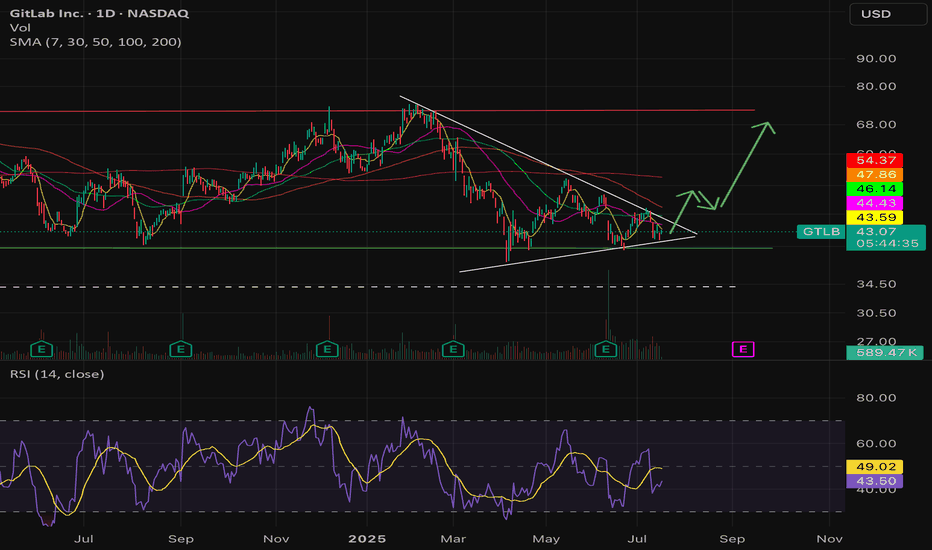

Levels to manage GTLB between now and Thanksgiving 2025If the today's earnings report meets or exceeds expectations, GTLB could confirm the recent analyst optimism and trigger a bullish trend. Conversely, a miss on the earnings could lead to a short-term price decline, potentially testing the support level.

Given the positive analyst sentiment and upc

Key facts today

GitLab's Q2 fiscal 2026 revenue hit $236 million, up 29% year-over-year, with adjusted EPS of $0.25. The company forecasts Q3 sales of $238-$239 million and EPS of $0.19-$0.20.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.11 USD

−6.33 M USD

759.25 M USD

136.98 M

About GitLab Inc.

Sector

Industry

CEO

William Staples

Website

Headquarters

San Francisco

Founded

2011

ISIN

US37637K1088

FIGI

BBG00DHTYPH8

Gitlab, Inc. provides code hosting and collaboration platform services. It offers continuous integration, source code management, out-of-the-box pipelines, agile development, and value stream management. The company was founded by Dmitriy Zaporozhets and Sid Sijbrandij in 2011 and is headquartered in Dover, DE.

Related stocks

GTLB GitLab Options Ahead of EarningsAnalyzing the options chain and the chart patterns of GTLB GitLab prior to the earnings report this week,

I would consider purchasing the 50usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $7.80.

If these options prove to be profitable prior to the earnings

How Does One Platform Navigate Eight Global Disruptions at Once?GitLab has emerged as a dominant force in the DevSecOps landscape during 2025, achieving a remarkable 29% year-over-year revenue growth to reach $759 million annually in fiscal Q4 2025. The platform's success stems from its ability to address multiple converging global challenges simultaneously, fro

GTLB | Triple Bottom ReversalGitLab (GTLB) is setting up for a potential trend reversal following a textbook triple bottom pattern and a clean breakout above the cloud. Here's the technical breakdown:

Why This Setup Matters

Triple Bottom Pattern: Reversal structure is clear with three defined lows at ~$38, ~$40, and ~$41. The

Worst Behind GTLB. Do you think the worst is behind for GTLB?

With news of senior management selling stock share and the downgrade, we see a clear test of low since April this year. Since the news always come out the latest, the decline during the last 3 months is likely the explaination to the selling pressure we ha

$GTLB undervalued, Potential 2X, AI assisted coding tailwind- NASDAQ:GTLB is likely one of the play for Agentic AI. When other companies like Windsurf, Codium, Cursor are in a goldrush. NASDAQ:GTLB is selling shovels.

- AI assisted coding is now a theme and is happening at a fast pace. I'm certain NASDAQ:GTLB will be a beneficiary of this trend.

-

Safe Entry Zone GTLBStock in Ranging Movement.

Stock current at SIGNIFICANT Support Level.

My Beloved Gathie Wood's Best investor ever just bought the stock too.

P.High's & P.Lows(Previous Highs & Previous Lows) acts as good Support and resistances levels.

4h Green Zone Is Buying Zone.

4h Red Zone is Selling Zone.

GTLB reverses to increaseBased on wave analysis, the main support line and RSI indicator when the price is oversold below 40, it shows a very high possibility of GTLB reversing to increase.

The price now (Closed on 06.16.2025): $42.08.

Price target: $47.76/ $50.50.

Stop loss: $39.

!!! Important note for stoploss as price

$GTLB: AI SaaS Software stock for tactical and long-term tradeIn this blog space we focus a lot on the AI trade. Be it semiconductors, AI powered Cybersecurity, AI Powered Fintech or just the industry itself, but we have not quietly focused on the AI Software stocks. The second and third derivatives of the AI trade will be more on the software space than Semic

# GitLab's Code Surge #GitLab Inc. (GTLB) is demonstrating potential bullish momentum, with a significant weekly gap around the $50 level. A breakout above the $55.26 level could indicate further strength, positioning the stock to target the $69.47 resistance. This trade setup offers an attractive risk-to-reward ratio, wi

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where GTLB is featured.

US software stocks: Overlooked operating systems

17 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of GTLB is 46.91 USD — it has decreased by −1.56% in the past 24 hours. Watch GitLab Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange GitLab Inc. stocks are traded under the ticker GTLB.

GTLB stock has risen by 2.39% compared to the previous week, the month change is a 9.30% rise, over the last year GitLab Inc. has showed a 0.60% increase.

We've gathered analysts' opinions on GitLab Inc. future price: according to them, GTLB price has a max estimate of 76.00 USD and a min estimate of 47.00 USD. Watch GTLB chart and read a more detailed GitLab Inc. stock forecast: see what analysts think of GitLab Inc. and suggest that you do with its stocks.

GTLB reached its all-time high on Nov 9, 2021 with the price of 137.00 USD, and its all-time low was 26.24 USD and was reached on May 4, 2023. View more price dynamics on GTLB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

GTLB stock is 4.08% volatile and has beta coefficient of 1.19. Track GitLab Inc. stock price on the chart and check out the list of the most volatile stocks — is GitLab Inc. there?

Today GitLab Inc. has the market capitalization of 7.88 B, it has increased by 6.17% over the last week.

Yes, you can track GitLab Inc. financials in yearly and quarterly reports right on TradingView.

GitLab Inc. is going to release the next earnings report on Dec 8, 2025. Keep track of upcoming events with our Earnings Calendar.

GTLB earnings for the last quarter are 0.24 USD per share, whereas the estimation was 0.16 USD resulting in a 46.56% surprise. The estimated earnings for the next quarter are 0.19 USD per share. See more details about GitLab Inc. earnings.

GitLab Inc. revenue for the last quarter amounts to 236.00 M USD, despite the estimated figure of 226.90 M USD. In the next quarter, revenue is expected to reach 240.45 M USD.

GTLB net income for the last quarter is −35.88 M USD, while the quarter before that showed 10.78 M USD of net income which accounts for −432.67% change. Track more GitLab Inc. financial stats to get the full picture.

No, GTLB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 4, 2025, the company has 2.38 K employees. See our rating of the largest employees — is GitLab Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. GitLab Inc. EBITDA is −102.53 M USD, and current EBITDA margin is −16.44%. See more stats in GitLab Inc. financial statements.

Like other stocks, GTLB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade GitLab Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So GitLab Inc. technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating GitLab Inc. stock shows the sell signal. See more of GitLab Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.