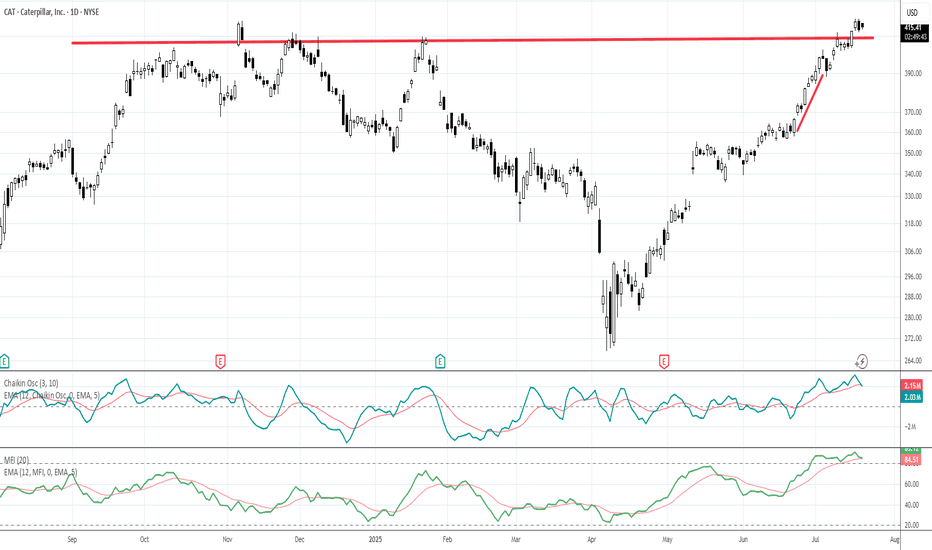

CAT Technical Outlook – Testing Major Resistance📊 CAT Technical Outlook – Testing Major Resistance

Ticker: CAT (Caterpillar Inc.)

Timeframe: 30-minute candles

🔍 Current Setup

CAT has been in a sideways consolidation after its sharp August drop. Price action has formed a range with clear resistance near 421.80 and support near 406.00.

At prese

Key facts today

Caterpillar Inc. (CAT) achieved a new 52-week high of $472.12, accompanied by a trading volume of 5,066,588 shares.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

19.76 USD

10.79 B USD

64.81 B USD

467.47 M

About Caterpillar, Inc.

Sector

CEO

Joseph E. Creed

Website

Headquarters

Irving

Founded

1925

ISIN

US1491231015

FIGI

BBG000BF0K17

Caterpillar, Inc. engages in the business of manufacturing construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. It operates through the following segments: Construction Industries, Resource Industries, Energy and Transportation, Financial Products, and All Other. The Construction Industries segment is involved in supporting customers using machinery in infrastructure and building construction applications. The Resource Industries segment offers machinery in mining, heavy construction, quarry, and aggregates. The Energy and Transportation segment focuses on reciprocating engines, turbines, diesel-electric locomotives, and related services across industries serving oil and gas, power generation, industrial, and transportation applications including marine- and rail-related businesses. The Financial Products segment provides financing alternatives to customers and dealers for Caterpillar products and services, as well as financing for power generation facilities. The All Other segment includes activities such as the business strategy, product management and development, manufacturing, and sourcing of wear and maintenance components products, parts distribution, integrated logistics solutions, distribution services responsible for dealer development, and administration. The company was founded on April 15, 1925 and is headquartered in Irving, TX.

Related stocks

CAT TRADE IDEA – HEAVY EQUIPMENT, HEAVY POTENTIAL 📈🏗️🐾Sector: Industrials – Construction & Machinery

When the giants sleep, we prepare. And when they wake, we ride the momentum.

Caterpillar has been consolidating, and the recent pullback opens the door for a high-conviction setup. I'm looking to build my position in 3 strategic zones — scaling in

Caterpillar Pulls BackCaterpillar rallied to a new high in late July, and now it’s pulled back.

The first pattern on today’s chart is $407.63, a record weekly closing price from January. It briefly thwarted the industrial stock’s advance in early July. Prices pushed above it and are now coming back to test the same leve

Angle of Ascent: what it means, how to use it.Angle of Ascent is a visual pattern that forms on a chart when stocks are running with momentum or velocity. Drawing a line along an up trending price action helps you see the Angle of ascent. Also Chaikins Osc and EMA MFI indicators are extremely helpful in warning a day ahead of time that the Angl

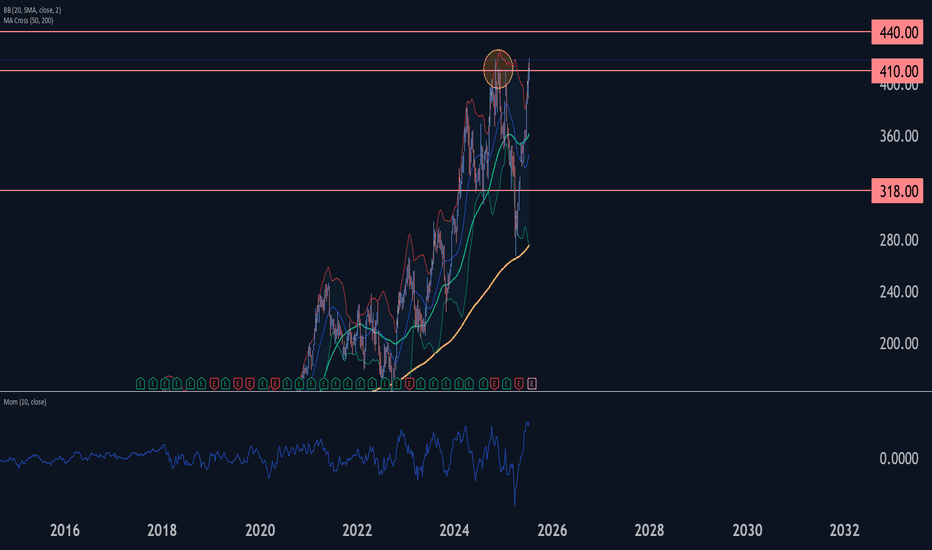

Caterpillar Wave Analysis – 17 July 2025

- Caterpillar broke long-term resistance level 410.00

- Likely to rise to resistance level 440.00

Caterpillar recently broke above the major long-term resistance level 410.00, which has been reversing the price from the end of 2024, as can be seen from the weekly Caterpillar chart below.

The brea

Caterpillar's Bullish Momentum Points to Extended GainsCurrent Price: $397.86

Direction: LONG

Targets:

- T1 = $407.80

- T2 = $415.75

Stop Levels:

- S1 = $390.50

- S2 = $384.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to i

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

CAT.MO

Caterpillar Inc. 7.375% 01-MAR-2097Yield to maturity

6.02%

Maturity date

Mar 1, 2097

US149123CE9

Caterpillar Inc. 4.75% 15-MAY-2064Yield to maturity

5.39%

Maturity date

May 15, 2064

US149123CF6

Caterpillar Inc. 3.25% 19-SEP-2049Yield to maturity

5.31%

Maturity date

Sep 19, 2049

US149123CJ8

Caterpillar Inc. 3.25% 09-APR-2050Yield to maturity

5.30%

Maturity date

Apr 9, 2050

CAT6075413

Caterpillar Inc. 5.5% 15-MAY-2055Yield to maturity

5.30%

Maturity date

May 15, 2055

US149123CD1

Caterpillar Inc. 4.3% 15-MAY-2044Yield to maturity

5.25%

Maturity date

May 15, 2044

US149123CB5

Caterpillar Inc. 3.803% 15-AUG-2042Yield to maturity

5.20%

Maturity date

Aug 15, 2042

CAT.RU

Caterpillar Inc. 6.95% 01-MAY-2042Yield to maturity

5.13%

Maturity date

May 1, 2042

CAT.AC

Caterpillar Inc. 5.2% 27-MAY-2041Yield to maturity

5.06%

Maturity date

May 27, 2041

CAT.HOH

Caterpillar Inc. 8.25% 15-DEC-2038Yield to maturity

4.93%

Maturity date

Dec 15, 2038

CAT6075085

Caterpillar Inc. 5.2% 15-MAY-2035Yield to maturity

4.68%

Maturity date

May 15, 2035

See all CAT bonds

Curated watchlists where CAT is featured.

Frequently Asked Questions

The current price of CAT is 466.54 USD — it has increased by 3.62% in the past 24 hours. Watch Caterpillar, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Caterpillar, Inc. stocks are traded under the ticker CAT.

CAT stock has risen by 10.15% compared to the previous week, the month change is a 11.36% rise, over the last year Caterpillar, Inc. has showed a 28.52% increase.

We've gathered analysts' opinions on Caterpillar, Inc. future price: according to them, CAT price has a max estimate of 540.00 USD and a min estimate of 350.00 USD. Watch CAT chart and read a more detailed Caterpillar, Inc. stock forecast: see what analysts think of Caterpillar, Inc. and suggest that you do with its stocks.

CAT stock is 2.03% volatile and has beta coefficient of 1.21. Track Caterpillar, Inc. stock price on the chart and check out the list of the most volatile stocks — is Caterpillar, Inc. there?

Today Caterpillar, Inc. has the market capitalization of 218.76 B, it has increased by 4.47% over the last week.

Yes, you can track Caterpillar, Inc. financials in yearly and quarterly reports right on TradingView.

Caterpillar, Inc. is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

CAT earnings for the last quarter are 4.72 USD per share, whereas the estimation was 4.89 USD resulting in a −3.57% surprise. The estimated earnings for the next quarter are 4.60 USD per share. See more details about Caterpillar, Inc. earnings.

Caterpillar, Inc. revenue for the last quarter amounts to 16.57 B USD, despite the estimated figure of 16.30 B USD. In the next quarter, revenue is expected to reach 16.76 B USD.

CAT net income for the last quarter is 2.18 B USD, while the quarter before that showed 2.00 B USD of net income which accounts for 8.79% change. Track more Caterpillar, Inc. financial stats to get the full picture.

Yes, CAT dividends are paid quarterly. The last dividend per share was 1.51 USD. As of today, Dividend Yield (TTM)% is 1.23%. Tracking Caterpillar, Inc. dividends might help you take more informed decisions.

Caterpillar, Inc. dividend yield was 1.52% in 2024, and payout ratio reached 25.08%. The year before the numbers were 1.72% and 25.34% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Sep 20, 2025, the company has 112.9 K employees. See our rating of the largest employees — is Caterpillar, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Caterpillar, Inc. EBITDA is 13.90 B USD, and current EBITDA margin is 24.20%. See more stats in Caterpillar, Inc. financial statements.

Like other stocks, CAT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Caterpillar, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Caterpillar, Inc. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Caterpillar, Inc. stock shows the strong buy signal. See more of Caterpillar, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.