2/9/26 - $pins - Call me old fashioned... but duh?2/9/26 :: VROCKSTAR :: NYSE:PINS

Call me old fashioned... but duh?

- under 3x gross profit

- which is where i'm focusing on software today

- hundreds of millions of entertainment users

- unlike other "socials"

- not snapchat or evan risk

- i still think this is a pretty obvious buy in '26

- will

Pinterest, Inc.

No trades

Key facts today

Pinterest's stock fell 22% to $14.51 in premarket trading after weak Q4 results and a poor Q1 outlook. Analysts downgraded the stock, citing challenges in ad revenue and AI competition.

Pinterest saw a 12% rise in monthly active users to 619 million and a 2% increase in revenue per user to $2.16. Adjusted EBITDA reached $542 million.

RBC Capital has downgraded Pinterest's stock rating from 'Outperform' to 'Sector Perform'.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.94 USD

1.86 B USD

3.65 B USD

589.38 M

About Pinterest, Inc.

Sector

Industry

CEO

William J. Ready

Website

Headquarters

San Francisco

Founded

2008

IPO date

Apr 18, 2019

Identifiers

3

ISIN US72352L1061

Pinterest, Inc. engages in the operation of a pinboard-style photo-sharing website. It allows users to create and manage theme-based image collections such as events, interests, and hobbies. The company was founded by Benjamin Silbermann, Paul C. Sciarra, and Evan Sharp in October 2008 and is headquartered in San Francisco, CA.

Related stocks

PINS Pinterest Options Ahead of EarningsAfter PINS touched the price target:

Analyzing the options chain and the chart patterns of PINS Pinterest prior to the earnings report this week,

I would consider purchasing the 23usd strike price Calls with

an expiration date of 2026-6-18,

for a premium of approximately $1.77.

If these options pr

Bullish Analyst Consensus on PinterestBullish Analyst Consensus on Pinterest (PINS) Amidst Near-Term Operational Recalibration

As of early February 2026, Pinterest, Inc. (NYSE: PINS) presents a compelling narrative of long-term potential juxtaposed against recent operational adjustments, resulting in a notably bullish but nuanced analys

Pinterest P/E (TTM),~7.7x,SUPER CHEAP ✅. The lowest level in the company's history.

Forward P/E,~11.8x, "Indicates that the market expects lower earnings in the short term."

Free Cash Flow,~$1.12 billion,EXCELLENT ✅. They generate huge cash.

ROE,~41.2%,PHENOMENAL ✅.

Debt/Equity,~0.04 (4%),PERFECT ✅. They h

$PINS might be acquired by Open AI - NYSE:PINS could be a beneficial company for companies which want curated dataset by users. All these human annotated and curated dataset with proper tagging could be very beneficial for Foundational Image and Video LLMs.

- On top of that, These companies will get an advertisement business which

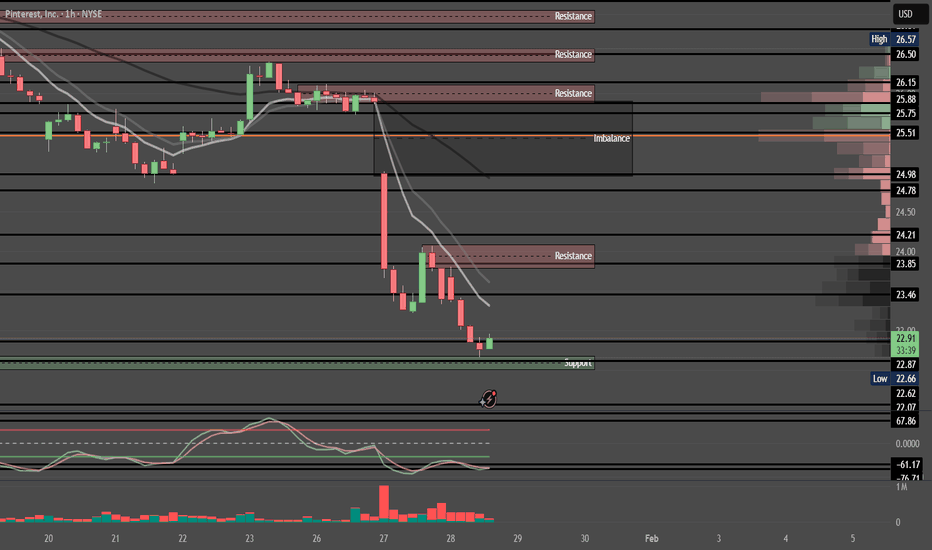

PINS Trapped Below Gamma Flip!!PINS Intraday Trading Playbook

Current Structure Snapshot

Spot: ~22.78

Trend: Bearish short-term, attempting basing

Context: Sharp selloff → liquidity vacuum → price now sitting near put-heavy / negative GEX zone

Gamma State: Mixed → locally stabilizing but not flipped bullish yet

Key Options & Li

1/27/26 - $pins - Pin IT to win IT1/27/26 :: VROCKSTAR :: NYSE:PINS

Pin IT to win IT

- i'm aware of the SBC

- apparently so is the mgmt that is going to pin the IT to the "looking 4 jobz" board

- reallocating to AI spend is a duh

- kudos for doing this now than later

- every woman i know... from too young to party to too old to p

PINS - Pinterest becoming social media ad-space royalty?With continued resilience shown in their financial performance...Is NYSE:PINS setting up for significant movement to the upside?

Our systems have identified a point of potential interest & volatility in PINS.

If price can hold above $22.81 ... Significant Bullish potential may be unlocked

Pinterest | PINS | Long at $26.20Pinterest's NYSE:PINS continued user growth is quite impressive, especially among Gen Z. Factoring in global expansion, the revenue and earnings projections caught my attention. Currently trading around a 9x price-to-earnings, it's kind of a sleeper in the tech world *if* the user numbers and fore

GEN ZWHAT DOES THE COMPANY DO?

Pinterest makes money the same way most “free” platforms do—by selling your attention to advertisers, just with prettier pictures and better lighting. Their entire business model revolves around visual discovery ads, which is a poetic way of saying sponsored content disgui

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of PINS is 15.42 USD — it has decreased by −2.88% in the past 24 hours. Watch Pinterest, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Pinterest, Inc. stocks are traded under the ticker PINS.

PINS stock has fallen by −6.46% compared to the previous week, the month change is a −31.23% fall, over the last year Pinterest, Inc. has showed a −60.56% decrease.

We've gathered analysts' opinions on Pinterest, Inc. future price: according to them, PINS price has a max estimate of 45.00 USD and a min estimate of 15.40 USD. Watch PINS chart and read a more detailed Pinterest, Inc. stock forecast: see what analysts think of Pinterest, Inc. and suggest that you do with its stocks.

PINS reached its all-time high on Feb 16, 2021 with the price of 89.90 USD, and its all-time low was 10.10 USD and was reached on Mar 18, 2020. View more price dynamics on PINS chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

PINS stock is 33.96% volatile and has beta coefficient of 1.58. Track Pinterest, Inc. stock price on the chart and check out the list of the most volatile stocks — is Pinterest, Inc. there?

Today Pinterest, Inc. has the market capitalization of 12.52 B, it has decreased by −3.03% over the last week.

Yes, you can track Pinterest, Inc. financials in yearly and quarterly reports right on TradingView.

Pinterest, Inc. is going to release the next earnings report on Apr 23, 2026. Keep track of upcoming events with our Earnings Calendar.

PINS earnings for the last quarter are 0.67 USD per share, whereas the estimation was 0.67 USD resulting in a 0.52% surprise. The estimated earnings for the next quarter are 0.23 USD per share. See more details about Pinterest, Inc. earnings.

Pinterest, Inc. revenue for the last quarter amounts to 1.32 B USD, despite the estimated figure of 1.33 B USD. In the next quarter, revenue is expected to reach 964.62 M USD.

PINS net income for the last quarter is 277.07 M USD, while the quarter before that showed 92.11 M USD of net income which accounts for 200.81% change. Track more Pinterest, Inc. financial stats to get the full picture.

No, PINS doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 14, 2026, the company has 5.26 K employees. See our rating of the largest employees — is Pinterest, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Pinterest, Inc. EBITDA is 345.03 M USD, and current EBITDA margin is 8.17%. See more stats in Pinterest, Inc. financial statements.

Like other stocks, PINS shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Pinterest, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Pinterest, Inc. technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Pinterest, Inc. stock shows the sell signal. See more of Pinterest, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.