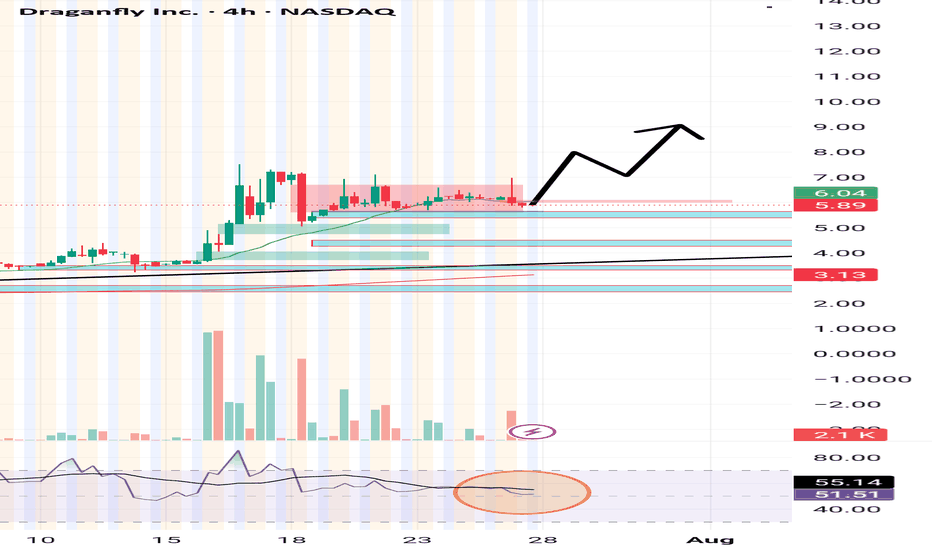

DPRO: in mid-term support NASDAQ:DPRO is pulling back toward the mid-term support zone. As long as price holds above 9–7.85, the trend structure outlined in the October update remains intact.

Chart:

Previously:

On support and trend structure (Oct 7):

DPRO shows good trend linearity, with price structure suggesting fu

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.77 USD

−9.64 M USD

4.56 M USD

5.40 M

About Draganfly Inc

Sector

Industry

CEO

Cameron Chell

Website

Headquarters

Saskatoon

Founded

1998

ISIN

CA26142Q3044

FIGI

BBG00QZ0QCM4

Draganfly, Inc. engages in the manufacture and sale of commercial unmanned aerial vehicle systems and software serving the public safety, agriculture, industrial inspections, security, mapping, and surveying markets. Its products include quad-copters, fixed wing aircrafts, ground based robots, hand held controllers, and software used for tracking, live streaming, and data collection. The firm also offers custom engineering, training, simulation consulting, as well as data and flight training services. The company was founded by Zenon Dragan and Christine Dragan in 1998 and is headquartered in Saskatoon, Canada.

Related stocks

$DPRO - Dragonfly, Inc - $8.60 Retest - $9.25 PTNASDAQ:DPRO broke out this morning, retesting the $8.60s before consolidating throughout the premarket. Based on current projections, we're targeting a $9.25 Price Target on the trade, look for a re-entry on that lower-level support trend.

This comes after NASDAQ:DPRO announced landing a US Arm

DPRO - DRAGONLY High Risk High RewardDragonfly is a very risky investment that has an amazing amount of upside potential.

A low price equity stock that is gaining market share in Canada as a major ecommerce delivery business.

As a resident of Canada its amazing to see how many of these vehicles have now appeared on our roads and de

DPRO falling wedge breakoutDPRO has broken out of a falling wedge on the weekly. Ticker will respond well to Trump's "Big Beautiful Bill" which includes over $30 billion for defense/military spending. The drone company is already making progress with US military projects and is setting up for a strong rally.

7/9/25 - $dpro - PSA... rotate7/9/25 :: VROCKSTAR :: NASDAQ:DPRO

PSA... rotate

- saw some d00d shilling this

- couldn't help myself

- this isn't a company with a future outside M&A or restructuring

- the meme move is simply what we've gotten in chitco's since the liquidity bottom in april

- you do you

- but friends don't let

Draganfly Inc. (DPRO) Stock Performance and Financial HighlightsDraganfly Inc. (DPRO) has experienced significant stock price fluctuations from October 2024 to December 2024. Here’s a summary of its recent performance:

October 2024: The stock opened at $0.88 on October 2, 2024, and traded mostly below $1 throughout the month. The price began to climb towards th

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of DPRO is 9.41 USD — it has decreased by −16.70% in the past 24 hours. Watch Draganfly Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Draganfly Inc. stocks are traded under the ticker DPRO.

DPRO stock has fallen by −16.27% compared to the previous week, the month change is a 88.08% rise, over the last year Draganfly Inc. has showed a 225.78% increase.

We've gathered analysts' opinions on Draganfly Inc. future price: according to them, DPRO price has a max estimate of 13.99 USD and a min estimate of 6.91 USD. Watch DPRO chart and read a more detailed Draganfly Inc. stock forecast: see what analysts think of Draganfly Inc. and suggest that you do with its stocks.

DPRO reached its all-time high on Feb 8, 2021 with the price of 417.50 USD, and its all-time low was 1.55 USD and was reached on Sep 10, 2024. View more price dynamics on DPRO chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

DPRO stock is 9.75% volatile and has beta coefficient of 3.29. Track Draganfly Inc. stock price on the chart and check out the list of the most volatile stocks — is Draganfly Inc. there?

Today Draganfly Inc. has the market capitalization of 52.98 M, it has increased by 14.07% over the last week.

Yes, you can track Draganfly Inc. financials in yearly and quarterly reports right on TradingView.

Draganfly Inc. is going to release the next earnings report on Nov 5, 2025. Keep track of upcoming events with our Earnings Calendar.

DPRO earnings for the last quarter are −0.45 USD per share, whereas the estimation was −0.39 USD resulting in a −15.09% surprise. The estimated earnings for the next quarter are −0.18 USD per share. See more details about Draganfly Inc. earnings.

Draganfly Inc. revenue for the last quarter amounts to 1.55 M USD, despite the estimated figure of 1.65 M USD. In the next quarter, revenue is expected to reach 1.68 M USD.

DPRO net income for the last quarter is −3.50 M USD, while the quarter before that showed −2.38 M USD of net income which accounts for −46.98% change. Track more Draganfly Inc. financial stats to get the full picture.

No, DPRO doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Oct 17, 2025, the company has 54 employees. See our rating of the largest employees — is Draganfly Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Draganfly Inc. EBITDA is −11.14 M USD, and current EBITDA margin is −215.25%. See more stats in Draganfly Inc. financial statements.

Like other stocks, DPRO shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Draganfly Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Draganfly Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Draganfly Inc. stock shows the buy signal. See more of Draganfly Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.