Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−65.42 M USD

7.28 M USD

97.88 M

About Red Cat Holdings, Inc.

Sector

Industry

CEO

Jeffrey M. Thompson

Website

Headquarters

San Juan

Founded

1984

ISIN

US75644T1007

FIGI

BBG000BQRDD7

Red Cat Holdings, Inc. provides products, services and solutions to the drone industry. It also engages in the provision of distributed data storage, analytics and services for the drone industry.The firm product include Dronebox, which is a blockchain technology that records, stores and analyzes flight data and information from a drone. It operates through the Enterprise Segment. The Enterprise Segment will focus on developing a hardware enabled software platform of services and solutions to government and commercial enterprises and the military. The company was founded by Jeffrey M. Thompson in February 1984 and is headquartered in San Juan, Puerto Rico.

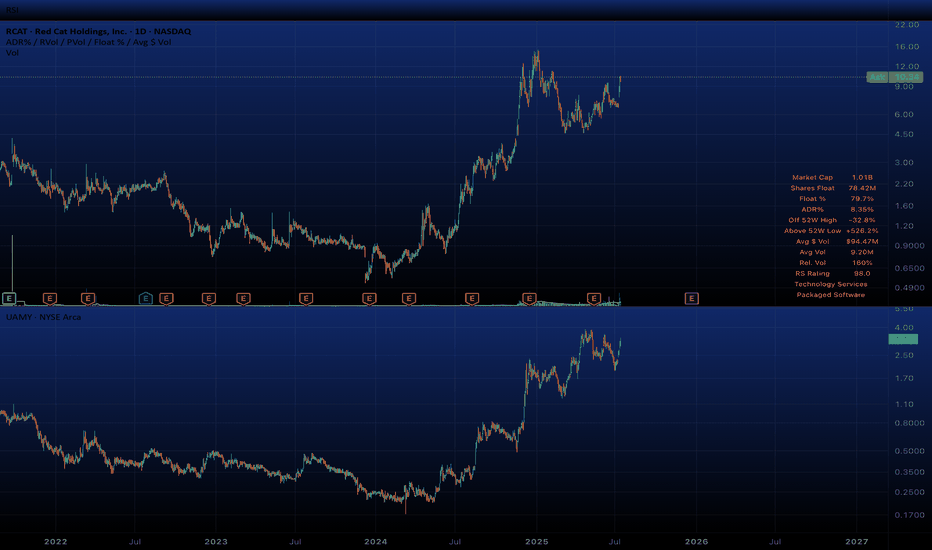

Related stocks

RCAT - STILL LONG AFTER FUZZY PANDAFuzzy Panda’s recent report makes several serious allegations about Red Cat Holdings, its contracts, and its products. However, much of the report is based on unverified or incomplete information, and several claims are contradicted or unsupported by public records and official statements.

1. U.S.

Red Cat Holdings, Inc. (RCAT) Expands Drone TechnologyRed Cat Holdings, Inc. (RCAT) provides drone products, technologies, and software solutions for defense, military, and commercial markets. Through its subsidiaries, the company develops drones and systems designed for tactical surveillance, training, and situational awareness. Red Cat’s growth is fu

Drones for everyone!The drone manufacturer celebrates its inclusion in the NATO catalog with a +30% surge.

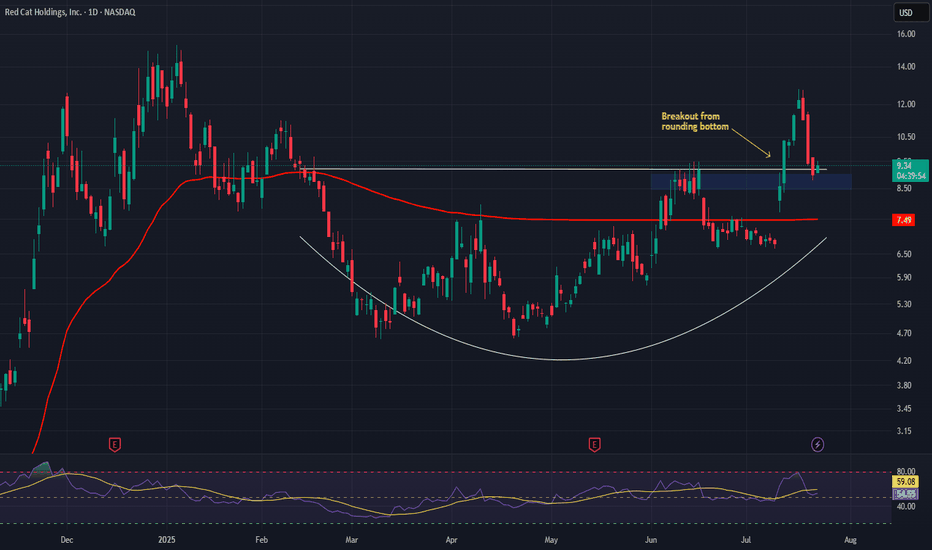

The price is heading toward its first breakout around $12, aiming for bullish confirmation at $12.80.

If the breakout is successful, the stock could easily reach new highs and possibly even double its current pr

RCAT - Red Cat Holdings - $12.81 PTNASDAQ:RCAT has been consolidating from it's $12.81 since reaching that price level back in July '25. It's been having issues breaking above the $10.12 Price Level of Resistance, but if it does and finds support, we could see this running back to retest the $12.81.

This comes after Red Cat Drones

Red Cat Holdings: Drone Technology Growth PotentialRed Cat Holdings NASDAQ:RCAT operates in the expanding drone technology sector, focusing on military, government, and consumer applications. Listed on NASDAQ since its April 2021 IPO, the company’s stock has risen about 200% over the past year, that shows to us rising interest in its contracts. Wi

Inside day after breaout base high volumeWhile closing the trade, I just realized I should have waited for the inside day break point for better confirmation. Unfortunately, I had already opened a trade.

Yesterday's high candle broke out of the base on high volume. Today, it's hitting resistance from the breakout on low volume.

Entry:

Red Cat Holdings (RCAT) – Soaring with Defense & Global DemandCompany Snapshot:

Red Cat NASDAQ:RCAT is an emerging UAV (drone) technology leader, rapidly scaling through defense-grade contracts, global expansion, and vertical integration.

Key Catalysts:

Defense Sector Traction 🎯

Recent U.S. DoD contract wins underscore RCAT’s credibility as a mission-crit

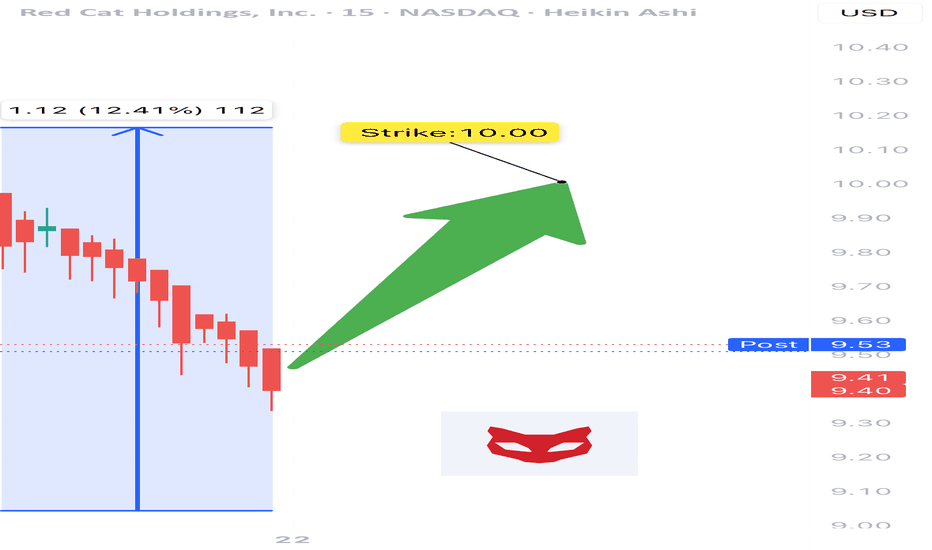

RCAT LEAP Options Play – Long-Term Bullish Setup (7/21/2025)

🚀 RCAT LEAP Options Play – Long-Term Bullish Setup (7/21/2025)

⚡ Weekly Momentum 🔼 | 💰 LEAP Premiums Cheap | ⚖️ Legal Overhang = Risk/Reward Opportunity

⸻

📊 Macro Sentiment Snapshot

📈 Weekly RSI: 60.7 – Momentum Building

📉 Monthly RSI: 38.7 – Neutral → Bullish bias forming

💤 Volatility (VIX 16.4

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RCAT is 11.47 USD — it has increased by 2.87% in the past 24 hours. Watch Red Cat Holdings, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Red Cat Holdings, Inc. stocks are traded under the ticker RCAT.

RCAT stock has fallen by −7.87% compared to the previous week, the month change is a 13.00% rise, over the last year Red Cat Holdings, Inc. has showed a 317.09% increase.

We've gathered analysts' opinions on Red Cat Holdings, Inc. future price: according to them, RCAT price has a max estimate of 18.00 USD and a min estimate of 15.00 USD. Watch RCAT chart and read a more detailed Red Cat Holdings, Inc. stock forecast: see what analysts think of Red Cat Holdings, Inc. and suggest that you do with its stocks.

RCAT reached its all-time high on Oct 9, 2025 with the price of 16.70 USD, and its all-time low was 0.35 USD and was reached on Mar 12, 2020. View more price dynamics on RCAT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RCAT stock is 10.65% volatile and has beta coefficient of 1.01. Track Red Cat Holdings, Inc. stock price on the chart and check out the list of the most volatile stocks — is Red Cat Holdings, Inc. there?

Today Red Cat Holdings, Inc. has the market capitalization of 1.32 B, it has decreased by −25.49% over the last week.

Yes, you can track Red Cat Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

Red Cat Holdings, Inc. is going to release the next earnings report on Apr 7, 2026. Keep track of upcoming events with our Earnings Calendar.

RCAT earnings for the last quarter are −0.15 USD per share, whereas the estimation was −0.12 USD resulting in a −26.48% surprise. The estimated earnings for the next quarter are −0.09 USD per share. See more details about Red Cat Holdings, Inc. earnings.

Red Cat Holdings, Inc. revenue for the last quarter amounts to 3.22 M USD, despite the estimated figure of 7.72 M USD. In the next quarter, revenue is expected to reach 8.45 M USD.

RCAT net income for the last quarter is −13.28 M USD, while the quarter before that showed −23.12 M USD of net income which accounts for 42.57% change. Track more Red Cat Holdings, Inc. financial stats to get the full picture.

No, RCAT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Oct 28, 2025, the company has 115 employees. See our rating of the largest employees — is Red Cat Holdings, Inc. on this list?

Like other stocks, RCAT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Red Cat Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Red Cat Holdings, Inc. technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Red Cat Holdings, Inc. stock shows the strong buy signal. See more of Red Cat Holdings, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.