Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12,250.00

0.00 USD

16.98 B USD

151.42 B USD

1.16 B

About Fannie Mae

Sector

Industry

CEO

Peter Akwaboah

Website

Headquarters

Washington

Founded

1938

ISIN

US3135866040

FIGI

BBG000006FL5

Federal National Mortgage Association is a government-sponsored company, which engages in the provision of liquidity for purchases of homes and financing of multifamily rental housing and refinancing existing mortgages. It operates through the Single-Family and Multifamily segments. The Single-Family segment offers liquidity to the mortgage market and increases the availability and affordability of housing for single families. The Multifamily segment includes guaranty fees on mortgages and on multifamily mortgage loans. The company was founded in 1938 and is headquartered in Washington, DC.

Related stocks

UGLY! FNMA Collapse! We Are in a Recession!The recession began in earnest in late 2022.

Subsequently, in March 2023, Silicone Valley Bank was wiped out; the feds took over and now here we are on the other side of the expansionary cycle. As it currently stands, banks are still sitting on hundreds of billions in unrealized losses.

This can

Fannie Mae (FNMA) AnalysisCompany Overview:

Fannie Mae OTC:FNMA , the government-sponsored enterprise (GSE), plays a critical role in supporting the U.S. housing market through mortgage liquidity and stability.

Key Catalysts:

Q2 2025 support: Provided $102B in liquidity, helping 381,000 households—with over 50% being fir

Trump will approve the FNMA privatization within 10 days.Trump works for Wall St. He plans his moves based on what Wall St wants.

He says stuff at certain times to get the markets to react in key times for Wall St.

The overall market is going to correct within the next 30 days.

FNMA just did a shakeout the last 3 weeks.

So Trump will time his announce

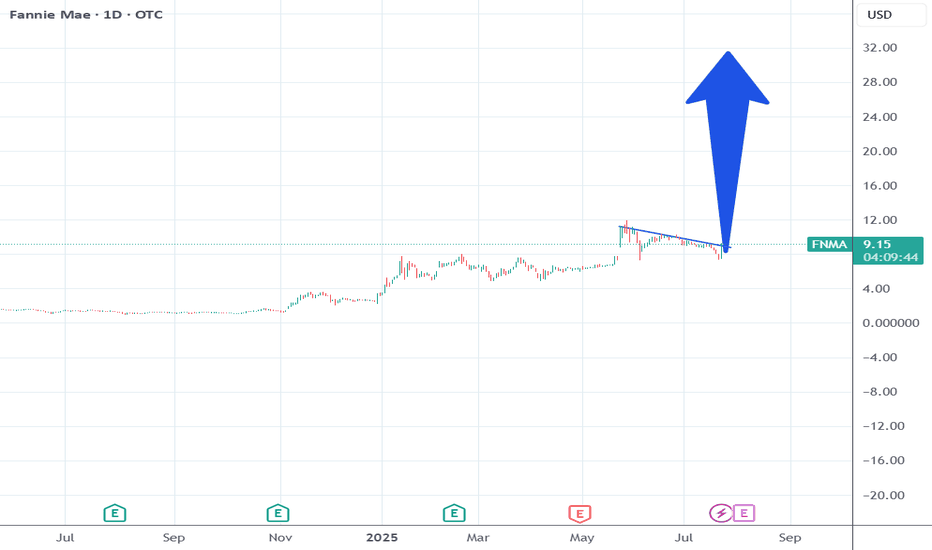

FNMA: great looking consolidation Price is showing impressive relative strength during recent market weakness with 3 weeks of tight closes

• W-bottom structure forming

• Fund accumulation increasing

• EPS estimates for 2025–26 rising sharply

• Regulative catalyst + Bill Ackman backing

Next mid-term resistance zone: 12–16

Macro/Wee

FNMA looks like a Crypto Meme coin...FNMA looks like a crypto meme coin that just got done with a long accumulation after going through a rug pull... except this rug is the 2007-2008 crash, and the accumulation time is 17 years!!! This is a big moment on the chart, I don't think this is any ordinary breakout. This is a monumental momen

FNMA near term resistance possibleFNMA daily update

Government has determined a path to release from conservatorship, if this happens then this stock will be relisted and be worth a lot more than the current value

At present the stock is nearing a short to medium term resistance level using elliot wave and fibonacci/ harmonics bet

FNMA Daily wave 5 projection3x potential ends of wave 5s,

Likely to see some significant moves up to finish a wave

It will be interesting to see what happens from there but I suspect there will be some retracement and possible complex correction for quite a while before pushing higher

The triangle is over a decade long... so

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

FNMA5077242

Federal National Mortgage Association 0.6% 25-NOV-2025Yield to maturity

11.60%

Maturity date

Nov 25, 2025

FNMA5078051

Federal National Mortgage Association 0.625% 25-NOV-2025Yield to maturity

5.40%

Maturity date

Nov 25, 2025

FNMA5076378

Federal National Mortgage Association 1.6% 16-NOV-2035Yield to maturity

5.07%

Maturity date

Nov 16, 2035

FNMA5066579

Federal National Mortgage Association 1.55% 26-OCT-2035Yield to maturity

5.01%

Maturity date

Oct 26, 2035

FNMA5841324

Federal National Mortgage Association 5.05% 26-JUN-2029Yield to maturity

5.01%

Maturity date

Jun 26, 2029

FNMA6005537

Federal National Mortgage Association 5.02% 13-FEB-2030Yield to maturity

5.00%

Maturity date

Feb 13, 2030

FNMA6004285

Federal National Mortgage Association 5.0% 21-FEB-2030Yield to maturity

5.00%

Maturity date

Feb 21, 2030

FNMA5040677

Federal National Mortgage Association 1.625% 24-AUG-2035Yield to maturity

4.99%

Maturity date

Aug 24, 2035

FNMA5986879

Federal National Mortgage Association 5.0% 16-JAN-2030Yield to maturity

4.98%

Maturity date

Jan 16, 2030

FNMA5977403

Federal National Mortgage Association 5.0% 09-JAN-2030Yield to maturity

4.98%

Maturity date

Jan 9, 2030

FNMA5093452

Federal National Mortgage Association 0.57% 29-DEC-2025Yield to maturity

4.96%

Maturity date

Dec 29, 2025

See all FNMFM bonds

Frequently Asked Questions

The current price of FNMFM is 24.00 USD — it has decreased by −2.04% in the past 24 hours. Watch Fannie Mae stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Fannie Mae stocks are traded under the ticker FNMFM.

FNMFM stock has fallen by −0.83% compared to the previous week, the month change is a −6.25% fall, over the last year Fannie Mae has showed a 92.00% increase.

FNMFM reached its all-time high on May 29, 2013 with the price of 28.10 USD, and its all-time low was 0.01 USD and was reached on Apr 19, 2012. View more price dynamics on FNMFM chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

FNMFM stock is 2.08% volatile and has beta coefficient of 0.22. Track Fannie Mae stock price on the chart and check out the list of the most volatile stocks — is Fannie Mae there?

Today Fannie Mae has the market capitalization of 12.52 B, it has increased by 26.73% over the last week.

Yes, you can track Fannie Mae financials in yearly and quarterly reports right on TradingView.

Fannie Mae is going to release the next earnings report on Feb 12, 2026. Keep track of upcoming events with our Earnings Calendar.

FNMFM earnings for the last quarter are 0.65 USD per share, whereas the estimation was 0.68 USD resulting in a −3.97% surprise. The estimated earnings for the next quarter are 0.65 USD per share. See more details about Fannie Mae earnings.

Fannie Mae revenue for the last quarter amounts to 7.31 B USD, despite the estimated figure of 7.70 B USD. In the next quarter, revenue is expected to reach 7.39 B USD.

FNMFM net income for the last quarter is 3.86 B USD, while the quarter before that showed 3.32 B USD of net income which accounts for 16.34% change. Track more Fannie Mae financial stats to get the full picture.

No, FNMFM doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Nov 9, 2025, the company has 8.2 K employees. See our rating of the largest employees — is Fannie Mae on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Fannie Mae EBITDA is 148.74 B USD, and current EBITDA margin is 94.37%. See more stats in Fannie Mae financial statements.

Like other stocks, FNMFM shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Fannie Mae stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Fannie Mae technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Fannie Mae stock shows the buy signal. See more of Fannie Mae technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.