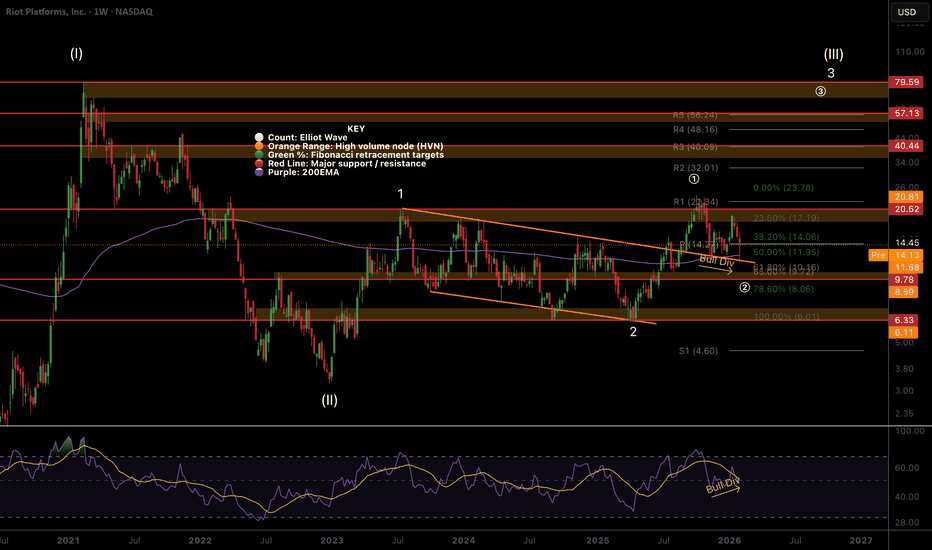

RIOT: Looking for bottoming formationThe overall equity and crypto market crash didn't do any favor to RIOT stock. Despite a lot of good things happening for the company, the short-term headwinds are propelling much of the selling. The rapid selling across the markets has a strong signature of capitulation. Which means, I am now lookin

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.45 USD

109.40 M USD

376.66 M USD

341.38 M

About Riot Platforms, Inc.

Sector

Industry

CEO

Jason Les

Website

Headquarters

Castle Rock

Founded

2000

IPO date

Jan 23, 2003

Identifiers

3

ISIN US7672921050

Riot Platforms, Inc. is a bitcoin mining company, which engages in the provision of special cryptocurrency mining computers. It invests in Verady, Coinsquare, and Tess. It operates through the Bitcoin Mining and Engineering segments. The Bitcoin Mining segment focuses on maximizing ability to successfully mine Bitcoin by growing hash rate. The Engineering segment designs and manufactures power distribution equipment and custom engineered electrical products that provides them the ability to vertically integrate many of the critical electrical components and engineering service. The company was founded on July 24, 2000 and is headquartered in Castle Rock, CO.

Related stocks

RIOT entering Wave (3) of 3 of III?This will be crazy if so...NASDAQ:RIOT has been trying to go on a tear for months, but keeps getting knocked back by broader economic and BTC uncertainty.

Price is testing the weekly 200EMA and previous range trend-line with RSI printing bullish divergence at the EQ, a bullish sign. Price recovered the weekly pivot, leaving

Riot Platforms at $15.47: Oversold Setup Points to a Bounce ThiCurrent Price: 15.47 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 56%(Price is sitting near a widely watched support zone with oversold momentum signals, while trader commentary suggests dip-buying interest despite mixed broader sentiment.)

Targets

Target 1: 16.30

RIOT, Wave III or wave B?NASDAQ:RIOT is following Bitcoin down this morning after hitting my take profit #1 target in the High Volume Node resistance, $18.7. Stop loss is at break even to protect the win as part of my strategy.

Th Elliot wave now looks like a III wave ABC corrective structure that completed a larger wave

RIOT Short-term analysis | Trading and expectationsNASDAQ:RIOT

🎯 Price completed wave II of 3, reclaiming the daily 200EMA and pivot. The next challenge is to overcome the High Volume Node resistance. The uptrend is strong.

📈 Daily RSI hit oversold with bullish divergence and has room to grow.

👉 Continued downside has a target of the High Volume

Riot Announces Fee Simple Acquisition of Land with AMDRiot Platforms, Inc. (NASDAQ: RIOT) is pleased to announce a series of transformative transactions that firmly establish the Company’s rapidly scaling data center business, including:

The fee simple acquisition of 200 acres of land at Rockdale currently occupied by Riot (the “Rockdale Site”) for to

RIOT Macro analysis | The bigger picture | Long-term holdersNASDAQ:RIOT

🎯 Riot tested the upper boundary trend-line after its breakout. Expected behaviour. The uptrend is intact with price above the weekly 200EMA and pivot. Price appears to be in a wave 3 with a target of $40, the R£ weekly pivot.

📈 Weekly RSI has hidden bullish divergence at the EQ

👉 An

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RIOT is 14.25 USD — it has decreased by −4.53% in the past 24 hours. Watch Riot Platforms, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Riot Platforms, Inc. stocks are traded under the ticker RIOT.

RIOT stock has risen by 3.59% compared to the previous week, the month change is a −15.19% fall, over the last year Riot Platforms, Inc. has showed a 29.85% increase.

We've gathered analysts' opinions on Riot Platforms, Inc. future price: according to them, RIOT price has a max estimate of 42.00 USD and a min estimate of 20.00 USD. Watch RIOT chart and read a more detailed Riot Platforms, Inc. stock forecast: see what analysts think of Riot Platforms, Inc. and suggest that you do with its stocks.

RIOT reached its all-time high on Oct 29, 2007 with the price of 3,638.40 USD, and its all-time low was 0.51 USD and was reached on Mar 18, 2020. View more price dynamics on RIOT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RIOT stock is 8.93% volatile and has beta coefficient of 2.19. Track Riot Platforms, Inc. stock price on the chart and check out the list of the most volatile stocks — is Riot Platforms, Inc. there?

Today Riot Platforms, Inc. has the market capitalization of 5.50 B, it has decreased by −2.41% over the last week.

Yes, you can track Riot Platforms, Inc. financials in yearly and quarterly reports right on TradingView.

Riot Platforms, Inc. is going to release the next earnings report on Mar 4, 2026. Keep track of upcoming events with our Earnings Calendar.

RIOT earnings for the last quarter are 0.26 USD per share, whereas the estimation was −0.07 USD resulting in a 446.84% surprise. The estimated earnings for the next quarter are −0.21 USD per share. See more details about Riot Platforms, Inc. earnings.

Riot Platforms, Inc. revenue for the last quarter amounts to 180.20 M USD, despite the estimated figure of 172.20 M USD. In the next quarter, revenue is expected to reach 159.93 M USD.

RIOT net income for the last quarter is 104.48 M USD, while the quarter before that showed 219.45 M USD of net income which accounts for −52.39% change. Track more Riot Platforms, Inc. financial stats to get the full picture.

No, RIOT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 12, 2026, the company has 783 employees. See our rating of the largest employees — is Riot Platforms, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Riot Platforms, Inc. EBITDA is −46.33 M USD, and current EBITDA margin is −40.62%. See more stats in Riot Platforms, Inc. financial statements.

Like other stocks, RIOT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Riot Platforms, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Riot Platforms, Inc. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Riot Platforms, Inc. stock shows the buy signal. See more of Riot Platforms, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.