Singapore Technologies Engineering Ltd.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.19 USD

514.05 M USD

8.25 B USD

1.52 B

About Singapore Technologies Engineering Ltd

Sector

Industry

CEO

Sy Feng Chong

Website

Headquarters

Singapore

Founded

1967

IPO date

Dec 8, 1997

Identifiers

2

ISIN SG1F60858221

Singapore Technologies Engineering Ltd. is an investment holding company, which engages providing solutions and services in the aerospace, electronics, land systems, and marine sectors. It operates through the following business segments: Commercial Aerospace, Urban Solutions and Satcom, and Defence and Public Security. The Commercial Aerospace segment refers to the airframe, engines, and components maintenance. The Urban Solutions and Satcom segment relate to smart mobility, smart utilities, and infrastructure. The Defence and Public Security segment is involved in defence, public safety and security, critical information infrastructure solutions, and others. The company was founded in 1967 and is headquartered in Singapore.

Related stocks

ST Engineering Break $4 - Is it a Good Buy?ST Engineering's share price finally breaks $4, records a 52-week high at $4.04 today.

From what I saw on Moomoo forum. The break out signals has captured investor attention excited them for a trading opportunity.

In fundamental speaking, ST Engineering has demonstrated robust performance. Its an

S63 - new trend formation - possible bullish biasTarget as shown - with stop loss indication.

Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

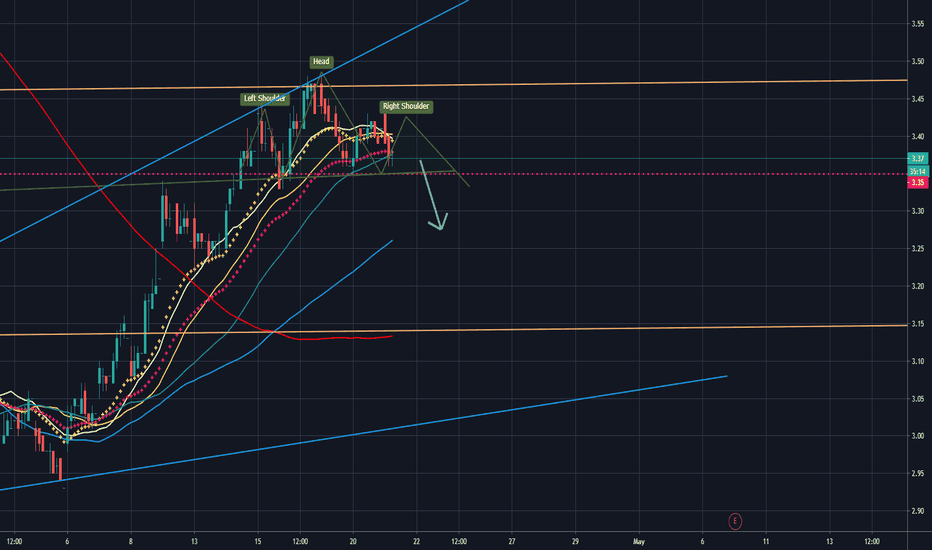

S63 - Is it possible in formation of Head & Shoulder?With the current oil crisis, market is in sort of jitters right now... this counter seems to follow the down trend (possibly) as well. Will the head & shoulder formation plays out in short term duration? or will it break out of the current formation and become bullish?

Feel free to share your thou

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

TMJC5405185

STE TransCore Holdings, Inc. 3.75% 05-MAY-2032Yield to maturity

4.24%

Maturity date

May 5, 2032

SEUS5596916

STE TransCore Holdings, Inc. 4.125% 23-MAY-2026Yield to maturity

4.20%

Maturity date

May 23, 2026

TMJC6073261

ST Engineering RHQ Ltd. 4.25% 08-MAY-2030Yield to maturity

4.00%

Maturity date

May 8, 2030

TMJC5405183

STE TransCore Holdings, Inc. 3.375% 05-MAY-2027Yield to maturity

3.61%

Maturity date

May 5, 2027

See all SGGKF bonds

Frequently Asked Questions

The current price of SGGKF is 8.15 USD — it has decreased by −1.30% in the past 24 hours. Watch Singapore Technologies Engineering Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Singapore Technologies Engineering Ltd. stocks are traded under the ticker SGGKF.

SGGKF stock has risen by 5.23% compared to the previous week, the month change is a 13.99% rise, over the last year Singapore Technologies Engineering Ltd. has showed a 111.14% increase.

We've gathered analysts' opinions on Singapore Technologies Engineering Ltd. future price: according to them, SGGKF price has a max estimate of 9.58 USD and a min estimate of 5.90 USD. Watch SGGKF chart and read a more detailed Singapore Technologies Engineering Ltd. stock forecast: see what analysts think of Singapore Technologies Engineering Ltd. and suggest that you do with its stocks.

SGGKF reached its all-time high on Jan 22, 2026 with the price of 7.84 USD, and its all-time low was 1.09 USD and was reached on Jun 1, 2020. View more price dynamics on SGGKF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SGGKF stock is 3.86% volatile and has beta coefficient of 0.68. Track Singapore Technologies Engineering Ltd. stock price on the chart and check out the list of the most volatile stocks — is Singapore Technologies Engineering Ltd. there?

Today Singapore Technologies Engineering Ltd. has the market capitalization of 24.74 B, it has increased by 2.00% over the last week.

Yes, you can track Singapore Technologies Engineering Ltd. financials in yearly and quarterly reports right on TradingView.

Singapore Technologies Engineering Ltd. is going to release the next earnings report on Feb 27, 2026. Keep track of upcoming events with our Earnings Calendar.

SGGKF net income for the last half-year is 316.66 M USD, while the previous report showed 267.71 M USD of net income which accounts for 18.28% change. Track more Singapore Technologies Engineering Ltd. financial stats to get the full picture.

Singapore Technologies Engineering Ltd. dividend yield was 3.65% in 2024, and payout ratio reached 75.45%. The year before the numbers were 4.11% and 85.02% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Singapore Technologies Engineering Ltd. EBITDA is 1.38 B USD, and current EBITDA margin is 14.64%. See more stats in Singapore Technologies Engineering Ltd. financial statements.

Like other stocks, SGGKF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Singapore Technologies Engineering Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Singapore Technologies Engineering Ltd. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Singapore Technologies Engineering Ltd. stock shows the strong buy signal. See more of Singapore Technologies Engineering Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.