Sime Darby Property Berhad

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.0181 USD

112.14 M USD

949.20 M USD

5.45 B

About Sime Darby Property Bhd.

Sector

Industry

CEO

Azmir Merican bin Azmi Merican

Website

Headquarters

Petaling Jaya

Founded

1973

IPO date

Nov 30, 2017

Identifiers

2

ISIN MYL5288OO005

Sime Darby Property Bhd. is an investment holding company. It operates through the following segments: Property Development, Investment and Asset Management, and Leisure. The Property Development segment includes development of residential, commercial, and industrial properties. The Investment and Asset Management segment focuses on leasing properties and providing assets and management services. The Leisure segment is involved in the provision of golf, hotel, and other recreational facilities and services. The company was founded on September 15, 1973 and is headquartered in Petaling Jaya, Malaysia.

Related stocks

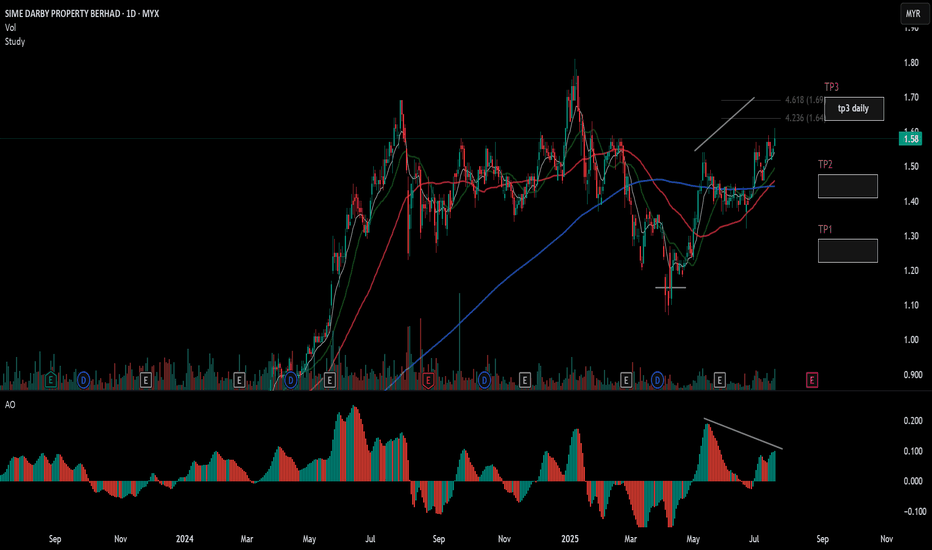

SimepropBullBear AlgoSystem has identified potential bullish momentum. Trading plan as below:

🛟 Support: 1.45

🛑 Stop Loss (SL): 1.38

✅ Idea Entry: 1.73

🎯 Target Price (TP1): 2.08

🎯 Target Price (TP2): 2.43

Trading success is 80-90% about risk management. Stay disciplined, size your positions wisely, a

SIMEPROP another fund manager's favourite?Looking at the chart for Sime Darby Property Berhad, here's my analysis:

Current Price Action:

- Trading at RM1.37, down 2.14%

- Currently forming what appears to be a triangle pattern

- Strong uptrend from late 2023 into early 2024

Technical Analysis:

1. Elliott Wave Pattern:

- Appears to be in W

SIMEPROP awaiting breakout to the upside MYX:SIMEPROP has seen some very sideways ranging action in recent weeks.

Targeting an initial area of RM0.78 IF prices are able to break above the current RM0.665 resistance area.

These are just my views and in no way represent any buy/sell call or recommendation. Information shared are meant fo

CUP AND HANDLE SETUP SIMEPROPSector : property.SIME DARBY.Big company but historically not a good both fundamental and technical company.However,lately showing improvement of quarter report.Maybe can be a turnaround company.Currently shows a very nice pattern of cup and handle.Wait for upward breakout of handle (square) with a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of SIMEF is 0.2755 USD — it has decreased by −10.23% in the past 24 hours. Watch Sime Darby Property Berhad stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange Sime Darby Property Berhad stocks are traded under the ticker SIMEF.

We've gathered analysts' opinions on Sime Darby Property Berhad future price: according to them, SIMEF price has a max estimate of 0.59 USD and a min estimate of 0.38 USD. Watch SIMEF chart and read a more detailed Sime Darby Property Berhad stock forecast: see what analysts think of Sime Darby Property Berhad and suggest that you do with its stocks.

SIMEF reached its all-time high on Jun 17, 2025 with the price of 0.3319 USD, and its all-time low was 0.000001 USD and was reached on Jan 13, 2020. View more price dynamics on SIMEF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SIMEF stock is 11.40% volatile and has beta coefficient of 0.93. Track Sime Darby Property Berhad stock price on the chart and check out the list of the most volatile stocks — is Sime Darby Property Berhad there?

Today Sime Darby Property Berhad has the market capitalization of 2.62 B, it has increased by 0.29% over the last week.

Yes, you can track Sime Darby Property Berhad financials in yearly and quarterly reports right on TradingView.

Sime Darby Property Berhad is going to release the next earnings report on Mar 4, 2026. Keep track of upcoming events with our Earnings Calendar.

SIMEF net income for the last quarter is 39.89 M USD, while the quarter before that showed 34.01 M USD of net income which accounts for 17.30% change. Track more Sime Darby Property Berhad financial stats to get the full picture.

Sime Darby Property Berhad dividend yield was 1.78% in 2024, and payout ratio reached 40.65%. The year before the numbers were 4.00% and 41.67% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 14, 2026, the company has 1.64 K employees. See our rating of the largest employees — is Sime Darby Property Berhad on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Sime Darby Property Berhad EBITDA is 224.31 M USD, and current EBITDA margin is 21.89%. See more stats in Sime Darby Property Berhad financial statements.

Like other stocks, SIMEF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Sime Darby Property Berhad stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Sime Darby Property Berhad technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Sime Darby Property Berhad stock shows the buy signal. See more of Sime Darby Property Berhad technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.