How to turn $100 into $1,000,000 through trading?

The answer — You can’t..

Yes, theoretically you can imagine a chain of unbelievable coincidences, aggressive risk-taking, and pure luck. But in reality, that path almost always ends with a blown account long before any meaningful growth happens.

However, most people who enter this field genuinely

S&P 500 Index

No trades

About S&P 500 Index

Standard and Poor's 500 Index is a capitalization-weighted stock market index measuring the performance of 500 large publicly traded companies in the United States. This index covers a wide range of industries, including technology, healthcare, energy, and finance. It serves as a benchmark for the overall health of the U.S. stock market, as well as a reflection of the country's economic strength.

Substantial gains in the S&P 500 are often interpreted as positive signals for the economy, while losses can be seen as indicators of potential trouble. Investors use this index as a barometer for their own portfolios and to assess the performance of individual stocks. The S&P 500 index plays a vital role in the financial world and is closely watched by analysts and policymakers.

Substantial gains in the S&P 500 are often interpreted as positive signals for the economy, while losses can be seen as indicators of potential trouble. Investors use this index as a barometer for their own portfolios and to assess the performance of individual stocks. The S&P 500 index plays a vital role in the financial world and is closely watched by analysts and policymakers.

Related indices

S&P 500: Late-Cycle Signals Are BuildingThe S&P 500 is still holding near highs, but under the surface, things are starting to weaken. Both the chart and the economy are sending warning signs that are easy to miss if you only look at price.

Weekly Bearish Divergence

On the weekly chart, price made higher highs, but momentum did not .

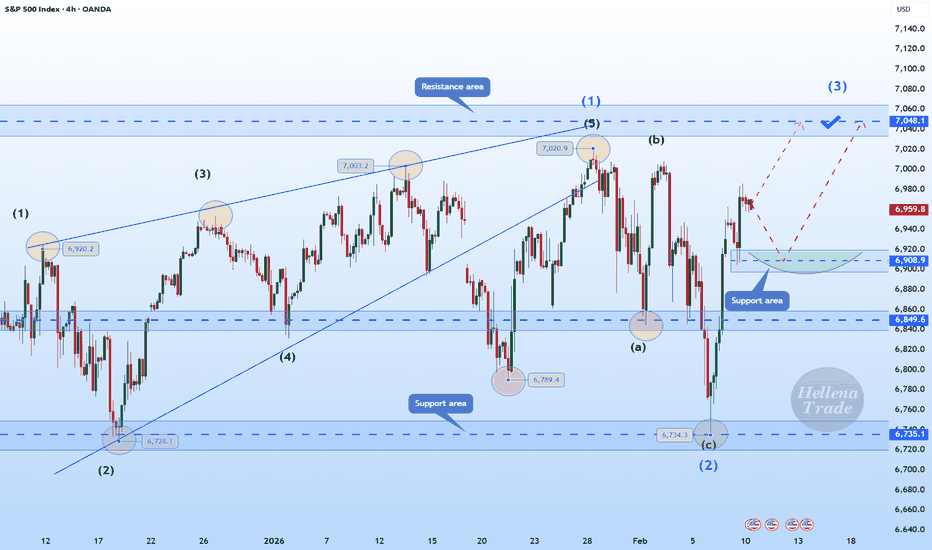

Hellena | SPX500 (4H): LONG to 7048 area (MAX of wave "1").Colleagues, the price continues to move in an upward five-wave impulse.

At the moment, I am considering a movement in wave “3” of medium order to the area of 7048 (the main thing here is the update of the maximum of wave “1”).

In principle, everything is quite simple in terms of wave construction, a

The Psychology of Holding Winners🧠 The Psychological Paradox of Trading

There is a paradox at the center of trading behavior that almost every trader experiences but very few truly deconstruct.

🟢 When a position is profitable, the urge to close it becomes overwhelming.

🔴 When a position is losing, the urge to “give it more time”

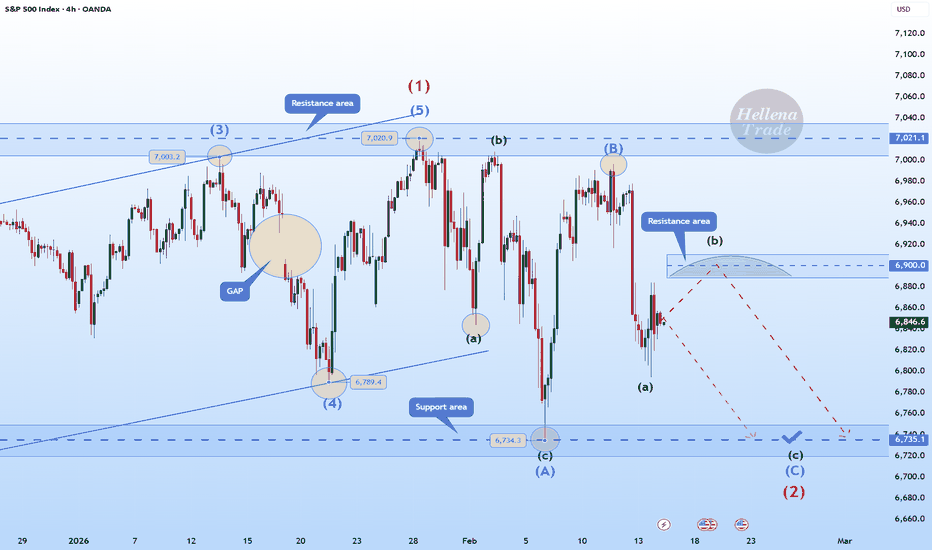

Hellena | SPX500 (4H): SHORT to support area of 6735.Colleagues, it seems that we are facing a combined correction, which means that wave “2” is not yet complete and we should expect a price decline to the support area of 6735, where I think we should take profits.

As part of a small “abc” correction, it is possible to reach the 6900 area before the

US500: Eyes on 7,050 & 7,100 TargetsUS500: Eyes on 7,050 & 7,100 Targets

US500 is consolidating just beneath a well-defined intraday resistance zone around 6,990–7,000 after a strong impulsive move off the recent swing low.

Price has built a classic flag pattern that often precedes expansion.

A movement above the 6990 area would

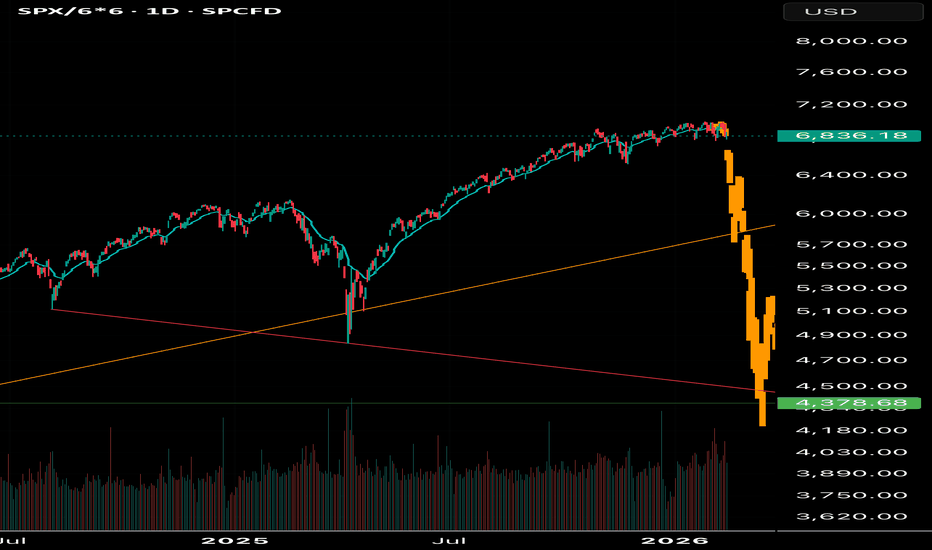

SPX - Covid style decline to repeat?It might be crazy idea, but SPX could experience another Covid 2020 style decline starting next week.

In late December I posted idea of a 35%+ decline in the market in 1H of 2026 (linked below), highlighting rotation away from growth/risk to value/safe assets. I anticipated few more weeks of chop

S&P 500: Retest Done — Next Push to New ATH?The S&P 500 index ( SP:SPX ) completed its downward movement as I expected in the previous idea (full target) .

Currently, the S&P 500 index has managed to break the resistance zone($6,956-$6,918) and is completing a pullback to this zone.

In terms of Elliott wave theory, it seems that the S&P 5

S&P500 is it about to crash due to a Global Liquidity peak??S&P500 (SPX) has been rising non-stop within its 3-year Bull Cycle following the October 2022 market bottom of the 2022 Inflation Crisis Bear Cycle. Such Bear Cycles are systemic and take place periodically on the long-term scale. Since the 2009 bottom of the U.S. Housing Crisis, those Bear Cycles h

General Market Conditions: What’s That and Why Should You Care?(It’s Jesse Livermore’s best friend — and maybe yours too.)

📖 A Lesson from an Old Tape Reader

In Reminiscences of a Stock Operator , a top read for traders , the legendary speculator Jesse Livermore repeatedly returns to one idea: before you bet big, understand the general market conditions.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's value movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of S&P 500 Index is 6,836.18 USD — it has risen by 0.05% in the past 24 hours. Track the index more closely on the S&P 500 Index chart.

S&P 500 Index reached its highest quote on Jan 28, 2026 — 7,002.28 USD. See more data on the S&P 500 Index chart.

The lowest ever quote of S&P 500 Index is 2.73 USD. It was reached on Jun 1, 1877. See more data on the S&P 500 Index chart.

S&P 500 Index value has increased by 0.29% in the past week, since last month it has shown a −1.46% decrease, and over the year it's increased by 12.80%. Keep track of all changes on the S&P 500 Index chart.

The top companies of S&P 500 Index are NASDAQ:NVDA, NASDAQ:AAPL, and NASDAQ:GOOG — they can boast market cap of 4.44 T USD, 3.76 T USD, and 3.70 T USD accordingly.

The highest-priced instruments on S&P 500 Index are NYSE:NVR, NASDAQ:BKNG, and NYSE:AZO — they'll cost you 7,507.43 USD, 4,140.60 USD, and 3,858.16 USD accordingly.

The champion of S&P 500 Index is NASDAQ:SNDK — it's gained 1.69 K% over the year.

The weakest component of S&P 500 Index is NASDAQ:FISV — it's lost −74.07% over the year.

S&P 500 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy S&P 500 Index futures or funds or invest in its components.

The S&P 500 Index is comprised of 503 instruments including NASDAQ:NVDA, NASDAQ:AAPL, NASDAQ:GOOG and others. See the full list of S&P 500 Index components to find more opportunities.