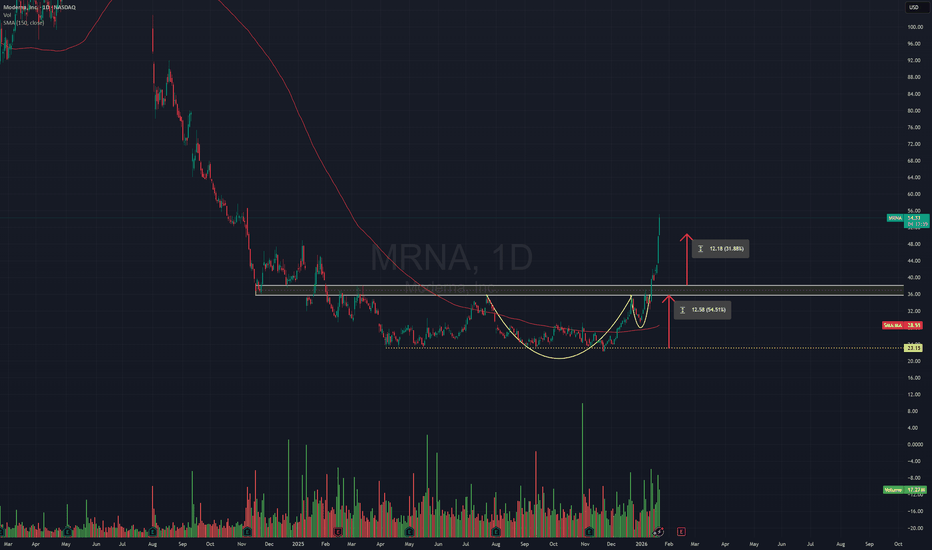

The Case for ModernaModerna ( NASDAQ:MRNA ) looks to be a rebounding stock specializing in RNA therapeutics. Their net income and net margin looks to be in the positive for next earnings by Feb 13th. Their Debt-To-Equity ratio is only 4.2% as per Forbes ( www.forbes.com ) compared to other S&P stocks. Their stock loo

Moderna, Inc.

No trades

Key facts today

Moderna is scheduled to report its earnings on February 13, 2026, as part of a series of corporate earnings announcements.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−6.870 EUR

−3.44 B EUR

3.13 B EUR

357.38 M

About Moderna, Inc.

Sector

Industry

CEO

Stéphane Bancel

Website

Headquarters

Cambridge

Founded

2010

IPO date

Dec 7, 2018

Identifiers

3

ISIN US60770K1079

Moderna, Inc. engages in the development of transformative medicines based on messenger ribonucleic acid. The firm's product pipeline includes the following modalities: prophylactic vaccines, cancer vaccines, intratumoral immuno-oncology, localized regenerative therapeutics, systemic secreted therapeutics, inhaled pulmonary therapeutics and systemic intracellular therapeutics. It operates through the following geographical segments: United States, Europe, and Rest of World. The company was founded by Noubar B. Afeyan, Robert S. Langer, Jr., Derrick J. Rossi, and Kenneth R. Chien in 2010 and is headquartered in Cambridge, MA.

Related stocks

MRNA Story - On A Smaller ScaleIn continuation of the previous idea, I wanted to cover the shorter time frame move on $NASDAQ:MRNA.

Really, this is a more simple analysis as the base is clearly set on the weekly chart. I should note I have analyzed the consolidation on the 2-Week time period. The 2-Week time period does also giv

MRNA: The Moment We Have Been Waiting ForNASDAQ:MRNA has been on a strong run lately. The stock has pushed up into the low 40s after spending a lot of time stuck in the 20s and 30s, and it is now trading near a new one‑year high with price riding above the main moving averages. This move comes after the company raised its 2025 revenue for

Breaking; Moderna, Inc. (NASDAQ: $MRNA) Spikes 15%Shares of Moderna, Inc. (NASDAQ: NASDAQ:MRNA ) saw a noteworthy uptick of 15% in Wednesday's trading session extending gains to Thursday's premarket session surging 4.34%

Shares of NASDAQ:MRNA has already broke the ceiling of a falling wedge. eyeing a 100% surge should market conditions remain

More than doubleAfter the previous idea, which concluded successfully, I am coming back to Moderna, which is included among the BIOTECH stocks I am following most closely.

Some background information:

Moderna is first and foremost a research‑driven biotechnology company, not a traditional, mature pharmaceutical fi

Double bottom with potential doubling!The price appears to have found a bottom at $23.2, and the high trading volume suggests growing interest from major investors.

The current pattern is a double bottom with a neckline at $35.6 (black line). A breakout above this level could target the resistance at $48.9 (blue line).

On Friday, the

Moderna - Easy MoneyWe continue the idea from the previous post, where the initial targets have already been reached.

At the moment, price action in Moderna shares is correcting the fifth wave formed during the downside move.

The structure suggests a developing bullish impulse, and the upward move is likely to co

Moderna - Upside PotentialSince August 2021, Moderna’s stock has been in a downtrend.

The latest decline started in May 2024 and ended in April 2025, dropping from 170 to 23 .

Since April 2025, a corrective move has begun for one of the sub-waves.

This move is nearly complete, with final targets at 36 -> 38 .

This do

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 0QF is 34.840 EUR — it has increased by 0.16% in the past 24 hours. Watch Moderna, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Moderna, Inc. stocks are traded under the ticker 0QF.

0QF stock has fallen by −2.20% compared to the previous week, the month change is a 20.06% rise, over the last year Moderna, Inc. has showed a 8.52% increase.

We've gathered analysts' opinions on Moderna, Inc. future price: according to them, 0QF price has a max estimate of 114.25 EUR and a min estimate of 14.39 EUR. Watch 0QF chart and read a more detailed Moderna, Inc. stock forecast: see what analysts think of Moderna, Inc. and suggest that you do with its stocks.

0QF stock is 2.59% volatile and has beta coefficient of 1.40. Track Moderna, Inc. stock price on the chart and check out the list of the most volatile stocks — is Moderna, Inc. there?

Today Moderna, Inc. has the market capitalization of 13.56 B, it has decreased by −3.53% over the last week.

Yes, you can track Moderna, Inc. financials in yearly and quarterly reports right on TradingView.

Moderna, Inc. is going to release the next earnings report on Feb 13, 2026. Keep track of upcoming events with our Earnings Calendar.

0QF earnings for the last quarter are −0.43 EUR per share, whereas the estimation was −1.60 EUR resulting in a 72.79% surprise. The estimated earnings for the next quarter are −2.17 EUR per share. See more details about Moderna, Inc. earnings.

Moderna, Inc. revenue for the last quarter amounts to 865.83 M EUR, despite the estimated figure of 784.75 M EUR. In the next quarter, revenue is expected to reach 540.78 M EUR.

0QF net income for the last quarter is −170.44 M EUR, while the quarter before that showed −700.35 M EUR of net income which accounts for 75.66% change. Track more Moderna, Inc. financial stats to get the full picture.

No, 0QF doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 9, 2026, the company has 5.8 K employees. See our rating of the largest employees — is Moderna, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Moderna, Inc. EBITDA is −2.77 B EUR, and current EBITDA margin is −116.07%. See more stats in Moderna, Inc. financial statements.

Like other stocks, 0QF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Moderna, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Moderna, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Moderna, Inc. stock shows the sell signal. See more of Moderna, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.