Key facts today

Citigroup has maintained its 'Buy' rating for Live Nation Entertainment (LYV) while reducing its price target from $195.00 to $181.00 per share.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.02 EUR

616.50 M EUR

22.37 B EUR

155.30 M

About Live Nation Entertainment, Inc.

Sector

Industry

CEO

Michael Rapino

Website

Headquarters

Beverly Hills

Founded

1996

ISIN

US5380341090

FIGI

BBG000TQYVP7

Live Nation Entertainment, Inc. operates as an entertainment company. The firm engages in producing, marketing, and selling live concerts for artists via its global concert pipe. It operates through the following segments: Concerts, Sponsorship and Advertising, and Ticketing. The Concerts segment is involved in the promotion of live music events in owned or operated venues and in rented third-party venues. The Sponsorship and Advertising segment manages the development of strategic sponsorship programs in addition to the sale of international, national, and local sponsorships and placement of advertising such as signage, promotional programs, rich media offerings, including advertising associated with live streaming and music-related content, and ads across its distribution network of venues, events, and websites. The Ticketing segment is involved in the management of the global ticketing operations, including providing ticketing software and services to clients, and consumers with a marketplace, both online and mobile, for tickets and event information. The Ticketing segment is an agency business that sells tickets for events on behalf of its clients and retains a portion of the service charge as its fee. The company was founded in 1996 and is headquartered in Beverly Hills, CA.

Related stocks

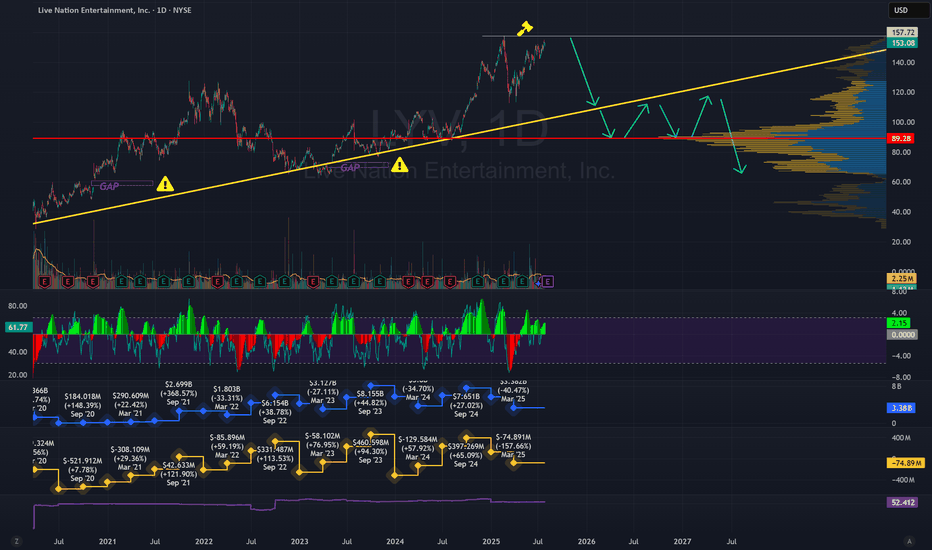

LYV Technical Analysis: Bullish Continuation Pattern SignalsTechnical Analysis:

LYV is exhibiting a strong bullish structure on the daily timeframe. Following a period of consolidation within a larger uptrend, the price has initiated a breakout from a symmetrical triangle pattern. This technical development suggests a high probability of trend continuation,

LIVE NATIONS Stock Chart Fibonacci Analysis 042725Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 127/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

WATCH $LYV The upward trend is positiveFundamental Analysis

Fundamental analysis focuses on the financial health, business model, and external market factors that influence a stock's value.

Company Profile

Live Nation Entertainment (LYV) is a global leader in live entertainment and ticket sales, with Ticketmaster as a subsidiary.

It ge

LYV spikes to $140, then pulls back to $120MODs have suggested that I provide more detail about the picks I make.

Sorry. I'm not as verbose as y'all, and I don't like things to be complicated.

My trading plan is very simple.

I buy or sell at top & bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's wh

LYV extremely stretched to the upsideUsing the MFI indicator on the 4D chart, you can see that past OB readings (orange boxes) were highly correlated with price corrections. I expect a correction soon, but it might not happen until after Trump is inaugurated. I would express this thesis with an out-of-the-money put with expiration betw

LYV – Bullish Breakout Above The White Resistance ZoneNYSE:LYV has been in a bullish uptrend since Feb 5, 2024 and is continuing to show some strength. I’m not interested in making a late entry here, but the key target is the previous $125.90 all time highs at the green trendline. I think LYV will eventually form a new all time high, but I’m not inter

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

LYV4987774

Live Nation Entertainment, Inc. 6.5% 15-MAY-2027Yield to maturity

5.78%

Maturity date

May 15, 2027

LYV5280317

Live Nation Entertainment, Inc. 6.5% 15-MAY-2027Yield to maturity

5.77%

Maturity date

May 15, 2027

LYV4611410

Live Nation Entertainment, Inc. 5.625% 15-MAR-2026Yield to maturity

5.64%

Maturity date

Mar 15, 2026

LYV5785950

Live Nation Entertainment, Inc. 3.75% 15-JAN-2028Yield to maturity

5.40%

Maturity date

Jan 15, 2028

LYV4893725

Live Nation Entertainment, Inc. 4.75% 15-OCT-2027Yield to maturity

5.16%

Maturity date

Oct 15, 2027

LYV5099205

Live Nation Entertainment, Inc. 3.75% 15-JAN-2028Yield to maturity

4.73%

Maturity date

Jan 15, 2028

LYV5738254

Live Nation Entertainment, Inc. 3.125% 15-JAN-2029Yield to maturity

—

Maturity date

Jan 15, 2029

LYV4611411

Live Nation Entertainment, Inc. 5.625% 15-MAR-2026Yield to maturity

—

Maturity date

Mar 15, 2026

LYV4893726

Live Nation Entertainment, Inc. 4.75% 15-OCT-2027Yield to maturity

—

Maturity date

Oct 15, 2027

US538034BB4

Live Nation Entertainment, Inc. 2.875% 15-JAN-2030Yield to maturity

—

Maturity date

Jan 15, 2030

See all 3LN bonds

Frequently Asked Questions

The current price of 3LN is 132.66 EUR — it has decreased by −1.00% in the past 24 hours. Watch Live Nation Entertainment, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Live Nation Entertainment, Inc. stocks are traded under the ticker 3LN.

3LN stock has risen by 0.91% compared to the previous week, the month change is a −4.00% fall, over the last year Live Nation Entertainment, Inc. has showed a 24.85% increase.

We've gathered analysts' opinions on Live Nation Entertainment, Inc. future price: according to them, 3LN price has a max estimate of 167.94 EUR and a min estimate of 113.69 EUR. Watch 3LN chart and read a more detailed Live Nation Entertainment, Inc. stock forecast: see what analysts think of Live Nation Entertainment, Inc. and suggest that you do with its stocks.

3LN stock is 1.55% volatile and has beta coefficient of 0.93. Track Live Nation Entertainment, Inc. stock price on the chart and check out the list of the most volatile stocks — is Live Nation Entertainment, Inc. there?

Today Live Nation Entertainment, Inc. has the market capitalization of 31.19 B, it has increased by 1.64% over the last week.

Yes, you can track Live Nation Entertainment, Inc. financials in yearly and quarterly reports right on TradingView.

Live Nation Entertainment, Inc. is going to release the next earnings report on Nov 4, 2025. Keep track of upcoming events with our Earnings Calendar.

3LN earnings for the last quarter are 0.35 EUR per share, whereas the estimation was 0.87 EUR resulting in a −60.11% surprise. The estimated earnings for the next quarter are 1.24 EUR per share. See more details about Live Nation Entertainment, Inc. earnings.

Live Nation Entertainment, Inc. revenue for the last quarter amounts to 5.95 B EUR, despite the estimated figure of 5.81 B EUR. In the next quarter, revenue is expected to reach 7.43 B EUR.

3LN net income for the last quarter is 81.16 M EUR, while the quarter before that showed −69.22 M EUR of net income which accounts for 217.25% change. Track more Live Nation Entertainment, Inc. financial stats to get the full picture.

No, 3LN doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Oct 24, 2025, the company has 16.2 K employees. See our rating of the largest employees — is Live Nation Entertainment, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Live Nation Entertainment, Inc. EBITDA is 1.76 B EUR, and current EBITDA margin is 8.79%. See more stats in Live Nation Entertainment, Inc. financial statements.

Like other stocks, 3LN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Live Nation Entertainment, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Live Nation Entertainment, Inc. technincal analysis shows the sell today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Live Nation Entertainment, Inc. stock shows the buy signal. See more of Live Nation Entertainment, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.