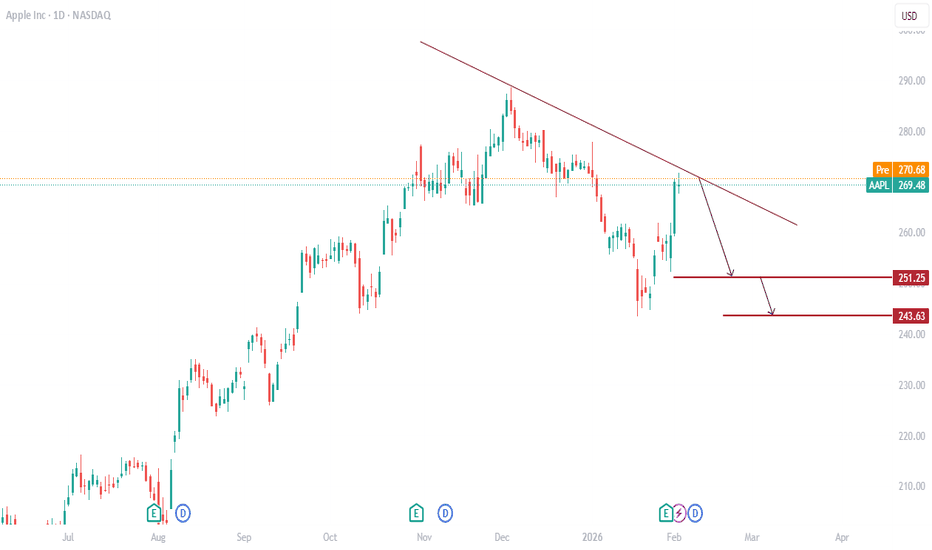

Apple Has Been Cored. What Its Chart Says Ahead of EarningsOften referred to as the greatest consumer-electronics company of all-time, Apple NASDAQ:AAPL has fallen more than 10% since its shares hit an all-time high in December. Let's check out its chart and fundamentals ahead of Thursday's fiscal Q1 earnings report.

Apple's Fundamental Analysis

AAPL

Apple Inc.

No trades

Key facts today

Apple is in discussions with Korean suppliers to secure better pricing on memory components, aiming to maintain profit margins amid rising memory costs in the tech industry.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

6.75 EUR

95.45 B EUR

354.65 B EUR

14.67 B

About Apple Inc

Sector

Industry

CEO

Timothy Donald Cook

Website

Headquarters

Cupertino

Founded

1976

IPO date

Dec 12, 1980

Identifiers

3

ISIN US0378331005

Apple, Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other varieties of related services. It operates through the following geographical segments: Americas, Europe, Greater China, Japan, and Rest of Asia Pacific. The Americas segment includes North and South America. The Europe segment consists of European countries, as well as India, the Middle East, and Africa. The Greater China segment comprises China, Hong Kong, and Taiwan. The Rest of Asia Pacific segment includes Australia and Asian countries. Its products and services include iPhone, Mac, iPad, AirPods, Apple TV, Apple Watch, Beats products, AppleCare, iCloud, digital content stores, streaming, and licensing services. The company was founded by Steven Paul Jobs, Ronald Gerald Wayne, and Stephen G. Wozniak in April 1976 and is headquartered in Cupertino, CA.

Related stocks

Hate to crash the bear party, but Bitcoin is primed to explode.Bitcoin is following the same growth pattern Apple did as it established its massive uptrend. Many investors are bearish, calling for low targets like $50K or even $30K—but most don’t realize Bitcoin is likely to rally all the way to a new all-time high.

The trend is your friend, and Bitcoin is in

AAPL Apple Options Ahead of EarningsIf you haven`t bought AAPL before the previous earnings:

Now analyzing the options chain and the chart patterns of AAPL Apple prior to the earnings report this week,

I would consider purchasing the 285usd strike price Calls with

an expiration date of 2026-5-15,

for a premium of approximately $5.25

AAPL Sitting in the Middle — How I’m Reading It for Feb 2

1-Hour View — Bigger Picture First

On the 1-hour timeframe, AAPL is no longer trending cleanly. The strong push higher earlier stalled, and since then price has been moving sideways with overlapping candles.

Structurally, this is range behavior, not continuation. Higher lows are not clean, and high

Apple H4 – Bullish Order Block Respect & RSI ConfirmationApple Inc (AAPL) H4 Bullish Order Block Respect

On the H4 timeframe, price previously showed a rapid upward move from an old bullish order block. After that, the market made a healthy pullback and again approached the same order block, showing clear respect, which is a strong sign of bullish contin

AAPL Earnings: Bull Call Spread Poised for Post-Earnings LiftAAPL Earnings Trade – 2026-01-29

Target Price: ~$258 (Katy AI) → short-term upside to $260 zone

Reason:

Katy AI projects modest upside (+1%, $2.51) despite market pricing $10.65 move

Support cluster $254–$255 provides floor; MACD bullish divergence forming

Institutional flow shows net call accu

AAPL — Dual Bullish ABCs, Unreached TargetsApple is currently trading within two active bullish ABC sequences , and both still have unreached C targets above .

The key edge here isn’t just the upside targets — it’s the correction structure .

Both bullish sequences formed their BC correction in the same price zone .

That overlap isn’t r

APPLE The Target Is DOWN! SELL!

My dear subscribers,

This is my opinion on the APPLE next move:

The instrument tests an important psychological level 259.34

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Tar

AAPL – Institutional Desk Report (ICT)AAPL – Institutional Desk Report (ICT)

HTF Bias:

The overall trend for the stock is upward on higher timeframes, and there is no structural breakout to confirm a trend reversal yet.

Current Price Action:

The price is trading within the Premium Zone.

→ There is no buy advantage at current levels.

→

AAPL (Apple) Stock Update, Price DecreaseAs of today Apple stock market traded between a low of $267.33 and high of $271.88. shares are currently priced at $269.48, with the stock down to 2%. well thanks to the success of the iPhone 17 series, Apple has seen "unprecedent demand," according to CEO Tim Cook. however strong demand could be ch

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US37833EB2

Apple Inc. 0.7% 08-FEB-2026Yield to maturity

5.86%

Maturity date

Feb 8, 2026

US37833ER7

Apple Inc. 4.1% 08-AUG-2062Yield to maturity

5.56%

Maturity date

Aug 8, 2062

US37833EG1

Apple Inc. 2.8% 08-FEB-2061Yield to maturity

5.54%

Maturity date

Feb 8, 2061

US37833EL0

Apple Inc. 2.85% 05-AUG-2061Yield to maturity

5.54%

Maturity date

Aug 5, 2061

US37833EK2

Apple Inc. 2.7% 05-AUG-2051Yield to maturity

5.54%

Maturity date

Aug 5, 2051

US37833DW7

Apple Inc. 2.65% 11-MAY-2050Yield to maturity

5.54%

Maturity date

May 11, 2050

US37833DQ0

Apple Inc. 2.95% 11-SEP-2049Yield to maturity

5.53%

Maturity date

Sep 11, 2049

US37833EA4

Apple Inc. 2.55% 20-AUG-2060Yield to maturity

5.52%

Maturity date

Aug 20, 2060

US37833EF3

Apple Inc. 2.65% 08-FEB-2051Yield to maturity

5.51%

Maturity date

Feb 8, 2051

US37833DZ0

Apple Inc. 2.4% 20-AUG-2050Yield to maturity

5.49%

Maturity date

Aug 20, 2050

US37833EQ9

Apple Inc. 3.95% 08-AUG-2052Yield to maturity

5.49%

Maturity date

Aug 8, 2052

See all APC bonds

Frequently Asked Questions

The current price of APC is 234.25 EUR — it has increased by 2.24% in the past 24 hours. Watch Apple Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Apple Inc. stocks are traded under the ticker APC.

APC stock has risen by 8.12% compared to the previous week, the month change is a 0.71% rise, over the last year Apple Inc. has showed a 6.43% increase.

We've gathered analysts' opinions on Apple Inc. future price: according to them, APC price has a max estimate of 295.38 EUR and a min estimate of 173.01 EUR. Watch APC chart and read a more detailed Apple Inc. stock forecast: see what analysts think of Apple Inc. and suggest that you do with its stocks.

APC stock is 3.74% volatile and has beta coefficient of 1.34. Track Apple Inc. stock price on the chart and check out the list of the most volatile stocks — is Apple Inc. there?

Today Apple Inc. has the market capitalization of 3.35 T, it has increased by 2.90% over the last week.

Yes, you can track Apple Inc. financials in yearly and quarterly reports right on TradingView.

Apple Inc. is going to release the next earnings report on Apr 30, 2026. Keep track of upcoming events with our Earnings Calendar.

APC earnings for the last quarter are 2.42 EUR per share, whereas the estimation was 2.28 EUR resulting in a 6.23% surprise. The estimated earnings for the next quarter are 1.63 EUR per share. See more details about Apple Inc. earnings.

Apple Inc. revenue for the last quarter amounts to 122.40 B EUR, despite the estimated figure of 117.83 B EUR. In the next quarter, revenue is expected to reach 91.71 B EUR.

APC net income for the last quarter is 35.84 B EUR, while the quarter before that showed 23.41 B EUR of net income which accounts for 53.13% change. Track more Apple Inc. financial stats to get the full picture.

Yes, APC dividends are paid quarterly. The last dividend per share was 0.22 EUR. As of today, Dividend Yield (TTM)% is 0.38%. Tracking Apple Inc. dividends might help you take more informed decisions.

Apple Inc. dividend yield was 0.40% in 2025, and payout ratio reached 13.66%. The year before the numbers were 0.43% and 16.11% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 5, 2026, the company has 166 K employees. See our rating of the largest employees — is Apple Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Apple Inc. EBITDA is 130.18 B EUR, and current EBITDA margin is 34.78%. See more stats in Apple Inc. financial statements.

Like other stocks, APC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Apple Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Apple Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Apple Inc. stock shows the strong buy signal. See more of Apple Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.