Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.230 EUR

4.31 B EUR

35.07 B EUR

1.49 B

About SLB Limited

Sector

Industry

CEO

Olivier Le Peuch

Website

Headquarters

Houston

Founded

1926

ISIN

AN8068571086

FIGI

BBG000C1YXV9

SLB Ltd. engages in the provision of energy technology. It operates through the following business segments: Digital and Integration, Reservoir Performance, Well Construction, and Production Systems. The Digital and Integration segment involves the combination of digital solutions and data products with its Asset Performance Solutions. The Reservoir Performance segment consists of technologies and services for productivity and performance optimization. The Well Construction segment includes the full portfolio of products and services for well placement and performance, drilling, and wellbore assurance. The Production Systems segment focuses on the development of technologies and provides services to production and recovery from subsurface reservoirs to the surface, into pipelines, and to refineries. The company was founded by Conrad Schlumberger and Marcel Schlumberger in 1926 and is headquartered in Houston, TX.

Related stocks

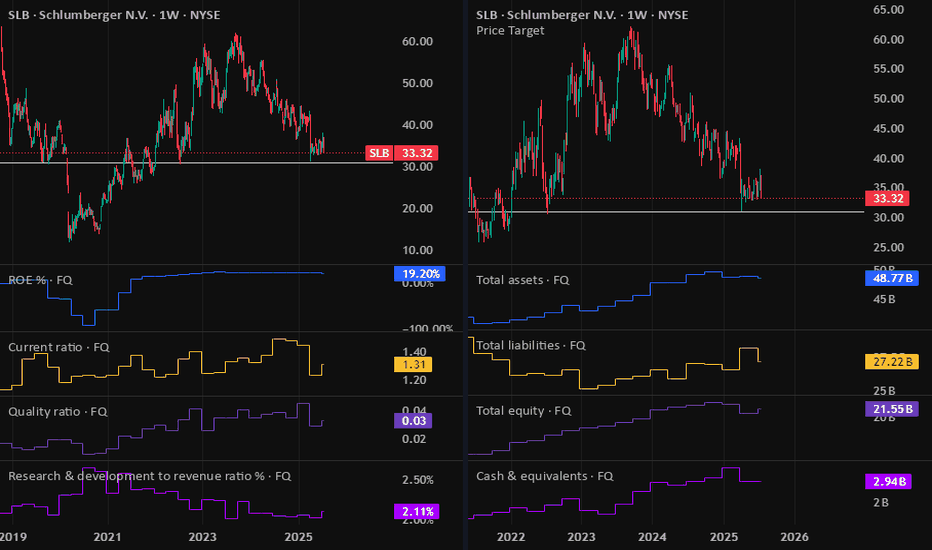

Very rare diamond patternThis very rare pattern usually indicates a change of trend. Is doing it in the weekly timeframe and setting up for a massive breakout of the descending channel. Also, oil is setting up an inverse HS and many of the big oil companies show bullish patterns. SL and TP are shown on the charts.

Good luc

AI assissted Anaysis of SLBThis chart shows Schlumberger (SLB) stock with some interesting technical analysis annotations. Looking at the price action, I can see several key observations:

The Bearish Channel Breakout:

The stock appears to have been trading within a descending channel (marked by the red dotted lines) for about

Schlumberger Stock Chart Fibonacci Analysis 082725Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 36/61.80%

Chart time frame:C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E)

SLB could bounce SLB is still in a down trend but we could’ve found bottom. Tomorrow is earnings and it sure looks like a D1 breakout to the upside. If correct tomorrow’s earnings report hopefully will send us higher. Long term 1st target $74.41. (I may close my original investment here) I see oil reaching all time

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SLB4080519

Cameron International Corporation 5.125% 15-DEC-2043Yield to maturity

5.87%

Maturity date

Dec 15, 2043

USU8066LAE4

Schlumberger Holdings Corporation 4.0% 21-DEC-2025Yield to maturity

5.15%

Maturity date

Dec 21, 2025

SLB3673764

Cameron International Corporation 7.0% 15-JUL-2038Yield to maturity

5.13%

Maturity date

Jul 15, 2038

SLB6056526

Schlumberger Holdings Corporation 4.85% 15-MAY-2033Yield to maturity

4.78%

Maturity date

May 15, 2033

SLB6039167

Schlumberger Holdings Corporation 5.0% 01-JUN-2034Yield to maturity

4.67%

Maturity date

Jun 1, 2034

SLB5816417

Schlumberger Investment SA 5.0% 01-JUN-2034Yield to maturity

4.58%

Maturity date

Jun 1, 2034

SLB5584893

Schlumberger Investment SA 4.85% 15-MAY-2033Yield to maturity

4.43%

Maturity date

May 15, 2033

US806854AJ4

Schlumberger Investment SA 2.65% 26-JUN-2030Yield to maturity

4.26%

Maturity date

Jun 26, 2030

USU8066LAF1

Schlumberger Holdings Corporation 4.3% 01-MAY-2029Yield to maturity

4.24%

Maturity date

May 1, 2029

SLB6040253

Schlumberger Holdings Corporation 4.5% 15-MAY-2028Yield to maturity

4.15%

Maturity date

May 15, 2028

SLB5584892

Schlumberger Investment SA 4.5% 15-MAY-2028Yield to maturity

4.12%

Maturity date

May 15, 2028

See all SCL bonds

Frequently Asked Questions

The current price of SCL is 31.250 EUR — it has decreased by −1.88% in the past 24 hours. Watch SLB Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange SLB Limited stocks are traded under the ticker SCL.

SCL stock has risen by 1.13% compared to the previous week, the month change is a 8.13% rise, over the last year SLB Limited has showed a −15.20% decrease.

We've gathered analysts' opinions on SLB Limited future price: according to them, SCL price has a max estimate of 53.60 EUR and a min estimate of 31.12 EUR. Watch SCL chart and read a more detailed SLB Limited stock forecast: see what analysts think of SLB Limited and suggest that you do with its stocks.

SCL stock is 2.58% volatile and has beta coefficient of 1.01. Track SLB Limited stock price on the chart and check out the list of the most volatile stocks — is SLB Limited there?

Today SLB Limited has the market capitalization of 46.57 B, it has increased by 3.27% over the last week.

Yes, you can track SLB Limited financials in yearly and quarterly reports right on TradingView.

SLB Limited is going to release the next earnings report on Jan 16, 2026. Keep track of upcoming events with our Earnings Calendar.

SCL earnings for the last quarter are 0.59 EUR per share, whereas the estimation was 0.56 EUR resulting in a 4.98% surprise. The estimated earnings for the next quarter are 0.64 EUR per share. See more details about SLB Limited earnings.

SLB Limited revenue for the last quarter amounts to 7.61 B EUR, despite the estimated figure of 7.60 B EUR. In the next quarter, revenue is expected to reach 8.23 B EUR.

SCL net income for the last quarter is 629.77 M EUR, while the quarter before that showed 860.79 M EUR of net income which accounts for −26.84% change. Track more SLB Limited financial stats to get the full picture.

Yes, SCL dividends are paid quarterly. The last dividend per share was 0.24 EUR. As of today, Dividend Yield (TTM)% is 3.13%. Tracking SLB Limited dividends might help you take more informed decisions.

SLB Limited dividend yield was 2.87% in 2024, and payout ratio reached 35.41%. The year before the numbers were 1.92% and 34.33% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Nov 3, 2025, the company has 110 K employees. See our rating of the largest employees — is SLB Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. SLB Limited EBITDA is 6.56 B EUR, and current EBITDA margin is 23.14%. See more stats in SLB Limited financial statements.

Like other stocks, SCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade SLB Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So SLB Limited technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating SLB Limited stock shows the sell signal. See more of SLB Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.