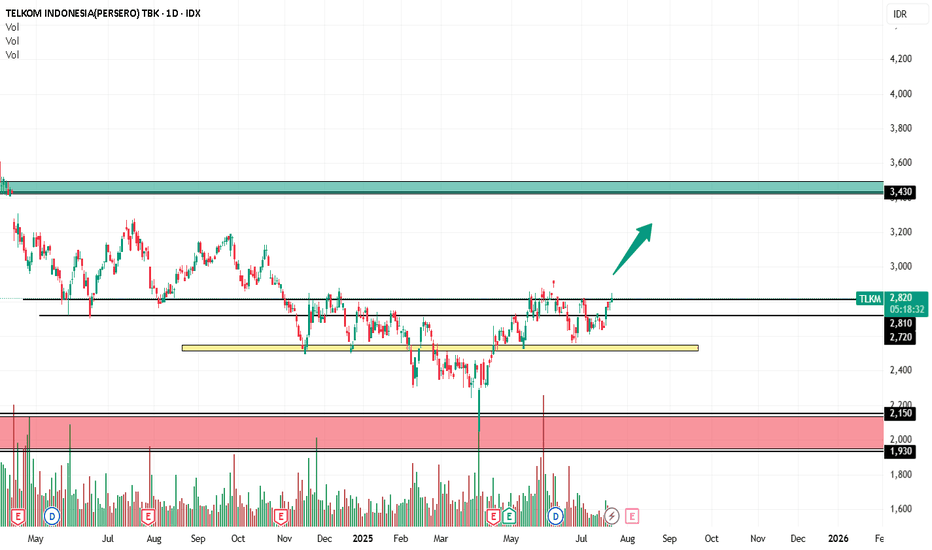

TLKM IDXTLKM has had a poor pattern so far, even though TLKM has quite good company fundamentals, penetration of its business network has been somewhat stagnant because it has expanded earlier than other brands in Indonesia. TLKM was stung because its investment in GOTO, which is now controlled by Bytedance

PT Telekomunick

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.0132 USD

1.47 B USD

9.30 B USD

47.45 B

About PT Telkom Indonesia (Persero) Tbk Class B

Sector

Industry

CEO

Dian Siswarini

Website

Headquarters

Jakarta

Founded

1991

IPO date

Nov 14, 1995

Identifiers

2

ISIN ID1000129000

PT Telkom Indonesia (Persero) Tbk is a holding company, which engages in the provision of telecommunications, information, and technology services. It operates through the following segments: Mobile, Consumer, Enterprise, Wholesale and International Business (WIB), and Others. The Mobile segment provides mobile voice, SMS, value added services, and mobile broadband. The Consumer segment offers fixed wire line telecommunications services, pay television, data, and internet services to home customers. The Enterprise segment provides end-to-end solutions to corporate and institutions. The WIB segment includes interconnection services, leased lines, satellite, VSAT, broadband access, information technology services, data, and Internet services to other licensed operator companies and institutions. The Others segment deals with digital service operating segments that do not meet the disclosure requirements for a reportable segment. The company was founded on September 24, 1991 and is headquartered in Jakarta, Indonesia.

Related stocks

TLKM On the Rise? Probably NotI was tempted to buy into TLKM again last month, because it rose so fast and sounds awesome. So, I looked at the books and... did nothing.

TLKM buyback plans between 28 Mei 2025 - 27 Mei 2026 may provide supports, but nothing on its book tells me to buy it now. The company's first quarter performan

Telkom Indonesia (TLKM): A Technical Setup You Can't Miss!Telkom Indonesia (TLKM) Stock Analysis

Date: January 22, 2025

________________________________________

1. Technical Analysis

A. Support and Resistance:

• Strong support is observed at the 2,490 level (lower red line), which has been tested multiple times.

• Nearest resistance is at 2,870, with the n

TLKMBullish Flag, Positive news, YOY surplus, Q4 '23 surplus, good volume

3490 25%Cap ; 3420 50%Cap ; 3320 25%Cap

D1 closed under 3260 = Cut lost at 3420

Target1 closed gap 3720 (RR 1:1 6%)

Target2 nearest Resist 3720 (RR 1:2 12%)

Target3 4360 breakout bull flag (RR 1:3 24%) and avg up around Target2

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of TLKMF is 0.2000 USD — it has increased by 1.93% in the past 24 hours. Watch PT Telekomunick stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on OTC exchange PT Telekomunick stocks are traded under the ticker TLKMF.

TLKMF stock has fallen by −10.41% compared to the previous week, the month change is a −9.20% fall, over the last year PT Telekomunick has showed a 25.08% increase.

We've gathered analysts' opinions on PT Telekomunick future price: according to them, TLKMF price has a max estimate of 0.27 USD and a min estimate of 0.20 USD. Watch TLKMF chart and read a more detailed PT Telekomunick stock forecast: see what analysts think of PT Telekomunick and suggest that you do with its stocks.

TLKMF reached its all-time high on Oct 11, 2007 with the price of 1.4300 USD, and its all-time low was 0.1232 USD and was reached on Apr 8, 2025. View more price dynamics on TLKMF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

TLKMF stock is 1.92% volatile and has beta coefficient of 1.21. Track PT Telekomunick stock price on the chart and check out the list of the most volatile stocks — is PT Telekomunick there?

Today PT Telekomunick has the market capitalization of 20.16 B, it has decreased by −3.43% over the last week.

Yes, you can track PT Telekomunick financials in yearly and quarterly reports right on TradingView.

PT Telekomunick is going to release the next earnings report on Mar 20, 2026. Keep track of upcoming events with our Earnings Calendar.

TLKMF earnings for the last quarter are 0.00 USD per share, whereas the estimation was 0.00 USD resulting in a −11.03% surprise. The estimated earnings for the next quarter are 0.00 USD per share. See more details about PT Telekomunick earnings.

PT Telekomunick revenue for the last quarter amounts to 2.20 B USD, despite the estimated figure of 2.19 B USD. In the next quarter, revenue is expected to reach 2.24 B USD.

TLKMF net income for the last quarter is 288.54 M USD, while the quarter before that showed 320.23 M USD of net income which accounts for −9.90% change. Track more PT Telekomunick financial stats to get the full picture.

Yes, TLKMF dividends are paid annually. The last dividend per share was 0.01 USD. As of today, Dividend Yield (TTM)% is 6.16%. Tracking PT Telekomunick dividends might help you take more informed decisions.

PT Telekomunick dividend yield was 7.84% in 2024, and payout ratio reached 89.00%. The year before the numbers were 4.52% and 72.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 14, 2026, the company has 19.7 K employees. See our rating of the largest employees — is PT Telekomunick on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. PT Telekomunick EBITDA is 4.45 B USD, and current EBITDA margin is 50.92%. See more stats in PT Telekomunick financial statements.

Like other stocks, TLKMF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade PT Telekomunick stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So PT Telekomunick technincal analysis shows the neutral today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating PT Telekomunick stock shows the neutral signal. See more of PT Telekomunick technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.