Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4 CHF

6.39 B CHF

34.23 B CHF

1.55 B

About Philip Morris International Inc

Sector

Industry

CEO

Jacek Olczak

Website

Headquarters

Stamford

Founded

1847

ISIN

US7181721090

FIGI

BBG00Z4HJYS5

Philip Morris International, Inc. is a holding company, which engages in the business of delivering a smoke-free future and evolving a portfolio for the long term to include products outside of the tobacco and nicotine sector. It operates through the following geographical segments: Europe Region (Europe), South and Southeast Asia, Commonwealth of Independent States, Middle East, and Africa Region (SSEA, CIS, and MEA), East Asia, Australia, and PMI Duty Free Region (EA, AU, and PMI DF), and Americas Region (Americas). The Europe segment includes all the European Union countries, Switzerland, the United Kingdom, Ukraine, Moldova, and Southeast Europe. The SSEA, CIS, and MEA segment focuses on South and Southeast Asia, the African continent, the Middle East, Turkey, Israel, Central Asia, Caucasus, and Russia. The EA, AU, and PMI DF segment is involved in the consolidation of international duty-free business with East Asia and Australia. The Americas segment is comprised of the United States, Canada, and Latin America. The company was founded by Philip Morris in 1847 and is headquartered in Stamford, CT.

Related stocks

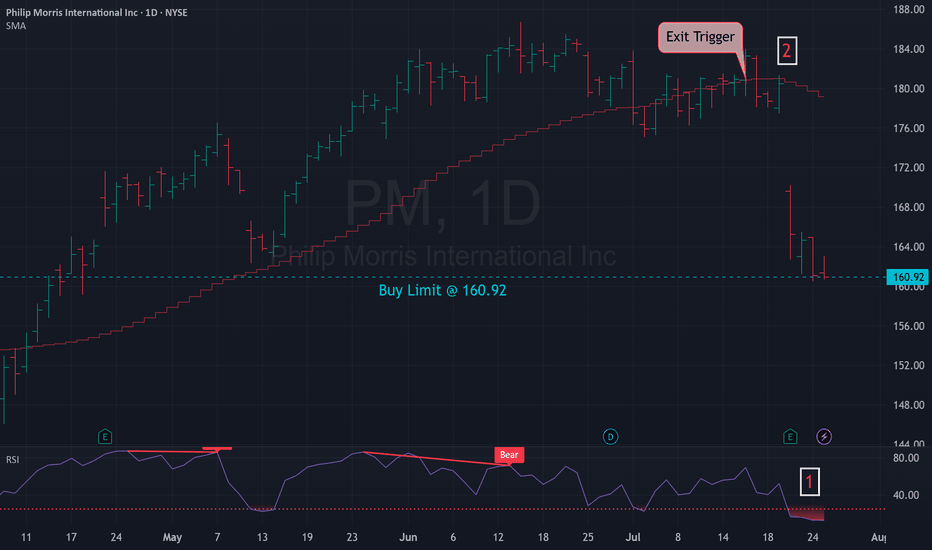

Philip Morris Turning Point: Surge to $200 or Drop to $140?

Technical Analysis

Overall Trend: The stock is in an upward channel, and the ascending trendline (blue) has been validated multiple times, showing strong price reactions.

Moving Average: The price is fluctuating near the 50-day moving average, which acts as short-term support/resistance.

Key Supp

$PM Maintains a Strong Uptrend: Long at $147.17!Philip Morris International Inc. ( NYSE:PM ) is showing a “Strong Uptrend” on a 1-week chart. 📈 We bought at $109.86 and sold at $142.88 previously. Now at $169.17, we’re in a long position at $147.17. With a Trend Score of 8/8 and 100% signal alignment, the short-term projected price is $196.2 (

130 isn't a decider, it's a finder based in all on significanceWith the right angle poised to coincide with oscillators and indicators pointed in the direction of stabilizing at some point, it could be messy and start an entirely new direction in the public's sentiment. However, it could extend further to newer levels when things are in the cool-down phase.

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

4I1L

Philip Morris International Inc. 4.25% 10-NOV-2044Yield to maturity

5.47%

Maturity date

Nov 10, 2044

4I1H

Philip Morris International Inc. 4.875% 15-NOV-2043Yield to maturity

5.47%

Maturity date

Nov 15, 2043

US718172AU3

Philip Morris International Inc. 3.875% 21-AUG-2042Yield to maturity

5.42%

Maturity date

Aug 21, 2042

4I1E

Philip Morris International Inc. 4.125% 04-MAR-2043Yield to maturity

5.41%

Maturity date

Mar 4, 2043

PM3831486

Philip Morris International Inc. 4.5% 20-MAR-2042Yield to maturity

5.39%

Maturity date

Mar 20, 2042

PM3699035

Philip Morris International Inc. 4.375% 15-NOV-2041Yield to maturity

5.30%

Maturity date

Nov 15, 2041

PM5503326

Philip Morris International Inc. 5.0% 17-NOV-2025Yield to maturity

5.12%

Maturity date

Nov 17, 2025

US718172AC3

Philip Morris International Inc. 6.375% 16-MAY-2038Yield to maturity

5.08%

Maturity date

May 16, 2038

PM6064954

Philip Morris International Inc. 4.875% 30-APR-2035Yield to maturity

4.81%

Maturity date

Apr 30, 2035

PM5929960

Philip Morris International Inc. 4.9% 01-NOV-2034Yield to maturity

4.74%

Maturity date

Nov 1, 2034

PM5751981

Philip Morris International Inc. 5.25% 13-FEB-2034Yield to maturity

4.71%

Maturity date

Feb 13, 2034

See all PMIZ bonds

Curated watchlists where PMIZ is featured.

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on TURQUOISE exchange Philip Morris International Inc. stocks are traded under the ticker PMIZ.

We've gathered analysts' opinions on Philip Morris International Inc. future price: according to them, PMIZ price has a max estimate of 176.45 CHF and a min estimate of 126.72 CHF. Watch PMIZ chart and read a more detailed Philip Morris International Inc. stock forecast: see what analysts think of Philip Morris International Inc. and suggest that you do with its stocks.

PMIZ reached its all-time high on Aug 23, 2021 with the price of 93 CHF, and its all-time low was 82 CHF and was reached on Apr 1, 2021. View more price dynamics on PMIZ chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Yes, you can track Philip Morris International Inc. financials in yearly and quarterly reports right on TradingView.

Philip Morris International Inc. is going to release the next earnings report on Oct 21, 2025. Keep track of upcoming events with our Earnings Calendar.

PMIZ earnings for the last quarter are 1.52 CHF per share, whereas the estimation was 1.47 CHF resulting in a 2.83% surprise. The estimated earnings for the next quarter are 1.67 CHF per share. See more details about Philip Morris International Inc. earnings.

Philip Morris International Inc. revenue for the last quarter amounts to 8.05 B CHF, despite the estimated figure of 8.19 B CHF. In the next quarter, revenue is expected to reach 8.47 B CHF.

PMIZ net income for the last quarter is 2.40 B CHF, while the quarter before that showed 2.37 B CHF of net income which accounts for 1.29% change. Track more Philip Morris International Inc. financial stats to get the full picture.

Yes, PMIZ dividends are paid quarterly. The last dividend per share was 1.17 CHF. As of today, Dividend Yield (TTM)% is 3.48%. Tracking Philip Morris International Inc. dividends might help you take more informed decisions.

Philip Morris International Inc. dividend yield was 4.40% in 2024, and payout ratio reached 117.24%. The year before the numbers were 5.46% and 102.46% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 9, 2025, the company has 83.1 K employees. See our rating of the largest employees — is Philip Morris International Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Philip Morris International Inc. EBITDA is 12.21 B CHF, and current EBITDA margin is 39.85%. See more stats in Philip Morris International Inc. financial statements.

Like other stocks, PMIZ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Philip Morris International Inc. stock right from TradingView charts — choose your broker and connect to your account.