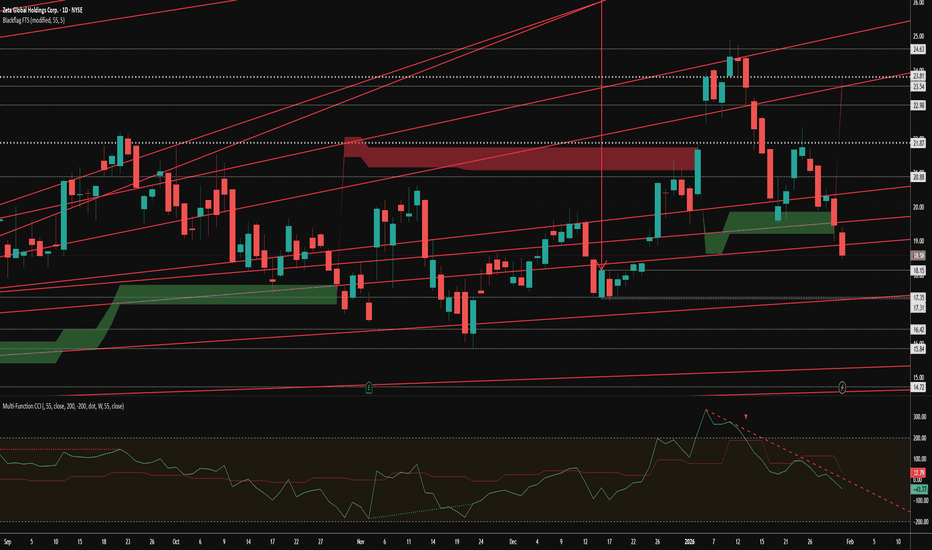

ZETA: The "AI-Gap" Fill to $28 (Inverse H&S + Rule of 60)The "Short Report" capitulation is over. Zeta Global (ZETA) is forming a textbook technical reversal while simultaneously transitioning into a "Rule of 60" AI-marketing powerhouse. The dislocation between price and value is now closing.

1. The Technical Setup: Inverse Head & Shoulders

Looking a

Zeta Global Holdings Corp.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.10 USD

−69.77 M USD

1.01 B USD

213.82 M

About Zeta Global Holdings Corp.

Sector

Industry

CEO

David Adam Steinberg

Website

Headquarters

New York

Founded

2012

IPO date

Jun 10, 2021

Identifiers

3

ISIN US98956A1051

Zeta Global Holdings Corp. operates as a marketing technology software company, which engages in the provision of enterprises with consumer intelligence and marketing automation software. It enables its customers to target, connect and engage consumers through software that delivers marketing across all addressable channels, including email, social media, web chat, connected TV and video among others. The company was founded by David A. Steinberg and John Sculley on May 9, 2012 and is headquartered in New York, NY.

Related stocks

ZETA daily scale: CCI system construction and readAdding ZETA to my stalk list. Not in a rush to get long but I do like the prospects of a upper 40s to lower 50s target. Currently looking at low 17s to initiate the long side and build into it with 1/4 lot purchases as supports are tested.

Content also looks at the history of ZETA's CCI trendli

Zeta Global: structure reset on the weeklyZeta Global Holdings Corp. operates in marketing technology, providing data-driven customer intelligence and automation solutions for enterprises.

On the weekly chart, ZETA has completed a breakout above the long-term descending trendline and is currently holding a clean retest zone. The key suppo

ZETA – Breakout Confirmed | Primary Wave 3Thesis

NYSE:ZETA is transitioning from long-term accumulation into the early phase of Primary Wave 3 following a confirmed breakout.

Context

- Daily / weekly structure

- Primary Wave 2 completed near $10 (April 2025)

- Wave 1 advanced to ~$22

- Recent phase was a controlled Wave 2 consolidatio

NYSE: ZETA— Swing Trade Idea (Gap Up Continuation)💰 ZETA — Swing Trade Idea (Gap Up Continuation)

🏢 Zeta Global Holdings Corp. (NYSE: ZETA)

🏢 Company Snapshot

• Zeta Global provides AI-driven customer data and marketing analytics software

• In focus due to renewed momentum in AI / data infrastructure names and strong post-gap price acceptance

📊

Zeta set up to see 32.00 or higherThis company continues to outperform under the radar. with the new open sea momentum we see the neckline broken on the head and shoulder, cup and handle break out, and cypher. This pattern is not new to zeta as you can see it has occurred in the past. I don't have stops in. but did show a tasty risk

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ZETA is 18.27 USD — it has increased by 0.54% in the past 24 hours. Watch Zeta Global Holdings Corp. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Zeta Global Holdings Corp. stocks are traded under the ticker ZETA.

ZETA stock has fallen by −12.71% compared to the previous week, the month change is a −9.06% fall, over the last year Zeta Global Holdings Corp. has showed a 4.58% increase.

We've gathered analysts' opinions on Zeta Global Holdings Corp. future price: according to them, ZETA price has a max estimate of 44.00 USD and a min estimate of 25.00 USD. Watch ZETA chart and read a more detailed Zeta Global Holdings Corp. stock forecast: see what analysts think of Zeta Global Holdings Corp. and suggest that you do with its stocks.

ZETA reached its all-time high on Nov 11, 2024 with the price of 38.20 USD, and its all-time low was 4.09 USD and was reached on Jul 5, 2022. View more price dynamics on ZETA chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ZETA stock is 4.40% volatile and has beta coefficient of 2.03. Track Zeta Global Holdings Corp. stock price on the chart and check out the list of the most volatile stocks — is Zeta Global Holdings Corp. there?

Today Zeta Global Holdings Corp. has the market capitalization of 4.59 B, it has decreased by −10.48% over the last week.

Yes, you can track Zeta Global Holdings Corp. financials in yearly and quarterly reports right on TradingView.

Zeta Global Holdings Corp. is going to release the next earnings report on Feb 19, 2026. Keep track of upcoming events with our Earnings Calendar.

ZETA earnings for the last quarter are 0.20 USD per share, whereas the estimation was 0.18 USD resulting in a 8.87% surprise. The estimated earnings for the next quarter are 0.23 USD per share. See more details about Zeta Global Holdings Corp. earnings.

Zeta Global Holdings Corp. revenue for the last quarter amounts to 337.17 M USD, despite the estimated figure of 328.09 M USD. In the next quarter, revenue is expected to reach 379.25 M USD.

ZETA net income for the last quarter is −3.63 M USD, while the quarter before that showed −12.81 M USD of net income which accounts for 71.64% change. Track more Zeta Global Holdings Corp. financial stats to get the full picture.

No, ZETA doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 3, 2026, the company has 2.19 K employees. See our rating of the largest employees — is Zeta Global Holdings Corp. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Zeta Global Holdings Corp. EBITDA is 76.82 M USD, and current EBITDA margin is −0.36%. See more stats in Zeta Global Holdings Corp. financial statements.

Like other stocks, ZETA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Zeta Global Holdings Corp. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Zeta Global Holdings Corp. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Zeta Global Holdings Corp. stock shows the buy signal. See more of Zeta Global Holdings Corp. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.