Key facts today

Cloudflare emphasizes edge computing's role in web development, processing data near users to lower latency and boost speed for web applications.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.34 USD

−78.80 M USD

1.67 B USD

306.85 M

About Cloudflare, Inc.

Sector

Industry

CEO

Matthew Browning Prince

Website

Headquarters

San Francisco

Founded

2009

ISIN

US18915M1071

FIGI

BBG001WMKHH5

Cloudflare, Inc. engages in the provision of cloud-based services to secure websites. It offers various products for performance and reliability, video streaming and delivery, advanced security, insights, cloudflare for developers, domain registration and cloudflare marketplace. The company was founded by Matthew Prince, Michelle Zatlyn and Lee Holloway in July 2009 and is headquartered in San Francisco, CA.

Related stocks

TradeUSAsignals Recommendations NET - It shows clear technical strength with indicators supporting continued upward movement in the coming period, backed by improved financial results and business expansion in the cloud services market. The presence of strong price supports and dominance above moving averages enhances the prospec

$NET Morning Star Reversal PatternI have been looking to take a position in NYSE:NET after earnings. I have waited for a pullback which has happened. On Wed, Thurs, and Fri of last week it formed a Morning Star Reversal pattern. So, I have put on a half size position pre-market. My risk reward is exceptionally good here as my stop

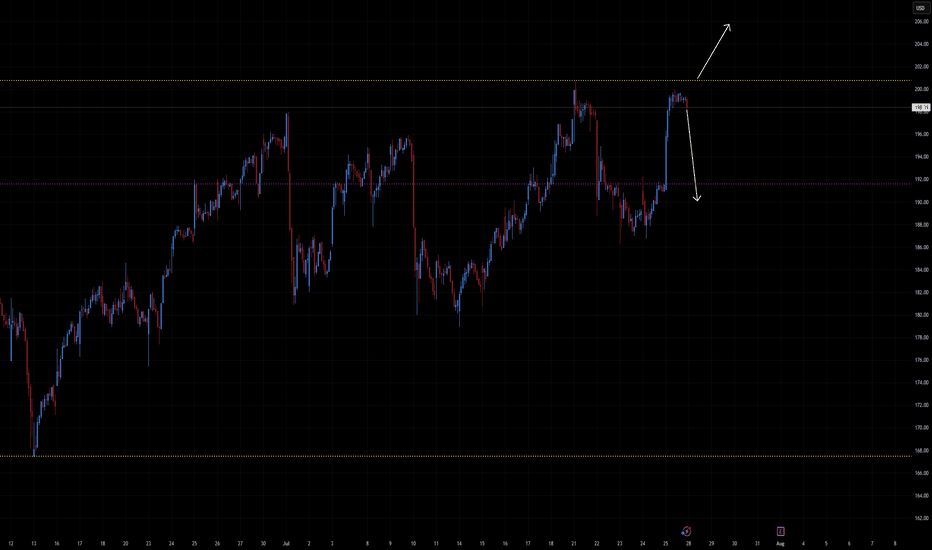

Will this stock ""NET"" you a nice return?📰 Cloudflare (NET) — Technical Overview & Breakout Strategy

Ticker: NET | Sector: Cybersecurity / Edge Computing

Date: July 26, 2025

Current Price: ~$198

⚠️ Context: Past Red‑Candle Sell-Offs

NET has experienced sharp downward reversals often signaled by large bearish engulfing candles, especially

$NET — Ascending-Base BreakoutNYSE:NET — Ascending-Base Breakout

• Seven-month ascending base resolving through $184-186 supply

• Volatility contracting; RS already at 52-w highs

• Cloud-security group remains a leadership pocket

📈 Trigger = daily close > $188.50 on strong volume

🛑 Risk line = < $175 (1.5 × ATR, below shelf)

An Internet Disaster - NET & GOOGL FallAs of Thursday, June 12, 2025, a significant internet outage has disrupted services across multiple major platforms, including Google, Amazon Web Services (AWS), Spotify, YouTube, Discord, and Shopify. Cloudflare acknowledged experiencing intermittent failures and noted that some services were begin

Will Tomorrow’s Secrets Remain Safe?The financial world stands at a critical juncture as the rapid advancement of quantum computing casts a shadow over current encryption methods. For decades, the security of sensitive financial data has relied on the computational difficulty of mathematical problems like integer factorization and dis

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

NET5475615

Cloudflare, Inc. 0.0% 15-AUG-2026Yield to maturity

—

Maturity date

Aug 15, 2026

US18915MAE7

Cloudflare, Inc. 0.0% 15-JUN-2030Yield to maturity

—

Maturity date

Jun 15, 2030

See all NET bonds

Curated watchlists where NET is featured.

Frequently Asked Questions

The current price of NET is 216.34 USD — it has increased by 0.29% in the past 24 hours. Watch Cloudflare, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NYSE exchange Cloudflare, Inc. stocks are traded under the ticker NET.

NET stock has risen by 0.67% compared to the previous week, the month change is a 11.10% rise, over the last year Cloudflare, Inc. has showed a 155.09% increase.

We've gathered analysts' opinions on Cloudflare, Inc. future price: according to them, NET price has a max estimate of 255.00 USD and a min estimate of 90.00 USD. Watch NET chart and read a more detailed Cloudflare, Inc. stock forecast: see what analysts think of Cloudflare, Inc. and suggest that you do with its stocks.

NET stock is 3.02% volatile and has beta coefficient of 1.87. Track Cloudflare, Inc. stock price on the chart and check out the list of the most volatile stocks — is Cloudflare, Inc. there?

Today Cloudflare, Inc. has the market capitalization of 76.04 B, it has decreased by −4.79% over the last week.

Yes, you can track Cloudflare, Inc. financials in yearly and quarterly reports right on TradingView.

Cloudflare, Inc. is going to release the next earnings report on Oct 30, 2025. Keep track of upcoming events with our Earnings Calendar.

NET earnings for the last quarter are 0.21 USD per share, whereas the estimation was 0.18 USD resulting in a 14.53% surprise. The estimated earnings for the next quarter are 0.23 USD per share. See more details about Cloudflare, Inc. earnings.

Cloudflare, Inc. revenue for the last quarter amounts to 512.32 M USD, despite the estimated figure of 501.27 M USD. In the next quarter, revenue is expected to reach 544.56 M USD.

NET net income for the last quarter is −50.45 M USD, while the quarter before that showed −38.45 M USD of net income which accounts for −31.19% change. Track more Cloudflare, Inc. financial stats to get the full picture.

No, NET doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Sep 27, 2025, the company has 4.26 K employees. See our rating of the largest employees — is Cloudflare, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Cloudflare, Inc. EBITDA is 57.24 M USD, and current EBITDA margin is −1.35%. See more stats in Cloudflare, Inc. financial statements.

Like other stocks, NET shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Cloudflare, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Cloudflare, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Cloudflare, Inc. stock shows the buy signal. See more of Cloudflare, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.